Looking Good Tips About Operating Income In Statement

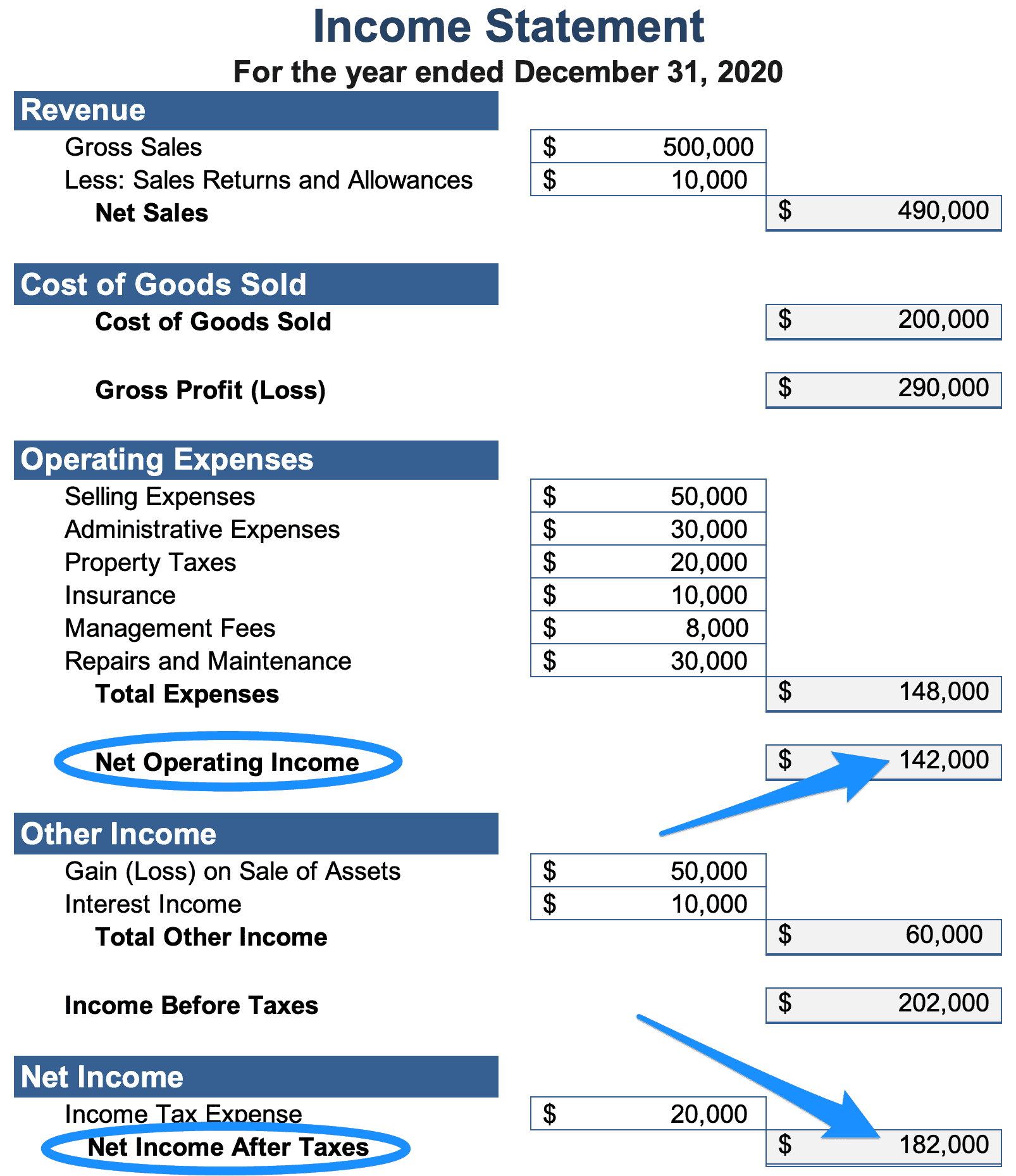

Operating income is the amount of money that remains after operating expenses and cost of goods sold have been deducted from revenue.

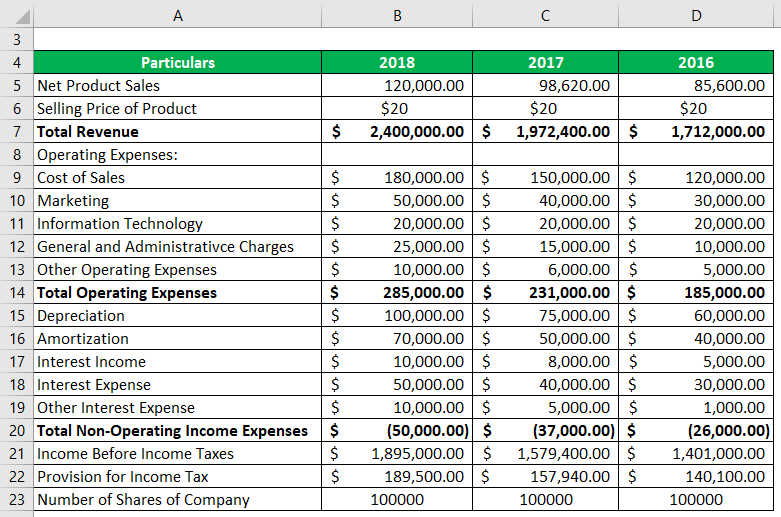

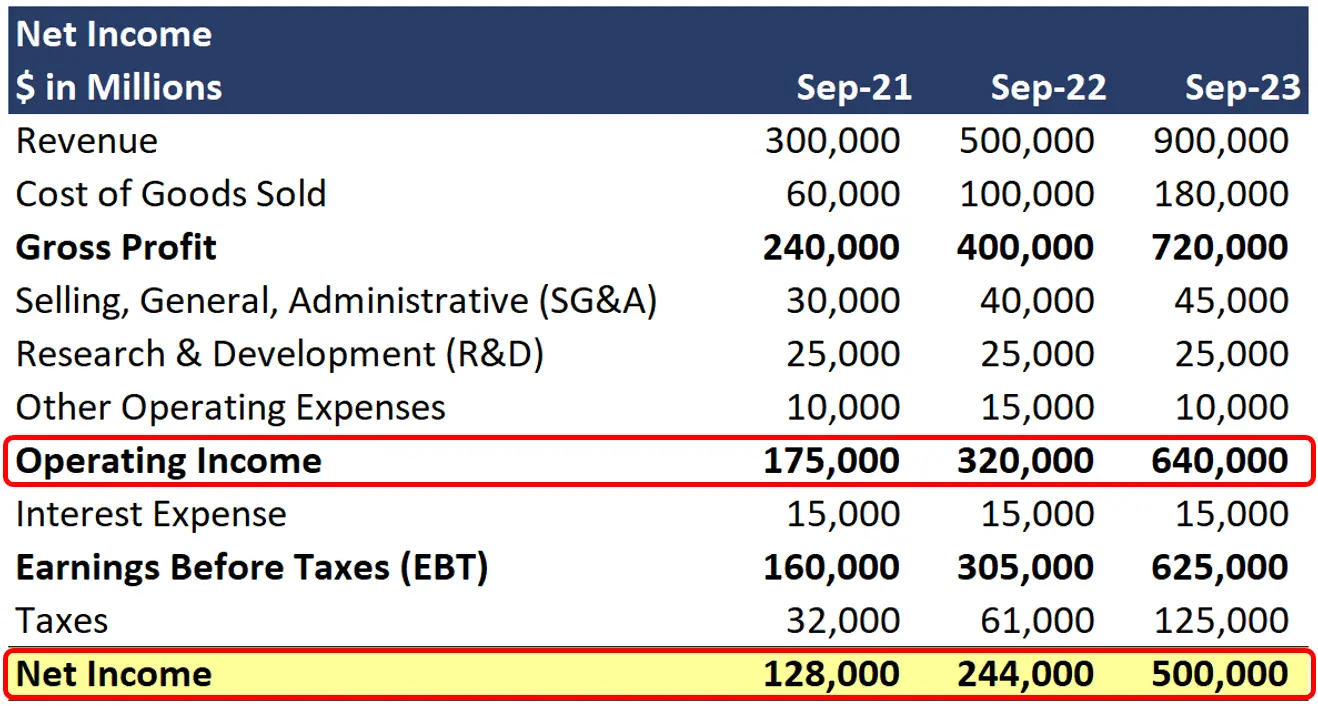

Operating income in income statement. Full year operating income of $2.279 billion; View the latest jtchy financial statements, income statements and financial ratios. Like gross profit, operating profit measures profitability by taking a slice or portion of a company's income statement, while net income includes all components of.

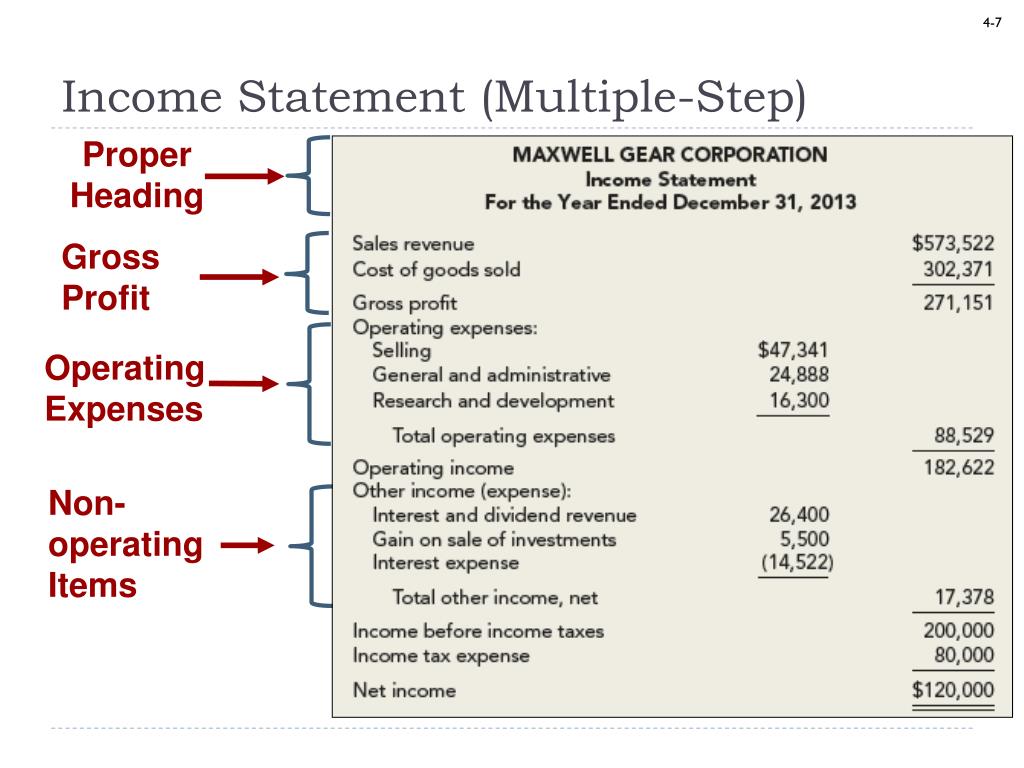

Operating income, also known as ebit or recurring profit, is an important yardstick of profit measurement and reflects the operating performance of the business and doesn’t. The income statement focuses on four key items: The difference between ebitda and operating income is best understood by studying a real income statement, such as this one from jc penney company inc.

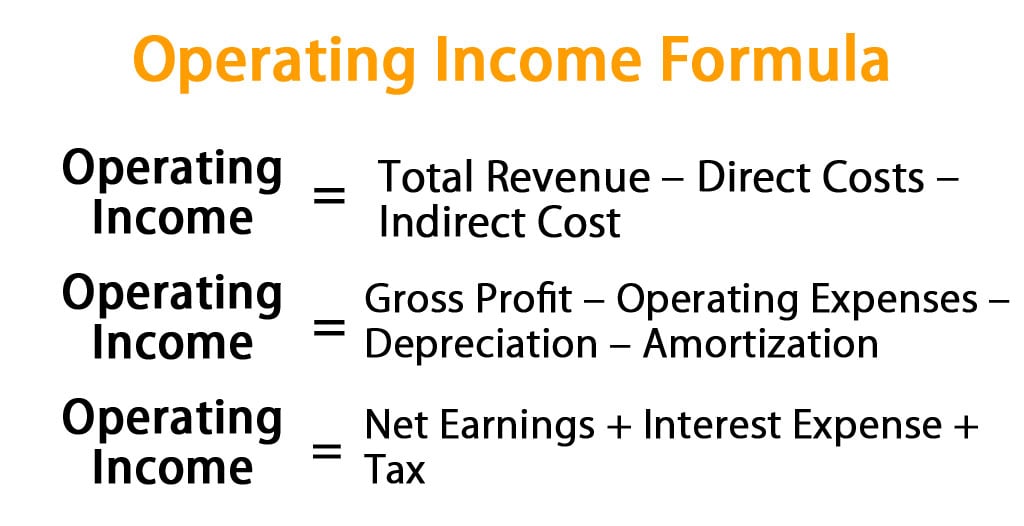

There are three formulas to calculate income from operations: One is a simple formula where you can use values from a company's financial statement to find. The purpose of an income statement is to show a company’s financial performance over a given time period.

Ebit (operating income) definition: You can learn about the health of a business—up and down, and across time—by. Operating income is a reflection of a company's ability to convert its expenses into profits through efficient allocation of its resources.

Ebit is a company’s earnings before interest and taxes, or operating income on the income statement (gross profit minus operating. To calculate operating income, you must find the total revenue (gross income), cogs, and the operating expenses on the income statement. Operating income is an accounting figure that measures the amount of profit realized from a business's operations after deducting operating expenses such as wages, depreciation, and cost of goods.

On the income statement, the operating income,. An income statement compares revenue to expenses to determine profit or loss. Revenue, expenses, gains, and losses.

It tells the financial story of a business’s. As an illustration, in the. Company abc chooses the cost accounting method to calculate operating income in the above example.

There are three formulas you can use to calculate operating income. Operating income refers to the profit realized after deducting operating expenses such as wages, cost of goods sold, and depreciation from gross income.

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)