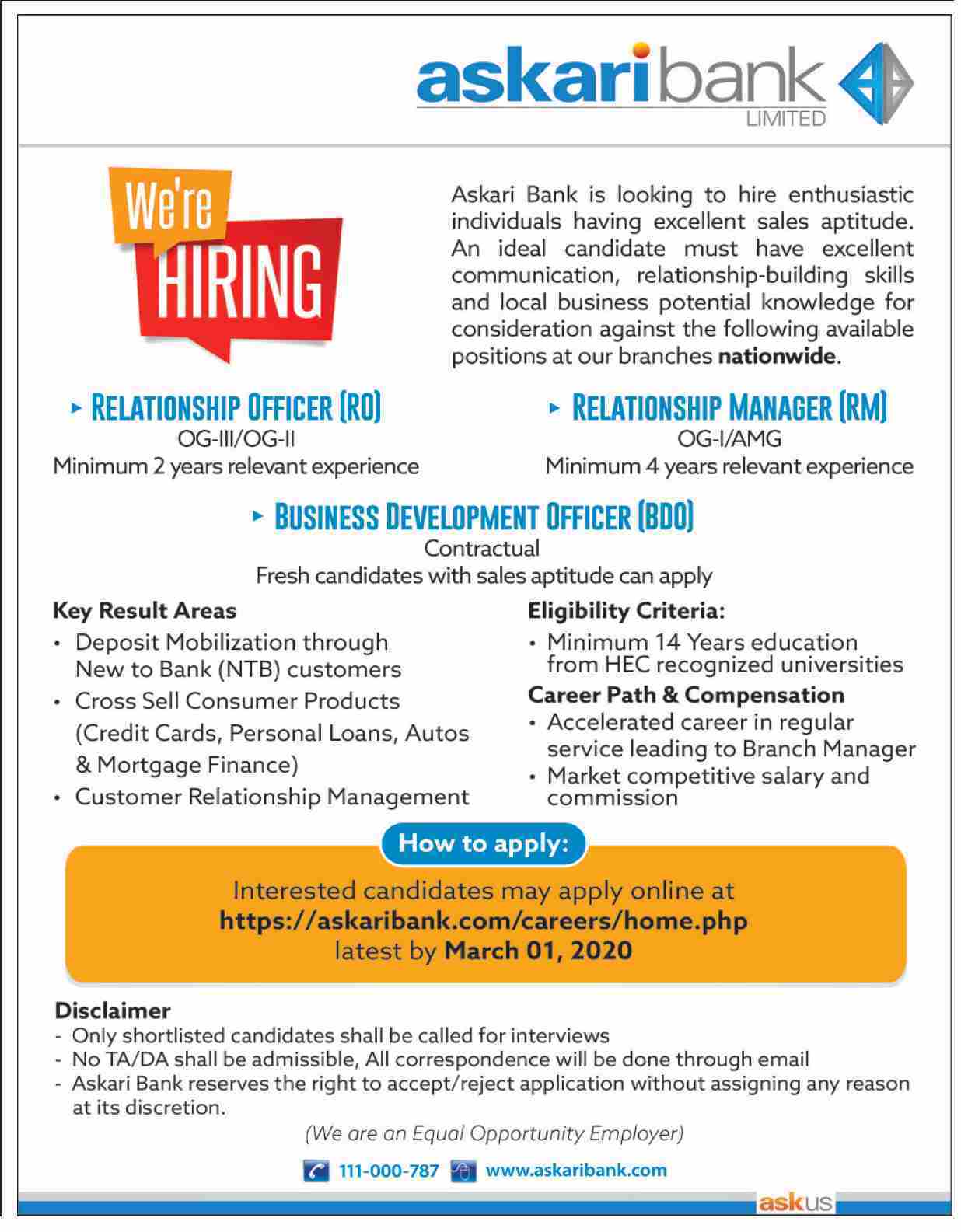

Looking Good Info About Askari Bank Financial Statements

Askari bank has shown a stable growth rate over the years;

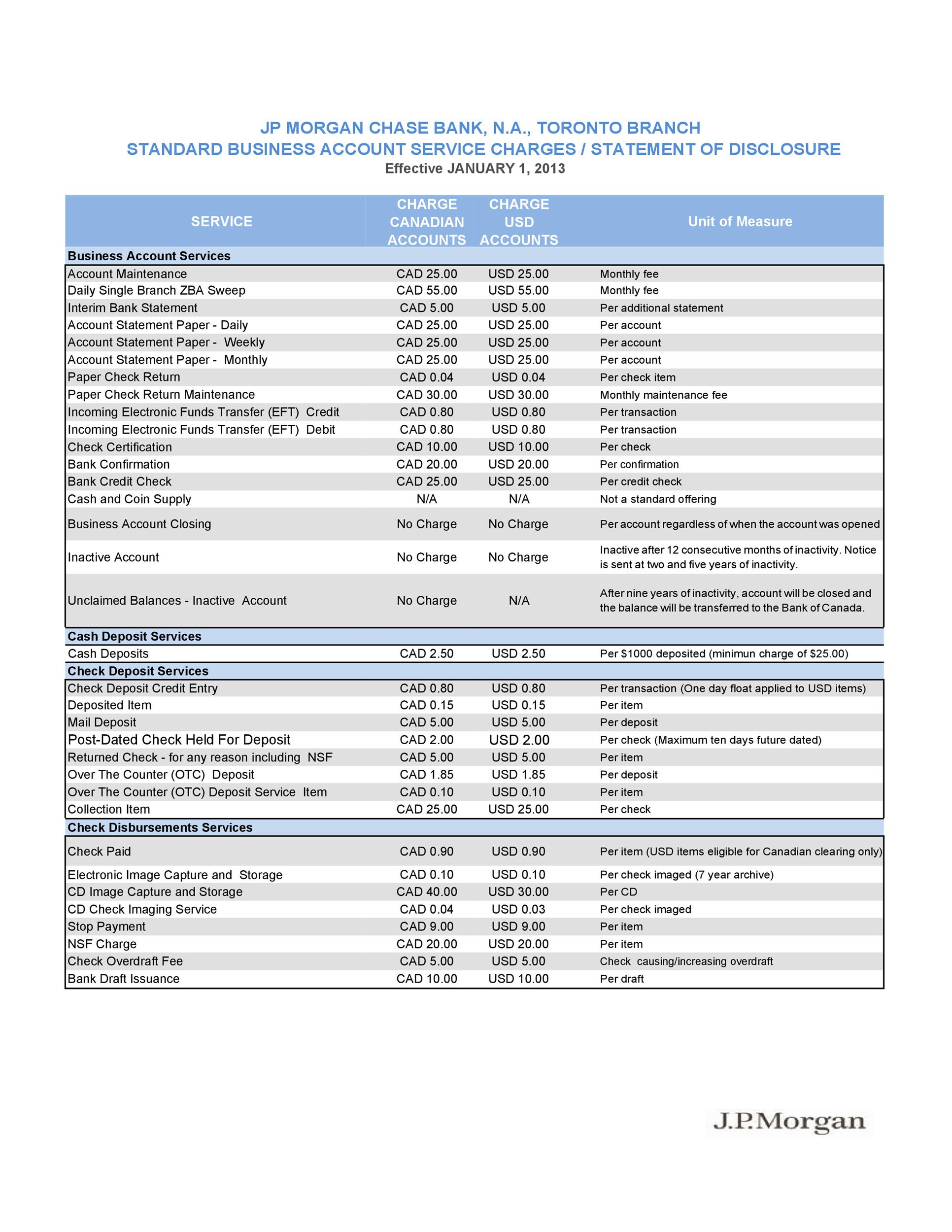

Askari bank financial statements. 1st quarter ended mar 31, 2018. View the latest akbl income statement, balance sheet, and financial ratios. Audited financial statements and corporate.

Askari bank limited. Audited financial statements and corporate profile 2012; To receive, consider and adopt the annual audited financial statements of the bank for the year ended december 31, 2020 together with the directors’ and auditors’ reports.

Audited financial statements and corporate profile. Audited financial statements and corporate profile 2011; Askari bank limited report contents 1.

For the second quarter, the company. Askari bank reported a profit after tax (pat) of rs21.54 billion in 2023, an increase of 53% compared to rs14.06 billion recorded in 2022. Askari bank limited reported earnings results for the second quarter and six months ended june 30, 2023.

Askari bank limited report contents 1. Get a brief overview of askari bank ltd financials with all the important numbers. As per the bank’s consolidated financial.

Issuance of premium prize bonds (registered) through commercial banks; It also provides corporate and investment banking, commercial banking, and agriculture banking services for business. Regulatory and supplementary disclosure rating history dissemination date.

Knowledge centre news publications of copy by im insights askari bank limited: Condensed interim financial information of. View akbl.pk financial statements in full, including balance sheets and ratios.

Total cash & due from banks Askari bank limited askari islamic bank limited habib bank limited the bank of punjab bank alfalah limited summit bank limited. View akbl.pk financial statements in full, including balance sheets and ratios.

3rd quarter and nine months ended sep 30, 2018. Askari bank reported a profit after tax (pat) of rs21.54 billion in 2023, an increase of 53% compared to rs14.06 billion recorded in 2022. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins.

Financial services compare to open 22.00 prior close 21.97 (12/28/23) 1 day akbl 5.78% djia 0.14% s&p 500 0.04% financial services 0.12% overview quarterly. The expensive funding avenues of the bank will. Its consumer products include ask4car,.