Fantastic Info About A Personal Balance Sheet Excel

Some of the more common assets include:

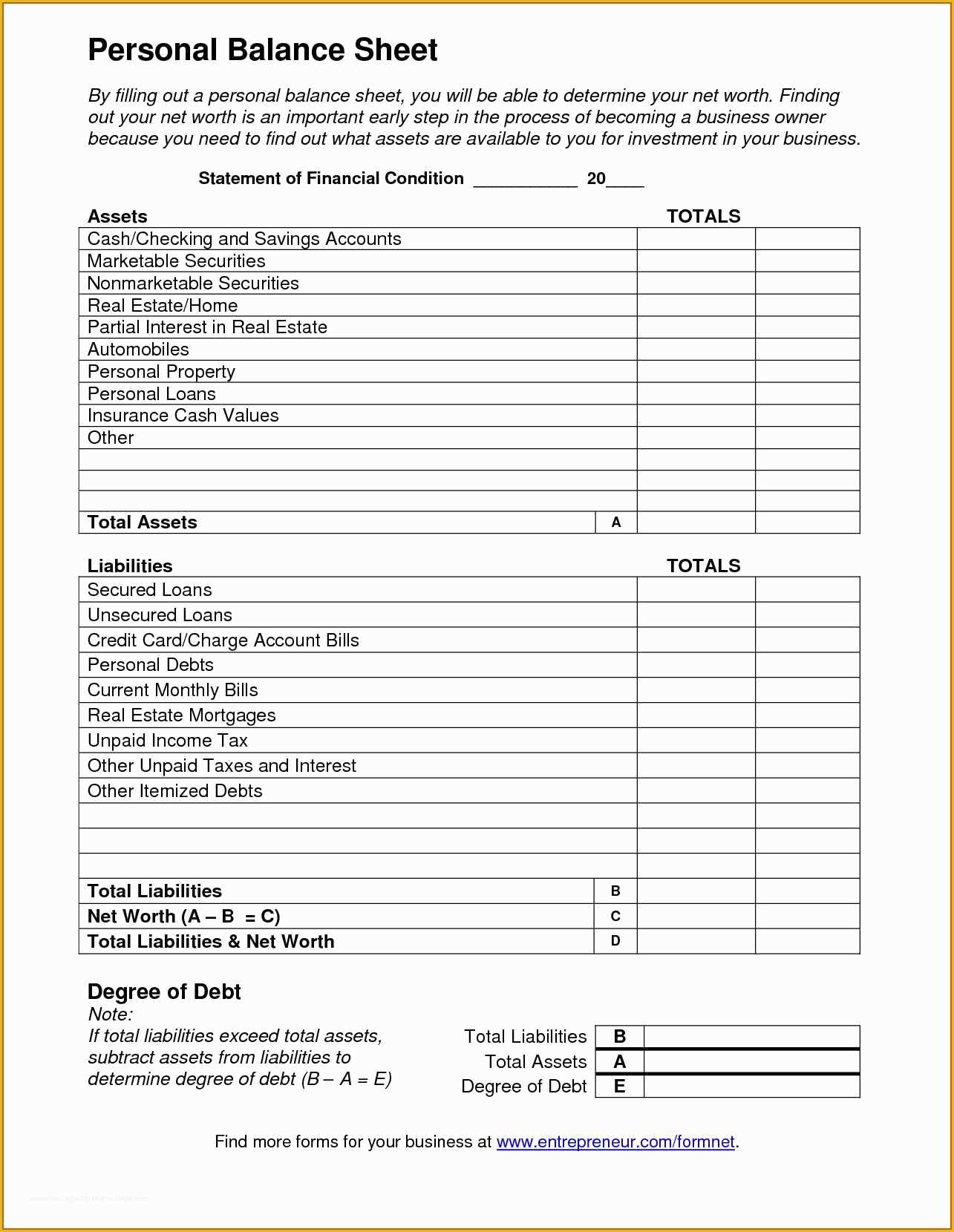

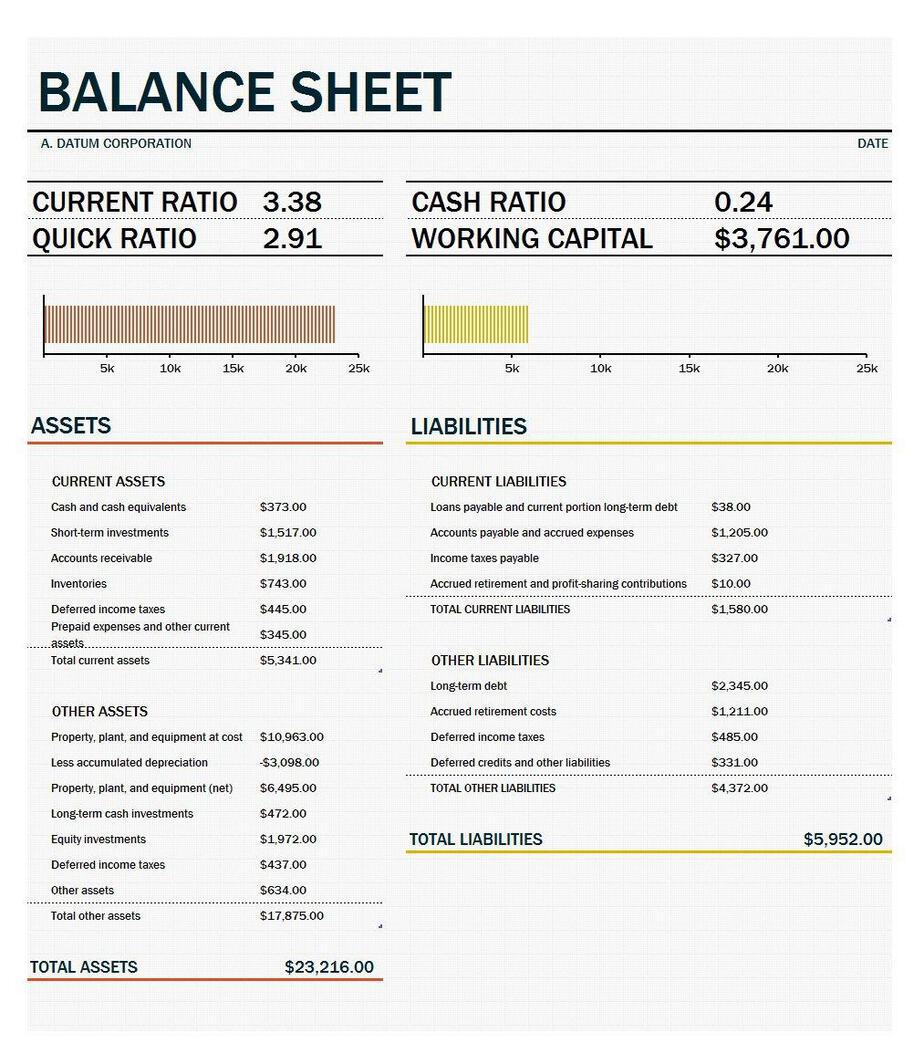

A personal balance sheet personal balance sheet excel. It’s not uncommon to have a negative net worth. The balance sheet is a very important financial statement that summarizes a company's assets (what it owns) and liabilities (what it owes ). A personal balance sheet is a simple tool in which all assets and all liabilities are listed.

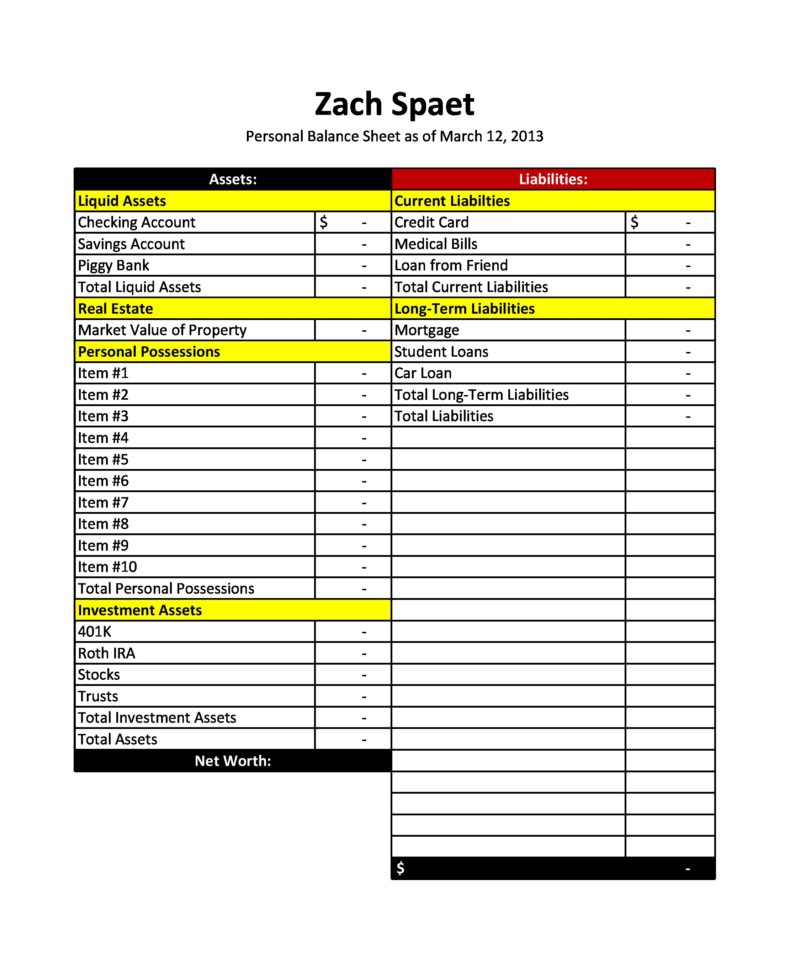

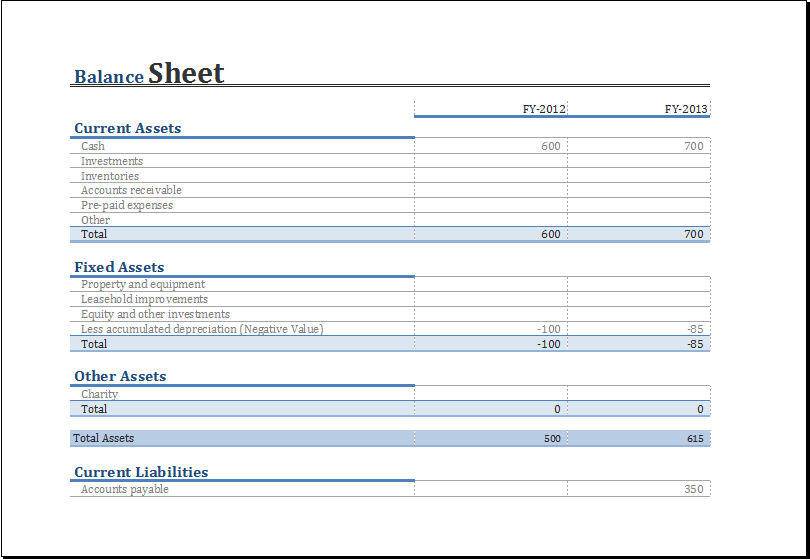

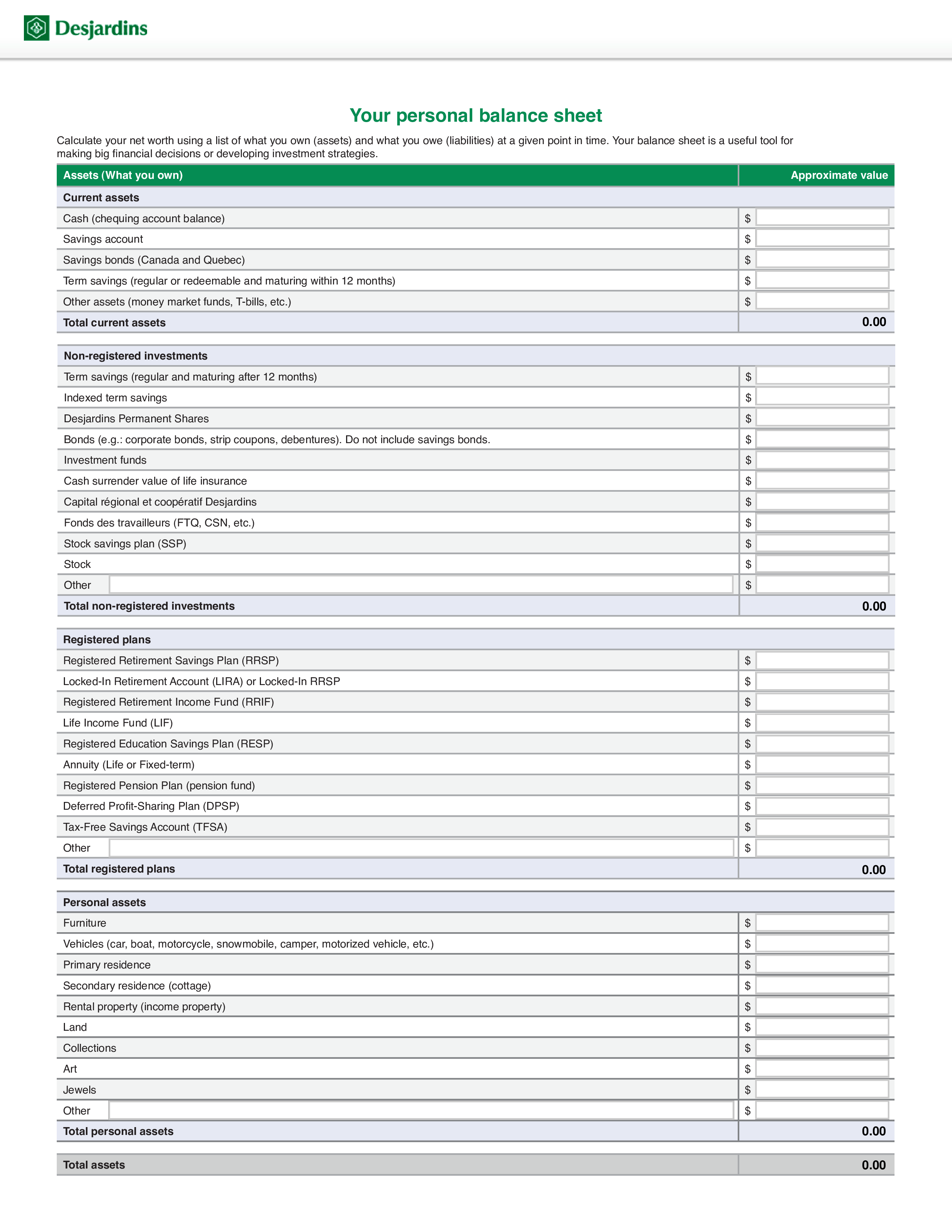

Arranging dataset in this case, our goal is to make a balance sheet format in excel for individuals. Personal balance sheet template details file format google docs google sheets ms excel ms word numbers pages size: While it may sound daunting, creating a personal balance sheet can be made easier with the help of excel.

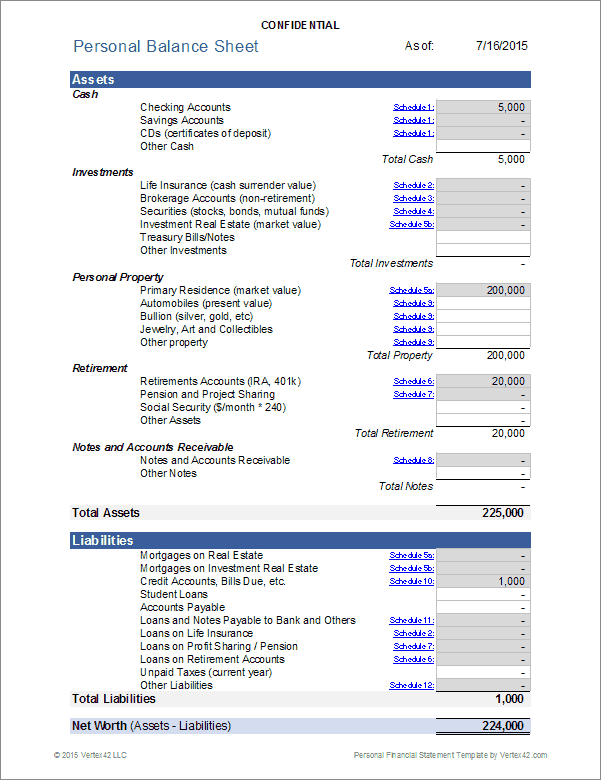

Download free, printable, and customizable balance sheet templates in excel, adobe pdf, and google sheets formats. It provides a snapshot of your financial standing by listing your assets, liabilities, and net worth. In one glance, you'll see how much of the company came from retained earnings, owner's equity, and loans.

Here's how you can create labels for each section of your worksheet: Using a sheet of some sort. Creating one can help you determine your net worth and find ways to continue to make positive changes.

Everything is categorized and very easy to find in this excel workbook. Keeping track of everything your owe and assets is important. How to create a personal balance sheet.

Make a list of your assets and where to get the most current values. To do so, we have to create a dataset. The steps are:

Investors or financial institutions usually require this form or spreadsheet. Here are the personal balance sheets that you can download and print for free. Make a list of your debts and where to get the most current values.

Add the total obligations owed. In this tutorial, we will guide you through. Assets — what you own:

You can create a balance sheet in excel by first creating a title section and labels for your worksheet. 17 personal financial statement templates and forms (word, excel, pdf) the personal financial statement is a document featuring an individual financial state at a specific time. Add the value of all assets.

It is often used for companies in order to measure the sum total of what the company owns in the form of its assets and compare that with the sum total of what all debts of the company owes or their liabilities. Now, we have the liabilities in cell b4, capital a/c in cell b5, amount in cell d4, loan in cell b8, date, and current liabilities in cell b4. Our primary objective is to build a workbook that efficiently pulls values from the trial balance into the balance sheet.