Favorite Info About Bad Debt Expense Is Reported On The Income Statement As

Bad debt expenses are classified as operating costs, and you can usually find them on your business’ income statement under selling, general & administrative costs (sg&a).

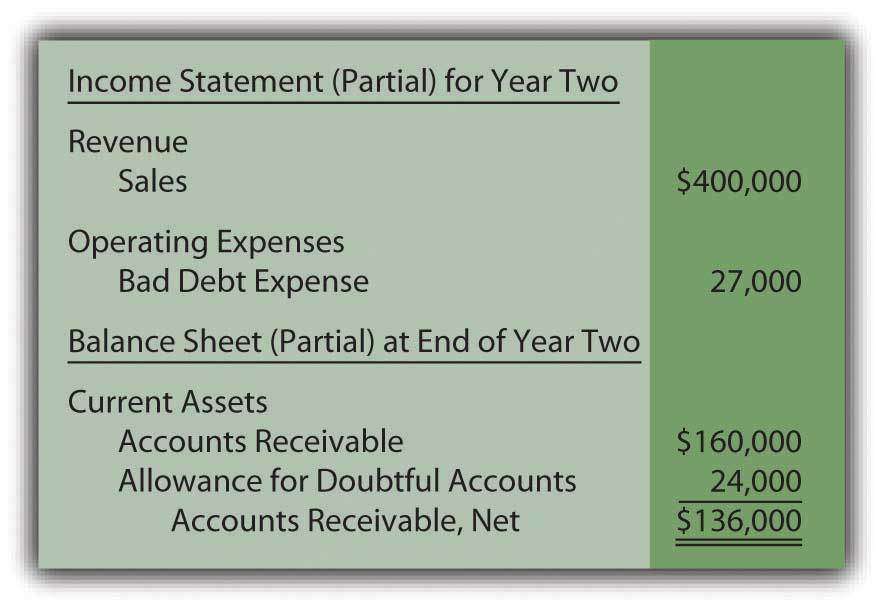

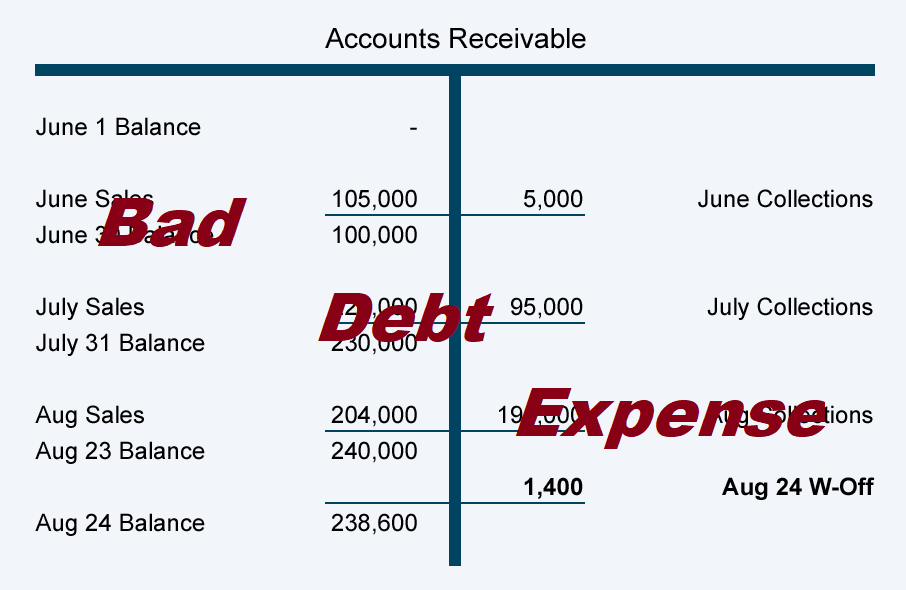

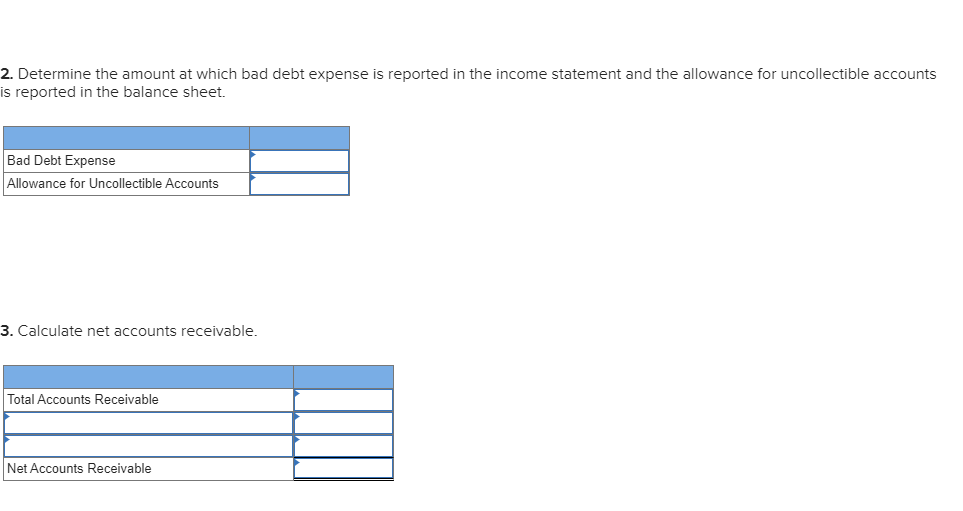

Bad debt expense is reported on the income statement as. Bad debt expenses are usually categorized as operational costs and are found on a company’s income statement. The income statement shows the aggregate financial position of a business during a specified period by displaying the amount of revenue generated and expenses incurred by a business. Part of cost of goods sold.

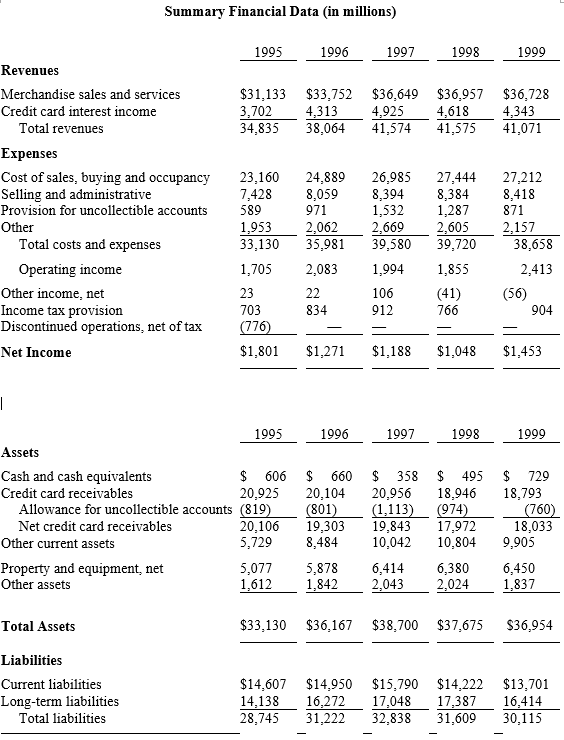

With respect to financial statements, the seller should. Bad debts expense is reported on the income statement as a. Other companies use provision for.

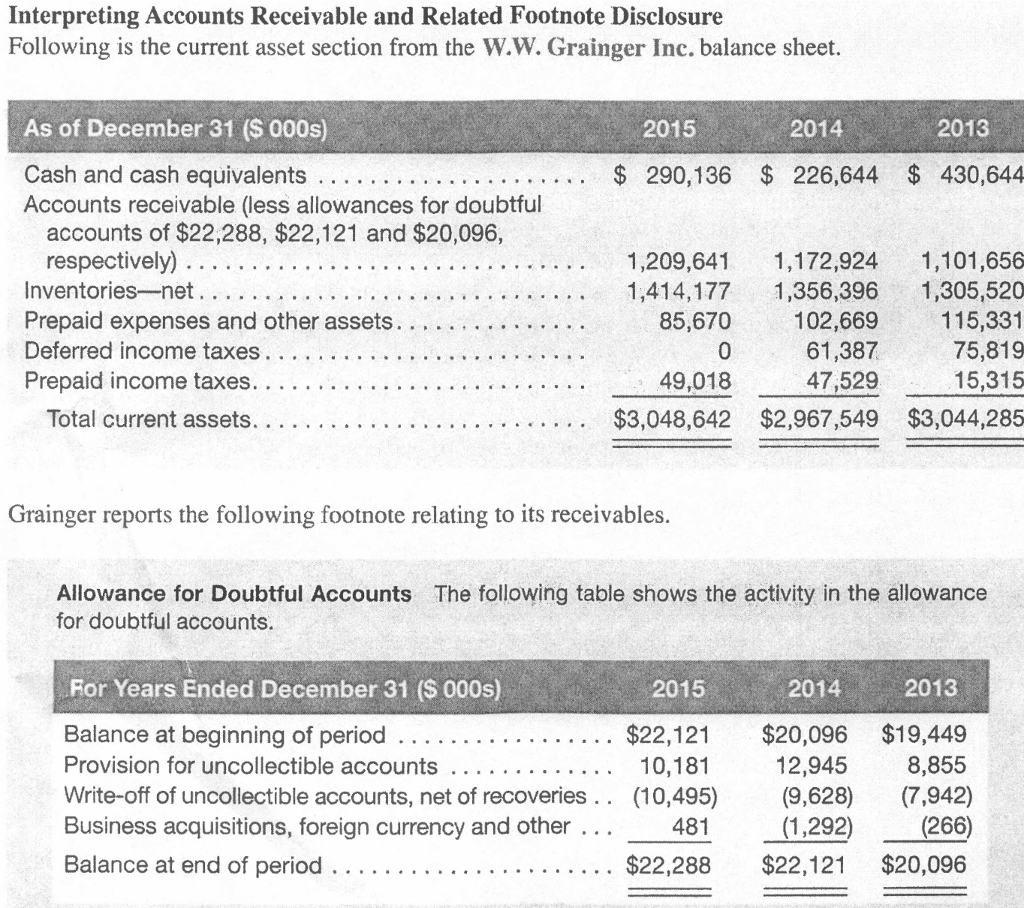

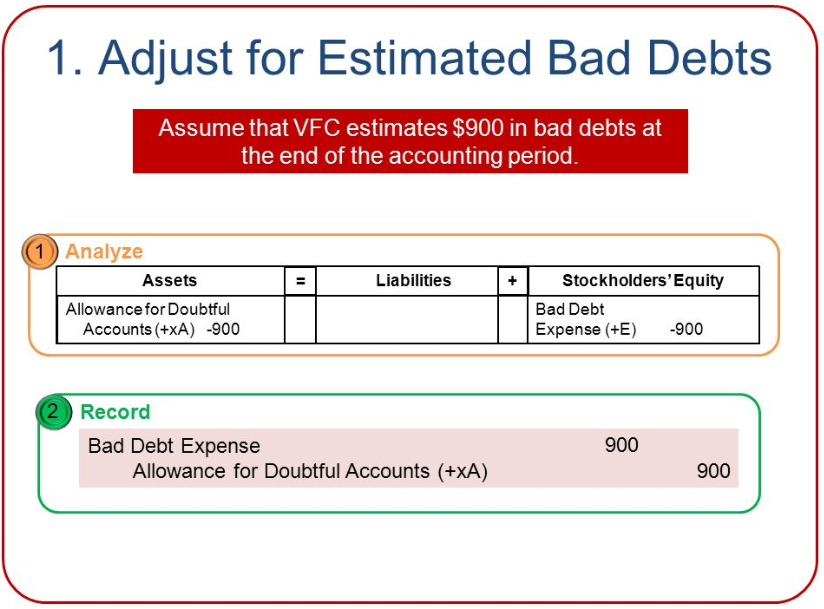

Part of cost of goods sold. A credit loss or bad debts expense on its income statement, and a reduction of accounts receivable on its balance sheet. Because a bad debt expense is comparable to other business expenses, it will be recorded in the general ledger.

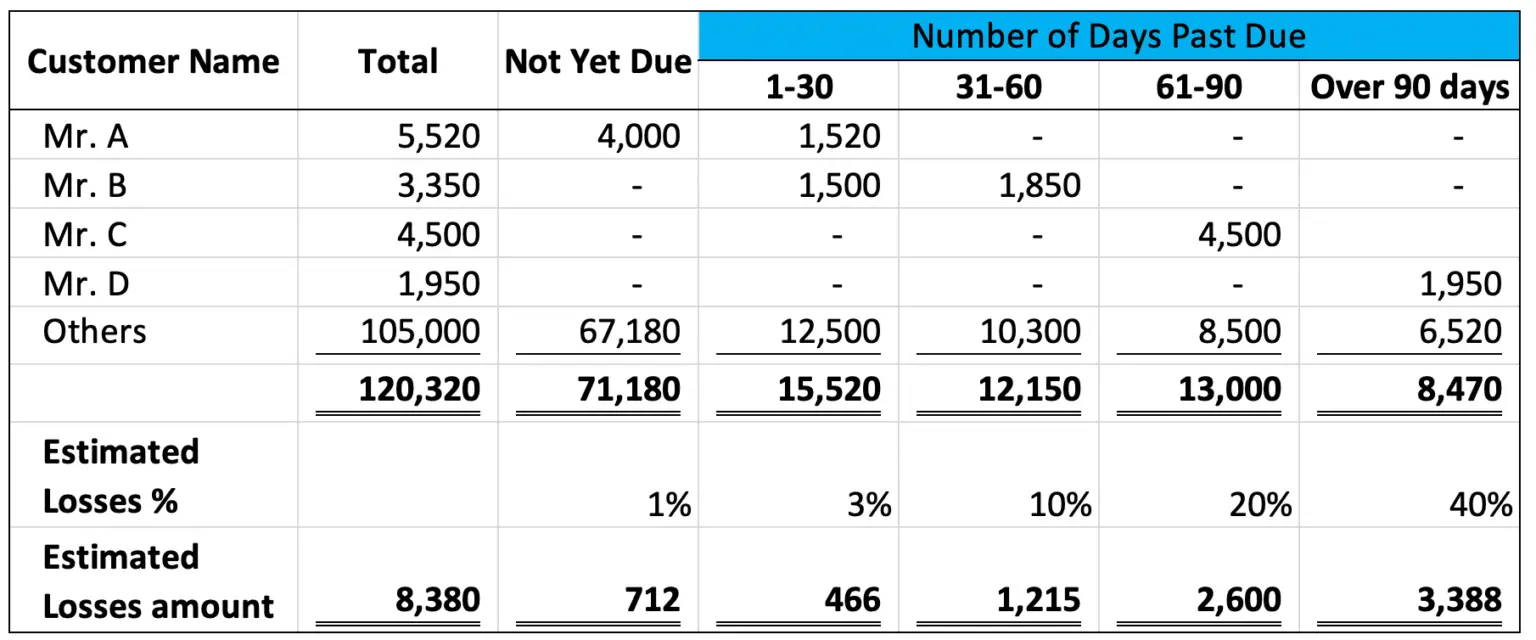

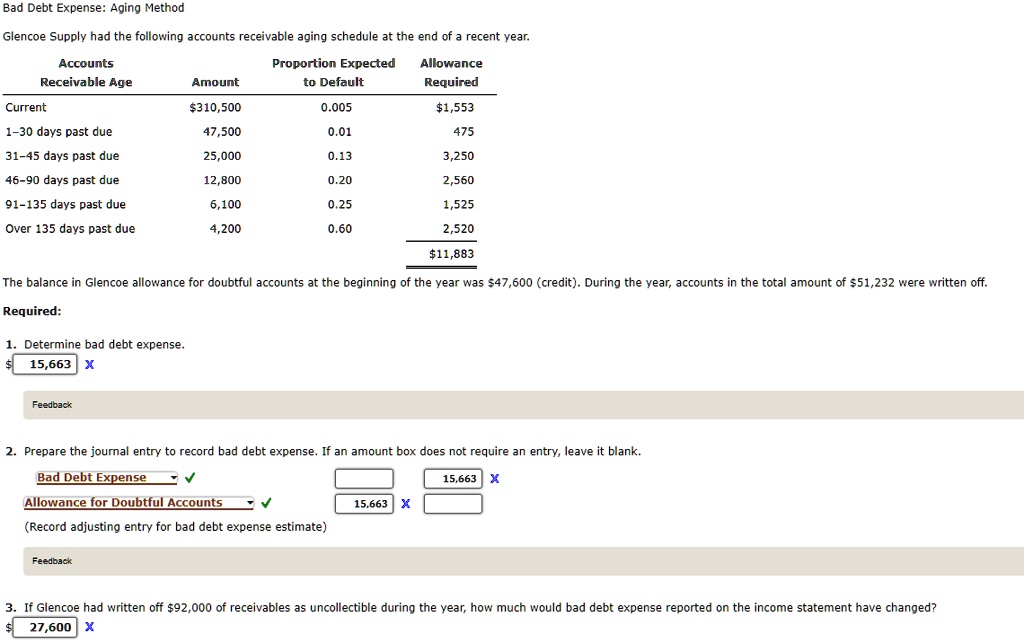

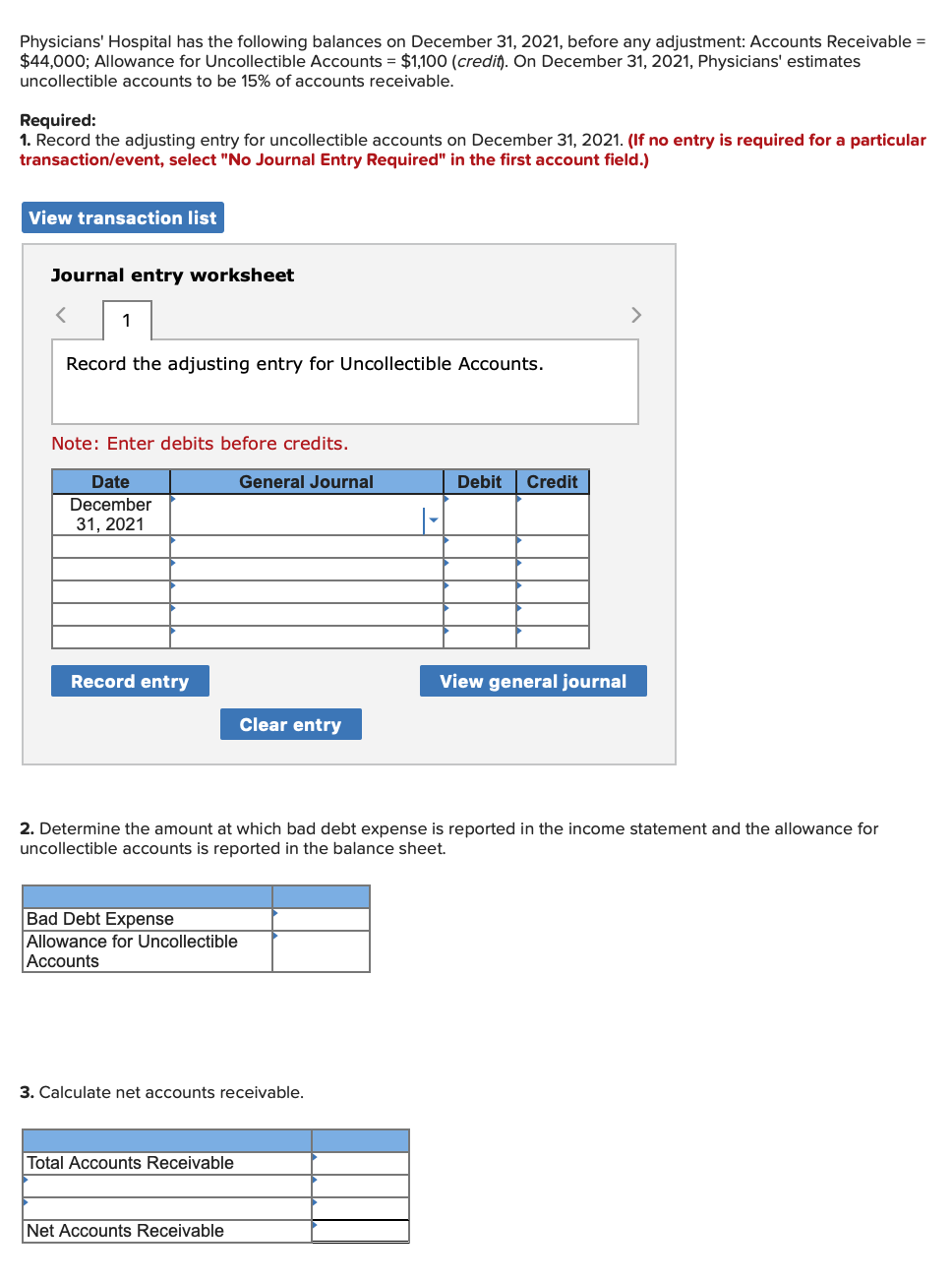

Bad debt expense is reported on the income statement as part. There are two methods for reporting the amount of bad debts expense: Trainor company estimates bad debt expense using a percentage of credit.

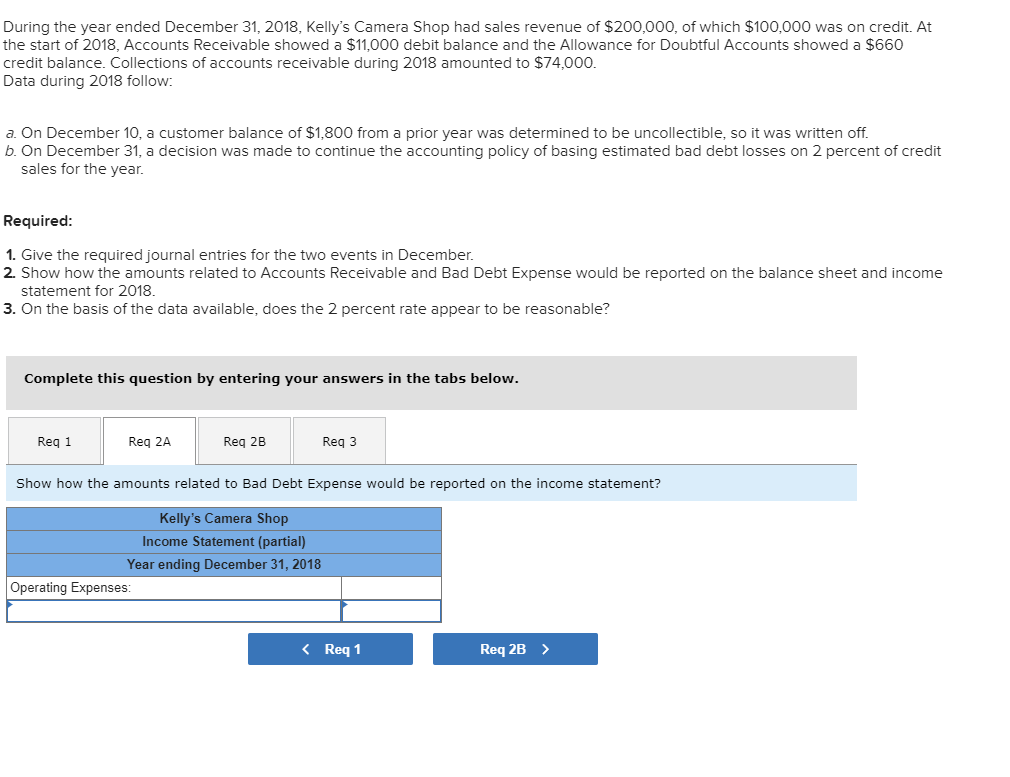

Bad debt expense is normally reported on the income statement as a(n) ?? On march 31, 2017, corporate finance institute reported net credit sales of $1,000,000. Presentation of bad debt expense.

Part of cost of goods sold. Bad debt expense is reported on the income statement as part of : View the full answer answer unlock previous question.

Bad debts expense is reported on the income statement as a. The amount reported in the income statement account bad debts expense pertains to the estimated losses from extending credit during the period shown in the heading of the. Using the percentage of sales method, they estimated that 1% of.

Yes, bad debts are recorded in the income statement. The percentage of sales method is an income statement approach, in which bad debt expense shows a direct relationship in percentage to the sales revenue that the. Bad debt expense is the uncollectable account receivable when the customer is no longer able to pay their outstanding debt due to financial difficulties or even bankruptcy.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)