Who Else Wants Info About Balance Sheet Explanation For Dummies

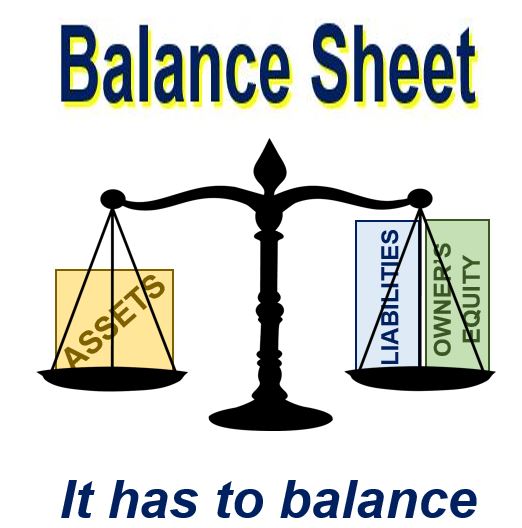

A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Balance sheet explanation for dummies. A balance sheet provides a summary of a business at a given point in time. You can either do some simple algebra and solve for the equity figure. The balance sheet is based on the fundamental equation:

This example balance sheet discloses the original cost of the company’s fixed assets and the accumulated depreciation recorded over the years since acquisition of the assets, which is standard practice. The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement. It’s essentially a net worth statement for a company.

The balance sheet is a key financial statement that provides a snapshot of a company's finances. Knowing how to read a balance sheet is fundamental to financial literacy. The balance sheet is a snapshot of your business’s financial health as of a particular date.

Understanding accounting values on the balance sheet. As such, the balance sheet may also be referred to as the statement of financial position. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders).

Balance sheet fundamentals a balance sheet shows two sides of the business, which you could think of as the financial yin and yang. Assets = liabilities + owner’s equity. Your balance sheet is one of three primary financial statements in the running of a business.

Balance sheets are useful tools. The balance sheet presents the balances (amounts) of a company’s assets, liabilities, and owners’ equity at an instant in time. It allows you to see what resources it has available and how they were financed as of a specific date.

A balance sheet is a financial statement that lists a company’s assets, liabilities, and equity. Reading financial reports for dummies explore book buy on amazon trying to read a balance sheet without having a grasp of its parts on a financial report is a little like trying to translate a language you've never spoken — you may recognize the letters, but the words don't mean much. The balance sheet — also called a statement of financial condition — is a “where do we stand at the end of the period?” type of report.

A balance sheet is a financial statement that shows a company's assets, liabilities, and shareholder’s equity, or how much shareholders have invested. The structure of a balance sheet a company's balance sheet is comprised of assets, liabilities, and equity. A balance sheet is one of the financial statements of a business that shows its financial position.

A business can prepare the balance sheet in several ways, but. Assets represent things of value that a company owns and has in its possession,. It is divided into various sections.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)