Inspirating Tips About Income Statement And Balance Sheet Of A Company Retained Earnings Example

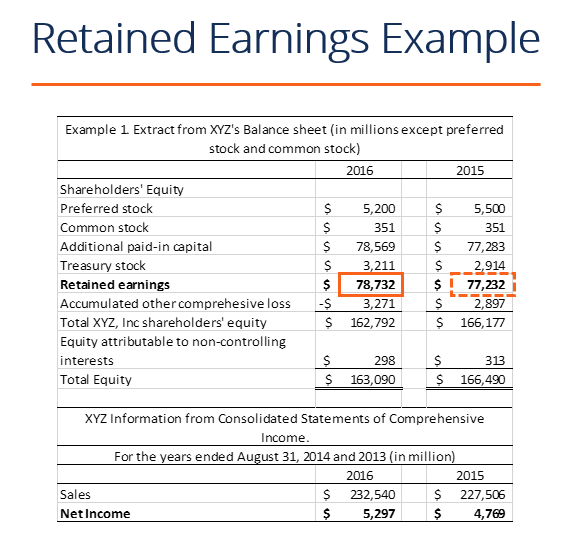

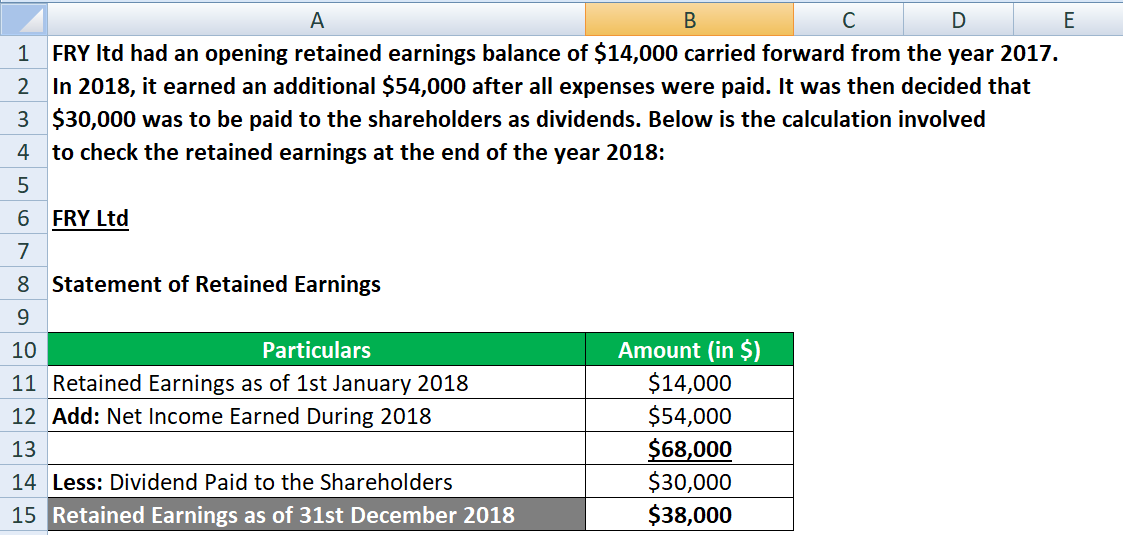

The recording of retained earnings is done on the balance sheet of a company.

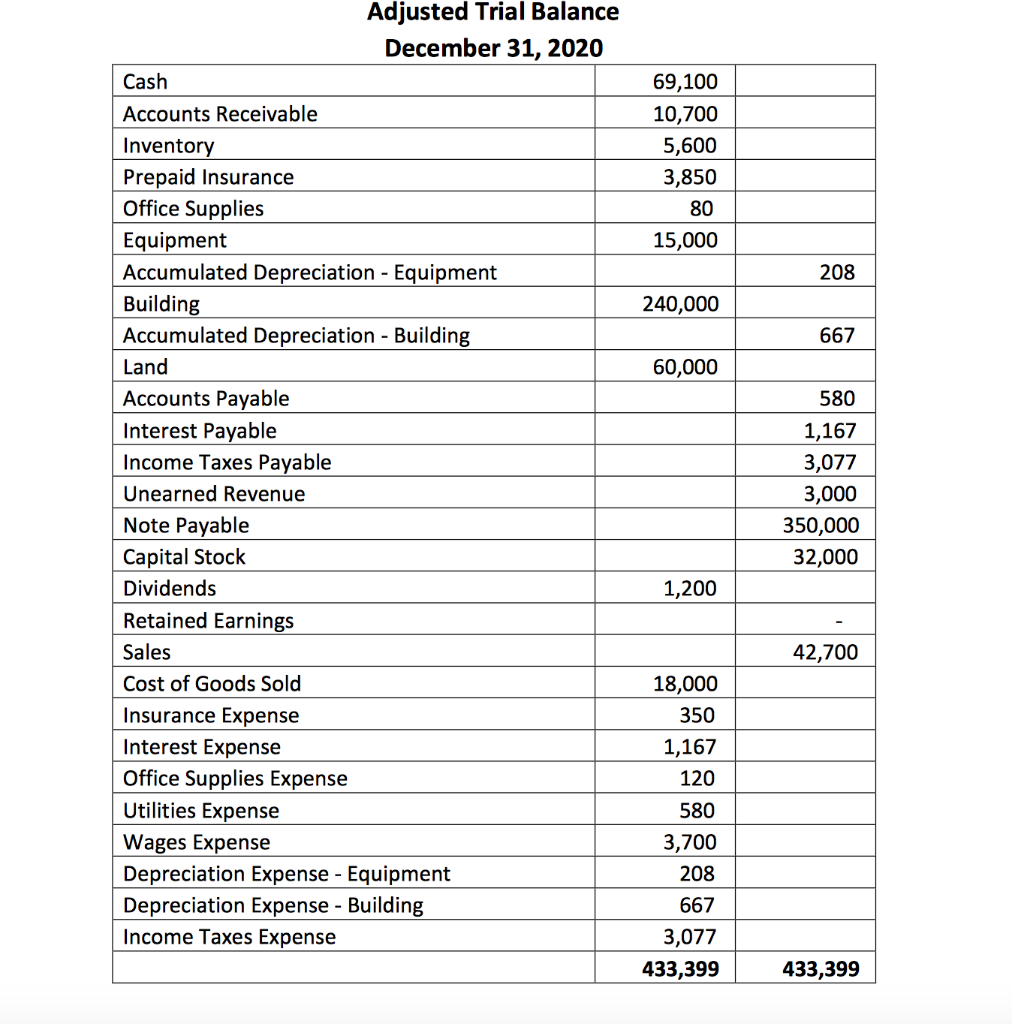

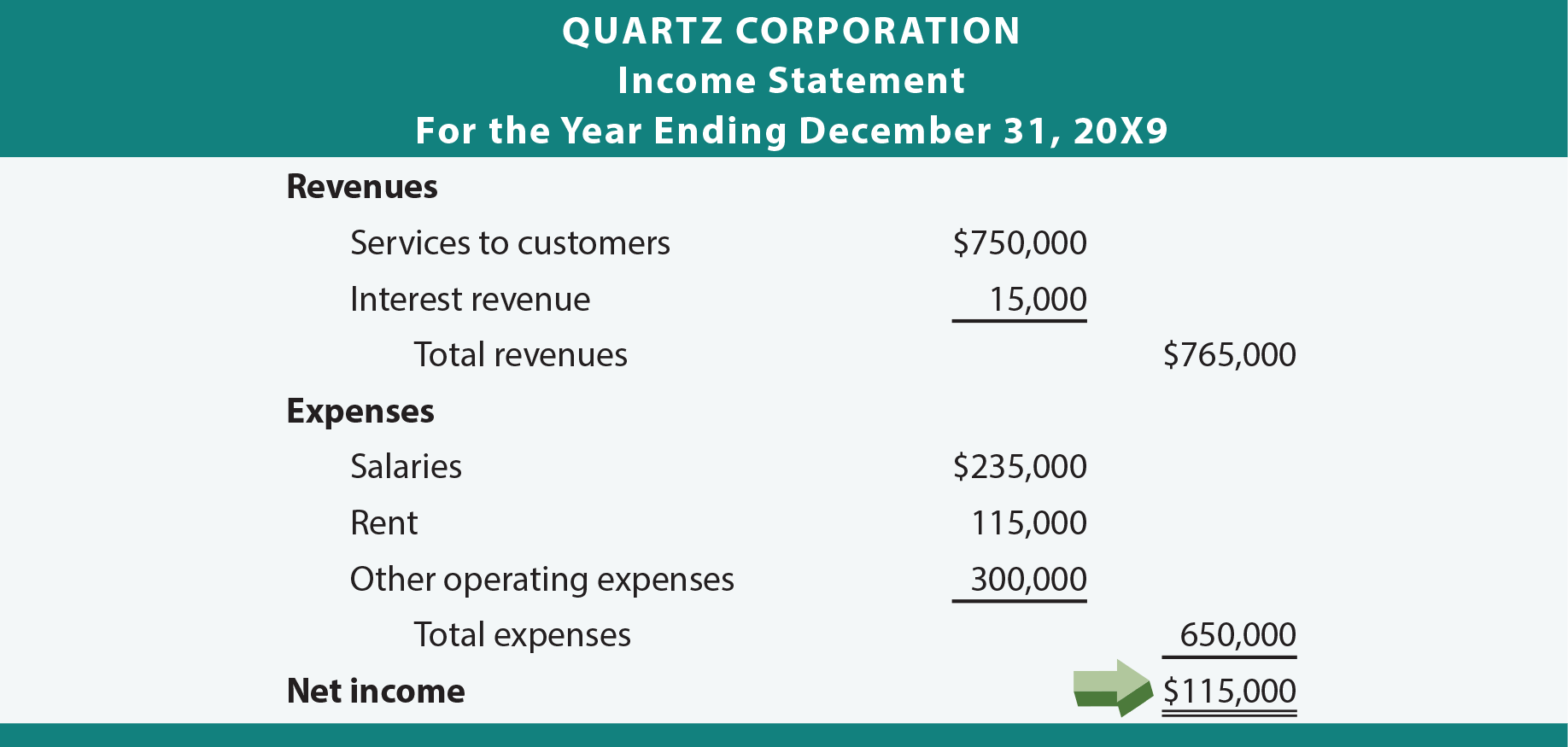

Income statement and balance sheet of a company income statement retained earnings balance sheet example. Net income and retained earnings as mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a. In finance and accounting, numbers hold the keys to understanding the health and performance of a business. How to calculate the effect of a stock dividend on retained.

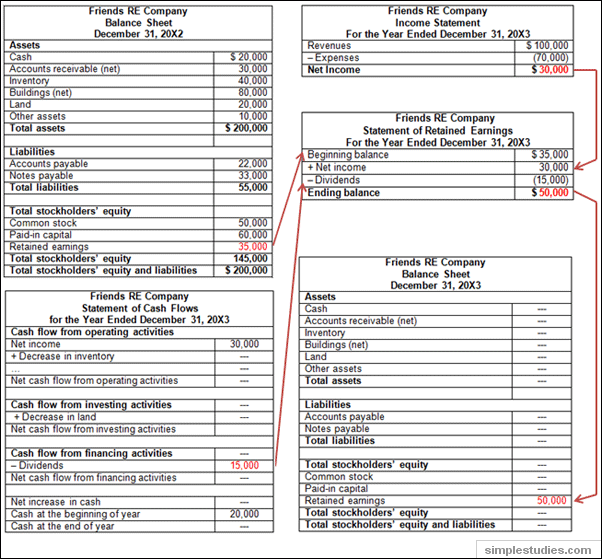

Identify connected elements between the balance sheet and the income statement. Thus the result (net income) of the income statement feeds the retained earnings account on the balance sheet. The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back.

The balance sheet, income statement, and cash flow statement: The formula is as follows: Example of retained earnings what makes up retained earnings how do you calculate retained earnings on the balance sheet?

Each of the financial statements provides important financial information for both internal and external stakeholders of a company. Determine the return on total assets. The core statements used in financial modeling are the same core statements used in accounting.

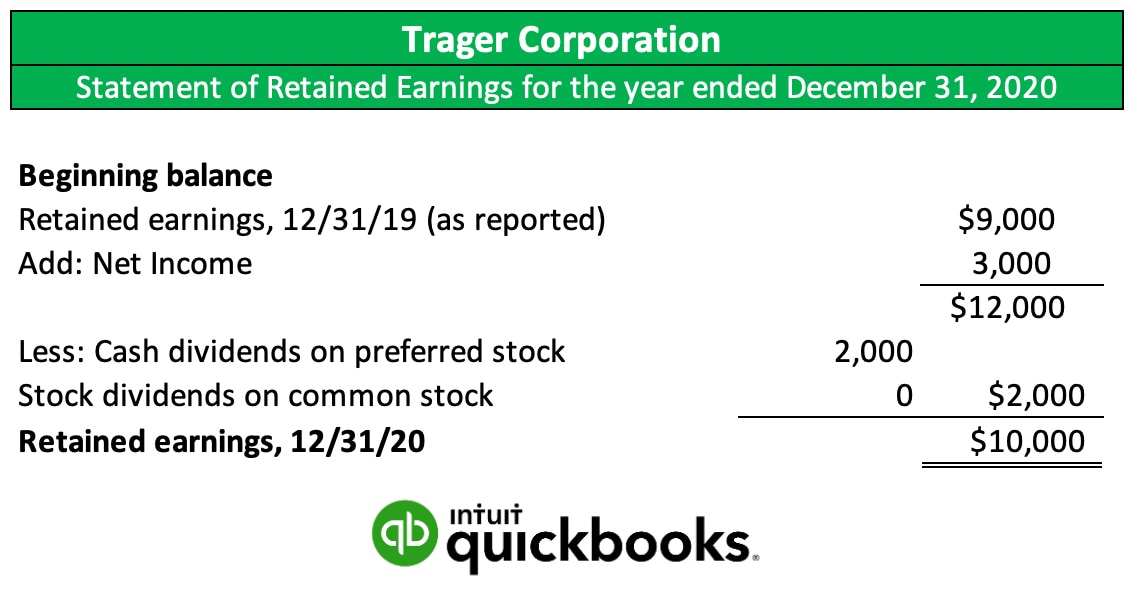

In a similar manner, the ending retained earnings balance is carried forward to the balance sheet. When the company earns money and keeps it, it gets added to the balance sheet. Learning outcomes by the end of this section, you will be able to:

This document shows how the company performed during its course of operations during a fixed period of time. The balance sheet shows the cumulative effect of the income statement over time. Did you get it ⬇️樂 question:

The three financial statements are: Balance sheets are used to see if the business has sufficient liquidity to pay off debts. If a company prepared its income statement entirely on a cash basis (i.e., no accounts receivable, nothing capitalized, etc.) it would have no balance sheet other than shareholders’ equity and cash.

Income statement (also known as the profit and loss statement) in short, this is the“what did we do” statement. The company's annual net income was $200,000. It’s the creation of the balance sheet through accounting principles that leads to the rise of the cash flow statement.

Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. Hub reports february 20, 2024 by examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports. Notice the amount of net income (or net loss) is brought from the income statement.

Click below to download a free sample template of each of these important financial statements. Learning the difference and when to use each can aid your business’s financial health. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends paid to shareholders.