Ace Tips About Ideal Ratios Of All Accounting

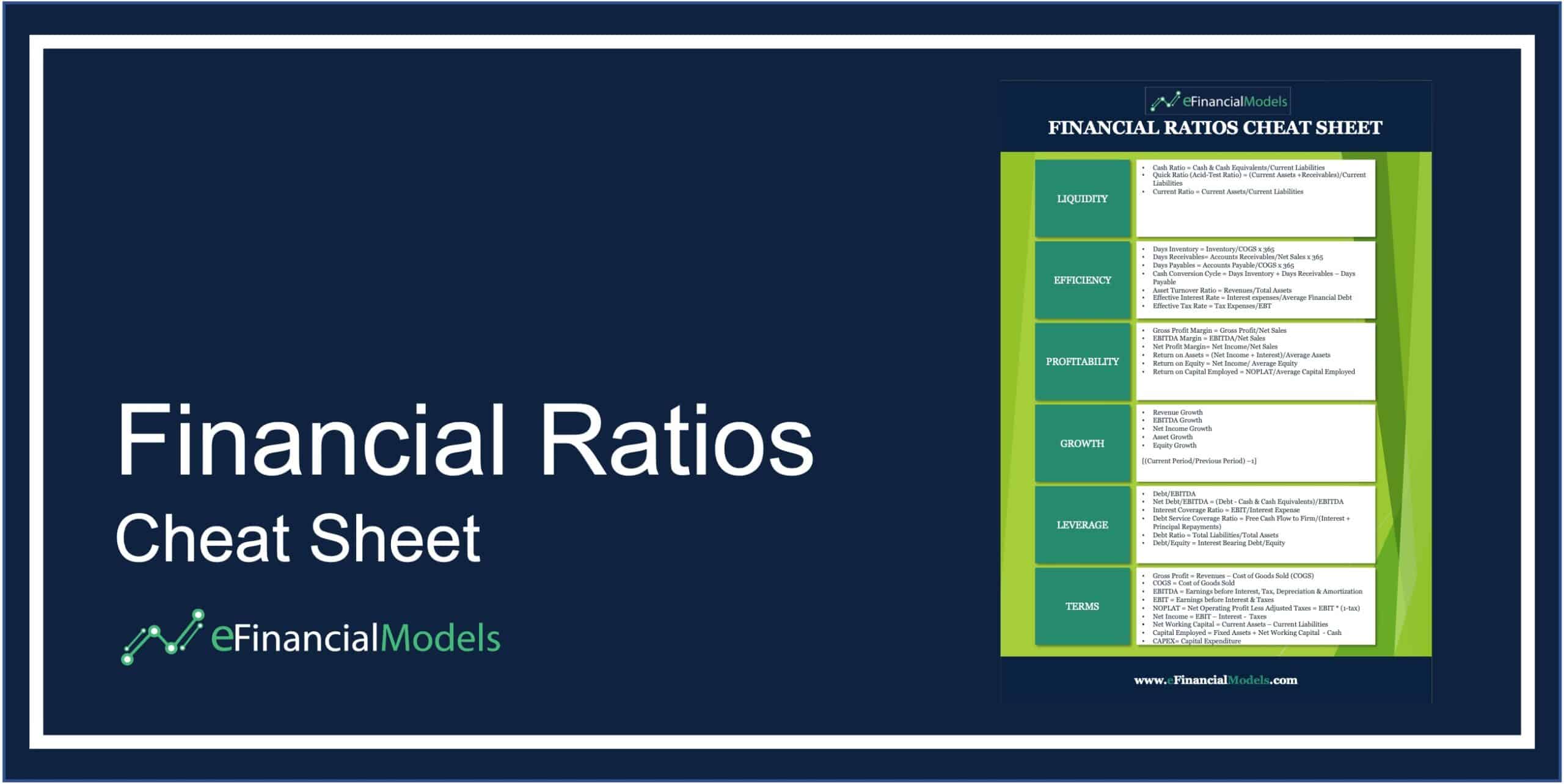

Efficiency ratios, also known as activity financial ratios, are used to measure how well a company is utilizing its assets and resources.

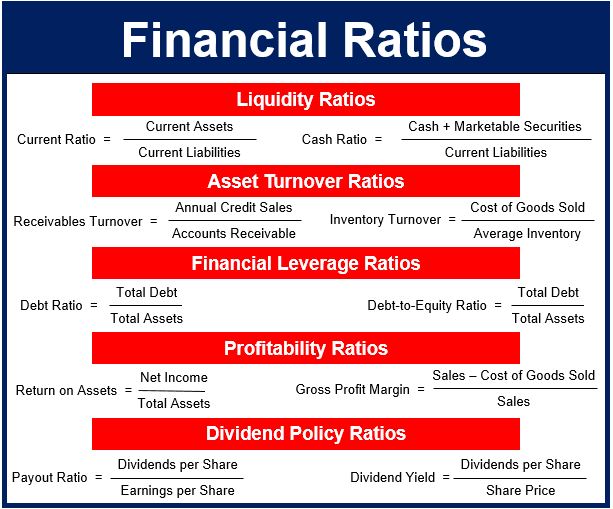

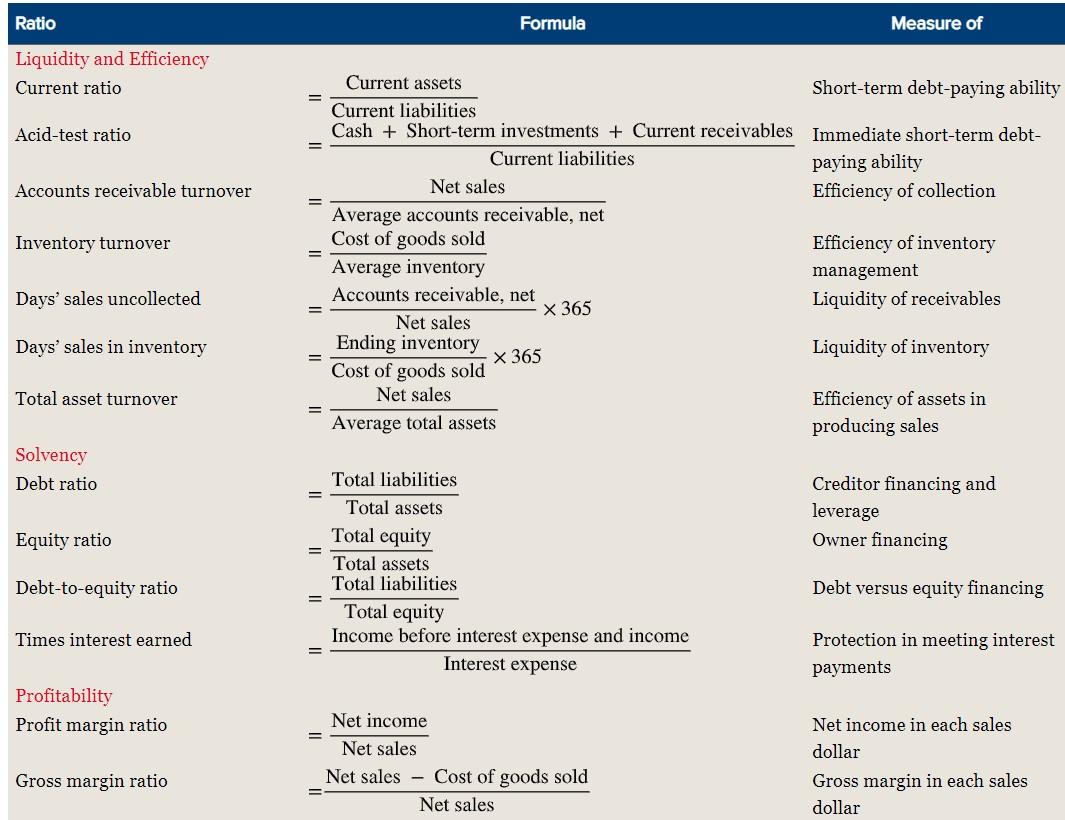

Ideal ratios of all accounting ratios. There are mainly 4 different types of accounting ratios to perform a financial statement analysis; The three most common types of accounting ratios are debt ratios, liquidity ratios, and profitability ratios. A ratio is a relationship between two quantities, attained by dividing one quantity by the other.

May 25th, 2023 | 9 min read contents [ show] accounting ratio is the comparison of two or more financial data which are used for analyzing the financial. Leverage ratio examples. And how different ratios are.

Accounting ratios are those ratio comparisons that can be derived solely from the financial statements. Share with friends accounting ratios, also known as financial ratios signify the relationships between figures of the balance sheet and the profit & loss account. Market ratios popular with current and potential.

= cost of goods sold / average inventory at cost. What are the different types of accounting ratios? The ideal liquid ratio or the generally accepted ‘norm’ for liquid ratio is ‘1’.

Financial/accounting ratios help analysts make meaningful. Each of these ratios provides a window into a specific. Ratios are classified into two types namely traditional classification and functional classification.

Liquidity ratios, solvency ratios, activity ratios and profitability ratios. Comparison of quick ratio with current ratio indicates the inventory hold ups. The accounting ratios or ratios in management accounting have four ratios:

Generally, the ratio of 2 : Leverage ratios are widely used in accounting financial ratios that help determine the ability of a company to meets its financial. Debtors or receivables turnover ratio/velocity.

Asset turnover ratio = net sales / average total assets the inventory. Cash flow analysis trend analysis this article talks about accounting ratios in detail. Liquidity ratios, activity ratios, solvency ratios, and profitability ratios.

For example a ratio can derive the answer $900 or can be expressed a 100% or 9:1 or just “9” in this tutorial, we will go over 4 major categories of accounting ratios that are. 1 is considered as an ideal. What are accounting ratios?

The asset turnover ratiomeasures a company’s ability to generate sales from assets: