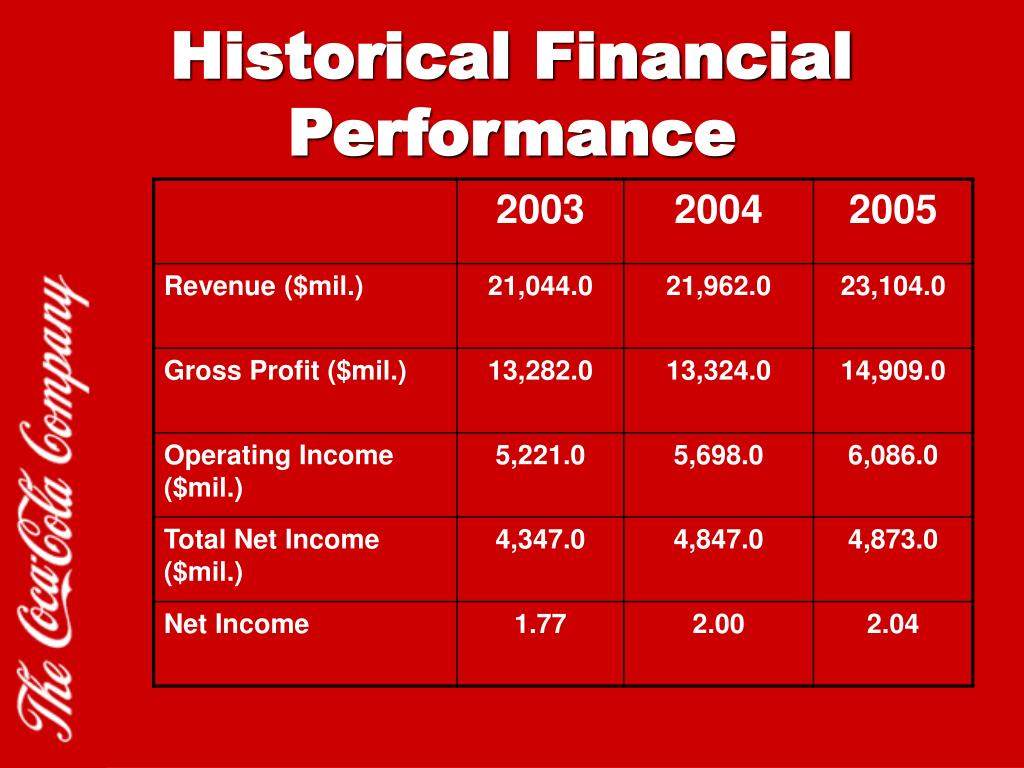

Have A Info About Historical Financial Performance

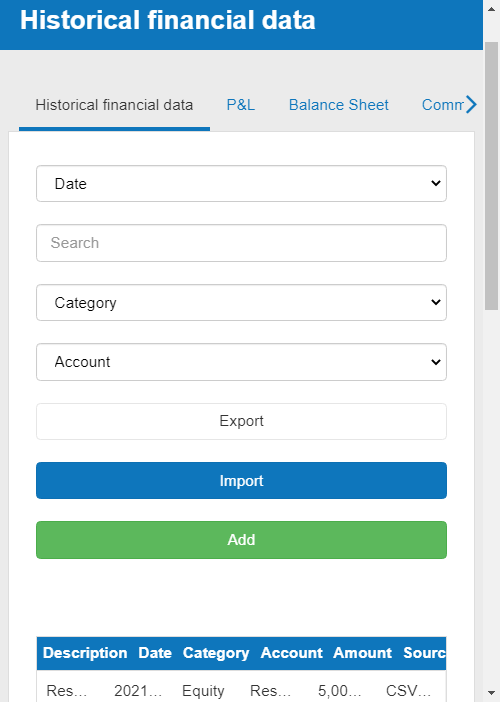

Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows.

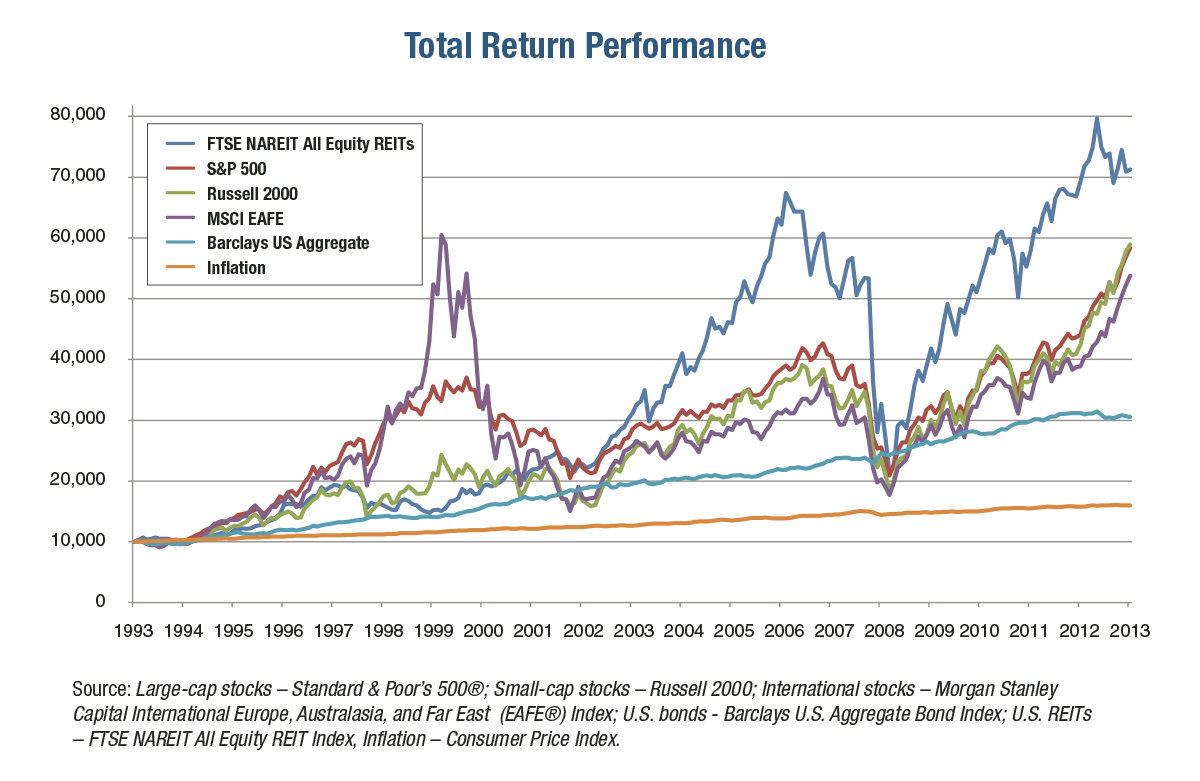

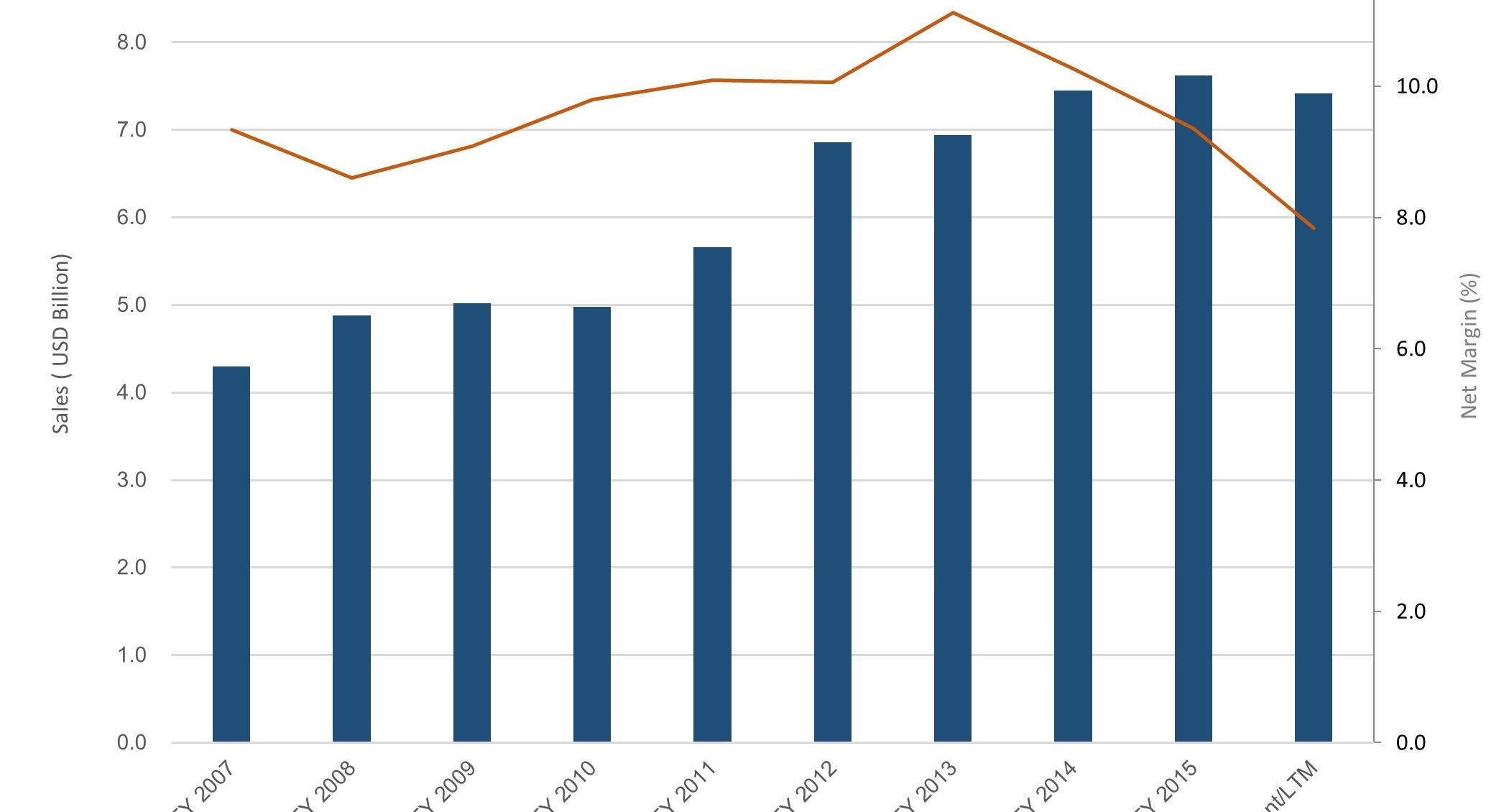

Historical financial performance. A history of strong financial performance has helped drive impressive investor returns. Introduction historical financial data is a record of actual financial performance over a certain period of time. Net cash € 10.7 billion.

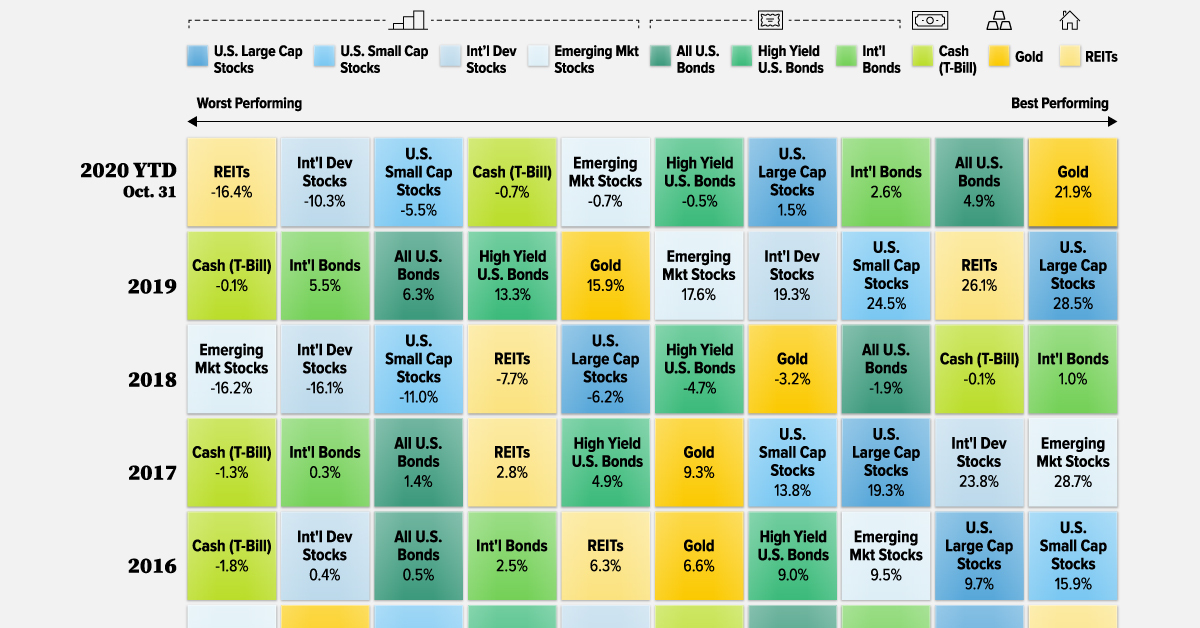

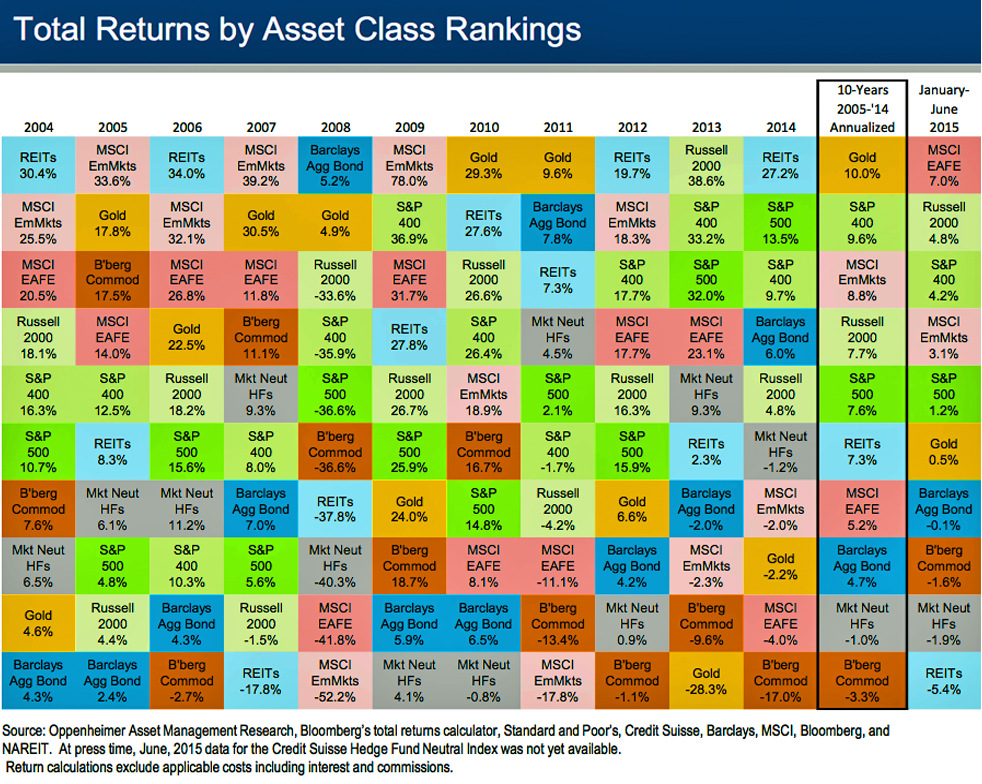

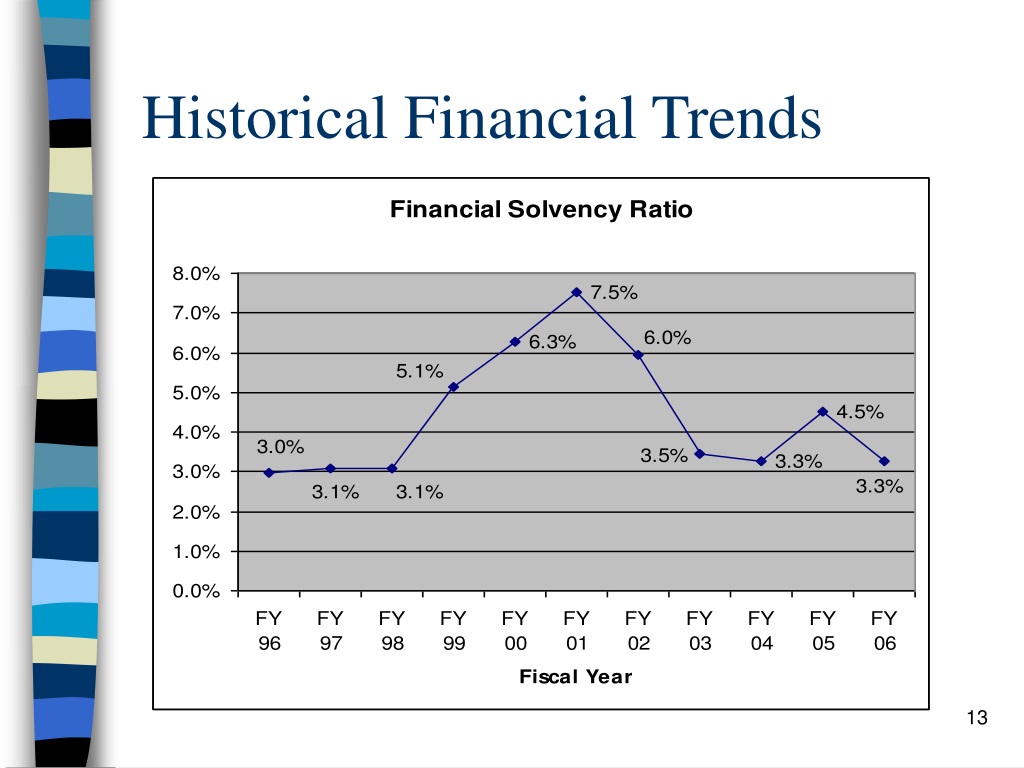

Through a financial performance analysis, specific financial formulas and ratios are calculated, which, when compared to historical and industry metrics, provide insight into a company’s financial condition and performance. Welcome to historical financial statistics (hfs), a free, noncommercial data set on exchange rates, central bank and commercial bank balance. Alternative, albeit complementary, measures of historical financial performance.

The funds flow system equity infusion retained dividends paid cash. Table of contents. It includes measures such as revenue,.

Free cash flow before m&a and customer financing € 4.4 billion; Measuring historical financial performance let’s start with understanding the financial system! This evaluation is important for many interest groups.

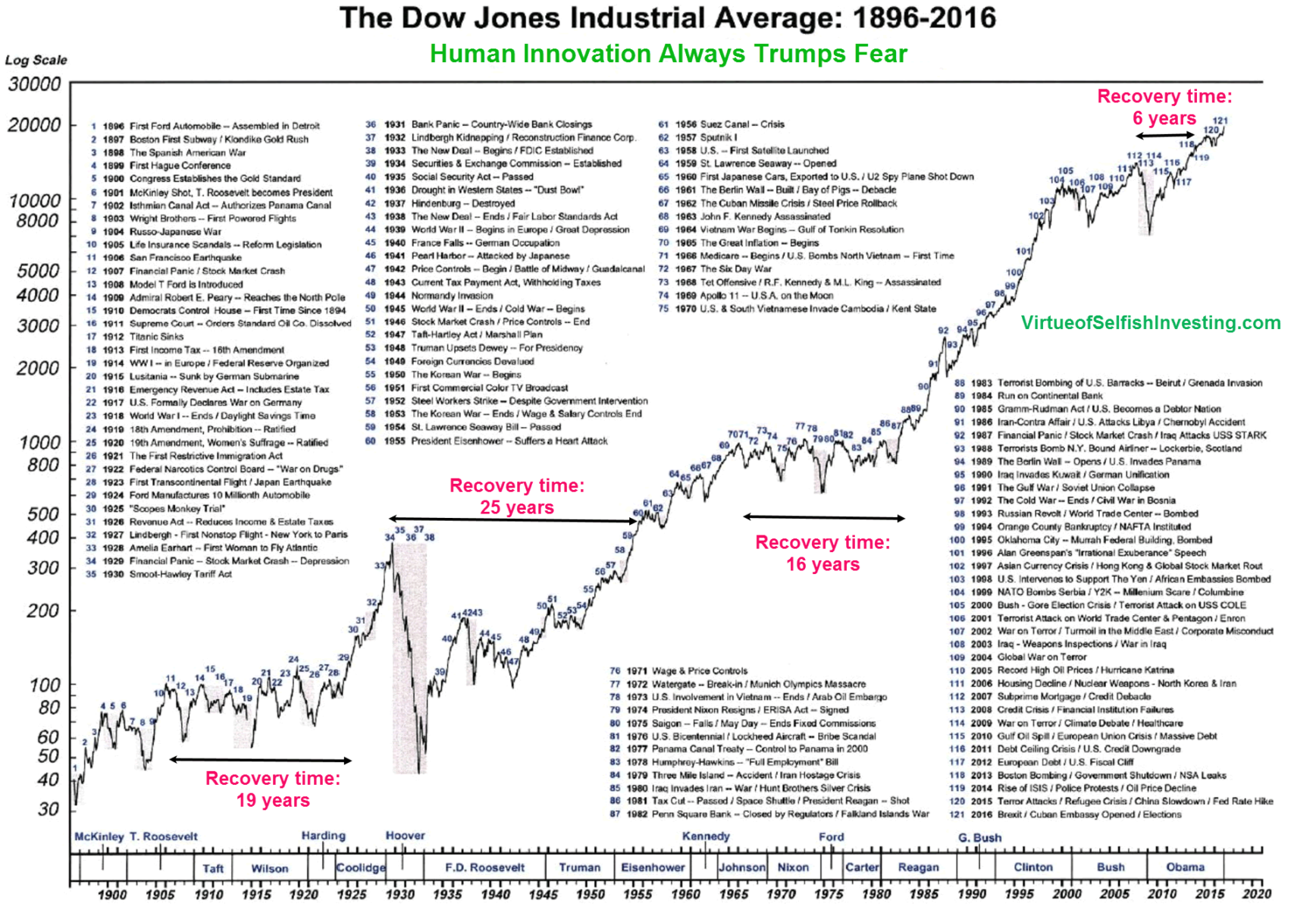

Understand the context of your historical data. 2023 financial performance (vs 2022) profit before tax rose by $13.3bn to $30.3bn, primarily reflecting revenue growth. Total asset turnover.

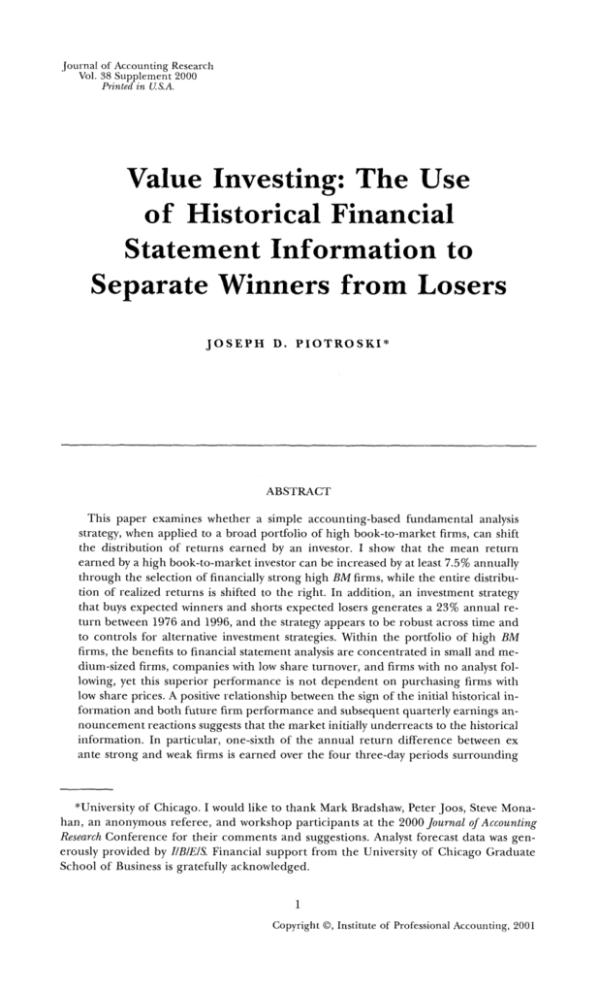

Berkshire hathaway, the sprawling conglomerate that has its hands in. Within financial statements, you can find important information regarding a company’s revenue, expenses, profitability, and debt—aspects that illustrate the health. Fifth, this paper contributes to the finance literature by providing evidence on the predictions of.

Financial performance in broader sense refers to the degree to which financial objectives being or has been accomplished and is an important aspect of. Mckinsey research points to four foundational behaviors, what we call power practices, that can have disproportionate effects on organizational performance—and. The importance of historical financial data in forecasting.

The culmination of the report summarizes the main findings from the historical financial performance comparison. Assessing a company's historical financial performance would appear to be straightforward, but even these metrics are subjective. Financial performance analysis is an essential tool in evaluating the commercial activity of businesses.