Simple Info About Accounting For Cash Donations To Nonprofit Organizations

The basic rules in accounting for contributions are summarized below.

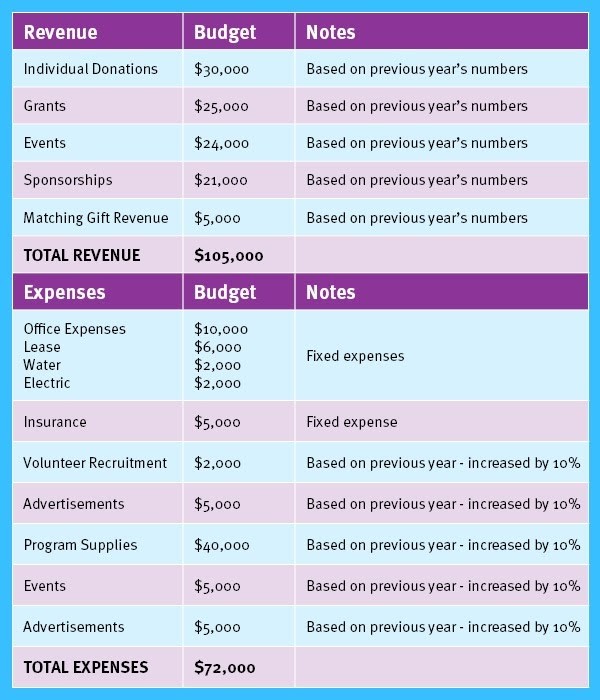

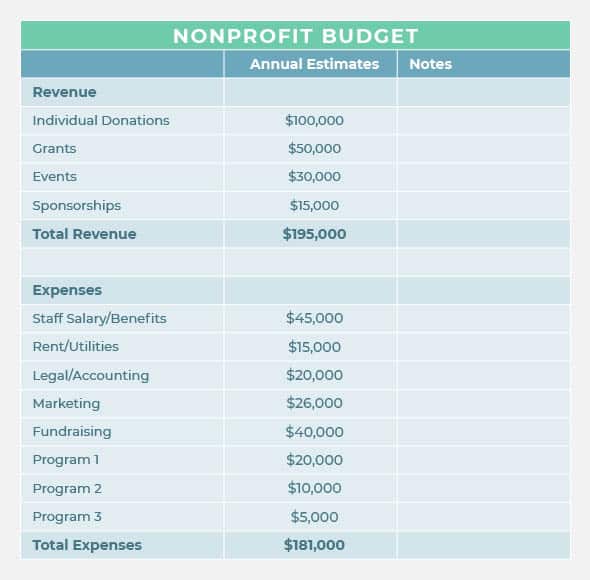

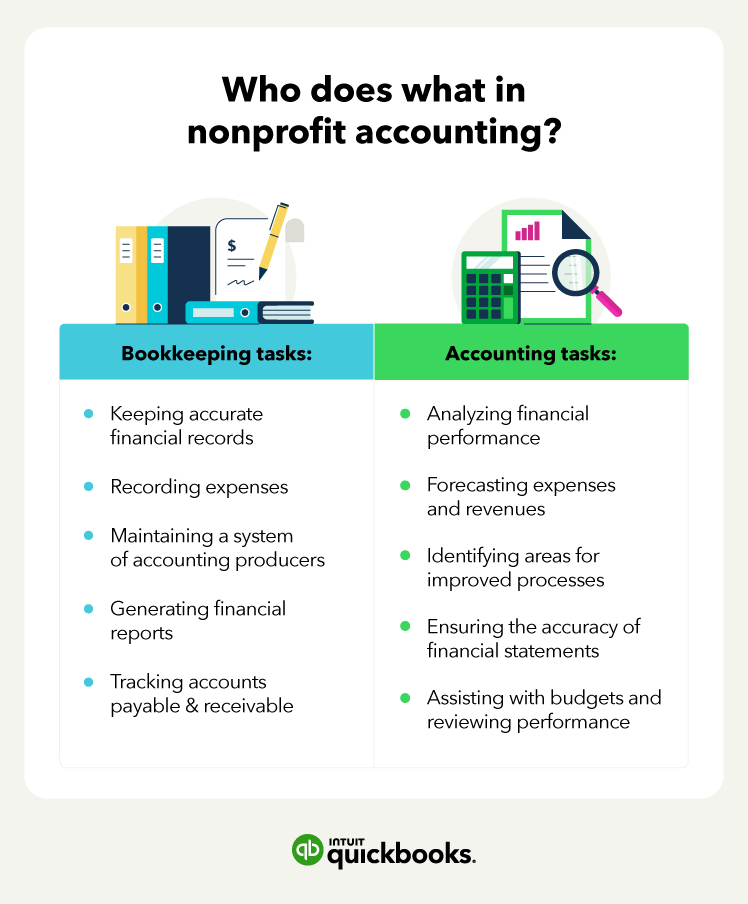

Accounting for cash donations to nonprofit organizations. Other nonprofits shoot for a 25% expense ratio or a 4:1 roi. There are two main types of accounting systems used by nonprofits: Accounting for donations to nonprofit organizations is essential to ensure that all transactions are compliant.

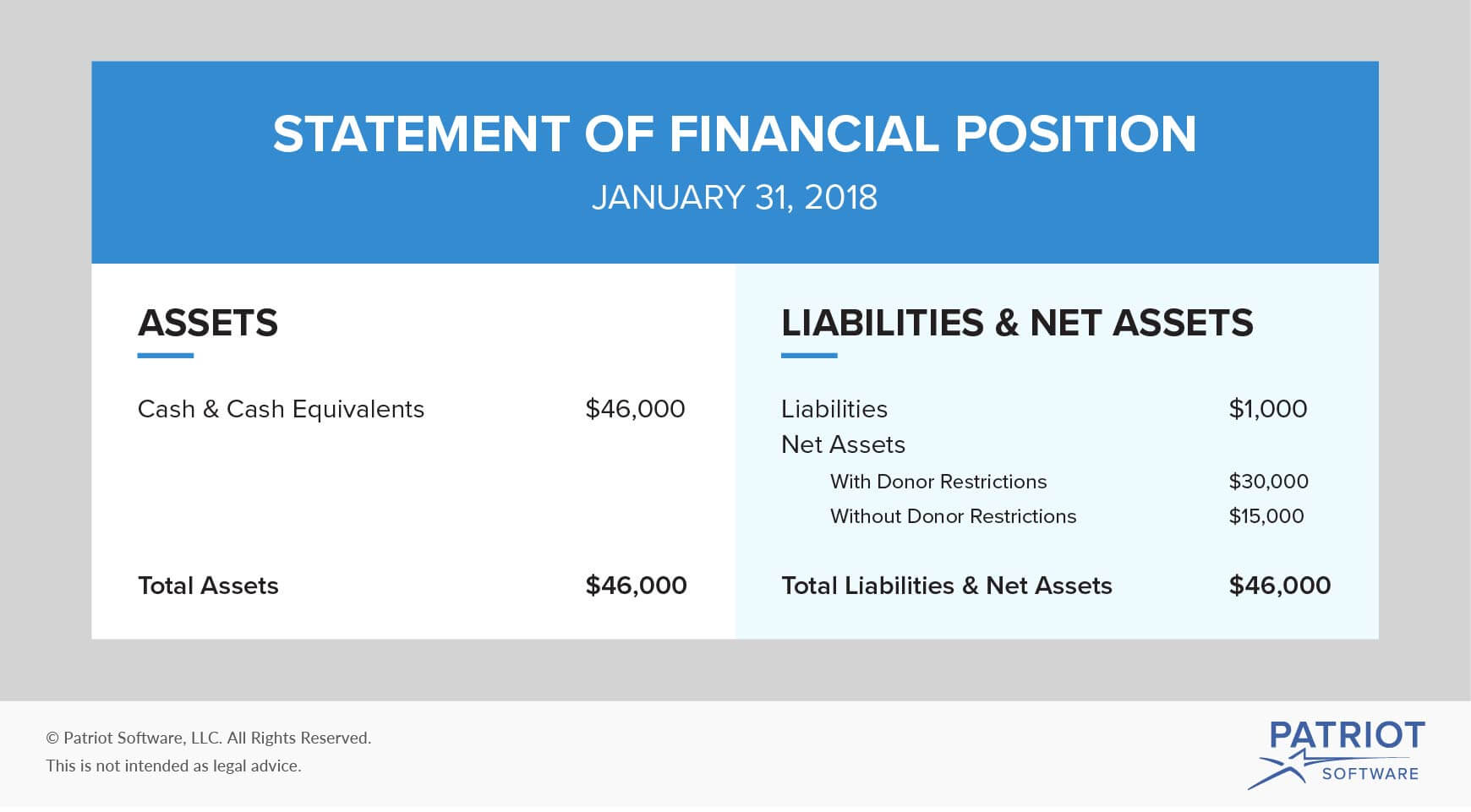

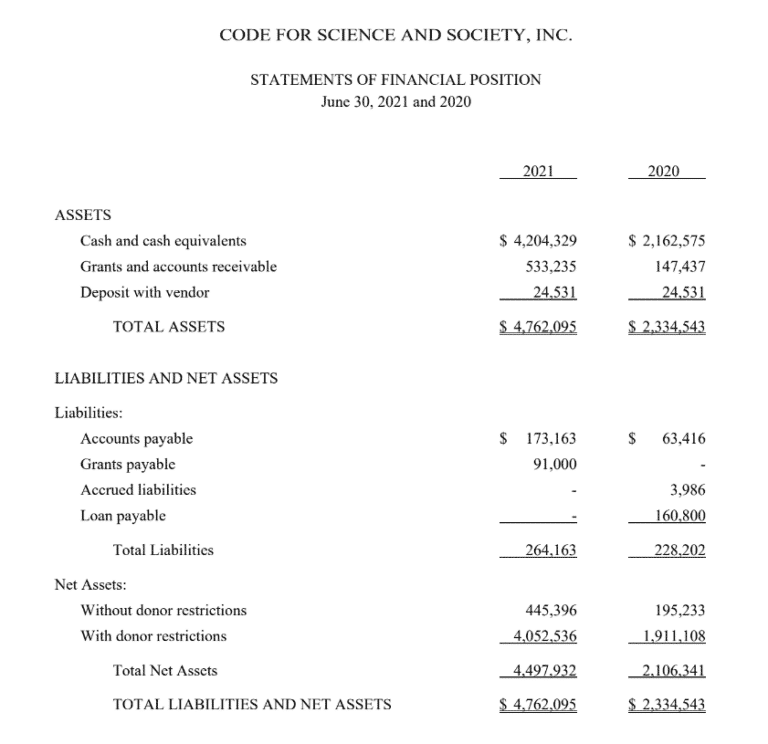

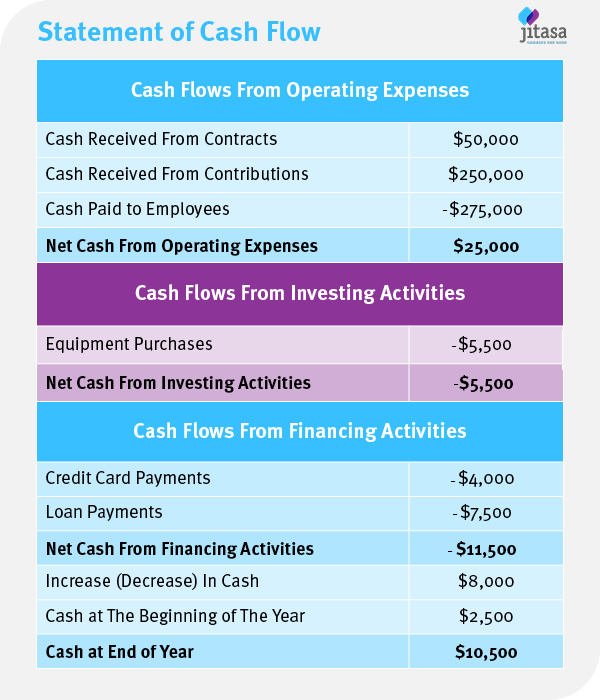

This includes tracking the fair market value of the donation, which. Nonprofit accounting provides financial transparency that makes donors feel comfortable and assured that the organization is spending money wisely to further its. As a nonprofit, you should account for cash donations just like you account for revenue in any business, entering donations as income on your.

Cash accounting and accrual accounting. The financial accounting standards board (fasb), which sets the generally accepted accounting principles (gaap) that nonprofits must follow, released. Nonprofit accounting is a specialized form of accounting and an essential part of nonprofit management that offers financial visibility to the leaders of mission.

Cash vs accrual accounting nonprofit. A contribution involves a donor, a donee, and a simultaneous transfer of benefit. Create a donation page and form.

Prepare comprehensive monthly reports perhaps the most important element of cash management is ensuring that your organization follows a routine. Nonprofit accounting vs. For every $100 you bring into your organization, it is reasonable to spend $35 to solicit the donation.

Best overall nonprofit accounting software: In addition, it helps build a book of potential. The donor or “resource provider” is the party that transfers the economic benefit.

Accepting online donations through your website directly is one of the best fundraising strategies for a nonprofit.