Cool Tips About Bookkeeping Up To Trial Balance

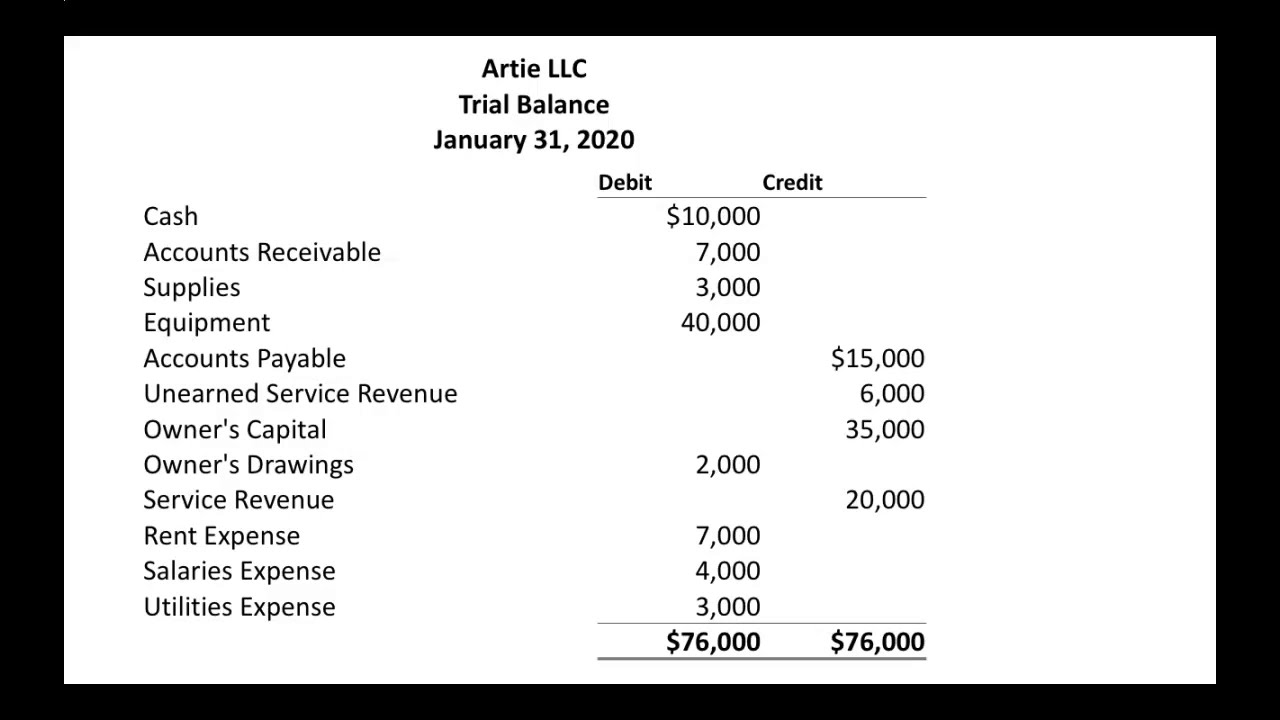

A trial balance consists of the following information:

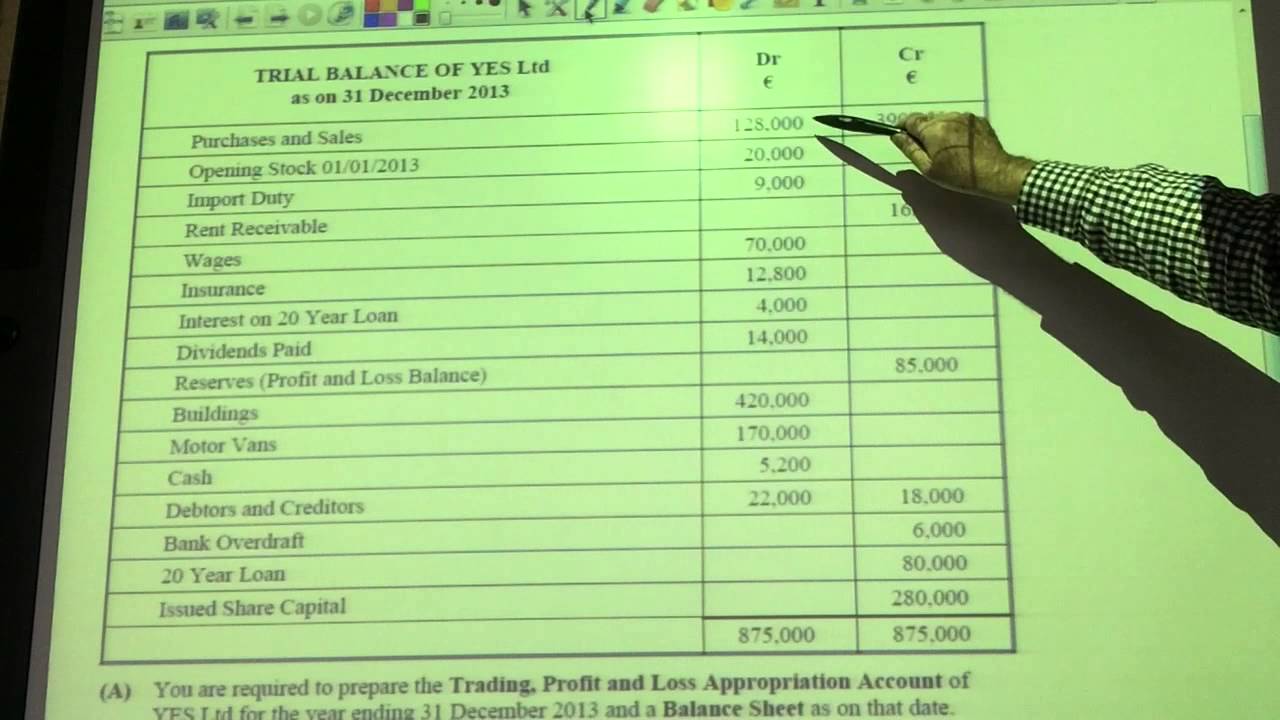

Bookkeeping up to trial balance. A trial balance is a document that is prepared that confirms whether your books are balanced or if there are errors that need to be addressed. The total debits should equal the total credits, which signifies that the accounting equation (assets = liabilities + equity) is in balance. To help identify the reasons why a trial balance may not balance the following steps can be taken.

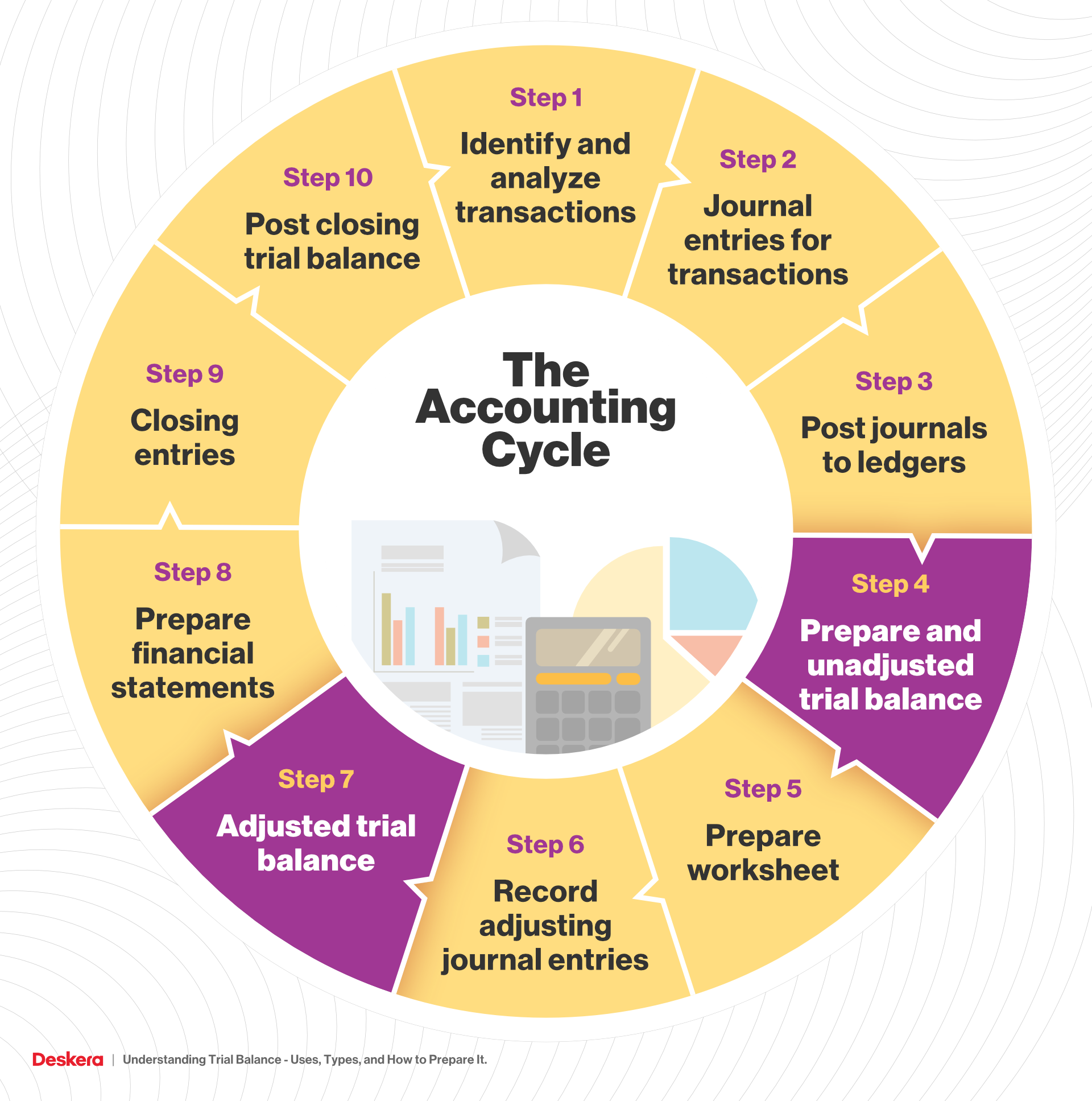

How do we prepare a trial balance? Up to the summary amounts found in the related general ledger account. With double entry bookkeeping, you make two entries, one credit and the other debit.

Journals are then summarised in the general ledger which is then summarised in the trial balance. The total of all debits should equal the total of all credits, resulting in a report balance of zero. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. It is the last step in the accounting cycle. Defining credit transactions the general journal is not reserved only for transactions with debtors and creditors.

The title of each general ledger account that has a balance to the right of the account titles are two columns for entering each account's balance. I am just working on some pricing plans and i realise that people may have differing opinions as to what the term up to trial balance actually means. Using information from the revenue and expense account sections of the trial balance, you can create an income statement.

The trial balance is a report listing the ending debit and credit balances in all accounts at the end of a reporting period. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. One would arrive at the net profit/loss made since the start of the current financial year up until the date of the trial balance.

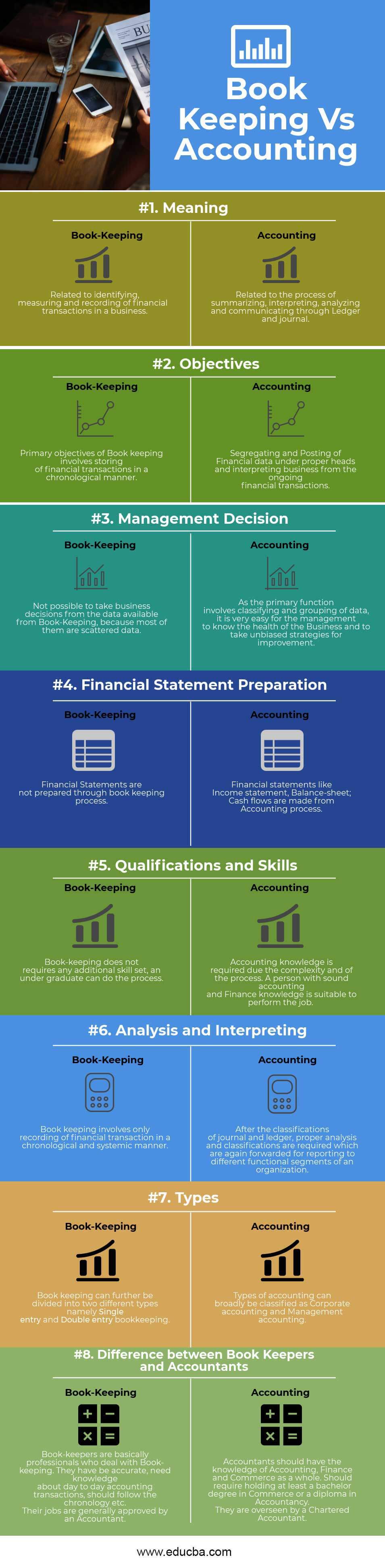

The trial balance is an internal document that lists any account in the general ledger which has a Joining as bookkeeper based from their exeter offices you will act for varied sole trader, partnership and limited company sme's and omb's of varying size and industry sector focused on the provision of bookkeeping services to a client portfolio. Known to be the first modern form of accounting and is the base of our accounting system that we still implement today on our society.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Errors that result in an unbalanced trial balance are usually the result of a one sided entry in the bookkeeping records or an incorrect addition. The trial balance has three uses:

A company prepares a trial balance. A trial balance typically consists of two columns: Would you consider working on fixed assets and depreciation something that the bookkeeper should do or the accountant?

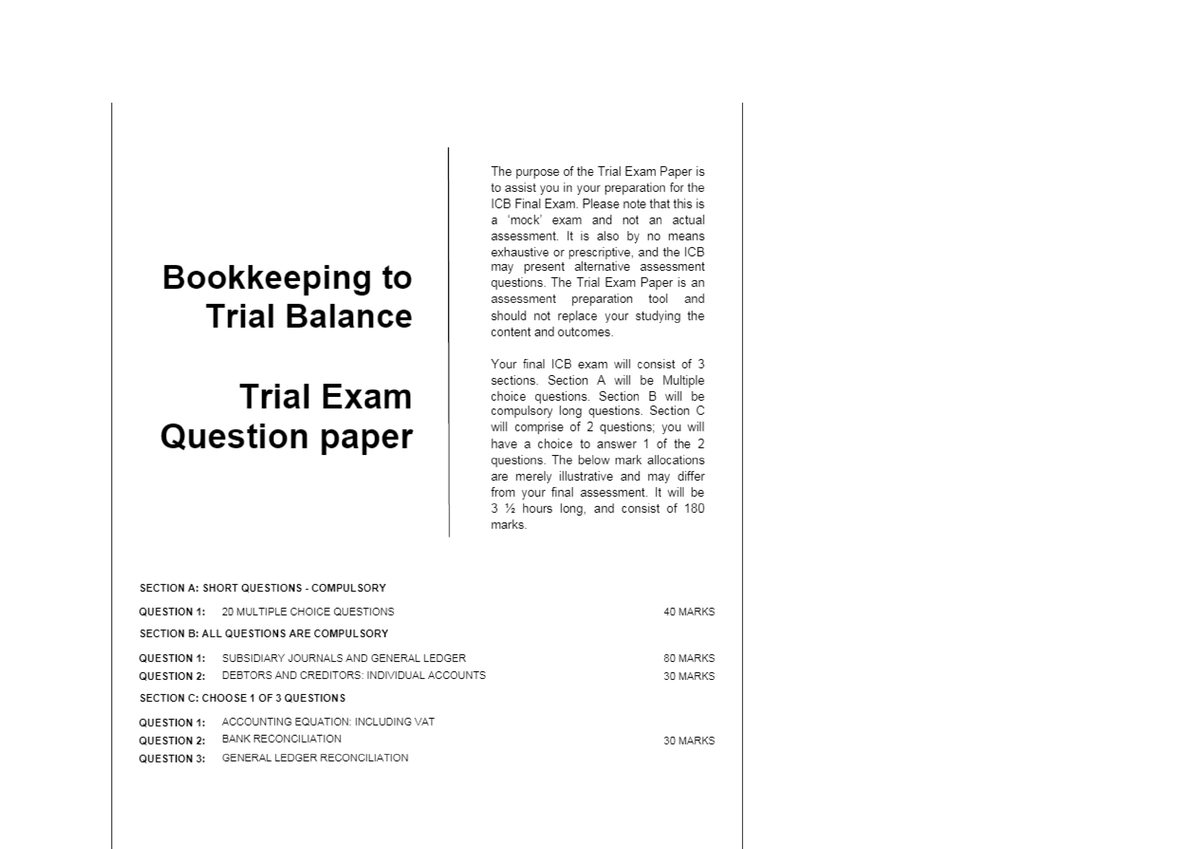

Once you have a completed, adjusted trial balance in front of you, creating the three major financial statements—the balance sheet, the cash flow statement and the income statement—is fairly straightforward. It is a very important step in the bookkeeping process as it ensures accuracy in your records. Hub reports april 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts.