Wonderful Tips About Income Statement And Of Comprehensive

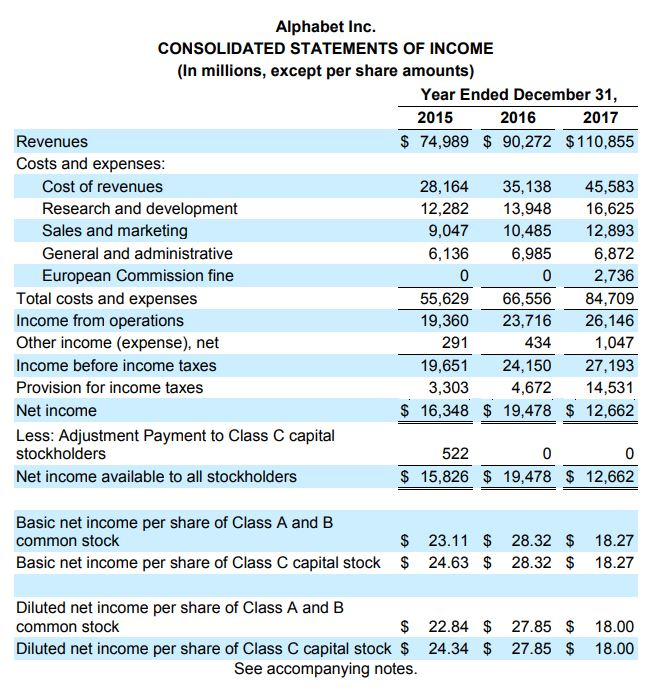

It accompanies an organization’s income statement, and is intended to present a more complete picture of.

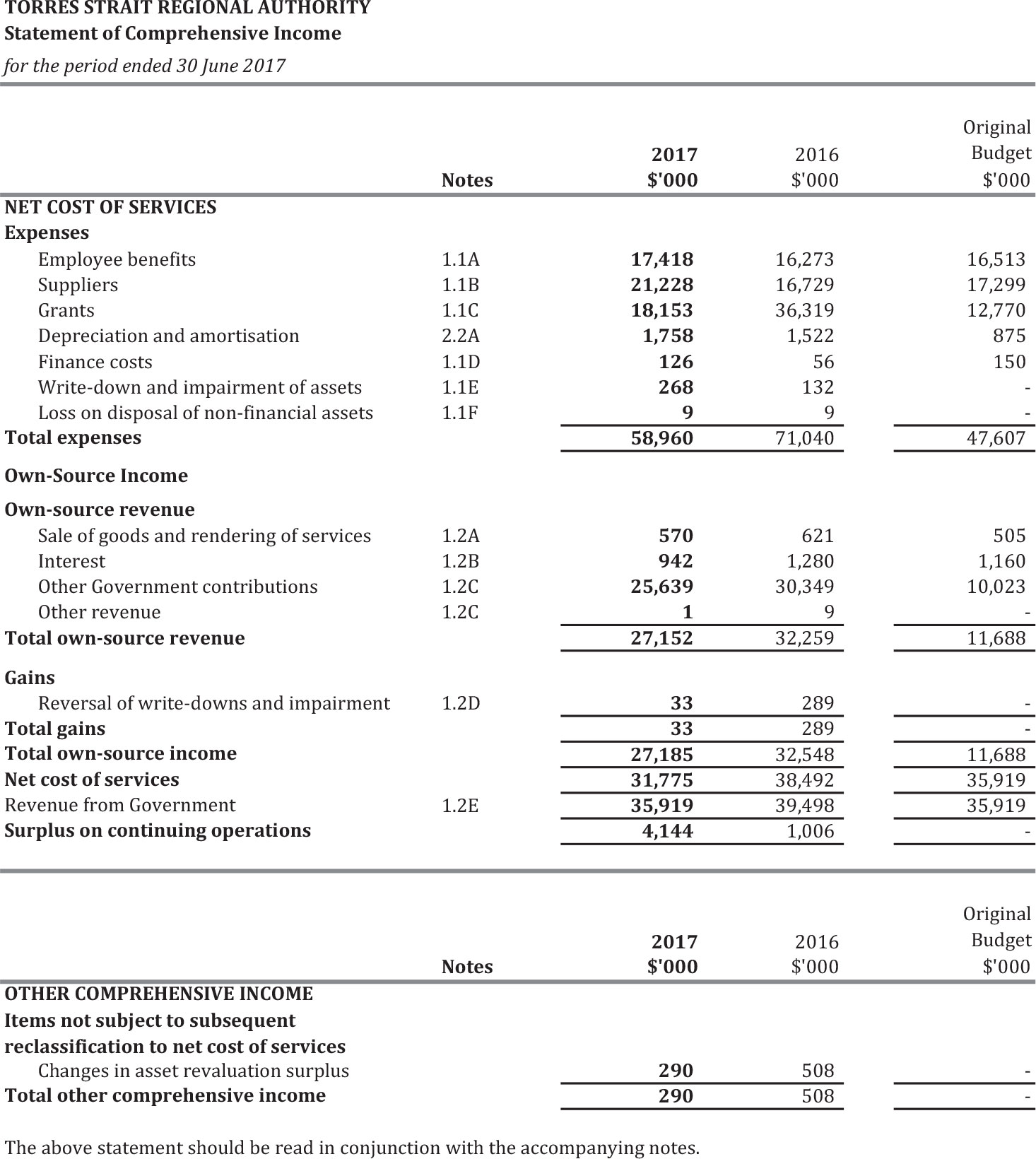

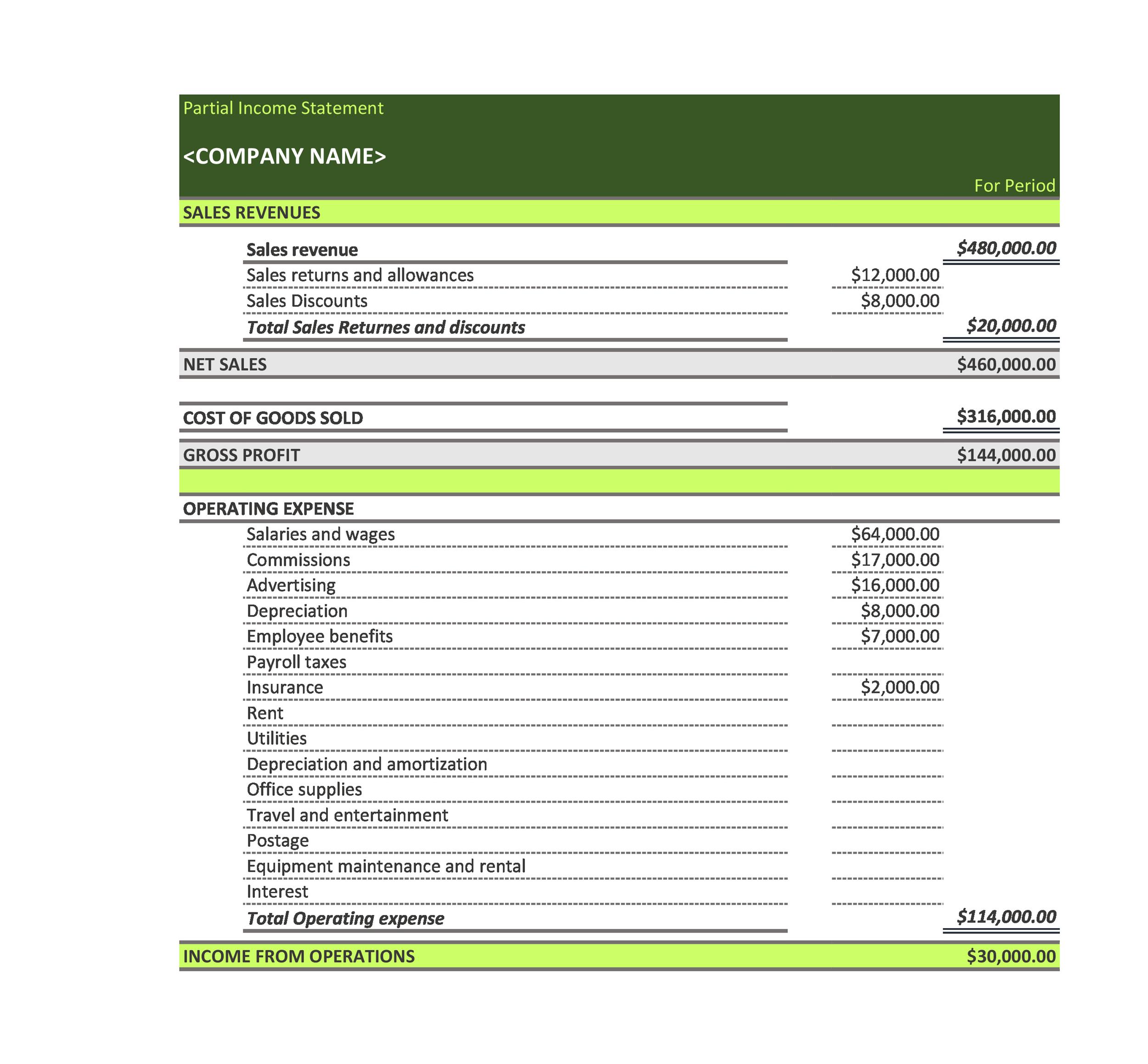

Income statement and statement of comprehensive income. Any equity changes that are not the consequence of transactions with shareholders are included in comprehensive income. As the name suggests, the statement represents the company’s net income.

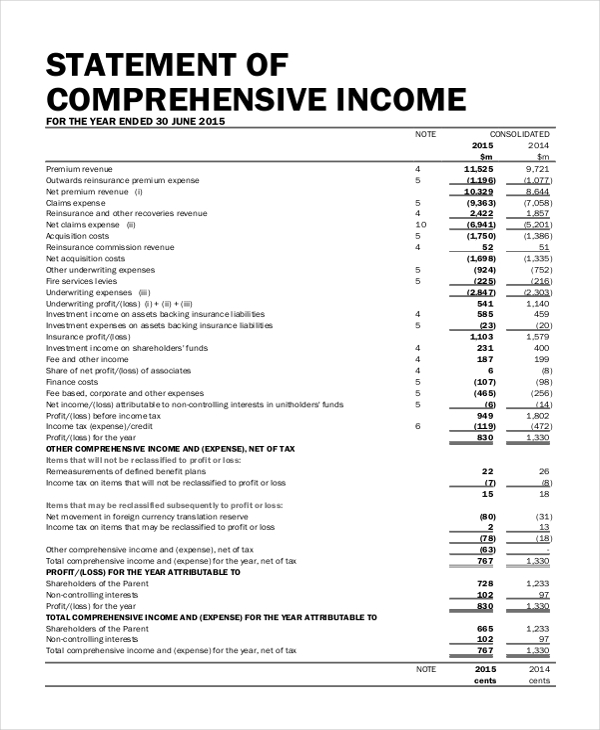

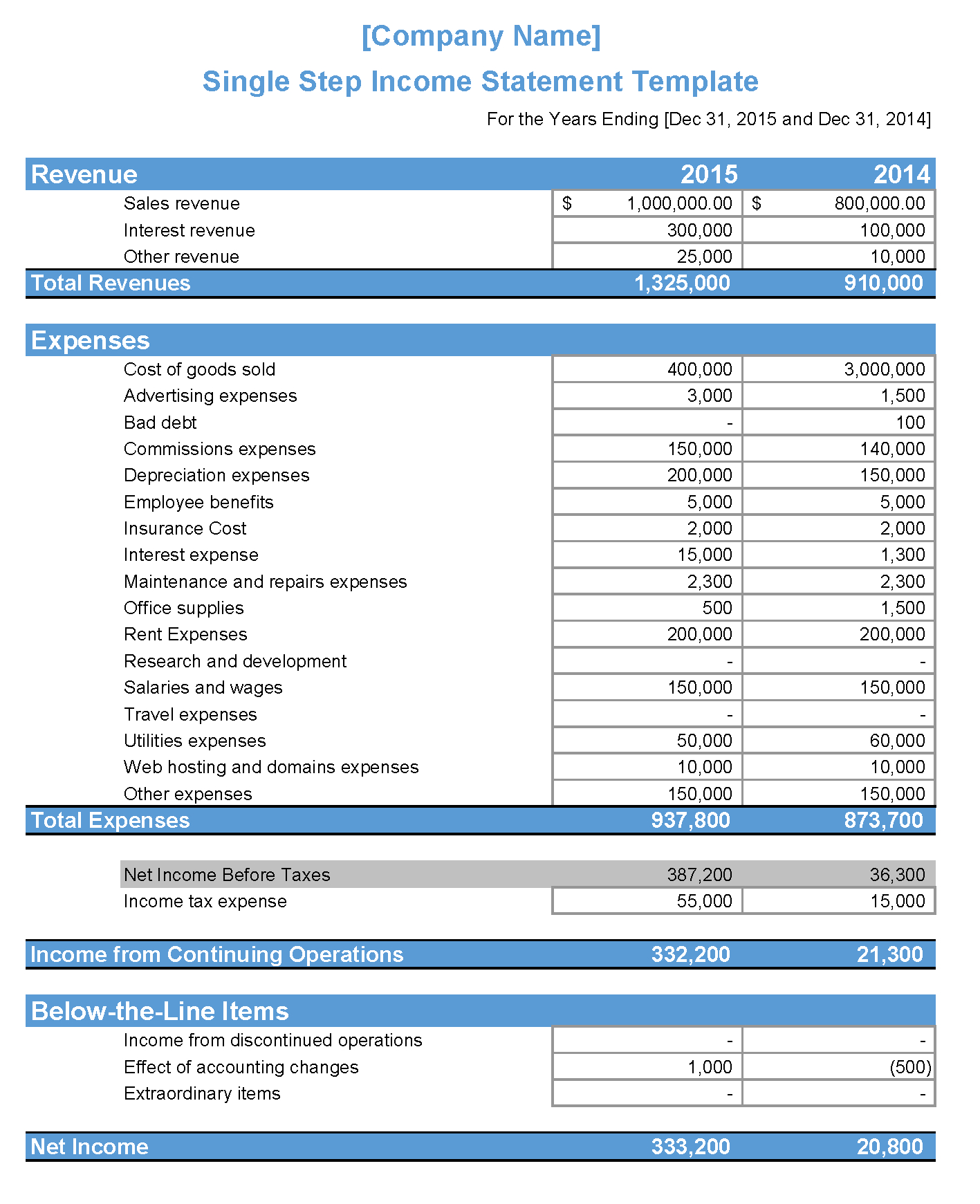

Gross profit determines how well a company can earn a profit while. It comprises all sources of income and spending, taxes, and interest payments. Ias 1 para 81 allows that all the items of income and expenses recognized in the period:

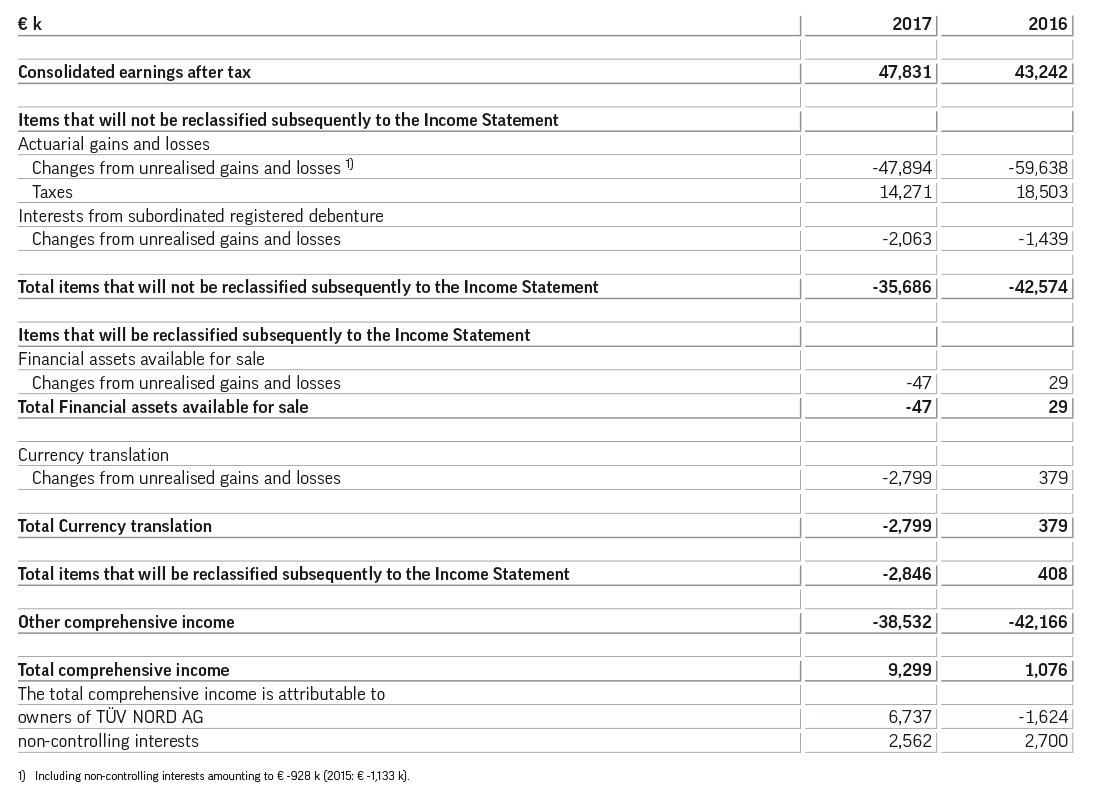

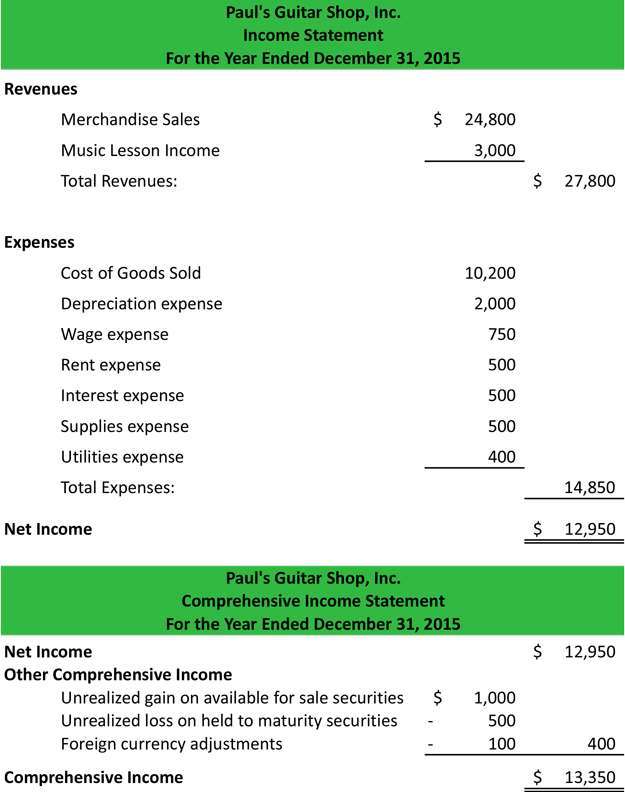

Total comprehensive income/(loss) for the period : However, net income merely accounts for. Two statements would be prepared for ifrs companies that prefer to separate net income from comprehensive income.

(however, it could be combined with the income statement.) Gross profit refers to a company's profits after subtracting the costs of producing and distributing its products. 406 556 (66 253) profit/(loss) for the period attributable to:

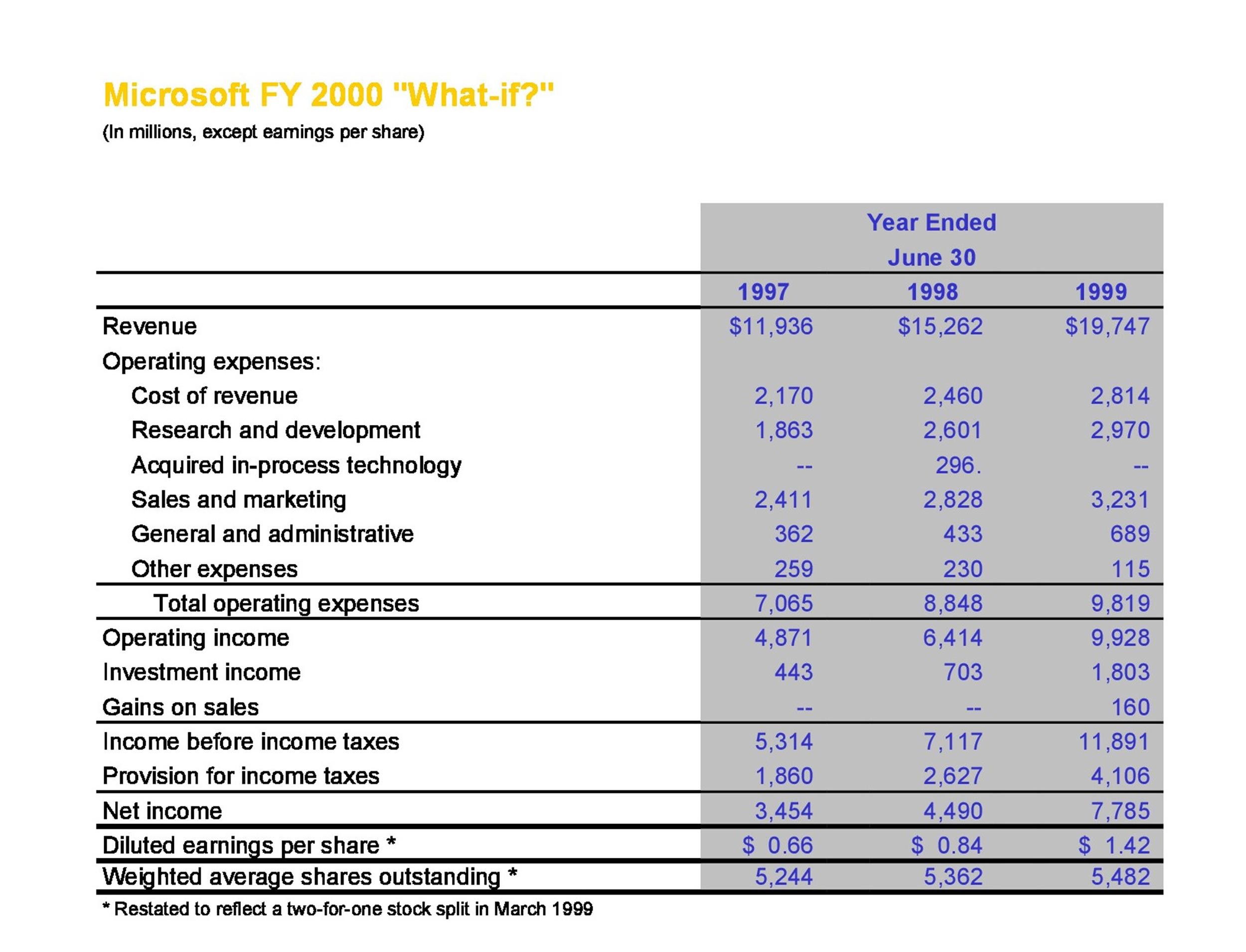

Income range where 85% of your social security is taxable. One of the most important components of the statement of comprehensive income is the income statement. A statement of comprehensive income shows all the details of your company’s cash flow, meaning it shows all the money your company made and spent during a given period.

Either in a single statement i.e. The statement of income and the statement of comprehensive income are both part of financial statements used to report the company’s performance and financial position to the users of financial statements.

Comprehensive income includes realized and unrealized income, such as unrealized gains and losses from the other comprehensive income statement, and therefore is a more detailed view of a. It summarizes all the sources of revenue and expenses, including taxes and interest charges. Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement.

With a provisional income of $34,001 and above for single files or $44,001 and. 413 187 (68 175) equity holders of the parent : One significant difference between both statements is income.

The net income is obtained from your business income statement for your accounting period. Let us look at the advantages of comprehensive income: Record adjusted ebitda margin fourth.

In comparison, oci consists of gains or losses that aren't realized in the income statement. The statement of comprehensive income and income statement is dealt with in section 5 of financial reporting standard (frs) 102. A second statement, called the statement of comprehensive income, would start with net income and include any other comprehensive income (oci) items.