Looking Good Info About Balance Sheet Profit And Loss Cash Flow

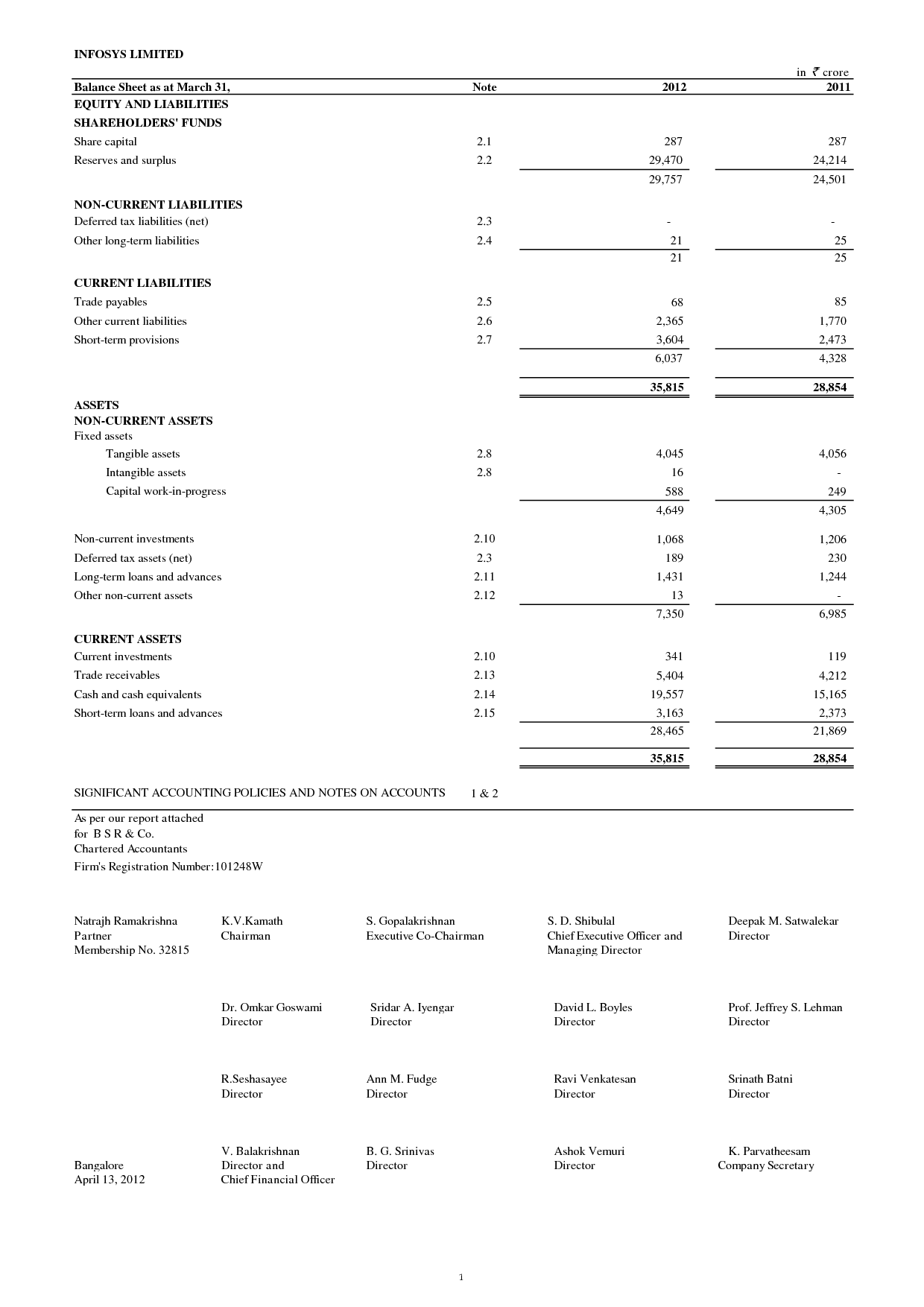

The balance sheet also referred to as the statement of financial position,.

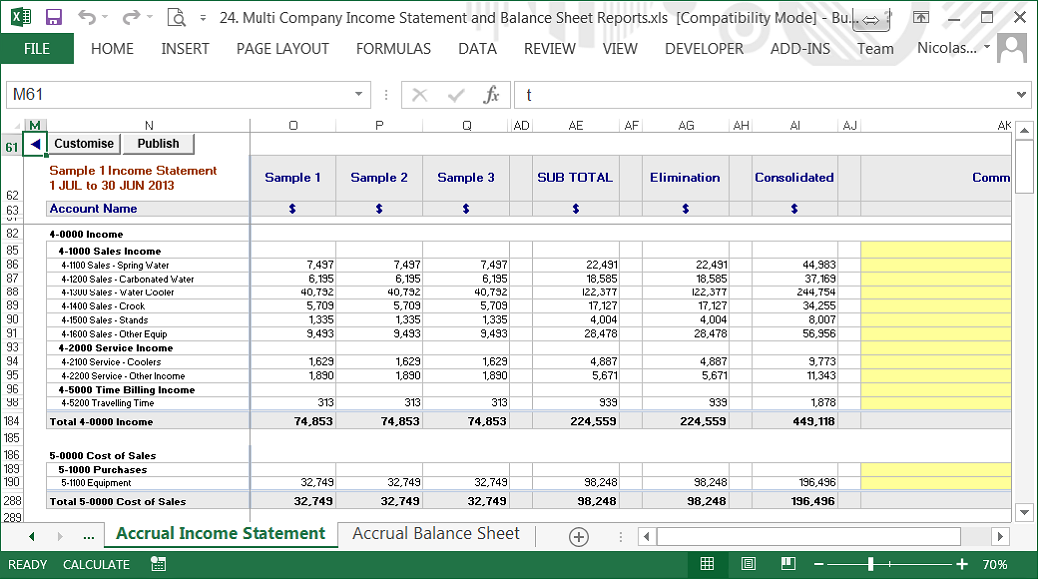

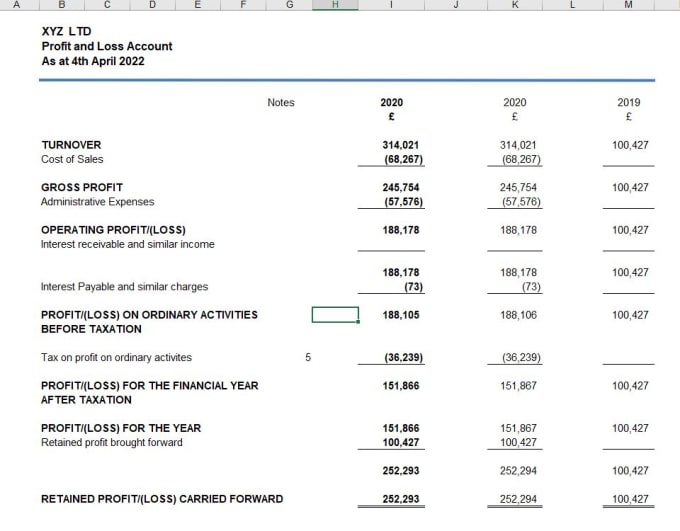

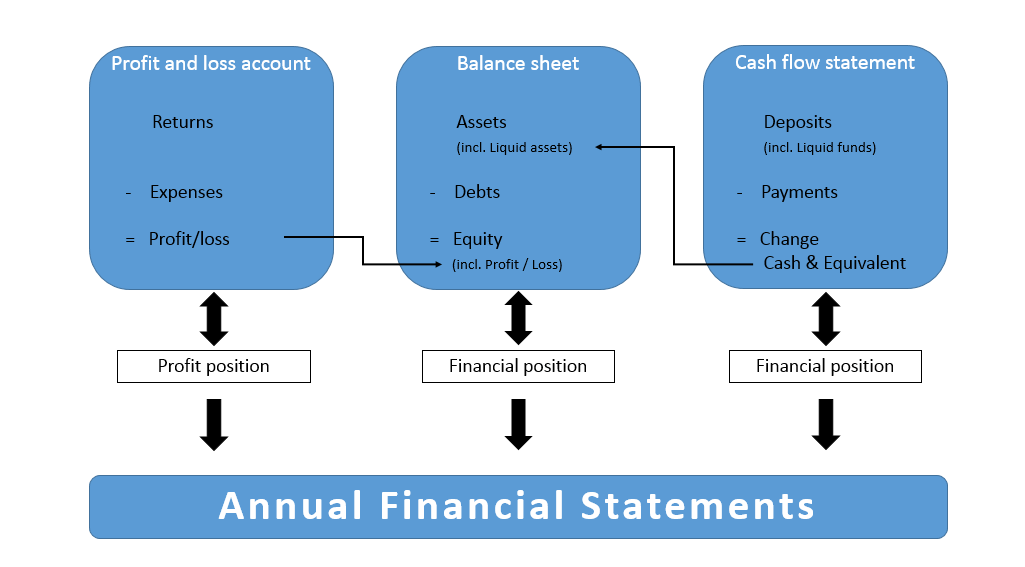

Balance sheet profit and loss and cash flow. When examining the financial statements for a business, the statement of cash flows and the income statement (also called the profit and loss statement) differ from the balance sheet in one important respect: Net income from the bottom of the income statement links to the balance sheet and cash flow statement. Income statements, balance sheets, and cash flow statements are important financial documents for all businesses.

Financial statements are one of the most important aspects of any business, providing a fantastic snapshot of its financial health. A balance sheet lists the following: For example, when a retailer purchases inventory, money flows.

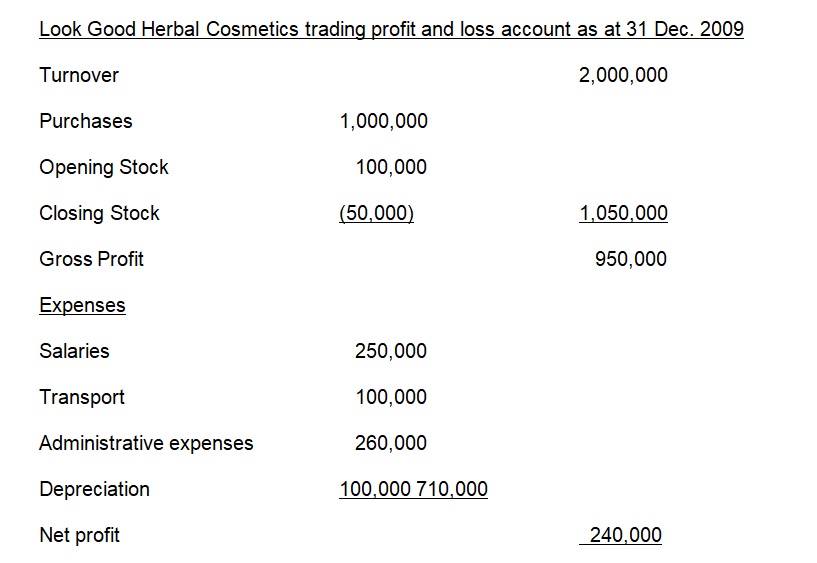

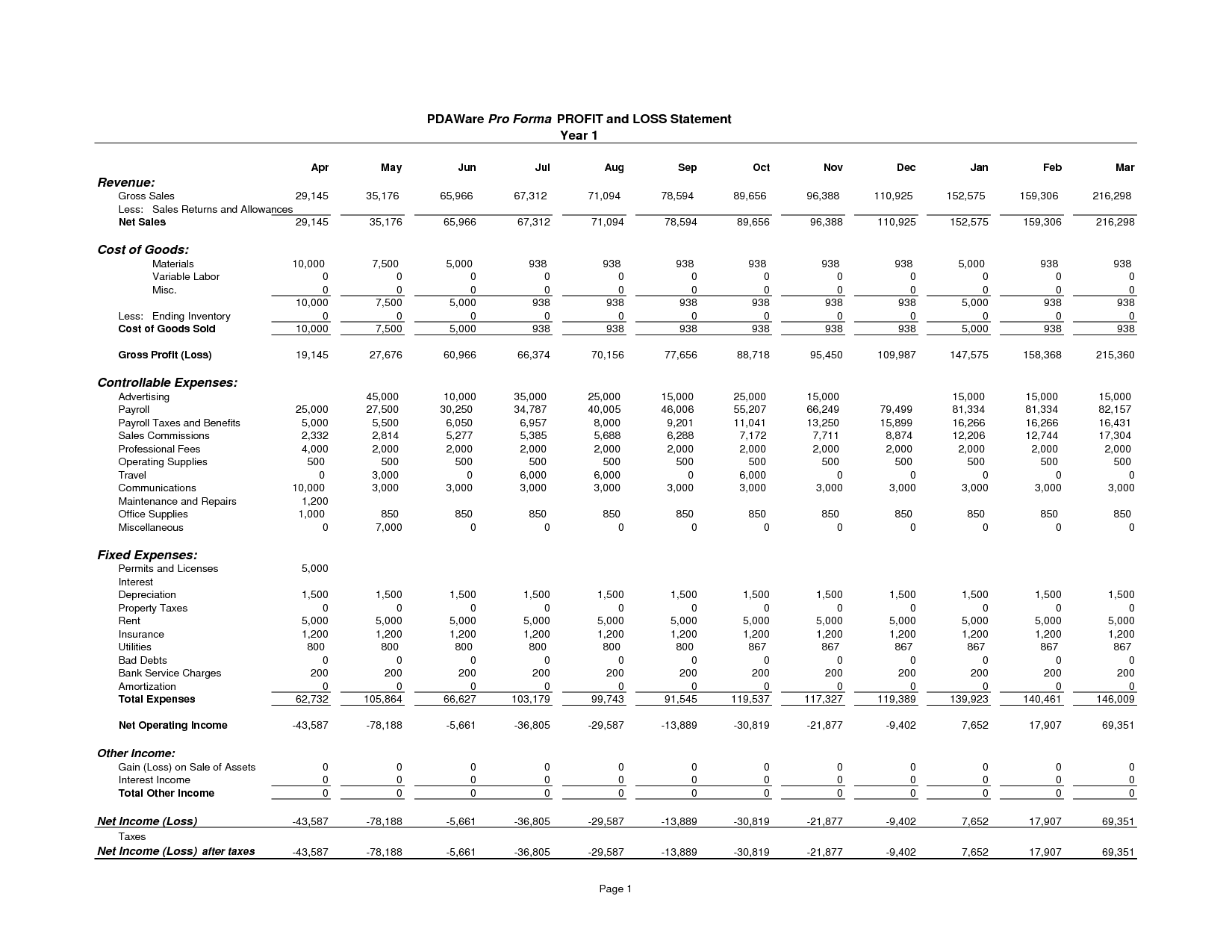

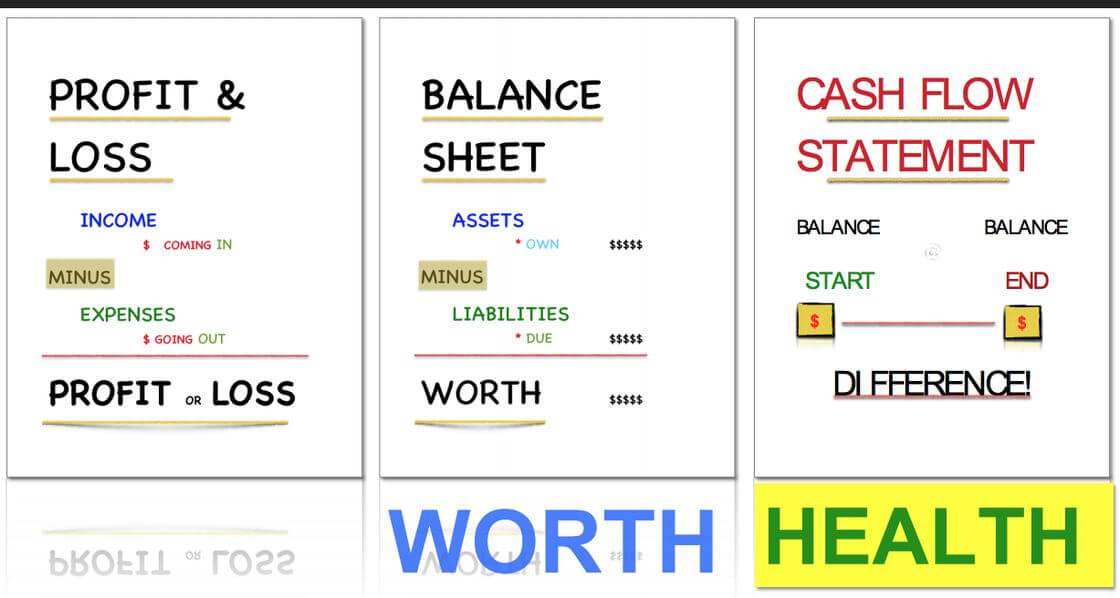

The difference between profit & loss and cash flow projections 00:00 07:50 profit and cash are not the same thing. Balance sheet, profit and loss report, cash flow statement, poland (100107) The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. Balance sheet your balance sheet is a snapshot of your business’s assets and liabilities at a specific point in time, such as the end of the month, quarter, or year. The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow statement.

The income statement illustrates the profitability of a company under accrual accounting rules. Then, it subtracts the costs of making those goods or providing those services, like. The cash flow statement provides a view of a company’s overall liquidity by showing cash transaction activities.

The balance sheet shows a company’s assets, liabilities, and shareholders’ equity at a particular point in time. A balance sheet conveys the “book value” of a company. July 13, 2022 when looking at your financial statements, there are three main types that you will issue on a regular basis:

It contains information about what the company owns, what the company's debt, what funds balance is, the profit and loss (in our post the main causes of financial failures you'll read more detailed. The balance sheet, the profit and loss (p&l) statement, and the cash flow statement. It allows you to see what resources it has available and how they were financed as of a specific date.

The other two are the balance sheet and the cash flow statement. Net income & retained earnings. Any accounting 101 student will learn that there are three primary financial statements of primary importance:

The profit and loss statement (p&l), the balance sheet, and the. Of these three statements, two are commonly confused: The three primary financial statements are the cash flow statement, the income statement (also known as profit & loss), and the balance sheet.

Financial statements are important for analyzing the performance of a business and making informed financial decisions. On the balance sheet, it feeds into retained earnings and on the cash flow statement, it is the starting point for. A balance sheet also shows the amount of money invested by.