Brilliant Info About Cash Flow From Financing Activities Format

Cash flow from financing activities is the net amount of funding a company generates in a given time period.

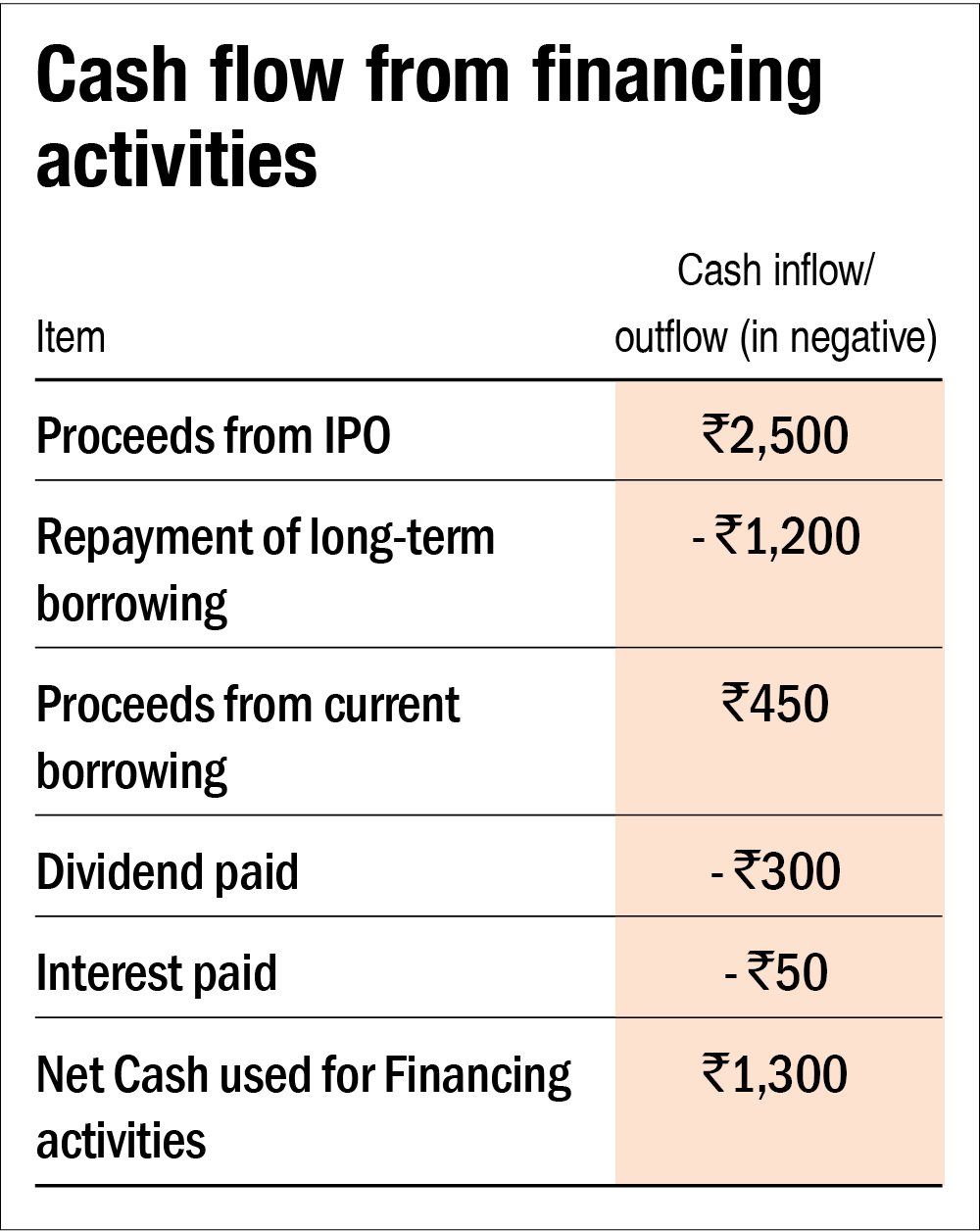

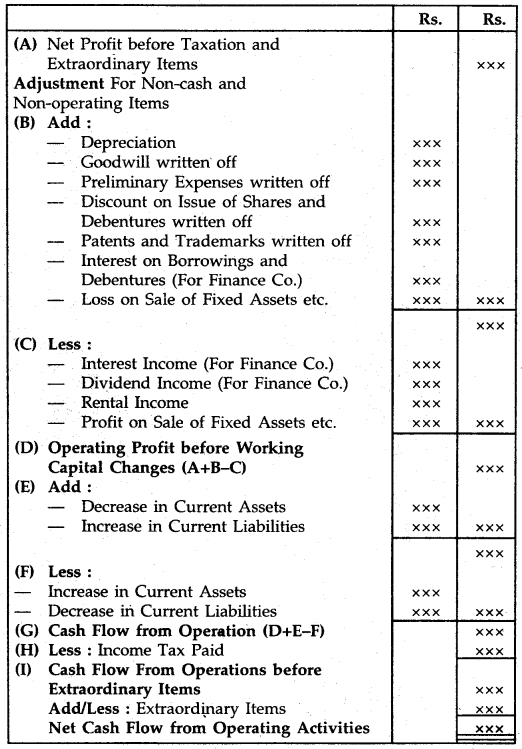

Cash flow from financing activities format. The cash flows from financing activities line item is one of the more important items on the statement of cash flows, for it can represent a substantial source. In order to calculate cash flow financing, one needs. Cash flow from operating activities.

Paying a part of a loan or line of credit or getting a new source. Operating activities, investing activities and financing activities. This section reconciles the net profit to net cash flow from.

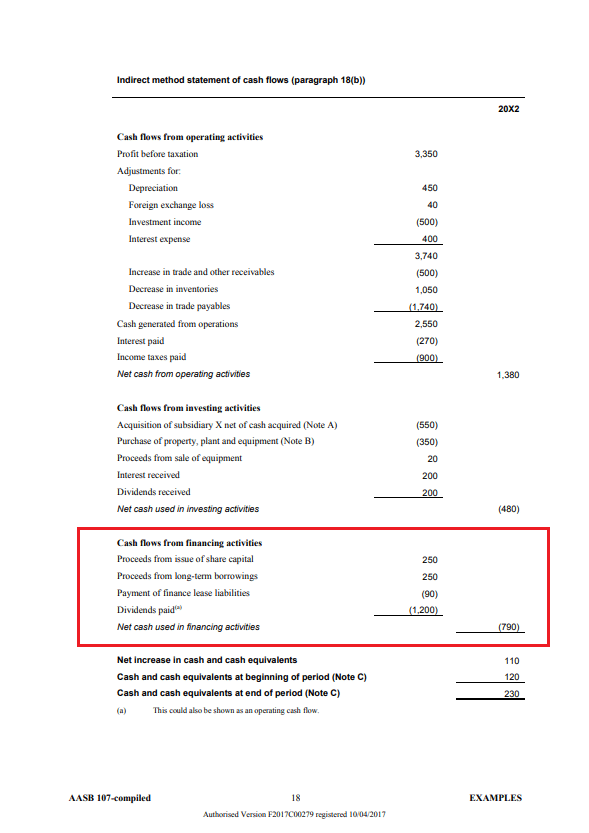

The cash flow statement (cfs), which tracks the net change in cash during a specific period, is split into three sections: The cash flow statement format is as follows. How to calculate cash flow from financing activities?

The format of a cash flow statement is as follows: The formula for calculating the cash from investing section is as follows. Format of cash flow from financing activities:

The three sections of the cash flow statement are: Finance activities include the issuance and repayment of equity,. Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities.

Companies can choose two different ways of presenting the. Repayment of financial lease obligations. The formula for cash flow from financing activities includes adding all items contributing to an inflow of cash, such as issuing stock, borrowing, and subtracting all.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. Cash flow from financing activities refers to revenue earned or assets spent on financing activities. Now let us take an example of an organization and see how detailed.

Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a.

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)