Brilliant Strategies Of Tips About Accounts Receivable Cash Flow Statement Sample Balance Sheet Format

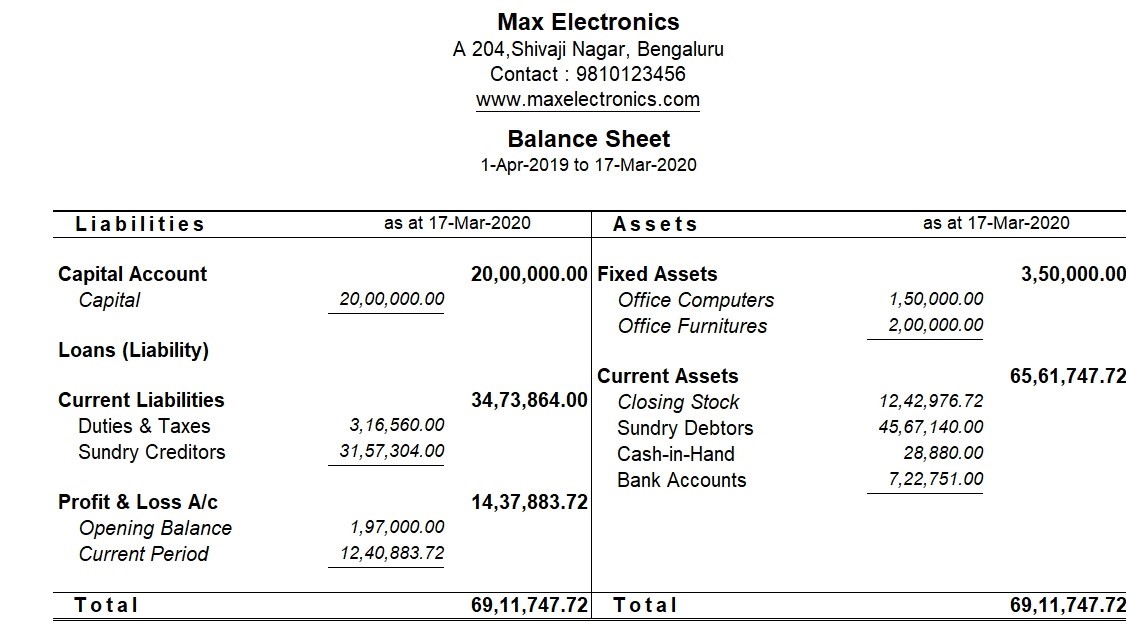

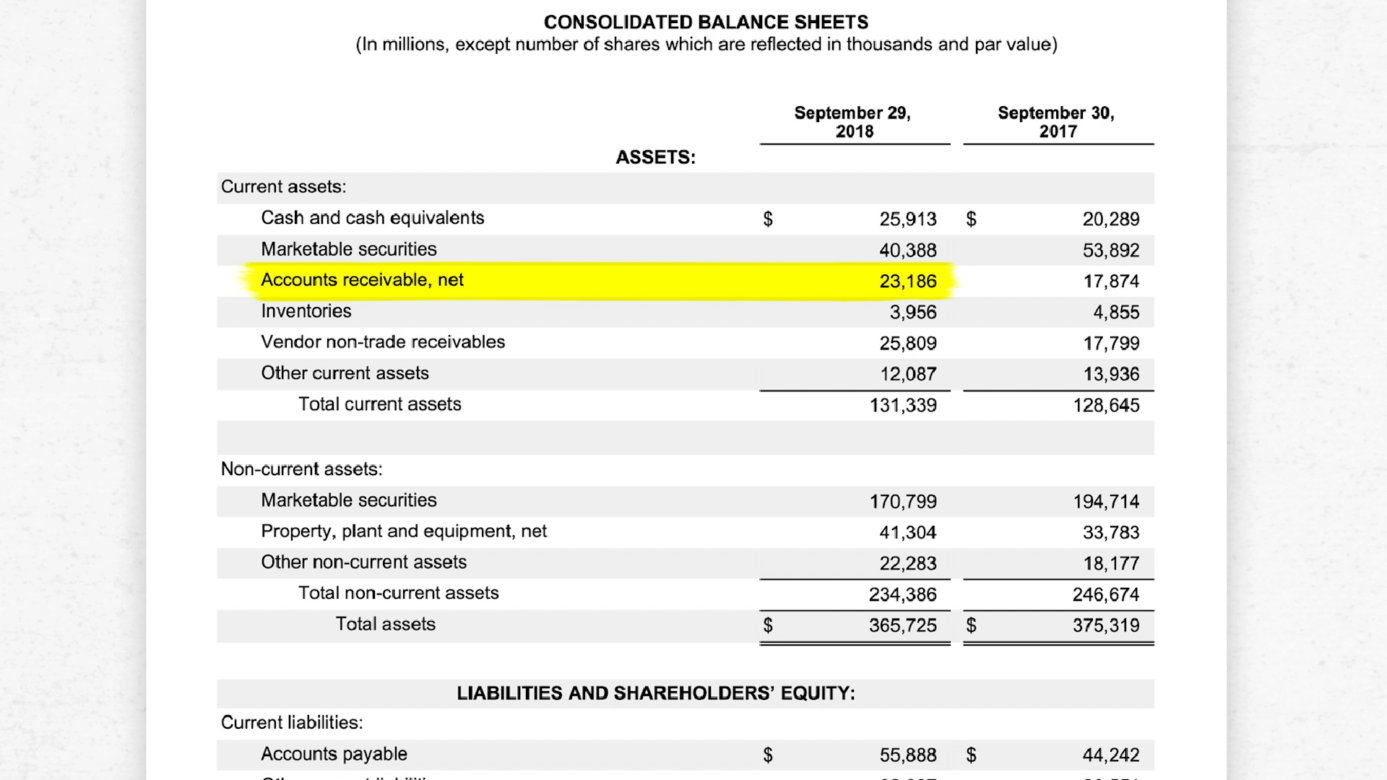

The balance sheet is one of the three core financial statements that are used.

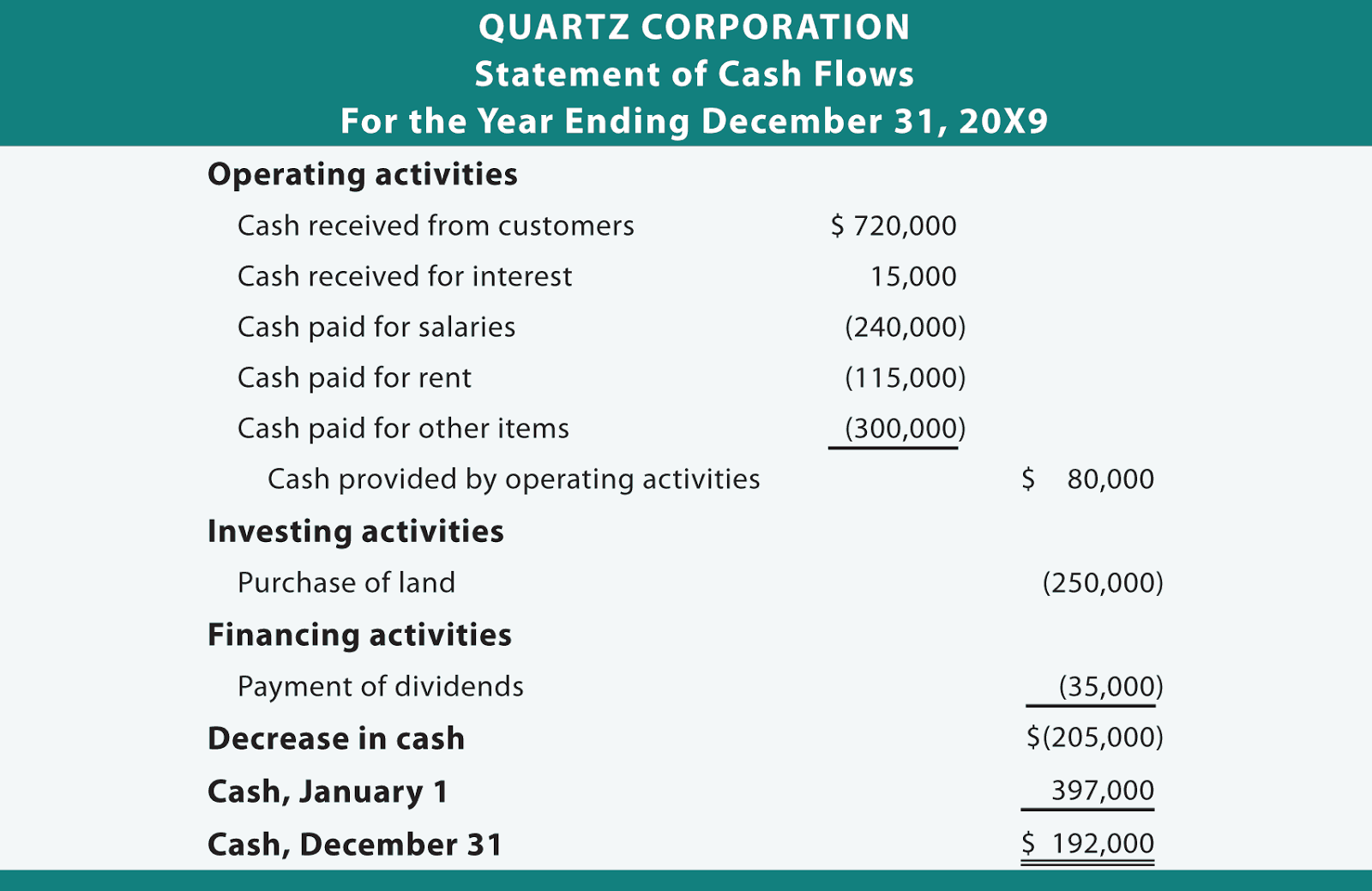

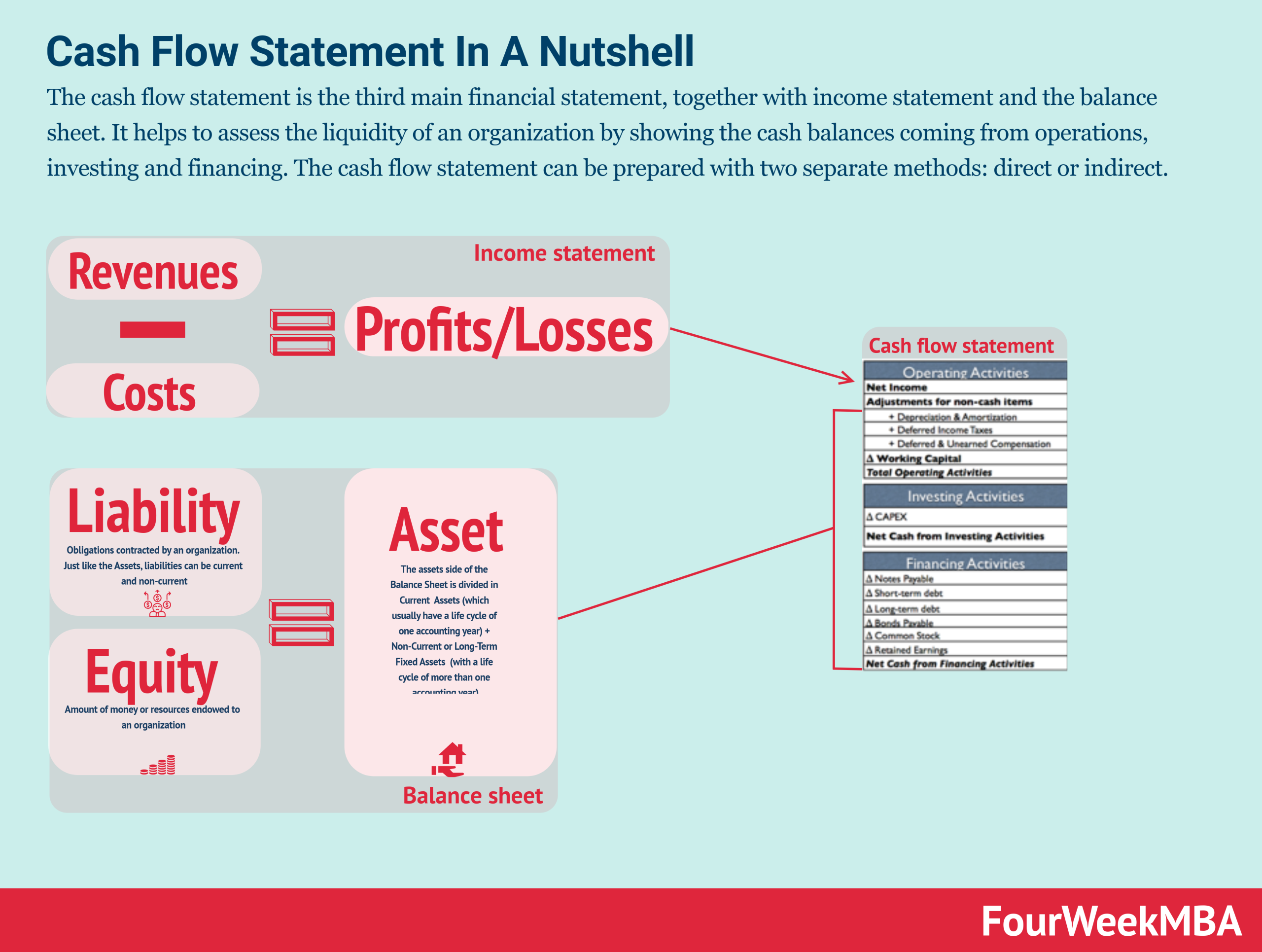

Accounts receivable cash flow statement sample balance sheet format. In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to. In account format, the balance sheet is divided into left and right sides like a t account. The cash flow statement provides business owners and stakeholders with information relating to the company's current and future debit and credits.

This value can be found on the income statement of the same accounting period. You use information from your income statement and your balance sheet to create your cash flow statement. Last updated january 14, 2024 learn online now what is cash flow statement?

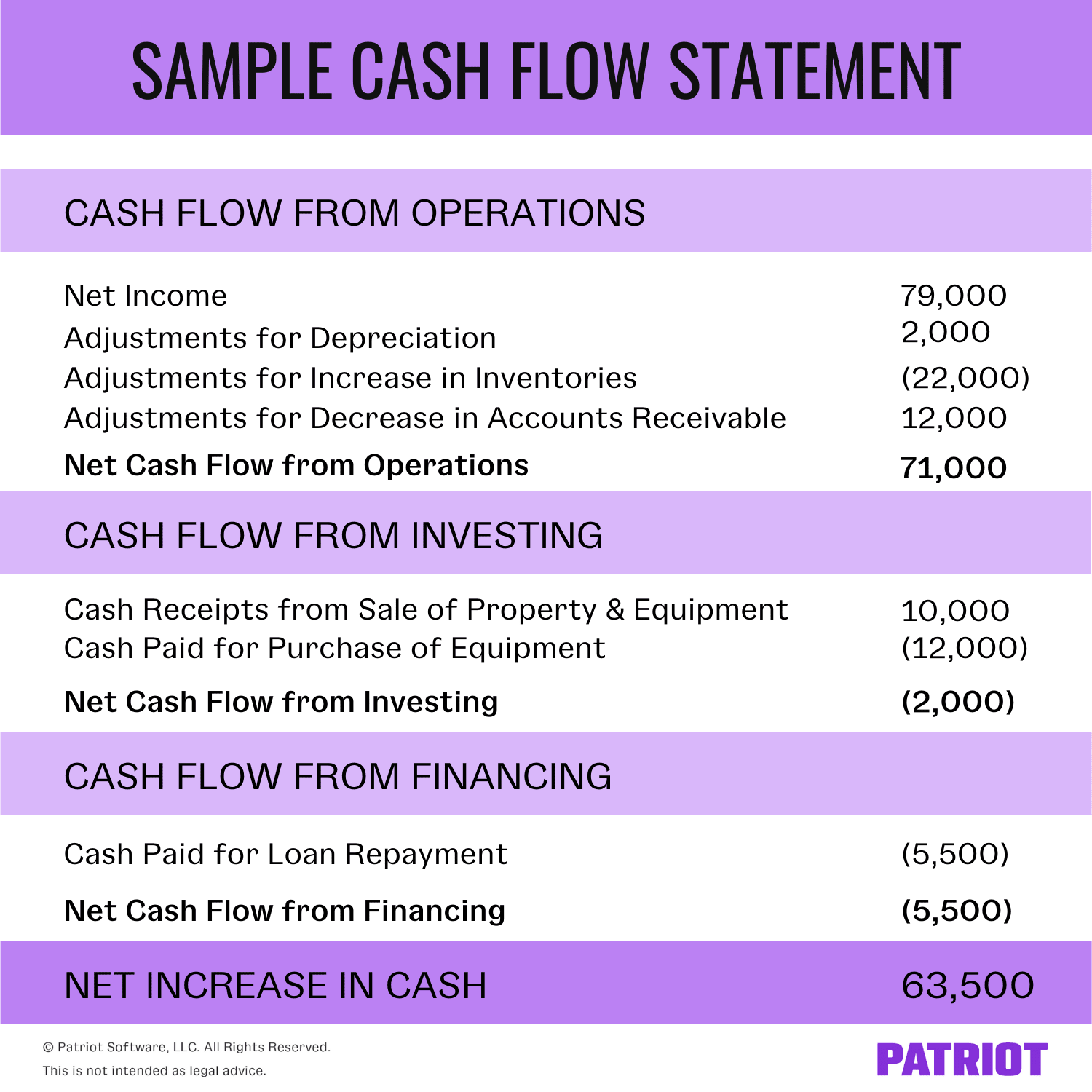

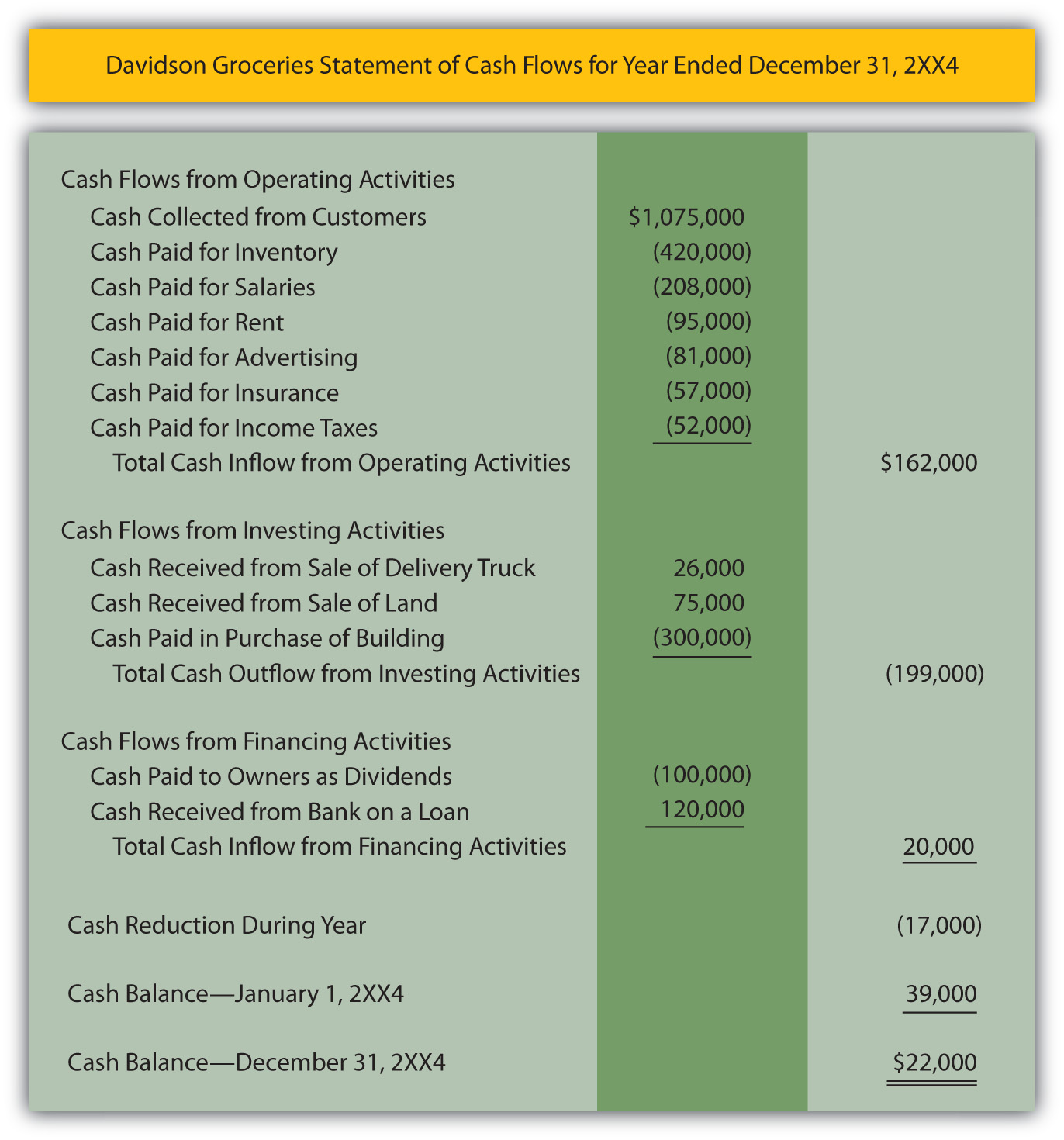

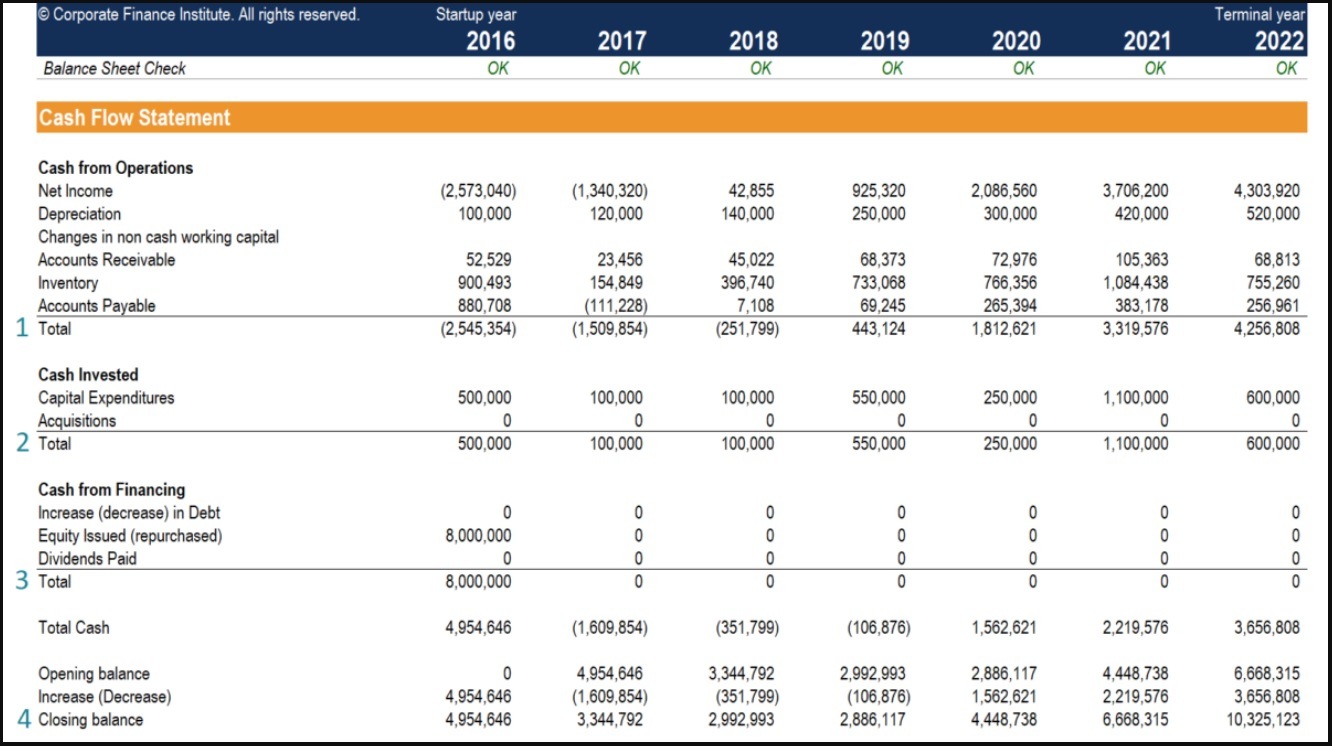

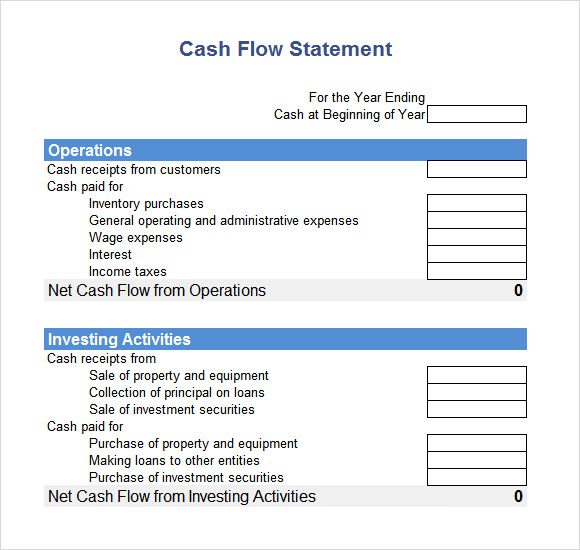

The following are the different formats of the cash flow statement used by small, medium, and large businesses alike. (the company and the amounts shown are hypothetical.) By getting to know the purpose of each of the reports you can better understand how they differ from one another.

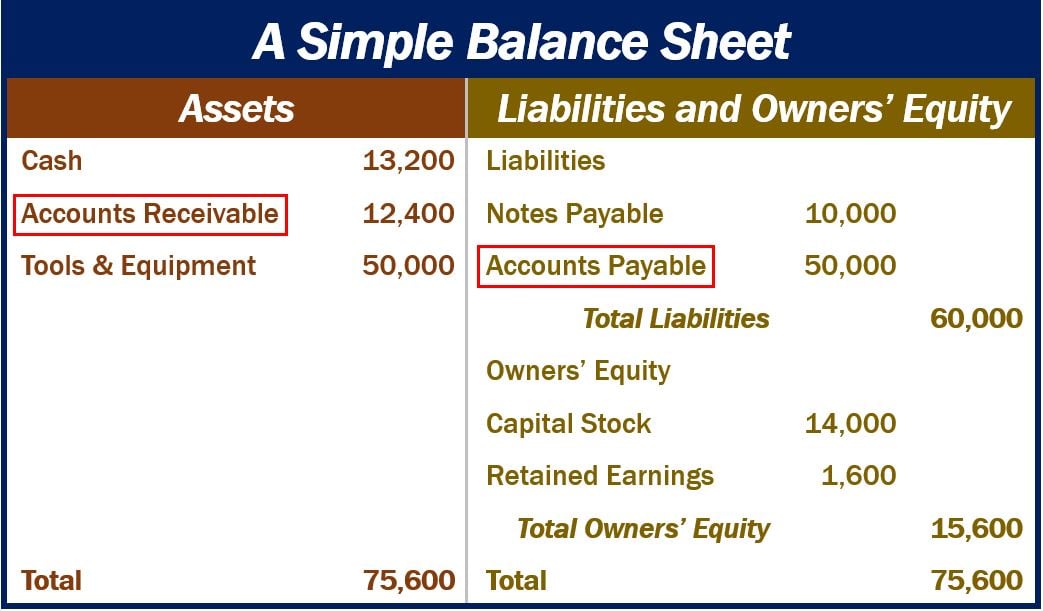

How do accounts receivable affect cash flow? By its nature, using a/r delays cash payments from customers, which will negatively affect cash flow in the short term. Below are examples of items listed on the balance sheet:

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. Balance sheet template download balance sheet template.

Accounts payable template; Sample balance sheet income statement vs balance sheet the income statement and the balance sheet report on different accounting metrics related to a business’s financial position. The higher a firm's accounts receivable balance, the less cash it.

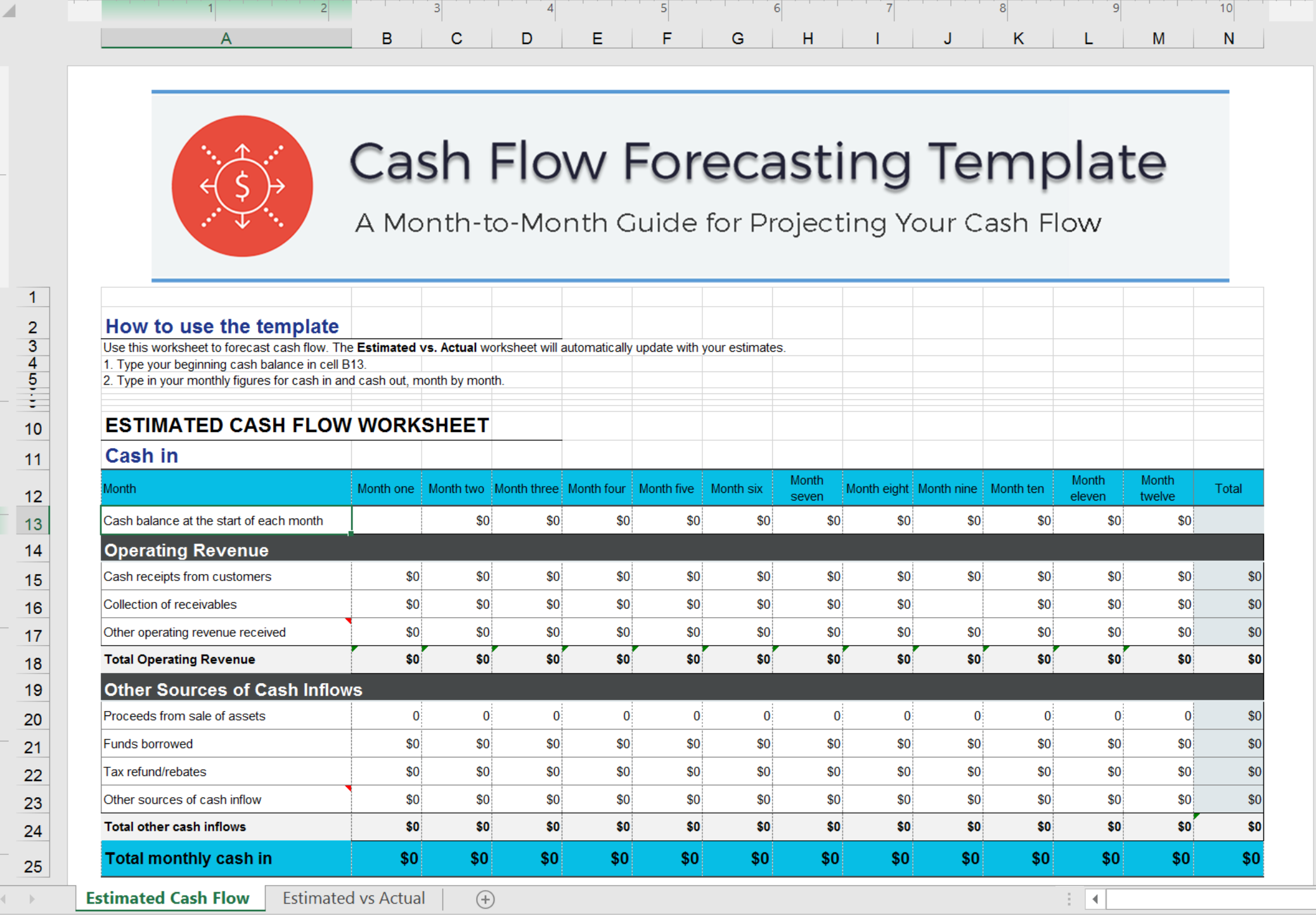

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. This template accounts receivable template lists customers, invoice tracking details, amounts due, and outstanding balances. Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements such as balance sheets, income statements, or statements of cash flow, right?but now you’ve got some money to invest, you’re looking at a few companies and trying to figure out whether.

Keeping track of these accounts can inform your collections process by helping you quickly identify which overdue payments have aged significantly. It also reconciles beginning and ending cash and cash equivalents account balances. The cfs measures how well a.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Assets cash and cash equivalents are liquid assets, which may include treasury bills and certificates of deposit. How to create a cash flow statement 1.

The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. Income statement + balance sheet = cash flow statement. Along with a balance sheet and income statement, a cash flow statement helps a business analyse its.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)