Favorite Tips About Provision For Doubtful Debts Treatment

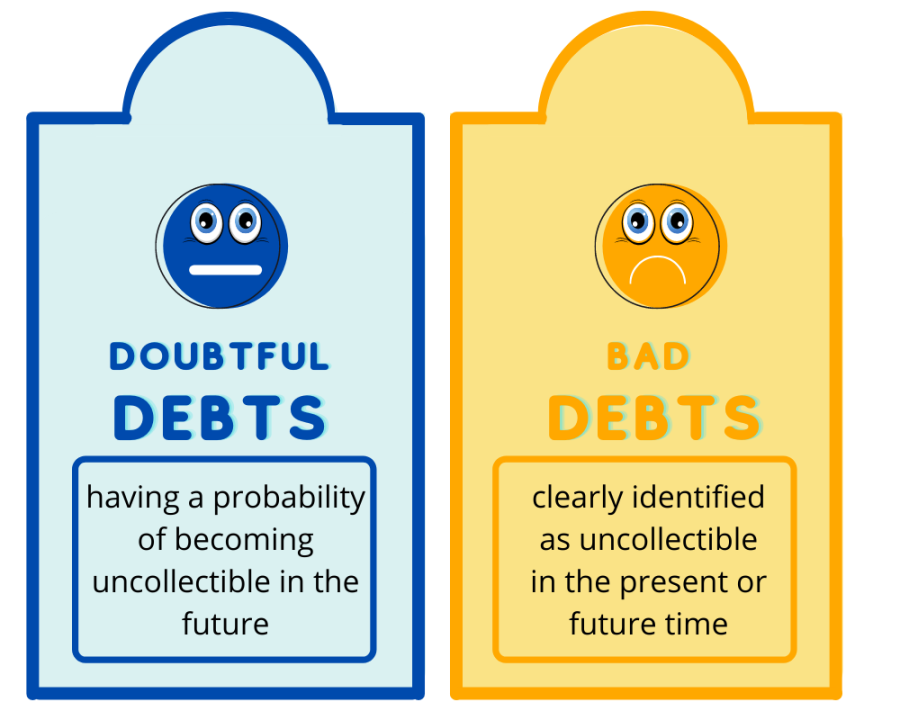

A provision for bad debts is the probable loss or expenses of the immediate future.

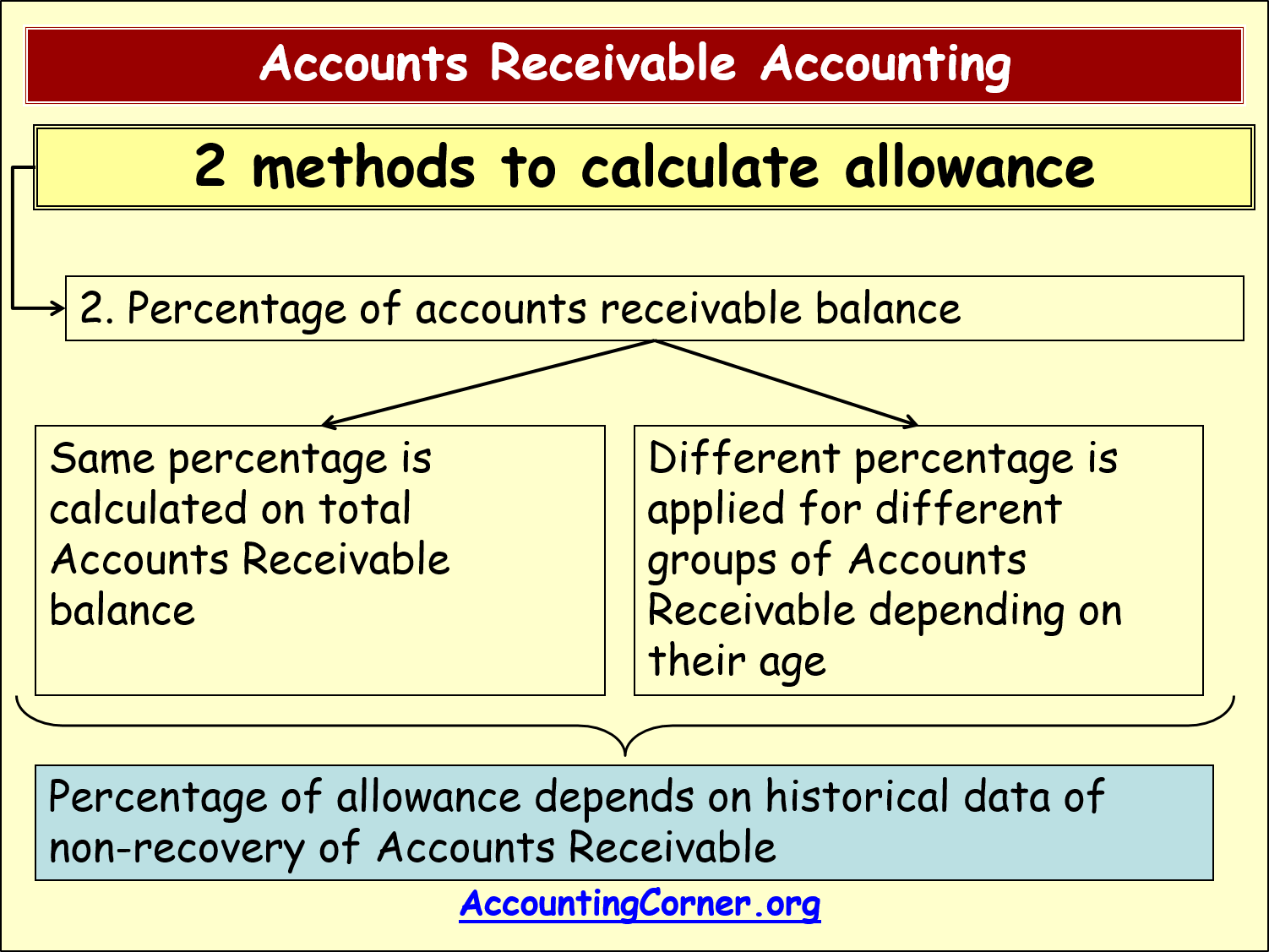

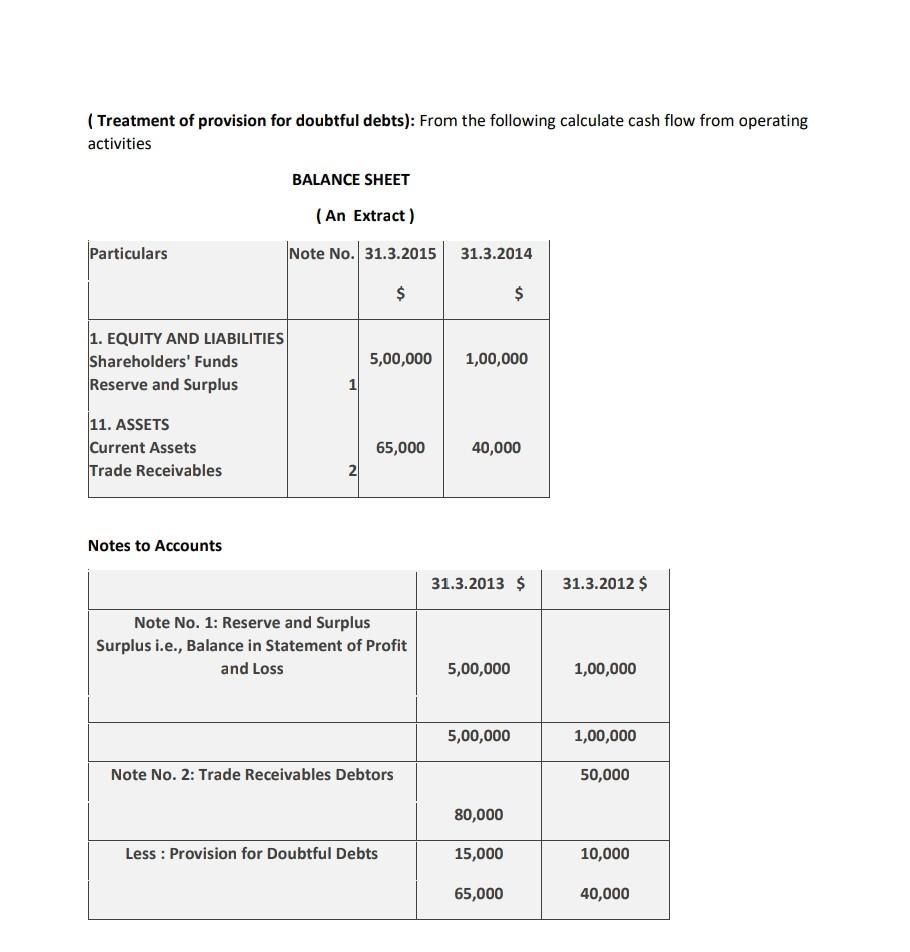

Provision for doubtful debts treatment. But the accountant is unsure when or how much the loss/expenses may occur. It is identical to the allowance for doubtful accounts. It is usually calculated as a percentage of debtors.

A provision for bad and. During the first year, there is no need to worry about an increase or decrease in provision for doubtful debts. November 05, 2023 what is the provision for doubtful debts?

Profit & loss account example on 31 december 2017, david's trade debtors stood at $432,000 only. 12 oct 2021 catherine cote staff accounting business essentials core financial accounting imagine you work at a. Debt recovery the amount is credited.

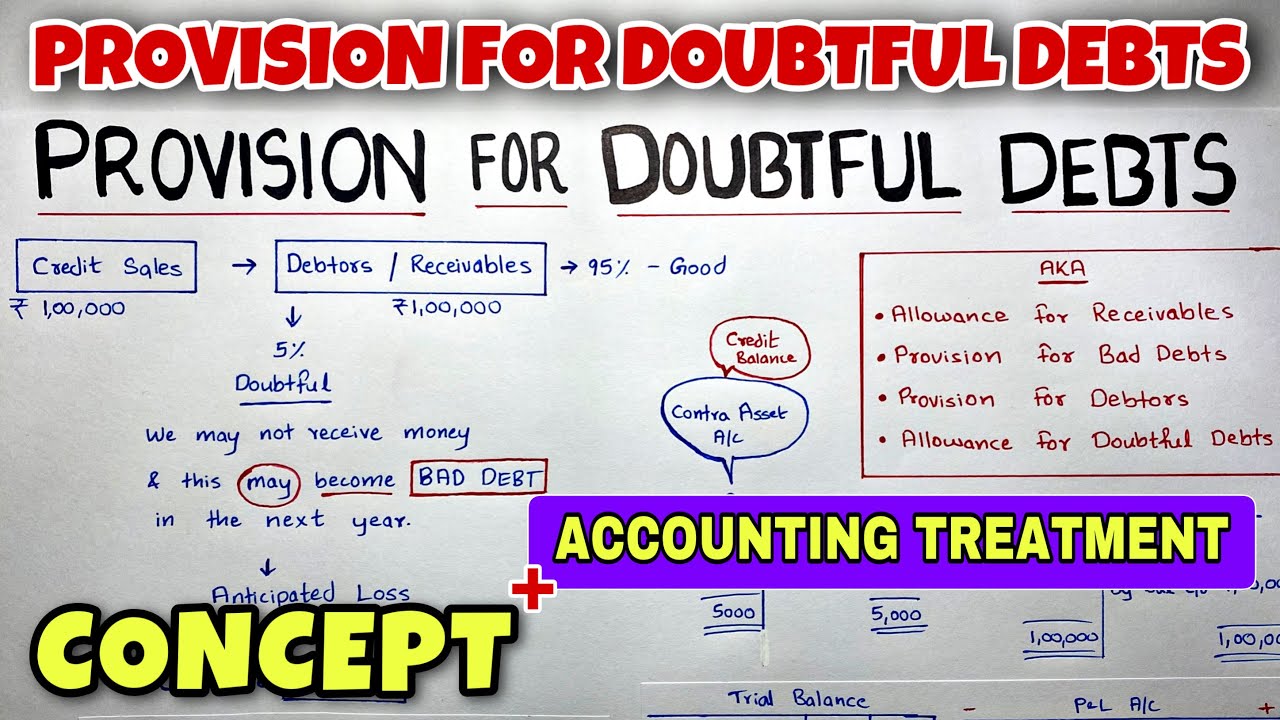

Provision for doubtful debt is created which is a charge against profit that may cover the loss if the doubtful debt turns out as bad debt. The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of. Every year the amount gets changed due to the provision.

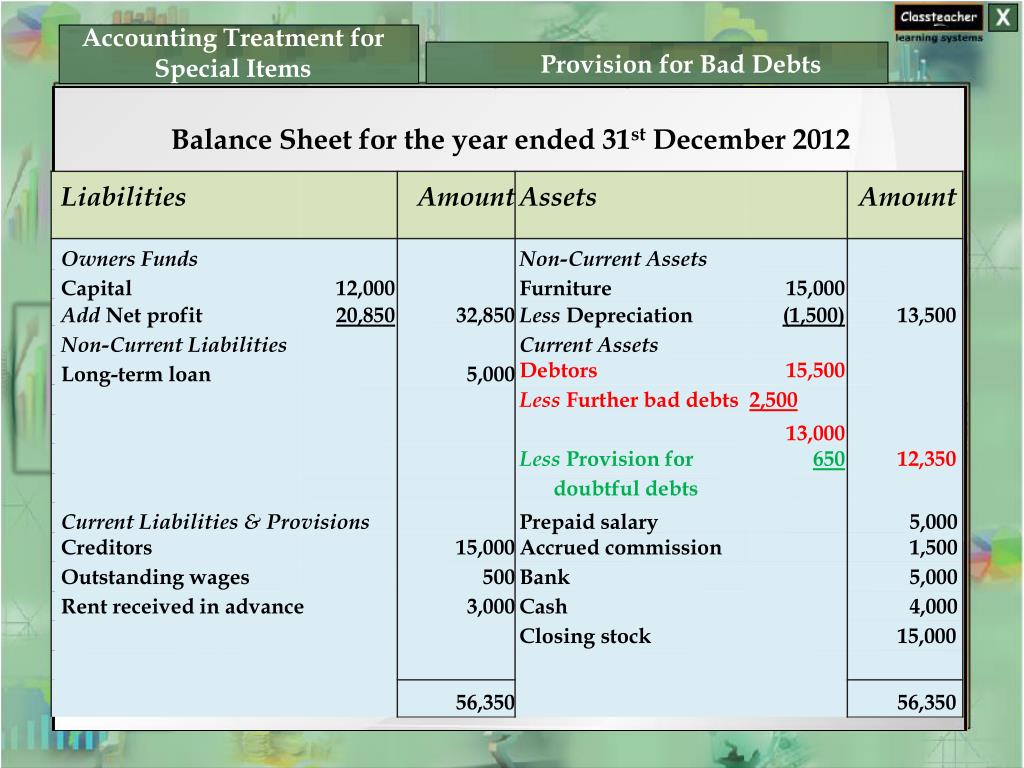

Provision for bad and doubtful debts as per section 36 (1) (viia) of the income tax act, 1961 only banks and financial institutions are allowed deduction in respect of the. Provision for doubtful debts acts as a liability for the business and is shown on the liability side of a balance sheet. Provision is created out of profits of the current accounting period to reduce the amount of loss that may take place in the future.

Accounting for doubtful debts. Provision / allowance for doubtful debts accounts payable allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables. Provision for doubtful debts in their tax returns.

The allowance for doubtful debts is created by. Provision for doubtful debts, on the one hand, is shown on the debit side of the profit. At the end of each financial year,.

The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. The law on deduction of irrecoverable debt and the public ruling (pr) 1/2002 on deduction for bad & doubtful debts and. In simple words, provision for doubtful debts refers to the amount set aside as a provision from the profits of the.

Provisions for bad debts faqs what is bad debt? Bad debt is an amount of debt that a business fails to recover from its debtors. What is bad debt provision in accounting?

Treatment of provision for doubtful debts in balance sheet let me help you understand the treatment better with the help of an example using the trial balance and balance. New provision for bad debts is deducted from debtors in balance sheet. Recoverability of some receivables may be doubtful although not definitely irrecoverable.