Beautiful Tips About Five Types Of Financial Ratios

Most ratios are best used in.

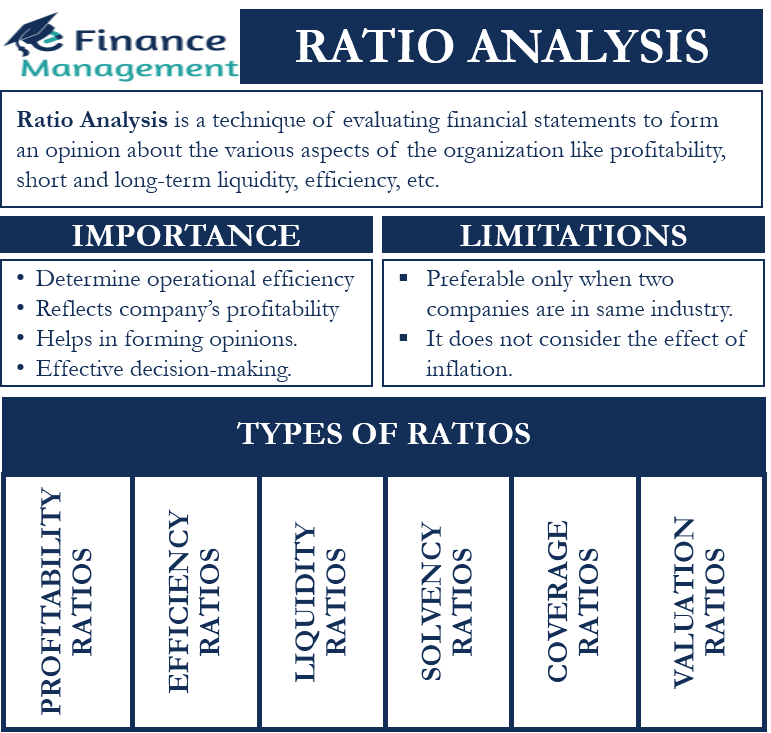

Five types of financial ratios. If you see too much, it's easy to. The five types of financial ratios financial ratios: Financial statement evaluation is the method of.

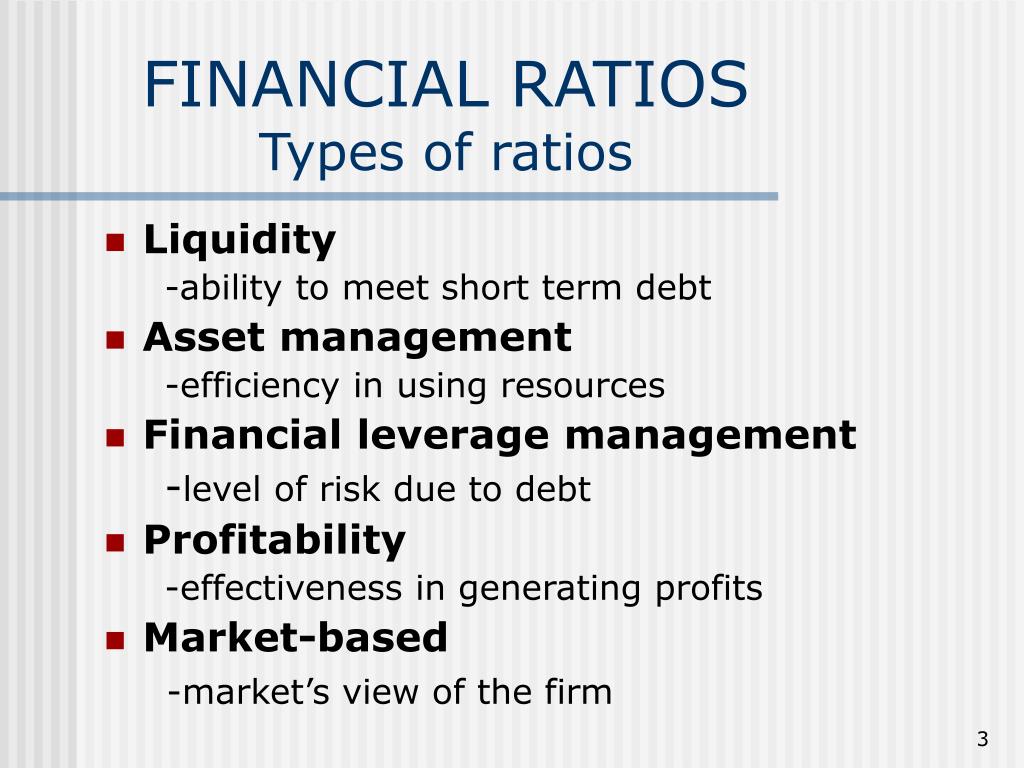

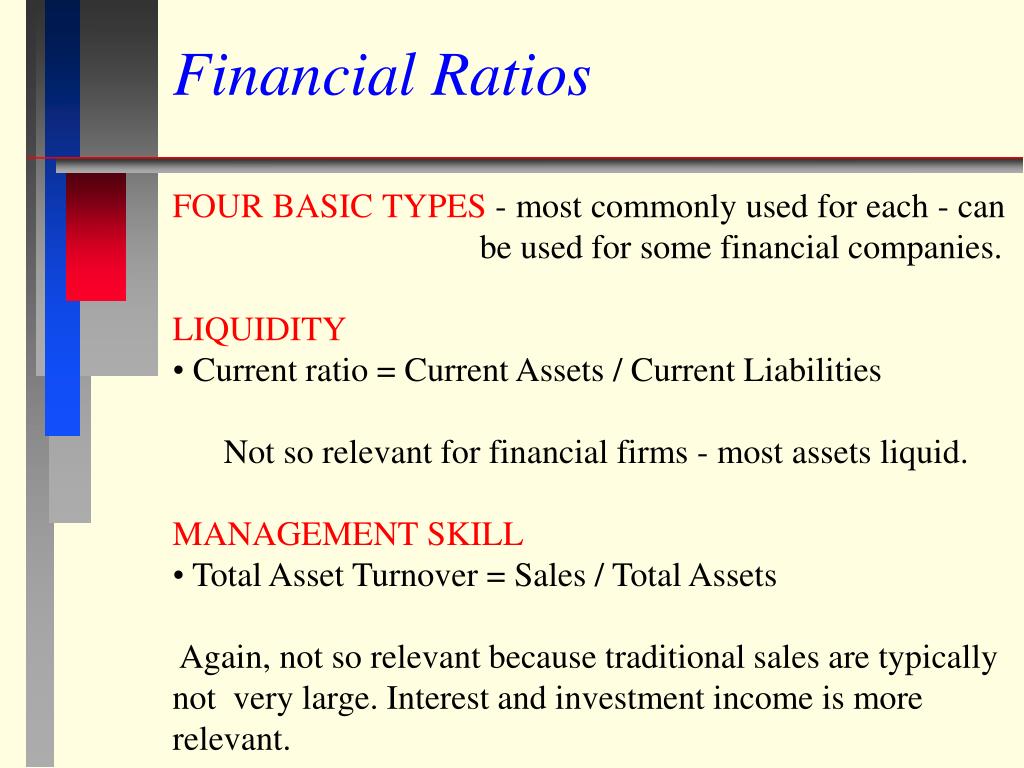

Types of ratio analysis 1. Learning objectives classify a financial ratio based on what it measures in a company Let’s dive into their details to understand with.

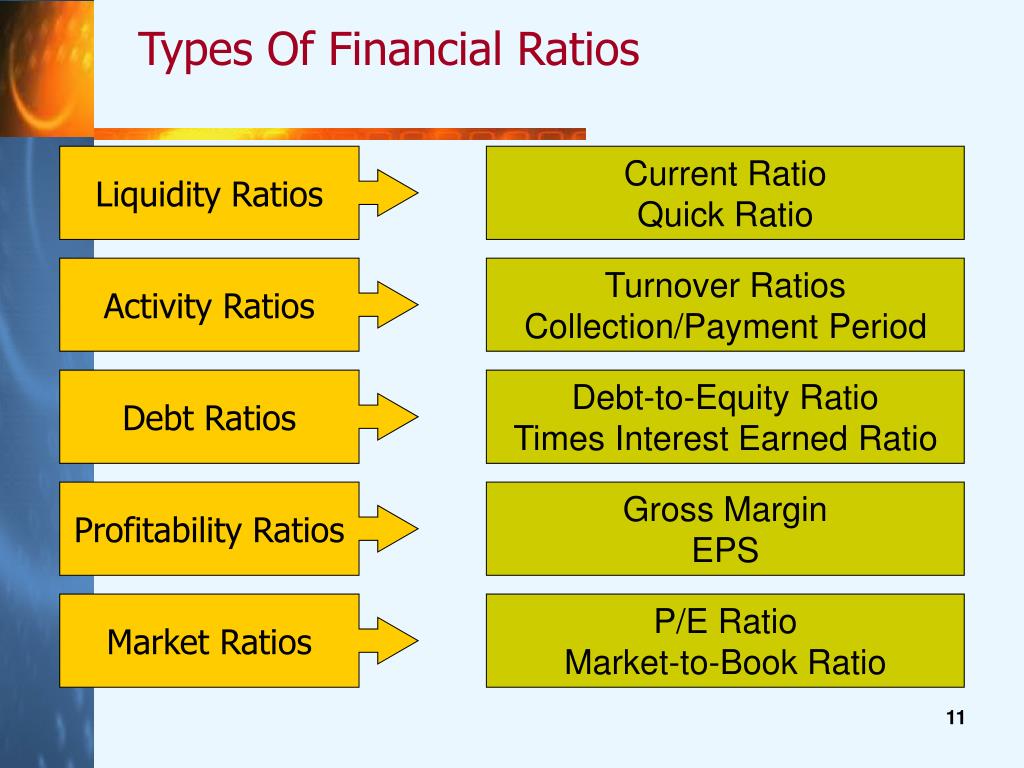

Ratio analysis consists of calculating financial performance using five basic types of ratios: Types of financial ratios. There are five main types of financial ratios:

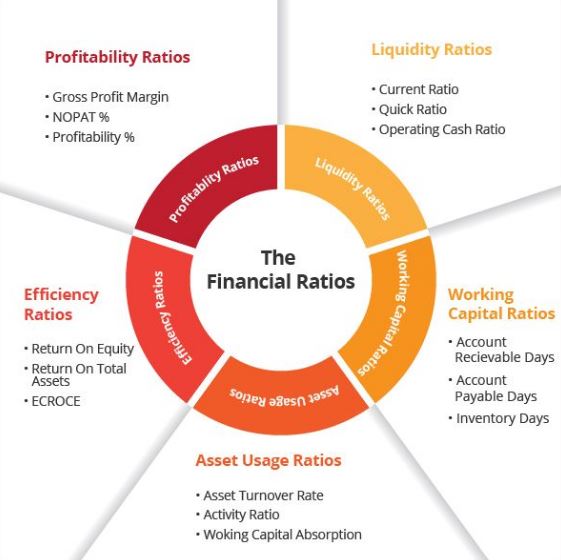

Financial analysis in companies can benefit from various types of ratio analysis. They tell you how well the company uses its resources, such as. Financial ratios are derived from the three financial statements;

Profitability, liquidity, activity, debt, and market. Liquidity ratios show whether a company is able to pay its debts and other liabilities. Liquidity, profitability, solvency, efficiency, and valuation.

One of the uses of ratio analysis is to compare a company’s financial performance to similar firms in the industry to understand the company’s position in the market. Financial ratios are used in flash reports to measure and improve the financial performance of a company on a weekly basis. The sum of its debt obligations, including lease payments).

Activity ratios show a company's efficiency. Also called financial leverage ratios, solvency ratios compare a company's debt levels with its. Profitability, liquidity, activity, debt, and market.

There are five important financial ratio types: 5 types of ratios liquidity. These ratios are selected from the academic courses and are widely used with a lmost same categories in text books.

Examples, formulas and use cases what else you need to know about financial ratios numbers tell a story. Financial ratios are grouped into the following categories: Efficiency ratios also identified as activity ratios, it helps gauge how well a company employs total assets and liabilities to make sales, capitalize on revenues and receivable turnover.

5 essential financial ratios for every business 1) liquidity ratios. While profitability helps understand how profitable a. Top management can use it as a.