Brilliant Strategies Of Info About The Balance Sheet Reports Financial Information

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

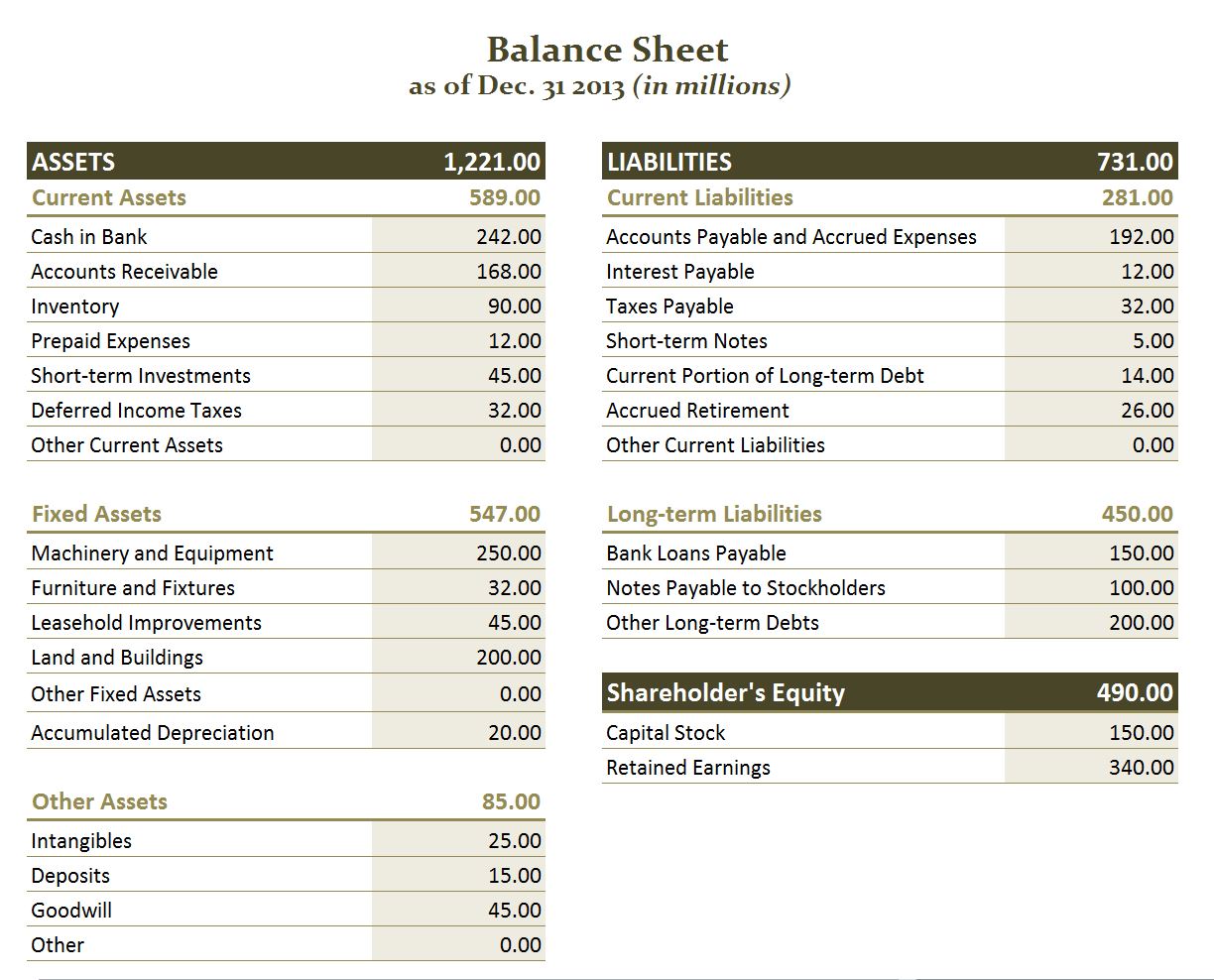

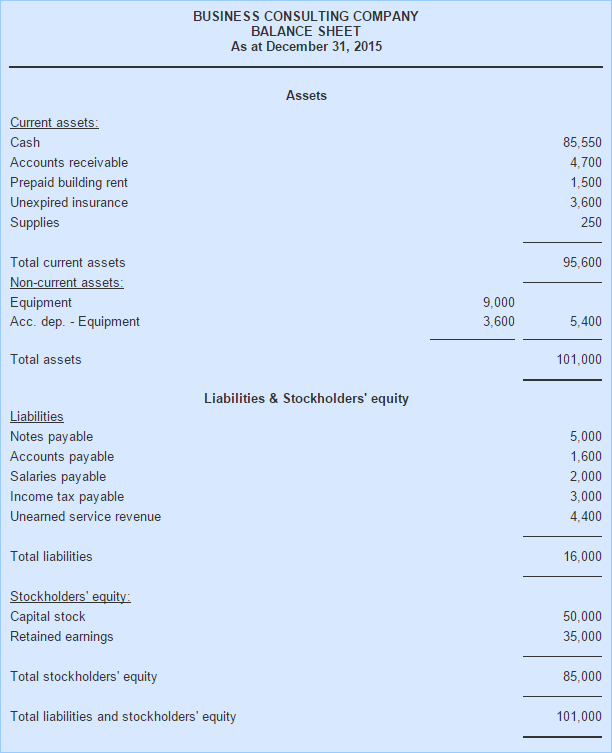

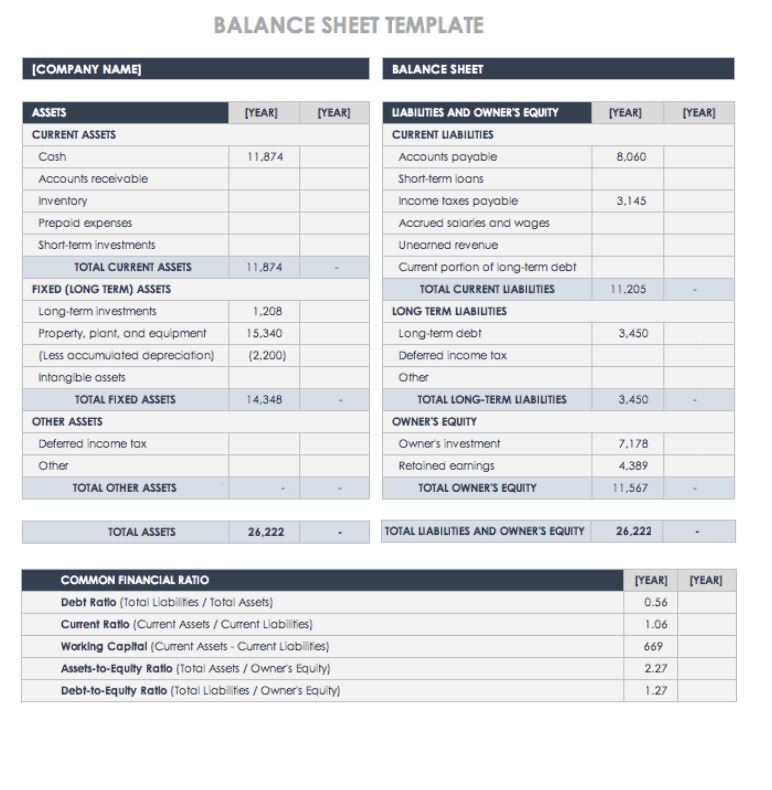

Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

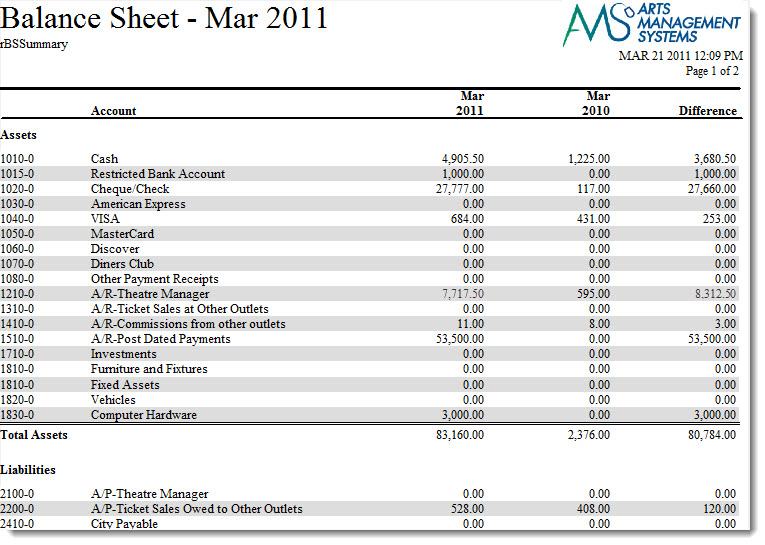

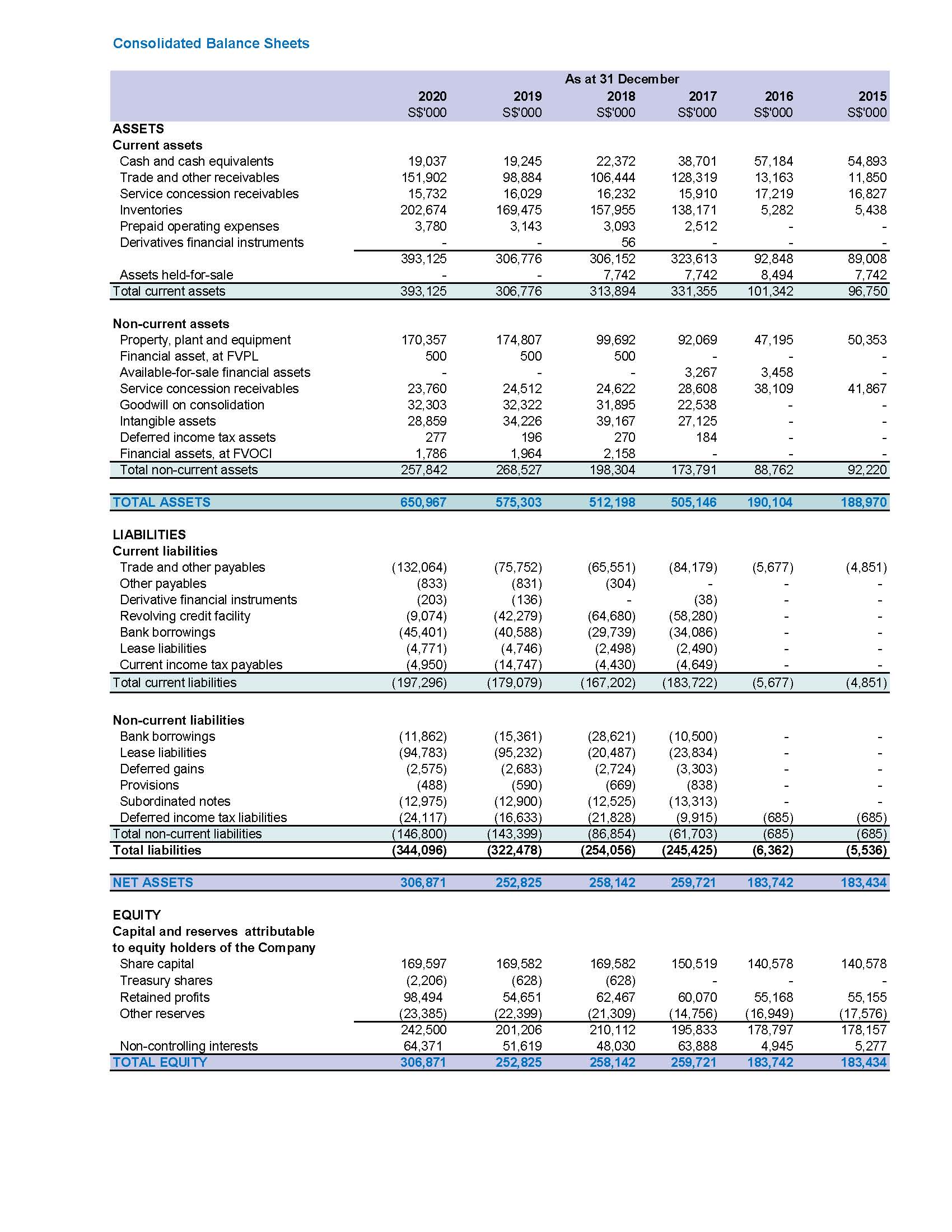

The balance sheet reports financial information. The balance sheet and income statement are two of the most important financial reports in the accounting system. 1,078 aircraft) with net orders of 2,094 aircraft after cancellations (2022: The investment in the business;

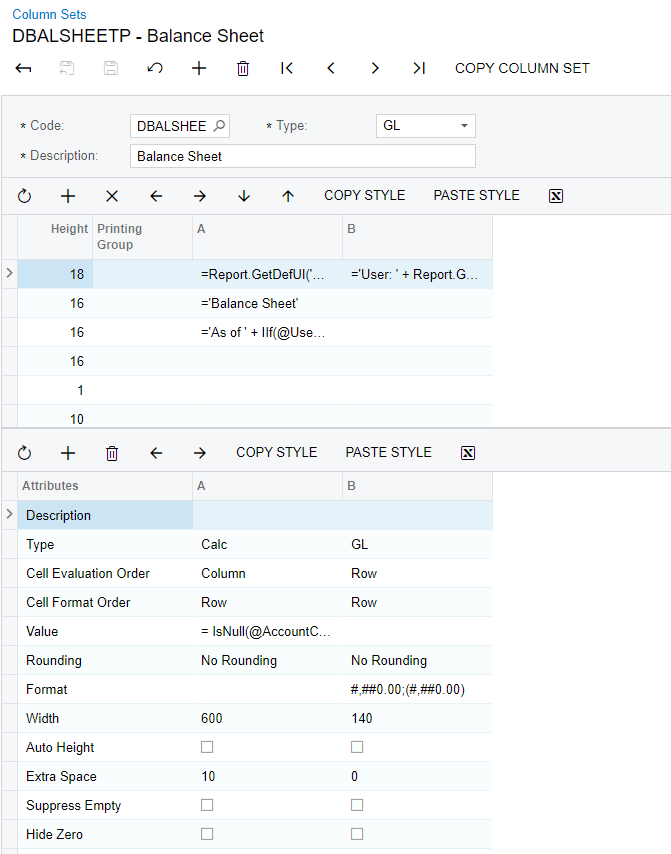

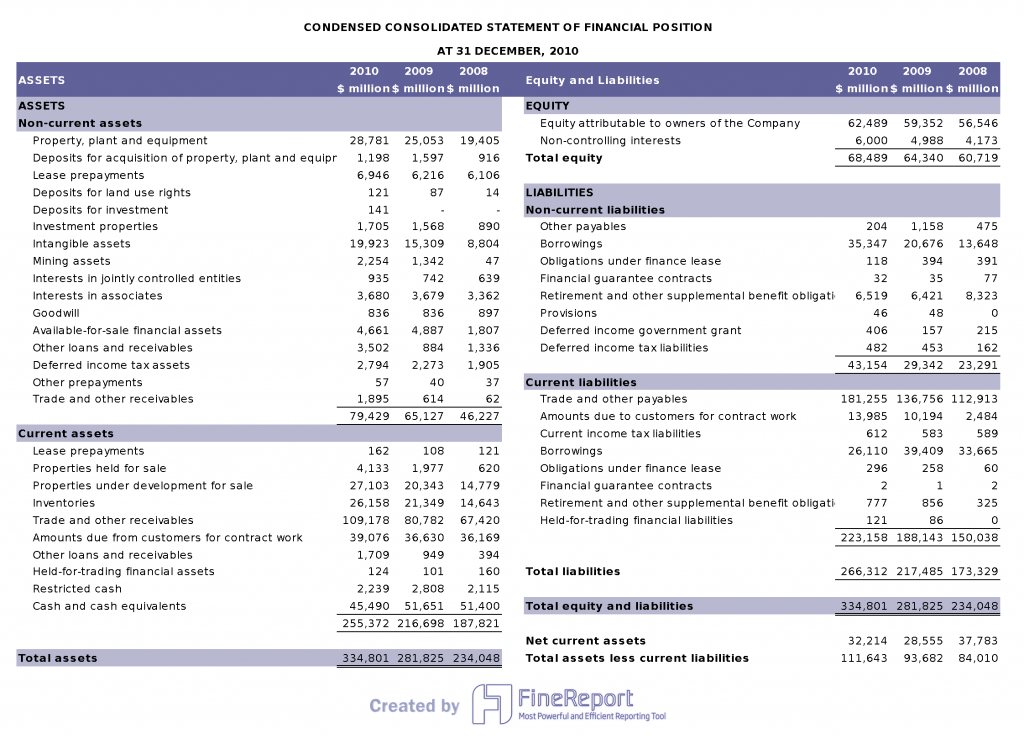

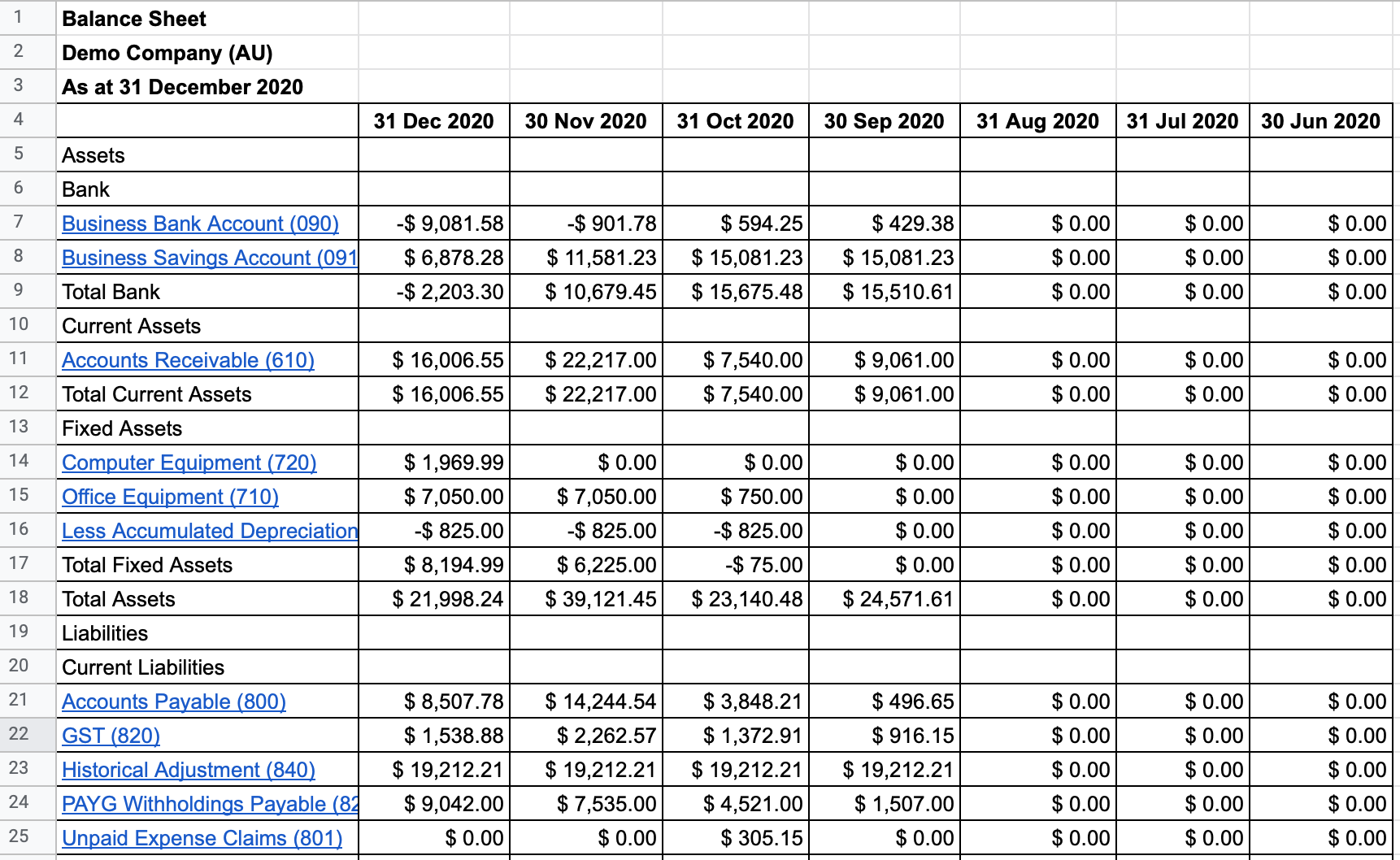

A balance sheet or a statement of financial position indicates the intricate details of assets, liabilities, and equity, empowering stakeholders to gauge the company’s financial standing and make. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. A ____ is the financial statement that reports the final balances in all asset, liability, and owner's equity accounts at the end of the fiscal period.

Financial statement analysis reviews financial information found on financial statements to make informed decisions about the business. The balance sheet discloses assets and liabilities as of the one specified date. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

The balance sheet is a company's financial report that records information related to assets, liabilities that must be paid to other parties, and capital owned by business owners in a certain period. They show you where a company’s money came from, where it went, and where it is now. Businesses typically prepare and distribute their balance sheet at the end of a reporting period, such as monthly, quarterly or annually.

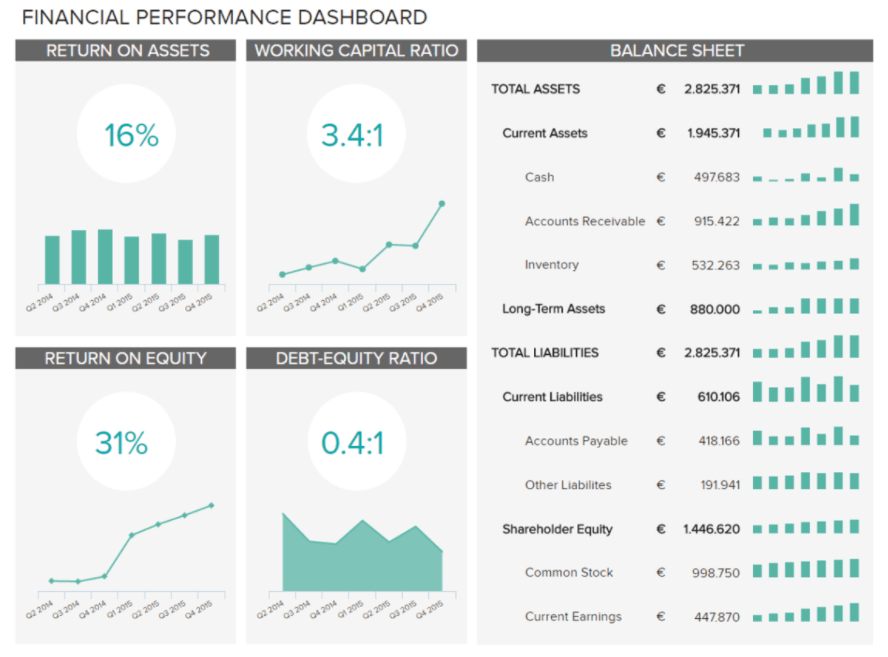

The balance sheet provides an overview of assets, liabilities, and shareholders' equity as a snapshot in time. Balance sheet information is used to calculate key rates of return for investors: On the balance sheet, a company will typically look at two areas:

The bipartisan corporate transparency act, enacted in 2021, created a legal framework to address this critical gap by requiring many companies doing business or registered in the united states to report information to the financial crimes enforcement network (fincen) about who ultimately owns or controls them. Financial statements to use the financial statements used in investment analysis are the balance sheet, the income statement, and the cash flow statement with additional analysis of a. The balance sheet doesn’t report the company’s current financial performance.

The resources from which it expects to gain some future benefit; It doesn’t include information about revenue or expenses, and it. As of september 30, 2023:

Return on equity (roe), return on assets (roa) and return on invested capital employed (roic). In the ____, the classification of balance sheet accounts are shown one under the other. And (4) statements of shareholders’ equity.

The balance sheet shows the company’s financial condition on one specific date. The income statement reports on income and expense accounts. It also provides industry insights, management’s discussion and analysis (md&a), accounting policies, and additional investor information.

The balance sheet shows a company’s assets, liabilities, and shareholders’ equity at a particular point in time. A balance sheet reports the following information: These three core statements are intricately linked to each other and this guide will explain how they all fit together.