Outstanding Info About Credit Side Of Trial Balance

The typical type of balance for an asset on the balance sheet is a debit balance, whereas the typical balance for a liability account is a credit balance.

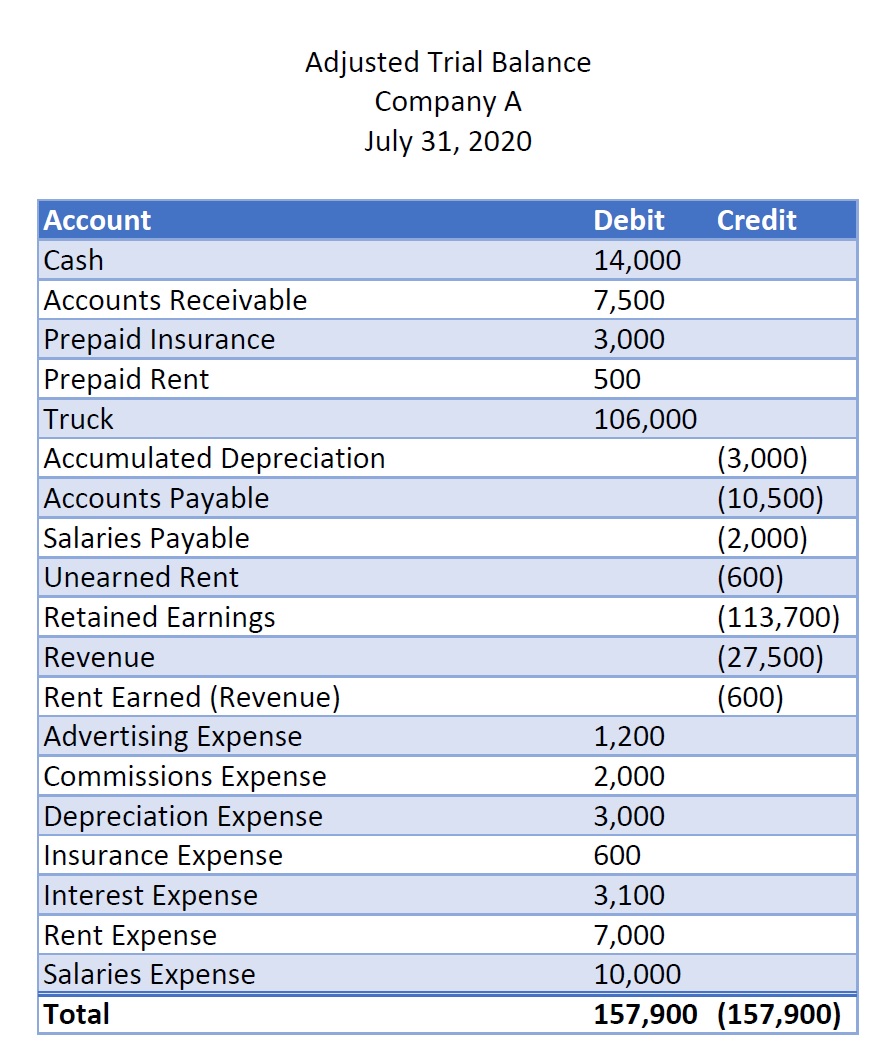

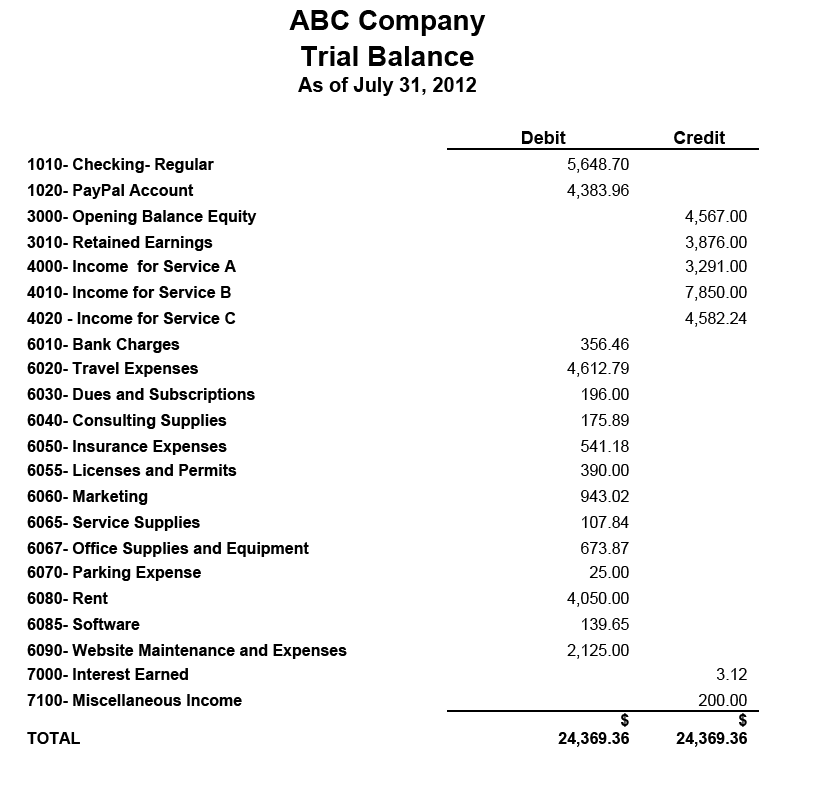

Credit side of trial balance. Generally capital, revenue and liabilities have credit balanceso they are placed on the credit side of the trial balance. It is a statement of. All liabilities must be reflected on the credit side and assets reflected on the debit side.

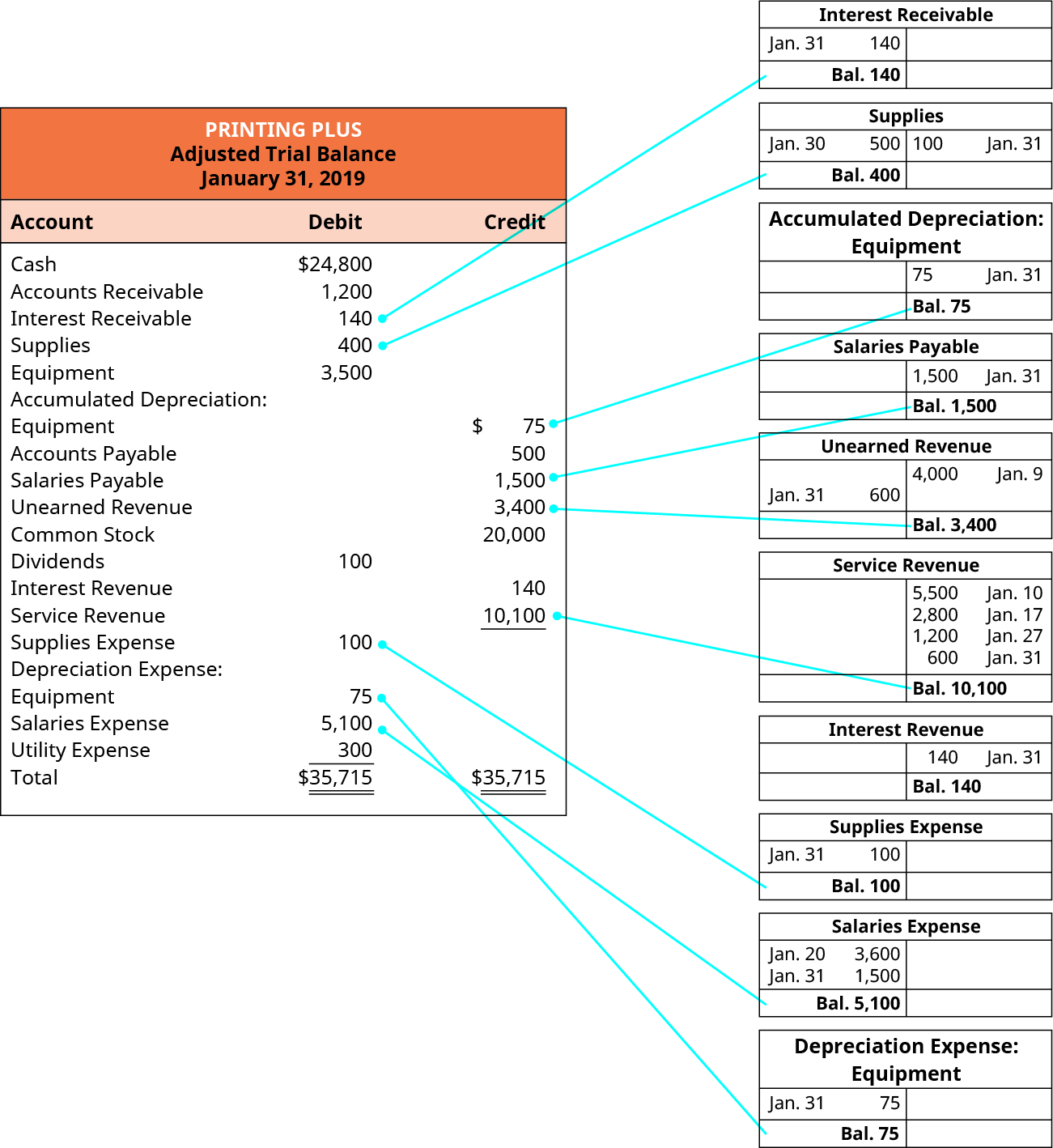

It has our assets, expenses and drawings on the left (the debit side) and our liabilities,. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. This statement comprises two columns:.

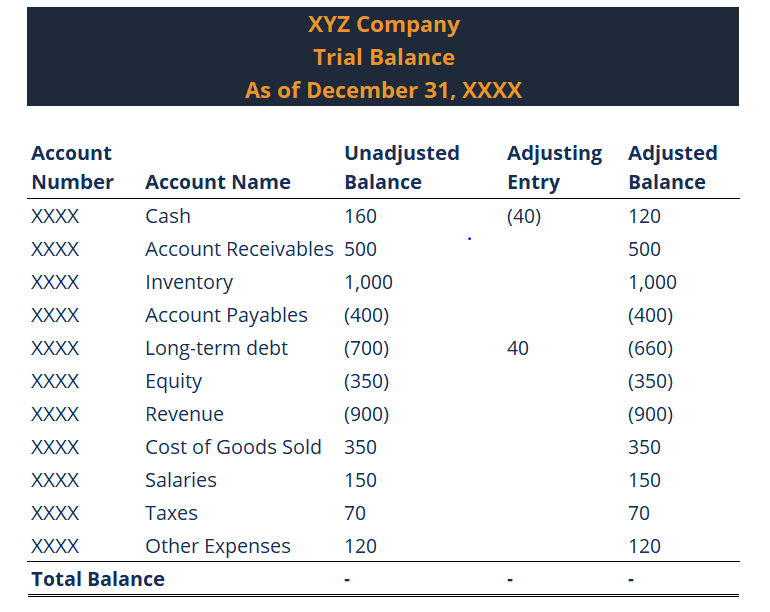

Let's go into greater detail about each of. The trial balance is composed of various components of general ledger accounts. In a trial balance statement, where the debit and credit side of it is equal, it is considered balanced.

Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their. The trial balance shows the list of all the accounts with both debit and credit balances in one place and helps analyze the position and transactions entered into during such a. The learner needs to understand that a trial balance is prepared for twofold reasons.

6.2 posting to the wrong side of. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. Gains and income must be reflected on the credit side of a trial balance.

A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from. 4 example of trial balance preparation. 5 limitations of trial balance.

6 errors disclosed by trial balance. Exclusive list of items 1. Additionally, it ensures that there are no errors in the ledger.

When the debit and credit sides of a trial balance do not match, it means one of two things. The purpose of a trial. Asset and expense accounts appear on the debit side of the trial balance whereas liabilities, capital and income accounts appear on the credit side.

Definition of trial balance in accounting. What does a trial balance include? The capital, revenue and liability increase when it is credited and vice versa.

As per the accounting cycle, preparing a trial balance is the next step after posting and balancing ledger accounts. One, there was an error in either recording the account balance.