Awe-Inspiring Examples Of Tips About Financial Statement For Dummies

To report on the current financial position of the company, and to show how well the company performs over a period of time.

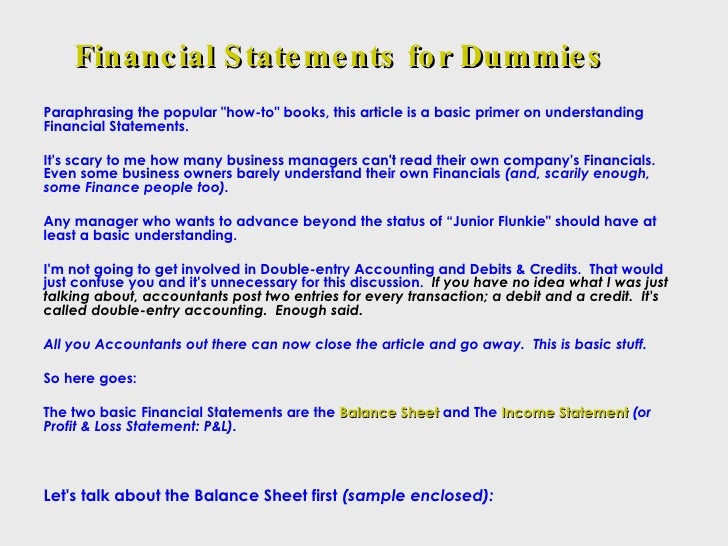

Financial statement for dummies. There are four main financial statements. Income statement (statement of recognized income and expenses) time coverage;. Details about potential problems with the numbers or how the numbers were derived

A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. The trial of rust chief weapons handler hannah gutierrez over the death of the film’s cinematographer will start on thursday, in a case likely to shape actor alec baldwin’s defense of his. Accounting equation assets = liabilities + owners’ equity liabilities and owners’ equity are the.

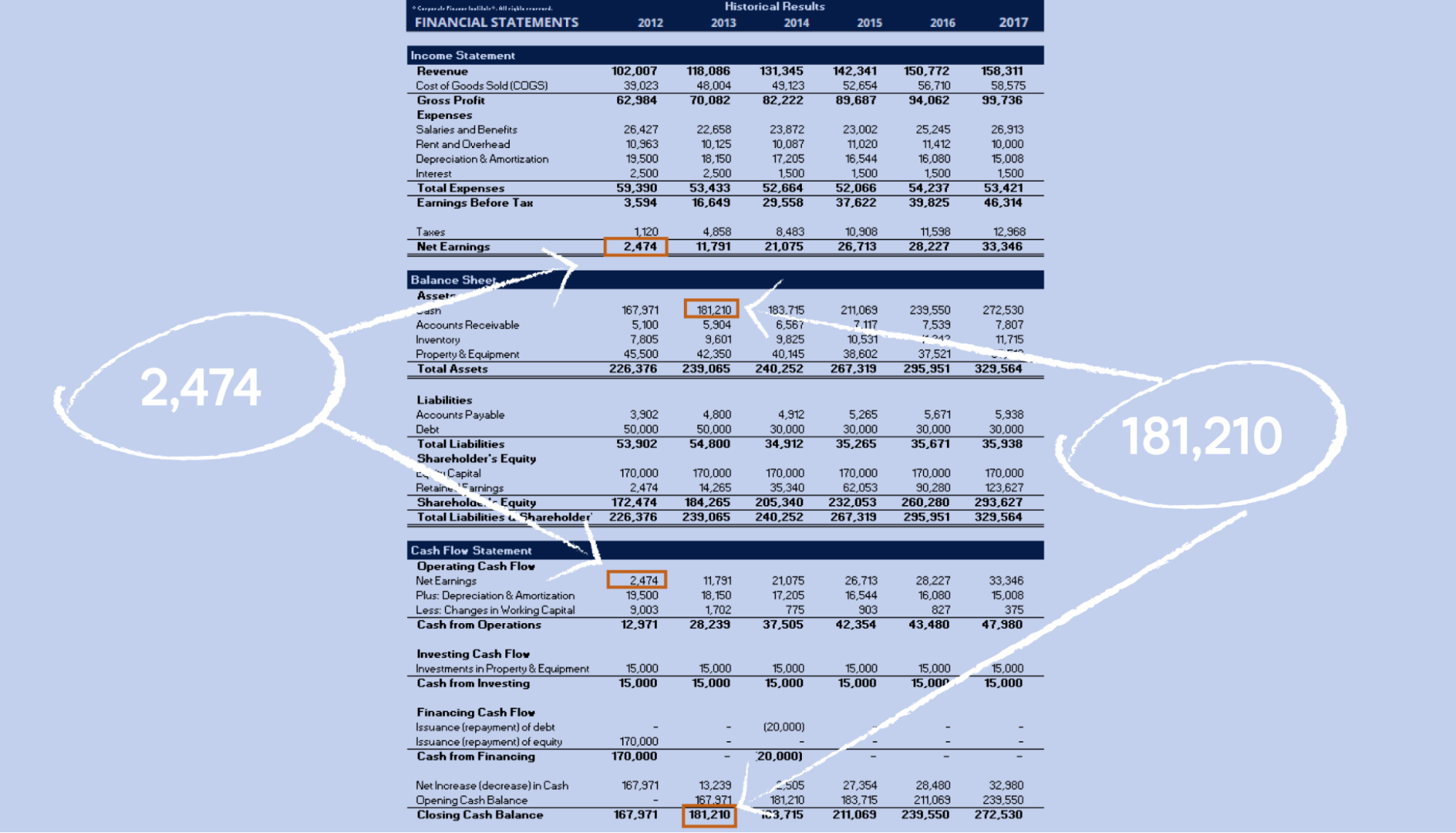

Financial statements are an essential tool for individuals and businesses to track and manage their financial performance and position. An income statement, also known as a profit and loss (p&l) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. And (4) statements of shareholders’ equity.

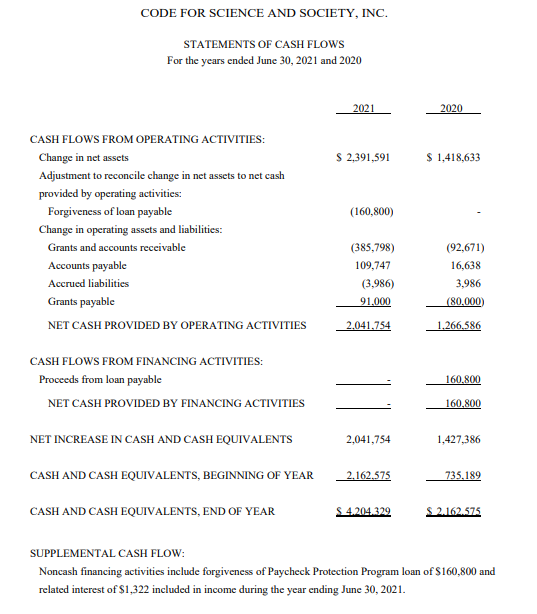

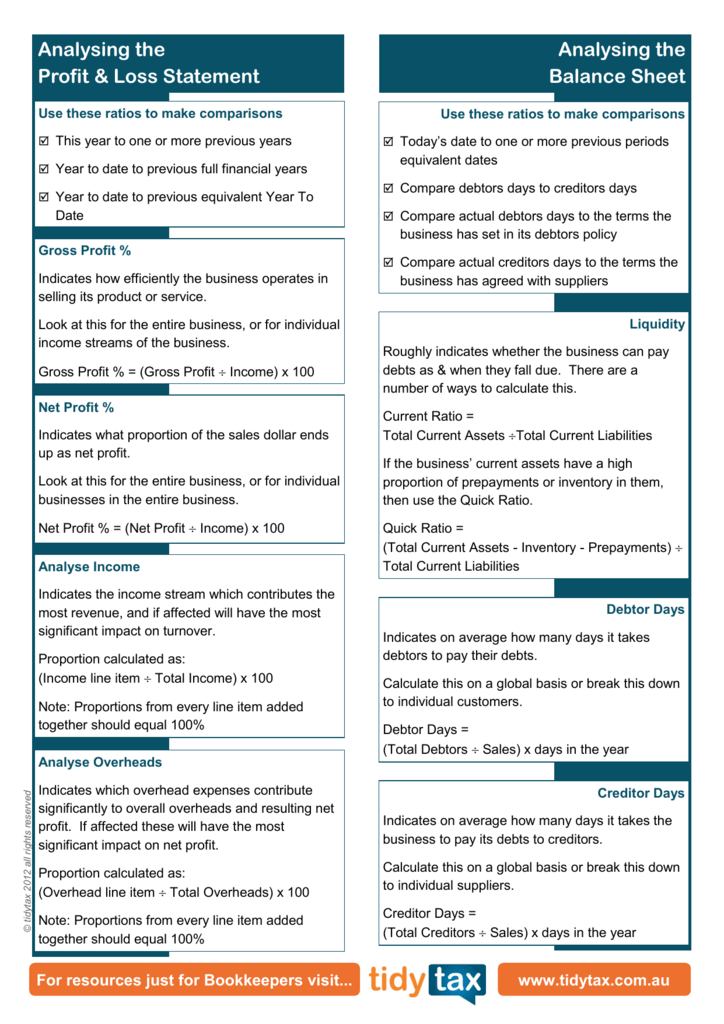

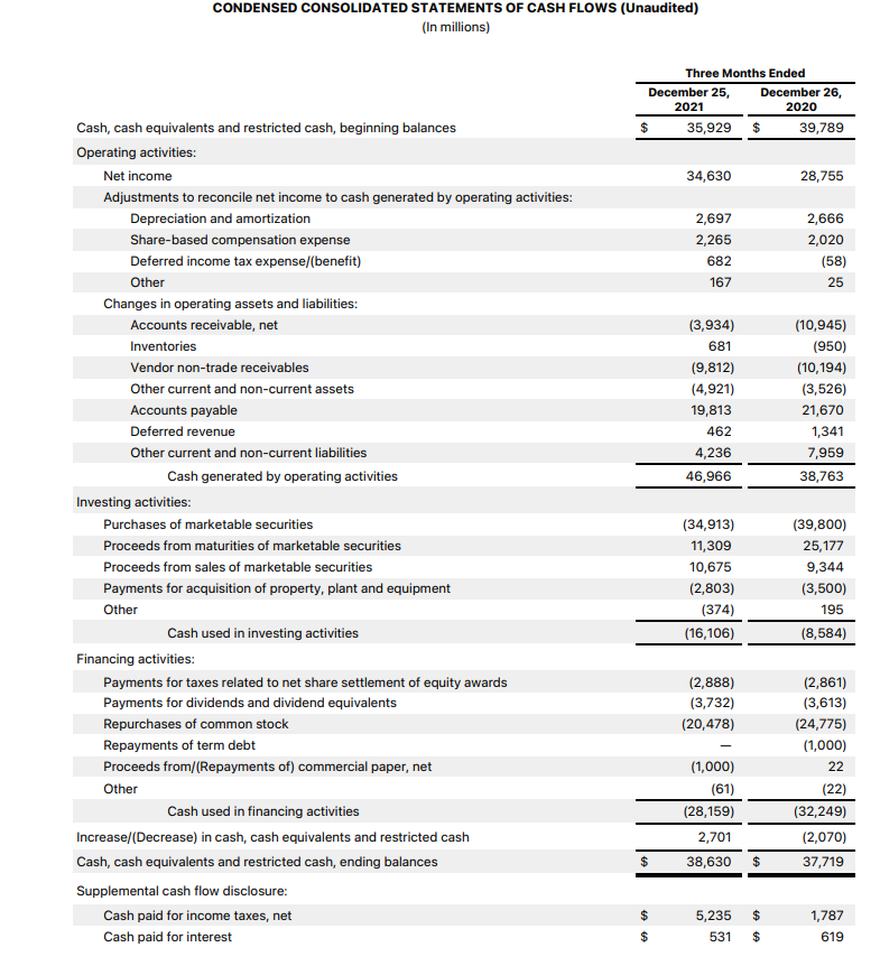

The balance sheet, the income statement, and the statement of cash flows; A statement of cash flows for the financial period. Financial statement analysis is the process of evaluating a company’s financial information in order to make informed economic decisions.

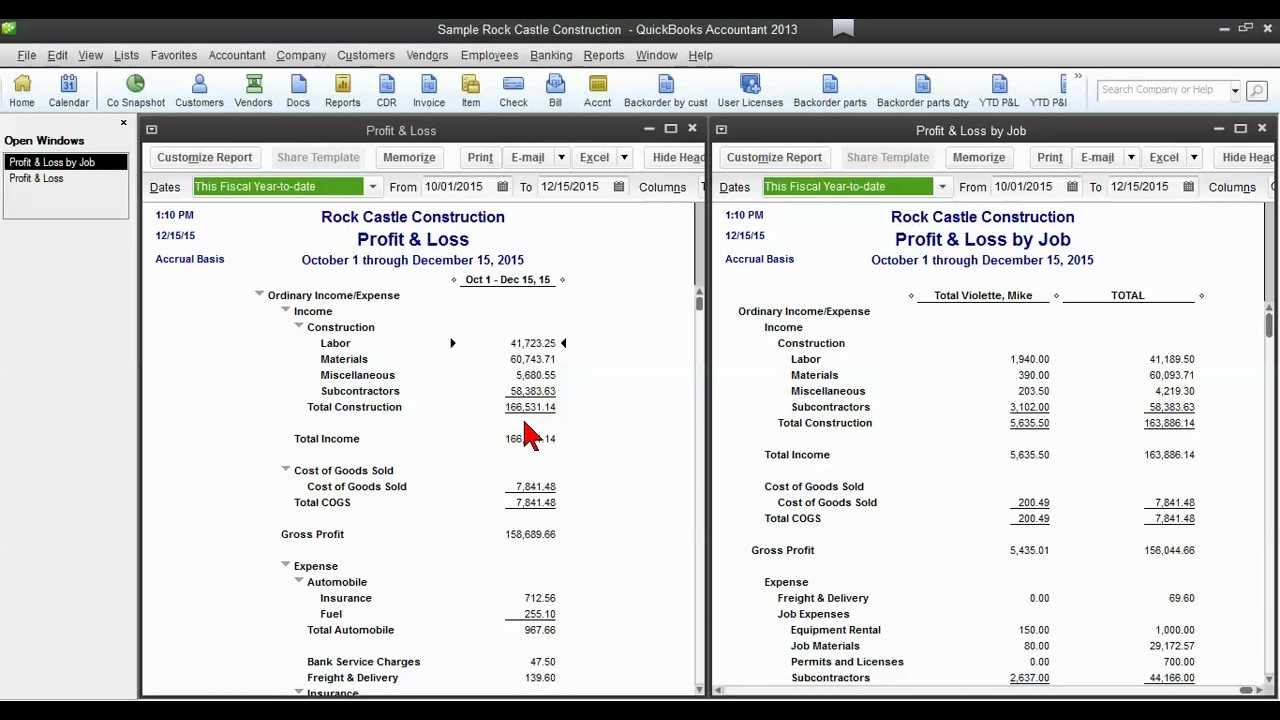

How to read the balance sheet. A separate statement of profit and loss, commonly called the income statement, immediately followed by a statement presenting comprehensive income beginning with profit or loss. Income statements show how much money a company made and spent over a period of time.

Financial analysis for dummies. The cash flow statement shows how a company's liquid assets are increasing or decreasing over time. Understand the basics of financial statements and how to analyze them to learn more about a corporation.

It involves the review and analysis of income statements, balance sheets, cash flow statements, statements of shareholders’ equity, and any other relevant financial statements. Financial statements to use the financial statements used in investment analysis are the balance sheet, the income statement, and the cash flow statement with additional analysis of a. Income statements show how much money a company made and spent over a period of.

Learn how to read financial statements. Updated february 7, 2021. The ruling razed trump's defense claims, accusing.

Where you find the actual financial results for the year notes to the financial statements: A statement of changes in equity for the financial period involved. There are four main financial statements.

The most important are balance sheets, income statements and cash flow statements. Balance sheets show what a company owns and what it owes at a fixed point in time. Keep the following important rules and points in mind as you prepare and use your business’s financial statements.