Sensational Tips About Operating Cash Flow Ratio Example

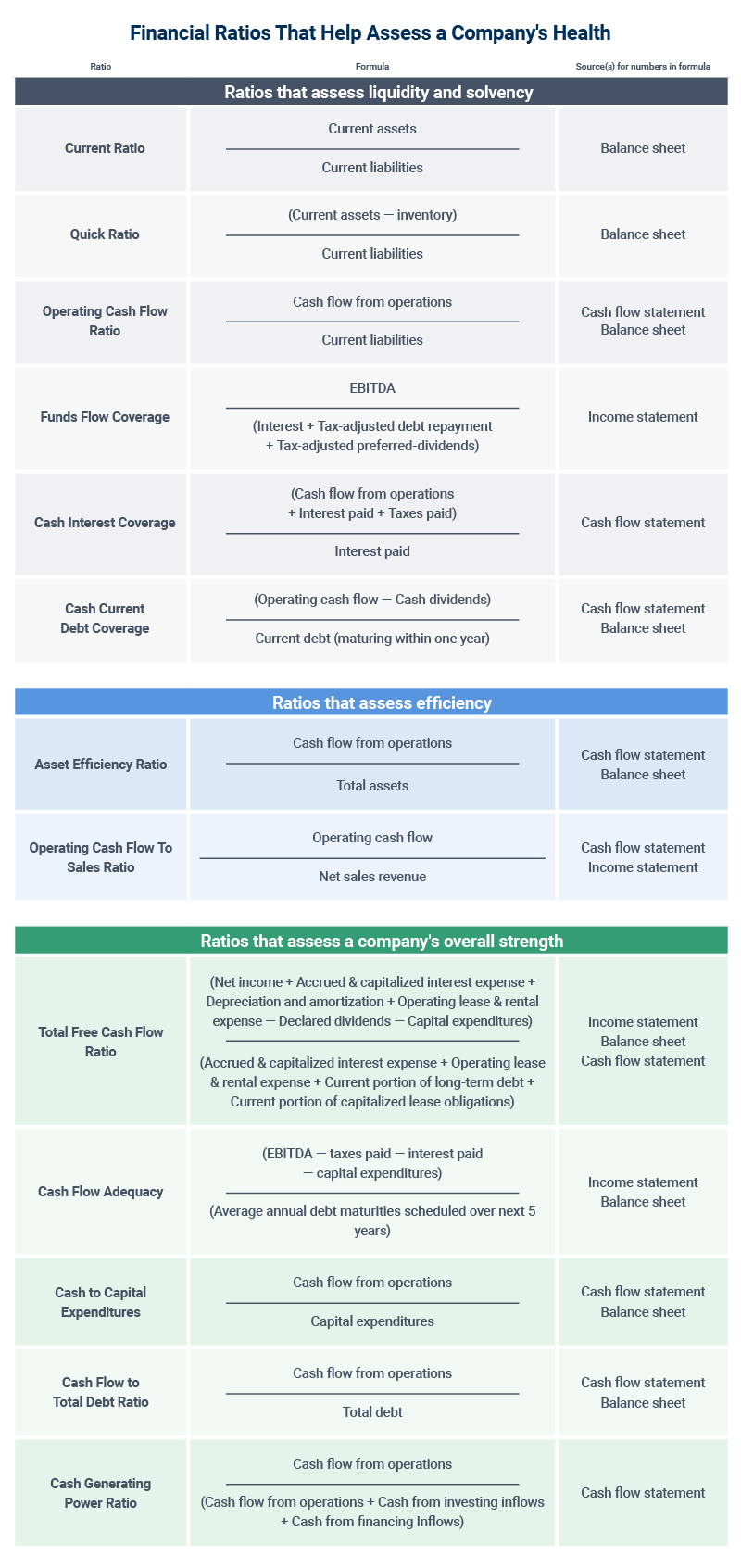

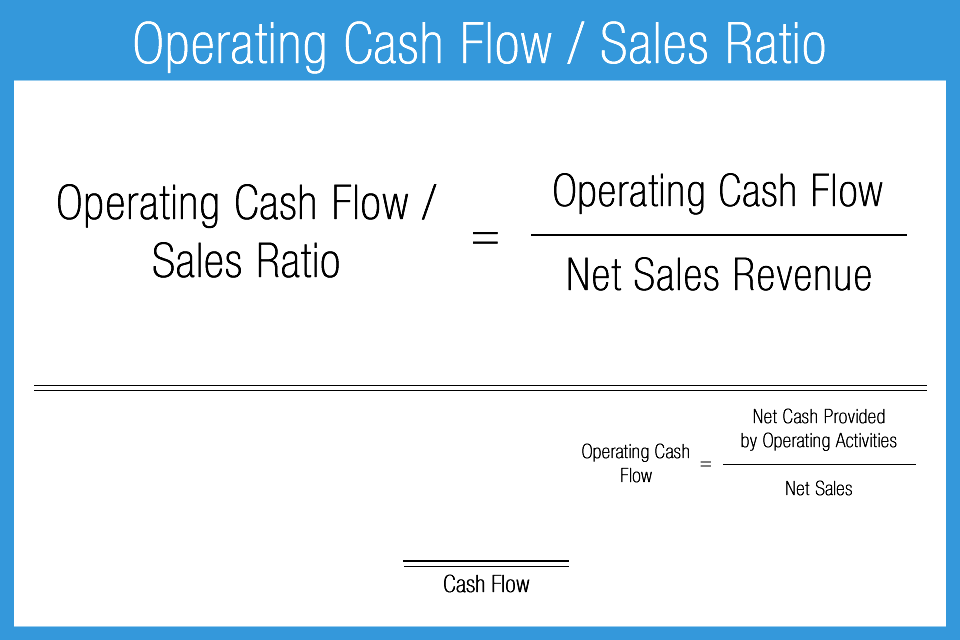

Operating cash flow ratio = operating cash flow / current liabilities¹ ² let’s take each component individually to understand what number needs to be plugged in.

Operating cash flow ratio example. An operating cash flow ratio above 1 means there's sufficient cash flow for a business. 250000 / 120000 = 2.08 27, 2019, the two had current liabilities of $77.5 billion and $17.6 billion.

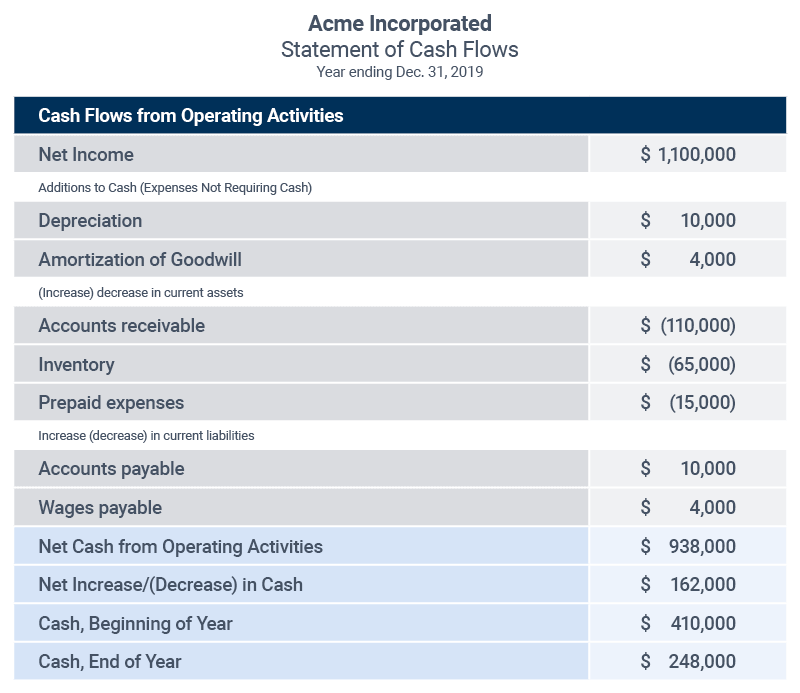

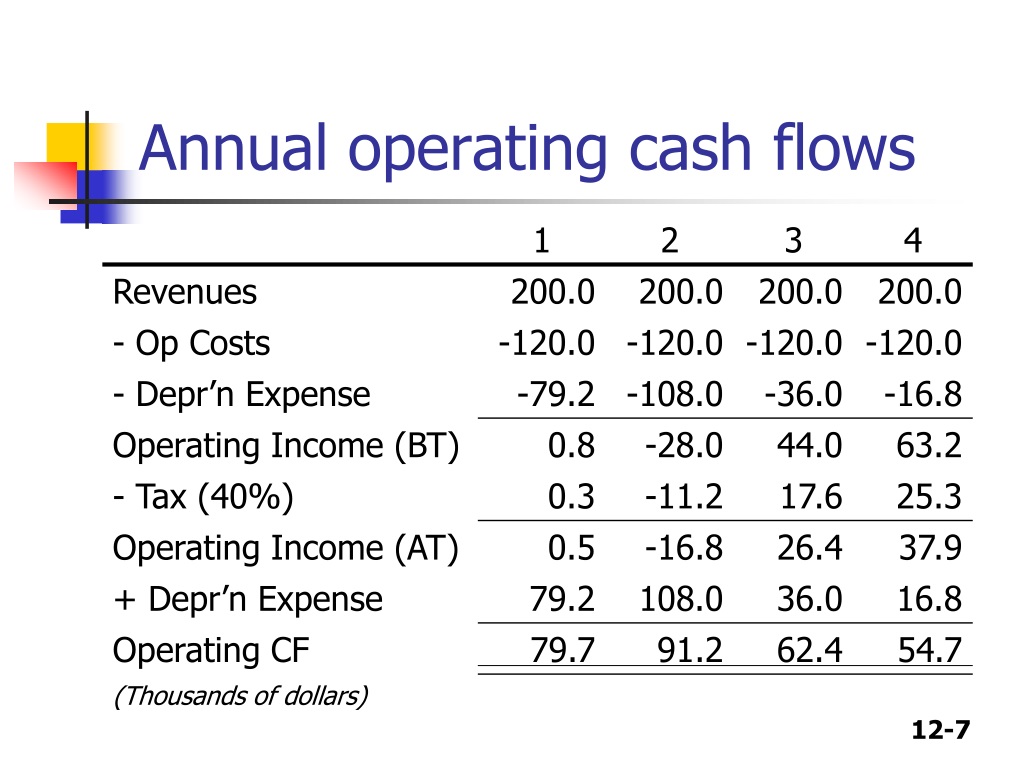

As you can see, the consolidated statement of cash flows is organized into three distinct sections, with operating activities at the top, then investing activities, and finally, financing activities. Since these figures are so close, we can say that walmart and target have similar liquidity. The formula to calculate the operating cash flow ratio example of operating cash flow ratio what are the advantages of operating cash flow ratio analysis limitations of the operating cash flow ratio how northone can help

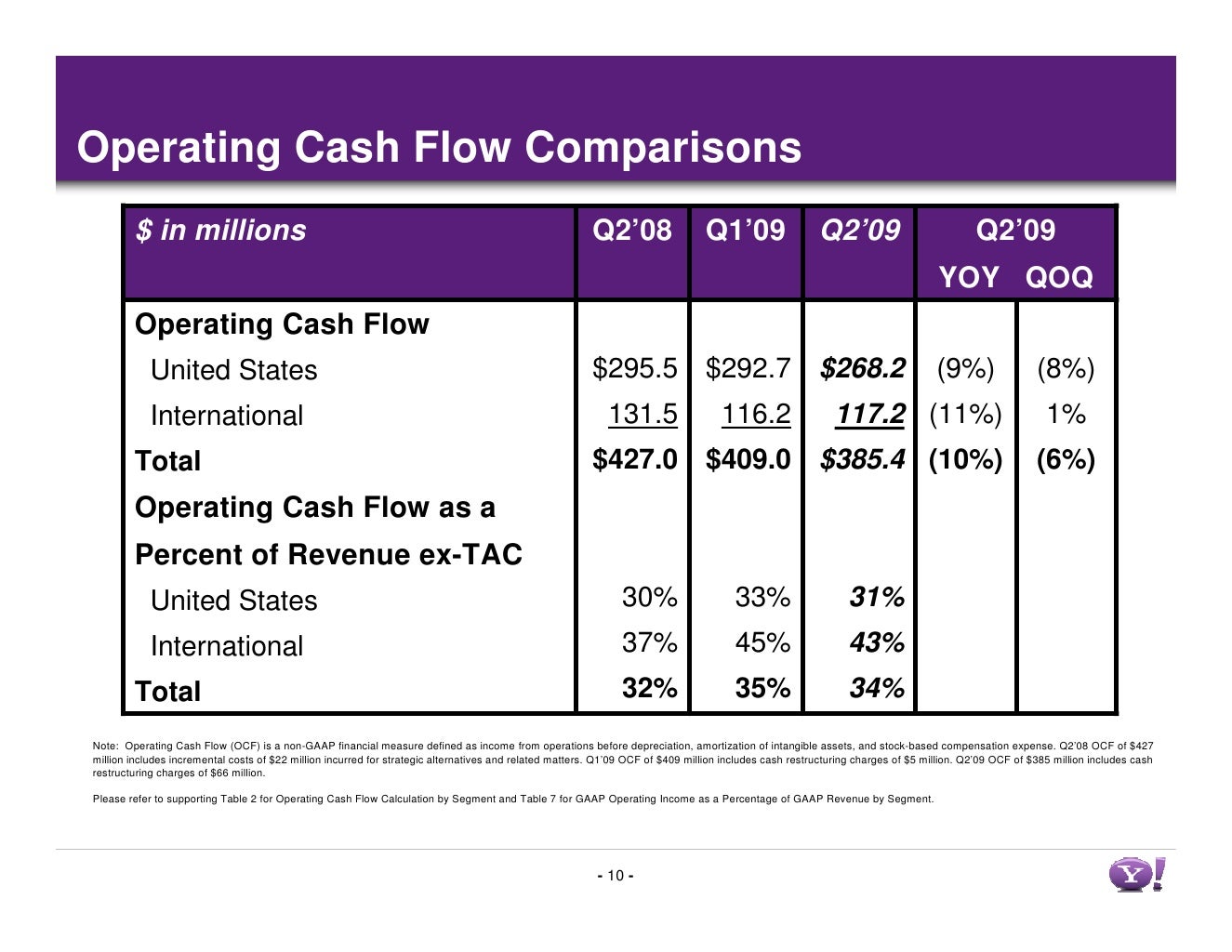

Operating income margin improves to 6.1 percent; Let's assume that the current liabilities of walmart was $77.5 billion, and target was $17.6 billion respectively as of feb. Example of the operating cash flow ratio consider two giants in the retail space, walmart and target.

Imagine that company a has a net cash flow from operations of around £250,000. In the next 12 months, walmart generated $27.8 billion in operating cash flow, whereas target generated $6 billion. However, they have current liabilities of £120,000.

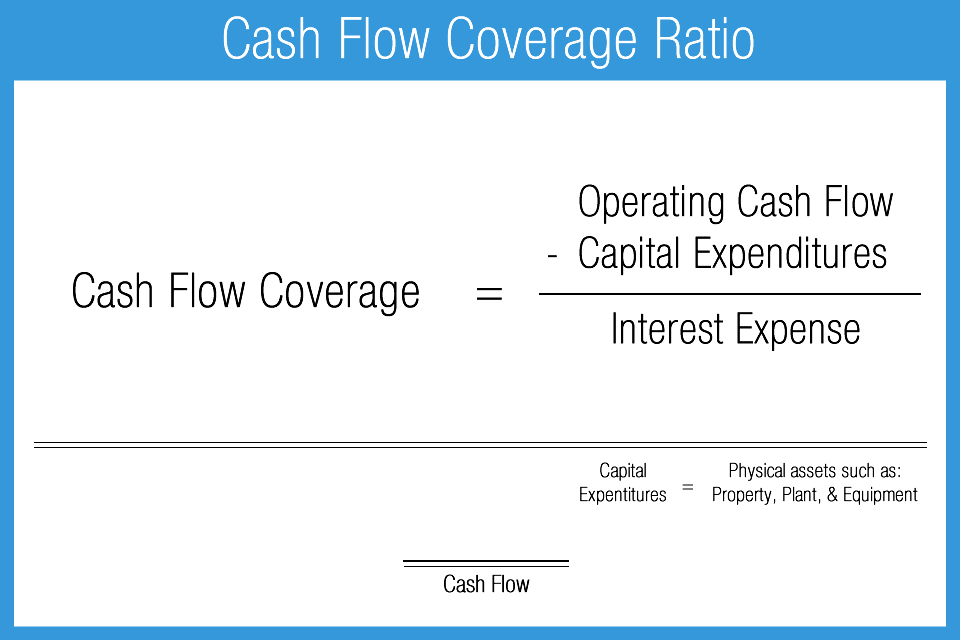

Example of using the operating cash flow ratio. The formula is as follows: For example, a firm may embark on a project that compromises cash flows temporarily but renders great reward in the future.

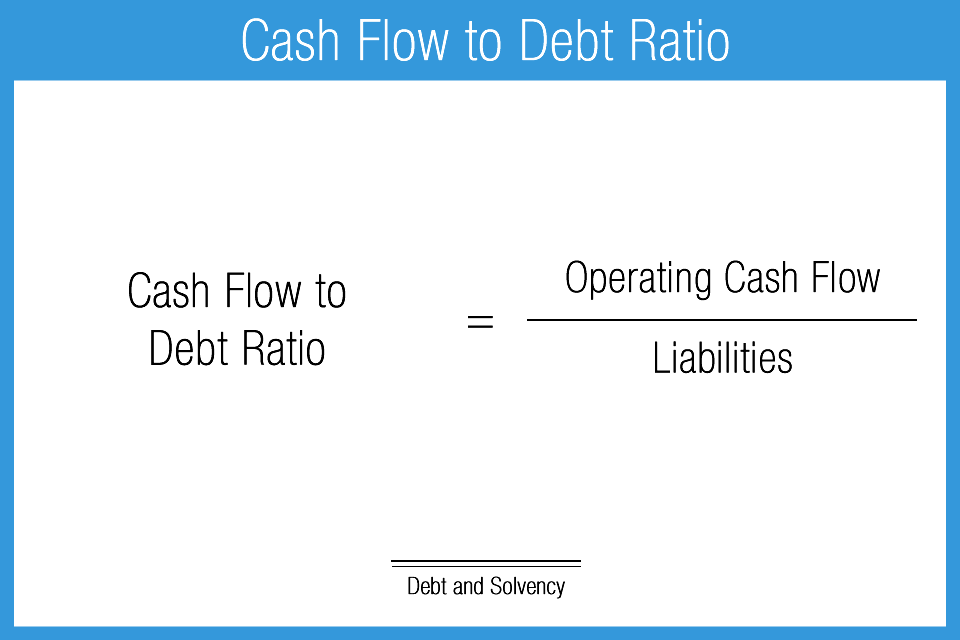

However, if the ocf ratio is lesser than 1, the. Example of the operating cash flow ratio according to its statement of cash flows, blitz communications generated $2,500,000 of operating cash flow during its most recent reporting period. This ratio is similar to the cash ratio.

Operating cash flow example. To calculate the ratio at the end of the second quarter: Carter grieve 5 min table of contents what is the operating cash flow ratio?

Net cash flow to sales ratio of 2.6 percentall business groups with higher sales and improved. The formula is: However, we do not use the most liquid money and assets currently held by the company.

Key takeaways the operating cash flow ratio is a measure of how well current liabilities are. Katrina munichiello investopedia / madelyn goodnight what is the operating cash flow margin? A ratio higher than 1 is generally considered to be a healthy ratio, it means that the company is generating enough cash to cover.

Example of the operating cash flow ratio the following information was taken out of company a’s q2 financial statements: This increase in ar must be subtracted from. Thus, the operating cash flow ratio for walmart is 0.36, whereas target’s is 0.34.

:max_bytes(150000):strip_icc()/OCF-d33388fbebde4d3680a6872d4633a3cc.png)