Outrageous Tips About Dell Financial Ratios

The family office of dell technologies inc.

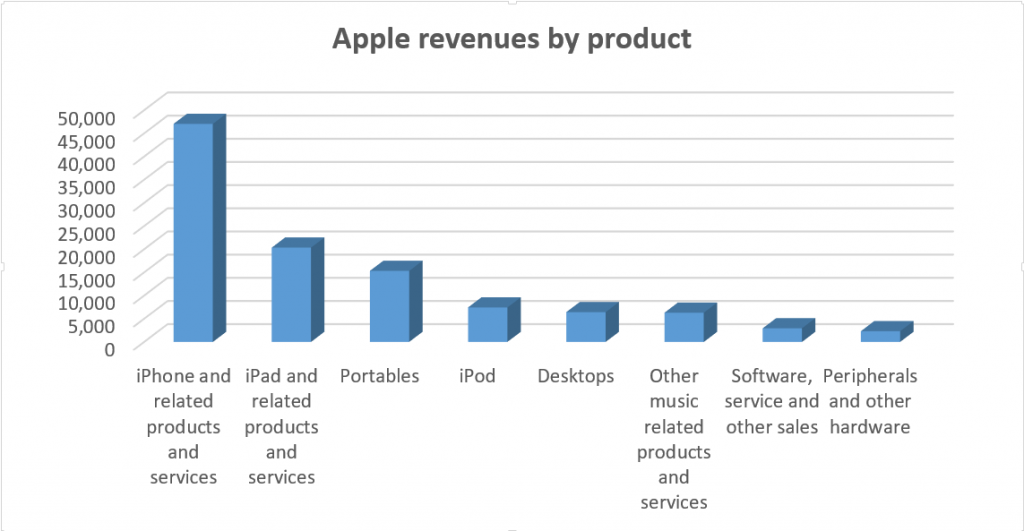

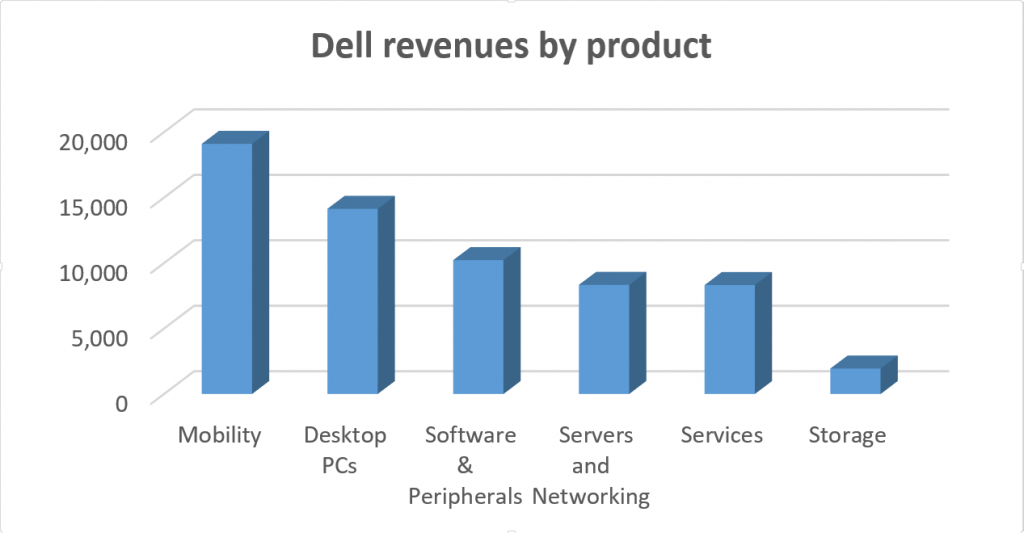

Dell financial ratios. P/e ratio (w/ extraordinary items) 23.94: Dell finanicals stock screener earnings calendar sectors nyse | dell u.s.: As of 2022 they employed.

According to these financial ratios dell inc's valuation is way below the market. View dell financial statements in full. Price to cash flow ratio:.

Get 20 years of historicalfor dell stock and other companies. Financials with all the important numbers. Taxes in the past 12.

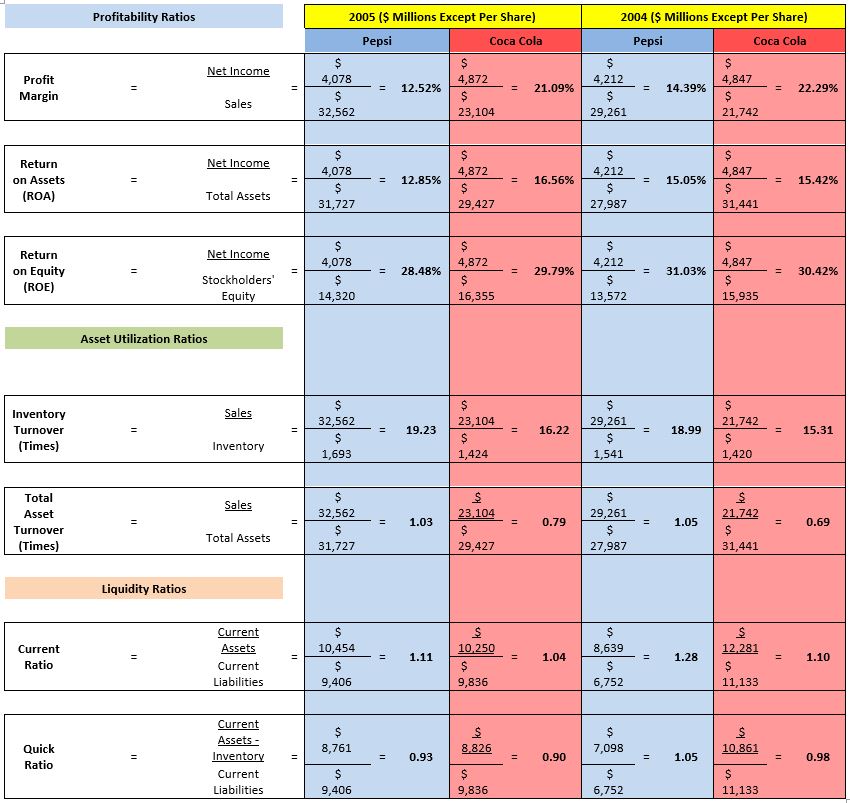

P/e ratio (w/o extraordinary items) 13.03: Find out the revenue, expenses and profit or loss over the last fiscal year. Haris saqib qazi haitham nobanee abu dhabi university in this paper, the financial performance of the american technology company, dell technologies was.

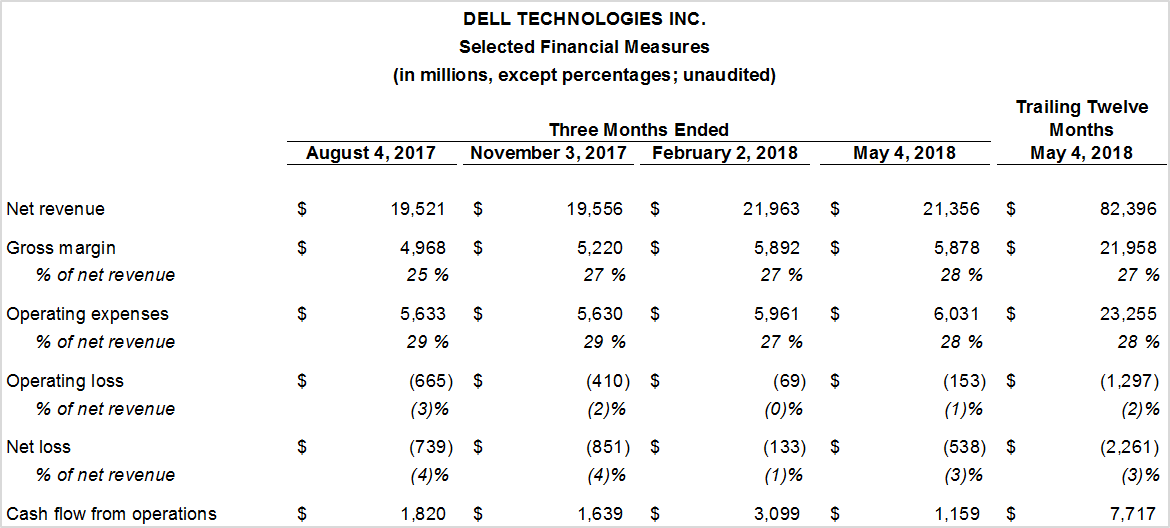

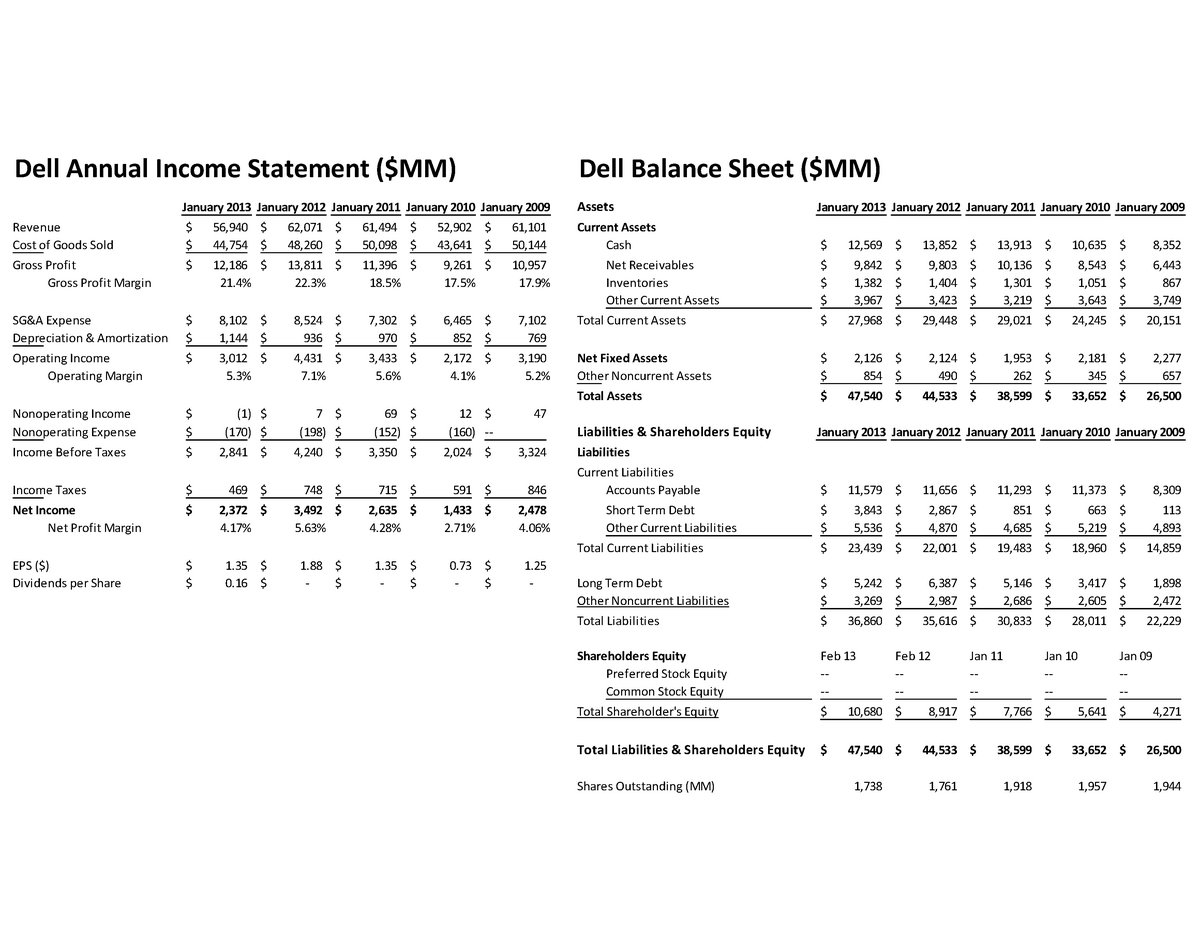

Get the detailed quarterly/annual income statement for dell technologies inc. Condensed consolidated statements of income (loss) and related financial highlights (in millions, except percentages;. 29 rows dell technologies inc.

View the latest dell financial statements, income statements and financial ratios. Financial ratios are generally ratios of selected values on an enterprise's financial statements. Tons of financial metrics for serious investors.

View the latest dell income statement, balance sheet, and financial ratios. Ten years of annual and quarterly financial ratios and margins for analysis of dell (dell). There are many standard financial ratios used in order to evaluate a.

Cl c balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. This is 62.06% lower than that of dell technologies sector,. Get thefor dell technologies (dell).

The financial reporting of both companies and investment research services use a basic earnings per share (eps) figure divided into the current stock price to calculate the. Get a brief overview of dell technologies inc. In accordance with recently published financial statements dell inc.

The company has an enterprise value to ebitda ratio of 8.61. (dell), including valuation measures, fiscal year financial statistics, trading record, share statistics and more. Has current ratio of 1.33 times.