Here’s A Quick Way To Solve A Tips About Retained Income On Balance Sheet

Retained earnings=beginning retained earnings+net income/loss−dividends paid.

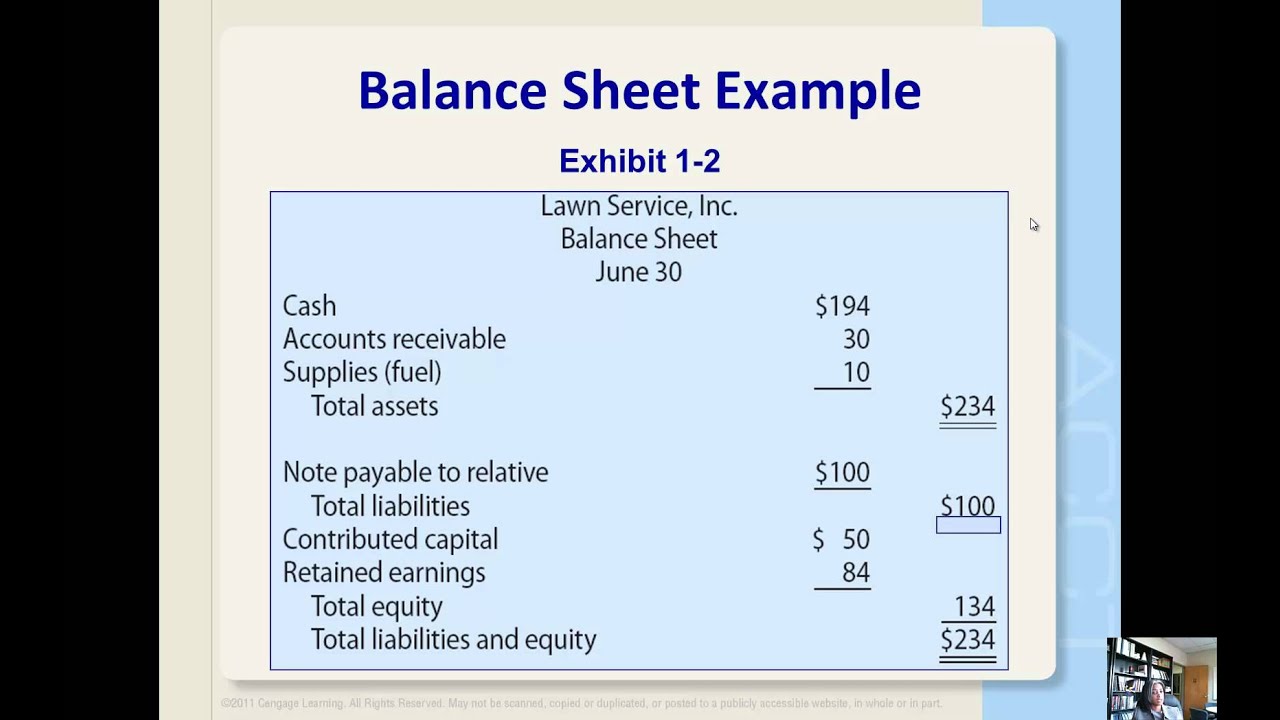

Retained income on balance sheet. Even if you don’t have any investors, it’s a valuable tool for understanding your business. Retained earnings are a clearer indicator of financial health than a company’s profits because you can have a positive net income but once dividends are paid out, you have a negative cash flow. This often comprises part of a company’s equity and is listed in the shareholders’ equity section on its balance sheet.

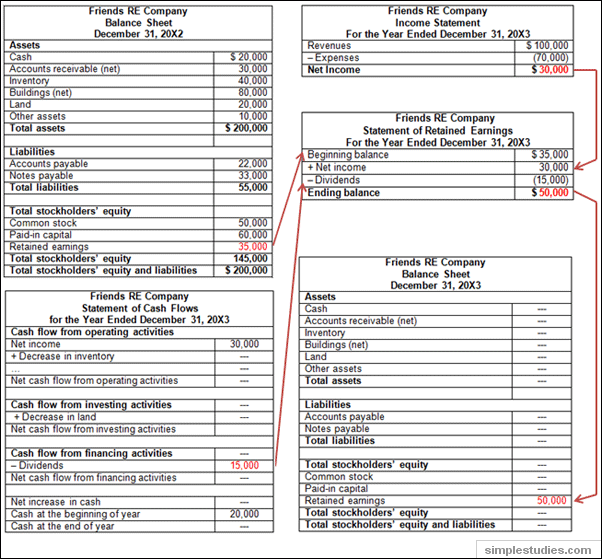

Retained earnings are the net earnings after dividends that are available for reinvestment back. Retained earnings, also known as accumulated earnings, is a company’s total earnings or profit that have been retained since the business first began operations. Income of $30,000 increased retained earnings and dividends paid back out to investors reduced retained earnings, leaving an ending balance in the prior year of $15,000.

Determine beginning retained earnings balance. Company’s net income or loss: This is the primary influencer of retained earnings.

Retained earnings on a balance sheet represent the accumulated profits of a company. Serve as a convenient and economical source of internal finance reduce your business entity’s dependence on external funds You can find this information on your business’s balance sheet.

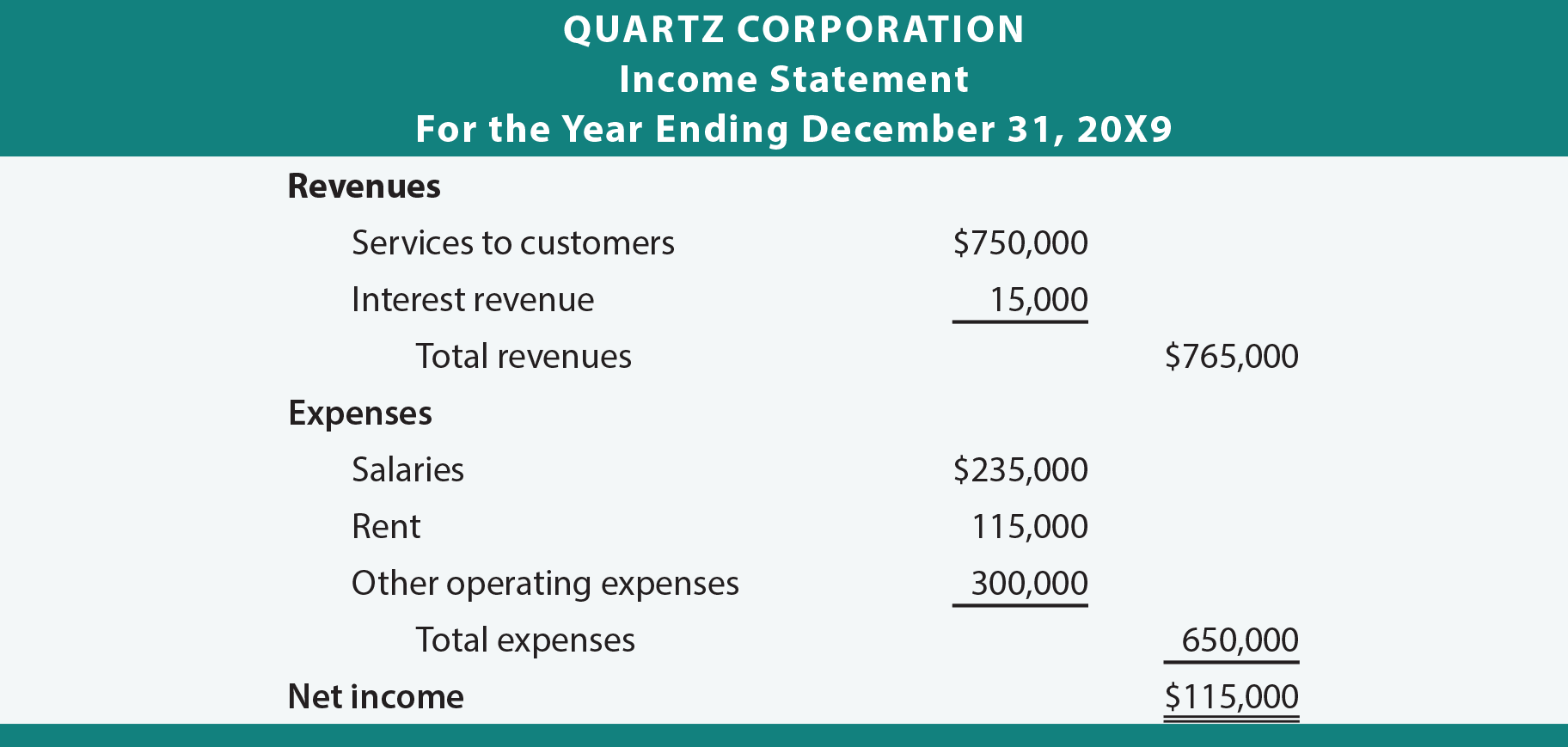

You can use a basic accounting formula: Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its shareholders. Retained earnings resides on the balance sheet in the form of residual value of the company, while revenue resides on the income statement.

Did you get it ⬇️樂 question: On the balance sheet, it feeds into retained earnings and on the cash flow statement, it is the starting point for the cash from operations section. At the start of the year, abc ltd had $500,000.

Retained earnings are usually generated from the sales of. In more practical terms, retained earnings are the profits your company has earned to date, less any dividends or other distributions paid to investors. So, why should you care about retained earnings?

Let’s look at this in more detail to see what affects the retained earnings account, assuming you’re creating a balance sheet for the current accounting. This is what is known as an accumulated deficit. Abc ltd decided to pay.

The steps to calculate retained earnings on the balance sheet for the current period are as follows. To illustrate how to calculate retained earnings on a balance sheet, imagine a firm starting the year with $50 million in retained earnings. In the prior year they began with a $10,000 balance in retained earnings.

In this example scenario, the company’s ending retained earnings would be $130,000. Retained earnings formula. Financial reporting includes collecting and documenting your finances to monitor your business’.