Brilliant Tips About Profit Loss In Balance Sheet

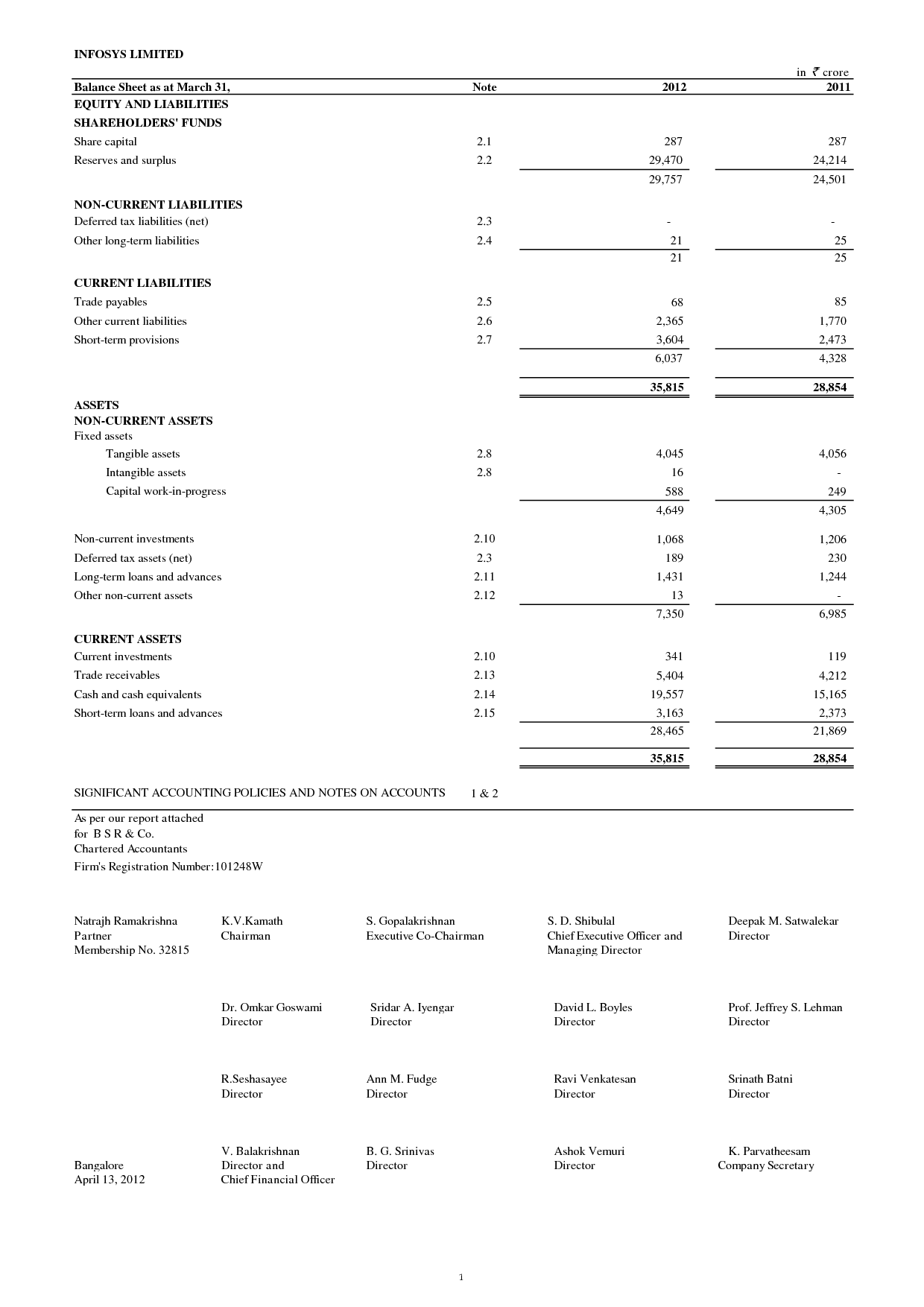

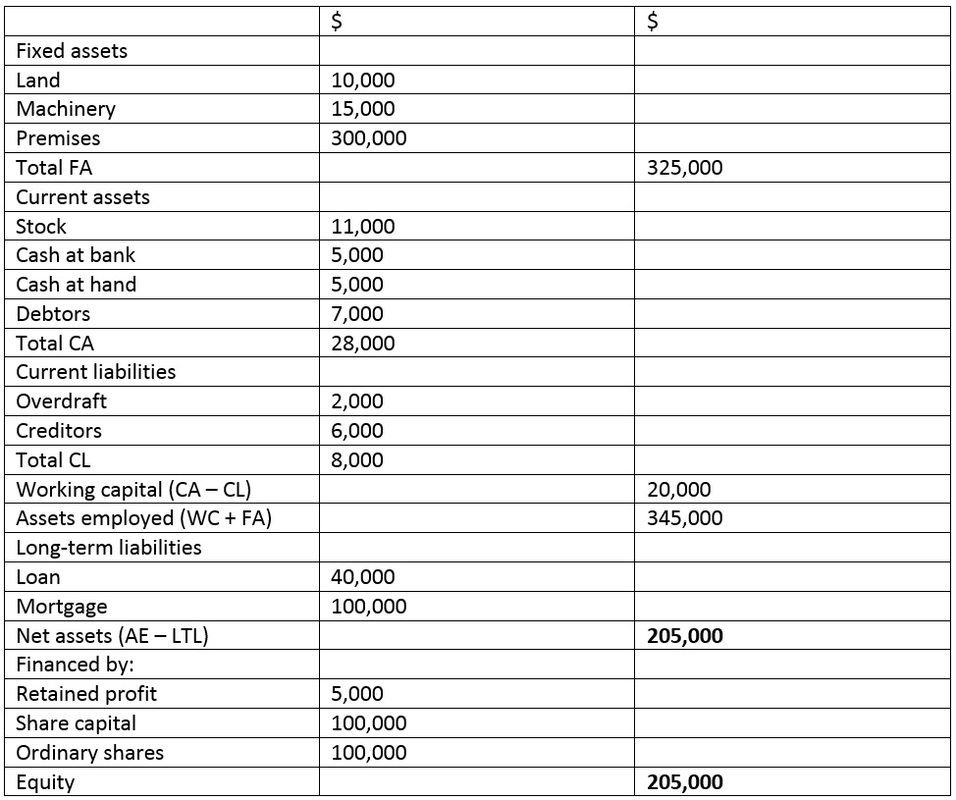

Balance sheets usually include more broad information like accounts payable, loans, cash, inventory, assets, investments, securities, expenses and dividends.

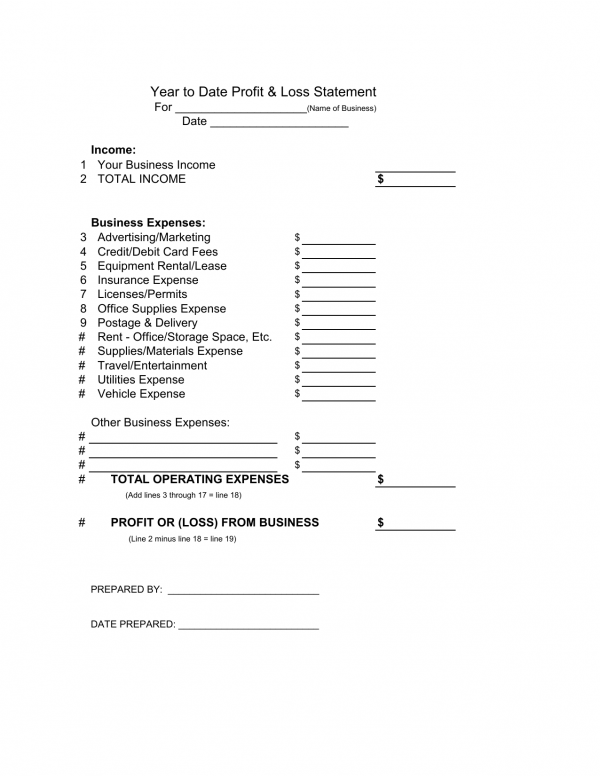

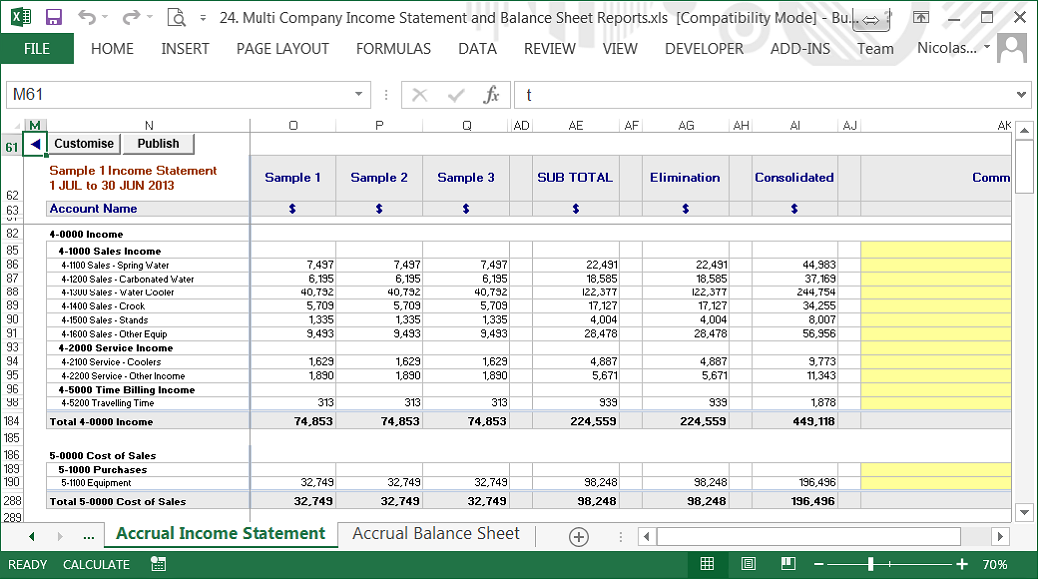

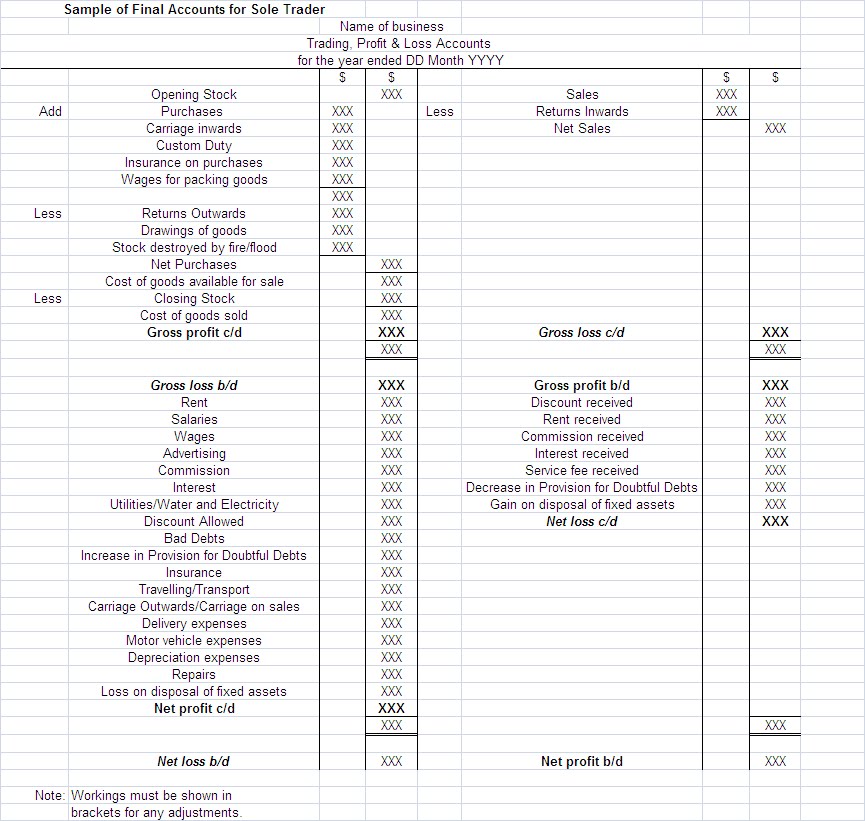

Profit loss in balance sheet. Provides a snapshot of the company's financial position at a specific point in time. Balance sheet for the year ended december 31, 2023: A profit and loss statement usually shows administrative expenses, dividends per common share, cost of goods sold, research costs and total revenue and sales.

Definition of profit profit is the result of revenues minus expenses. The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. Increase in assets of qr287mn.

Value of assets, liabilities, and equity are mentioned in the balance sheet and profit and loss account of a company consisting of expenses and revenues to determine the financial standing. P&l statements tend to follow a standard format: Assets = liabilities + shareholders' (or owner's) equity.

These typically look at both the profit and loss statement and the balance sheet to show a company’s ability to use the assets and borrowings it has in order to make a profit. A balance sheet is prepared on the last day of a financial year while the profit and loss account is maintained for the whole accounting period. Our correspondent points out bsp’s balance sheet is stronger, its margins are wider, and its dividends are fatter.

The outcome is either your final profit or loss. How profits change the balance sheet since all business transactions affect at least two accounts, there will likely be an enormous number of changes to the balance sheet. It shows your revenue, minus expenses and losses.

And it knows its market. Represents the financial position at a specific point. A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.

Here are some of the changes: Such statements provide an ongoing record of a company's. These two along with the cash flow statement constitute the financial statement.

James leckie | last updated: The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The balance sheet explained.

The profit and loss balance sheet, also known as the income statement, is a crucial financial document that provides insights into a company’s revenue, expenses, and overall profitability. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Return on assets 3.9% an increase of 5% from 2022.

A profit and loss account, on the other hand, is an account that shows the revenue earned and expenses sustained by the company, during the course of business, in a financial year. A balance sheet is a declaration that details a company's assets, liabilities, and equity as of a certain time. A profit and loss account displays the company's earnings and outlays expenses within a fiscal year.

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)