Beautiful Work Tips About Consolidated Income Tax

Under paragraph (d)(5)(ii) of this section, x and x 1 and y and y 1.

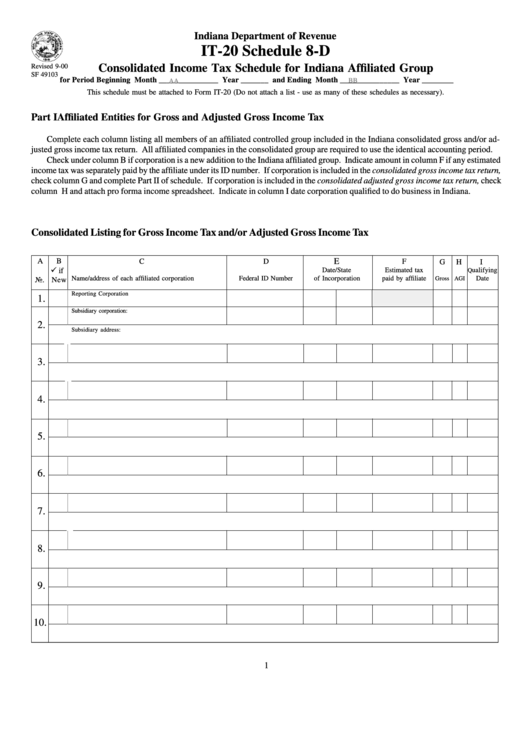

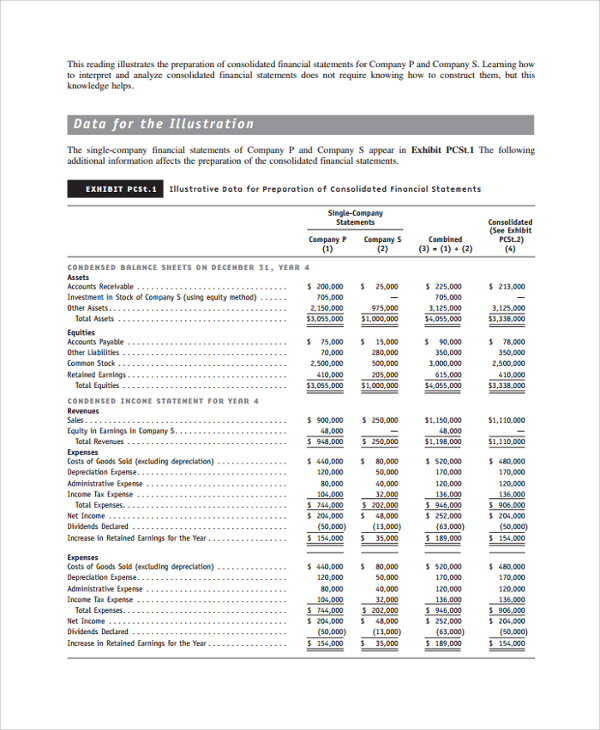

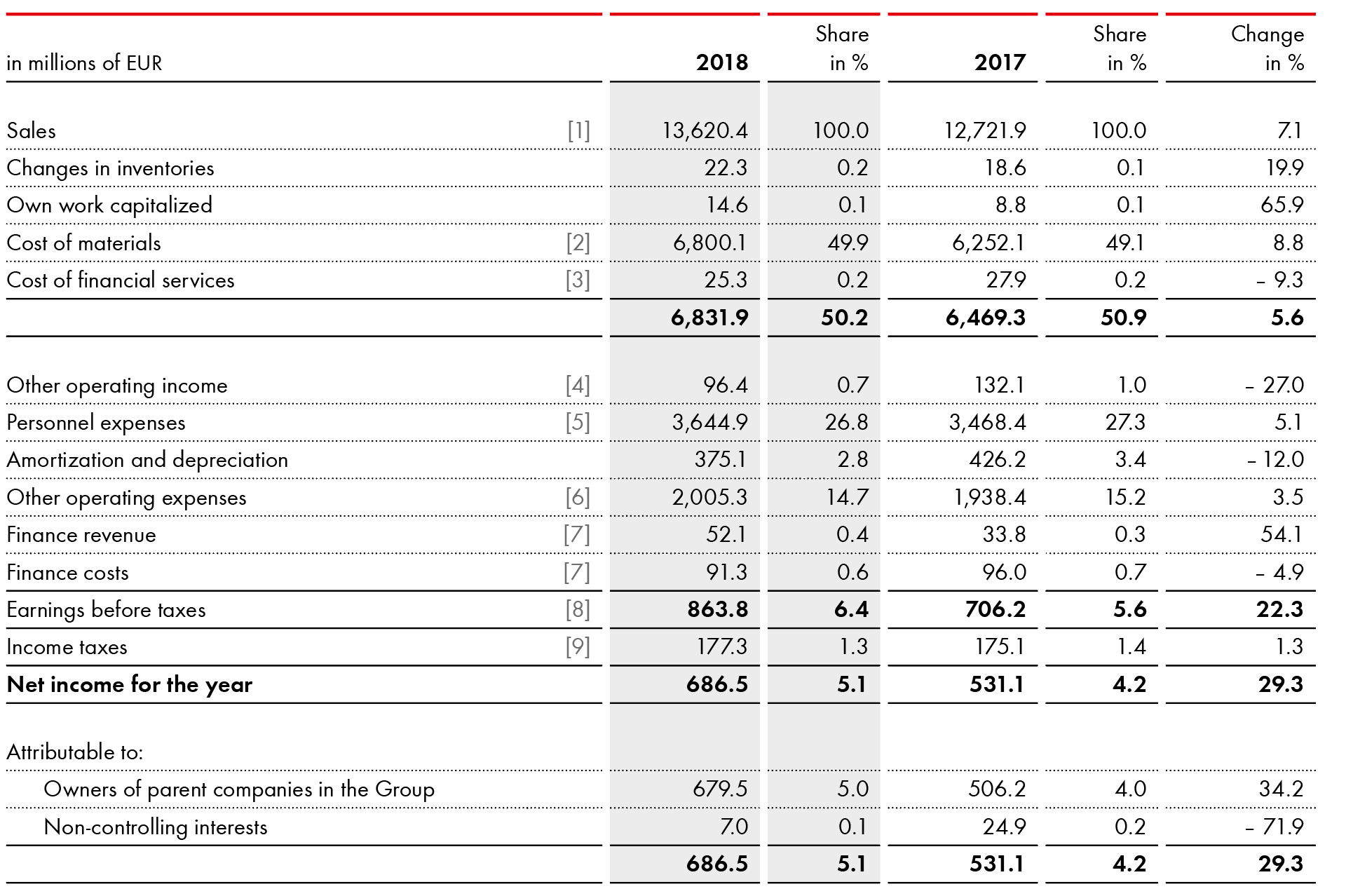

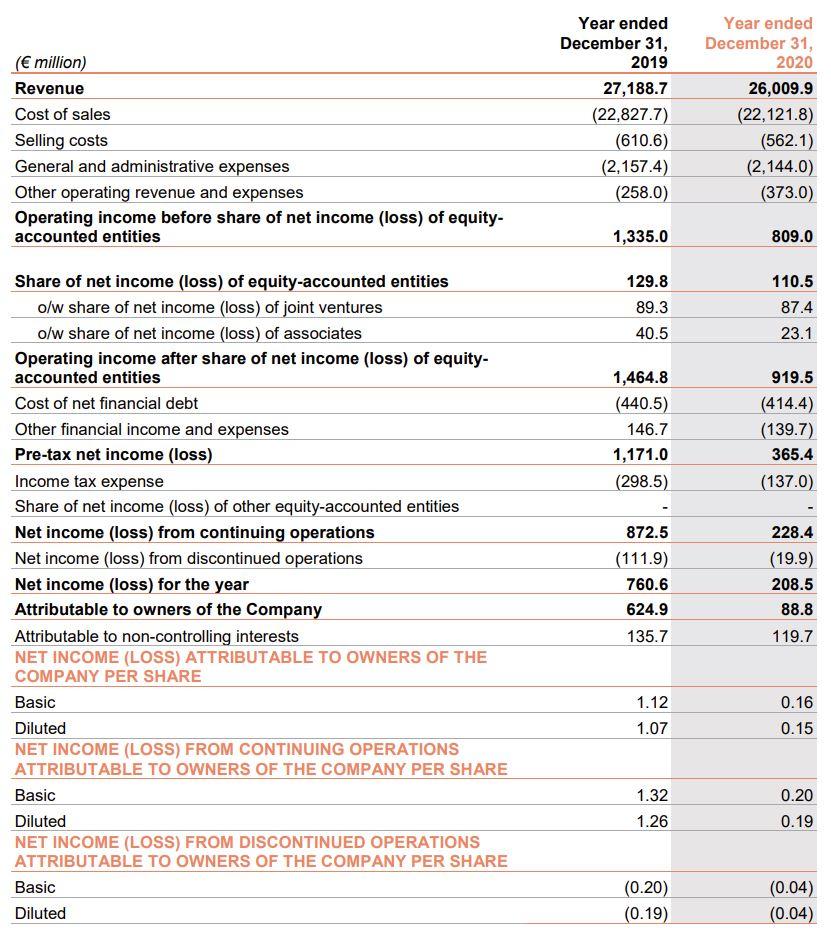

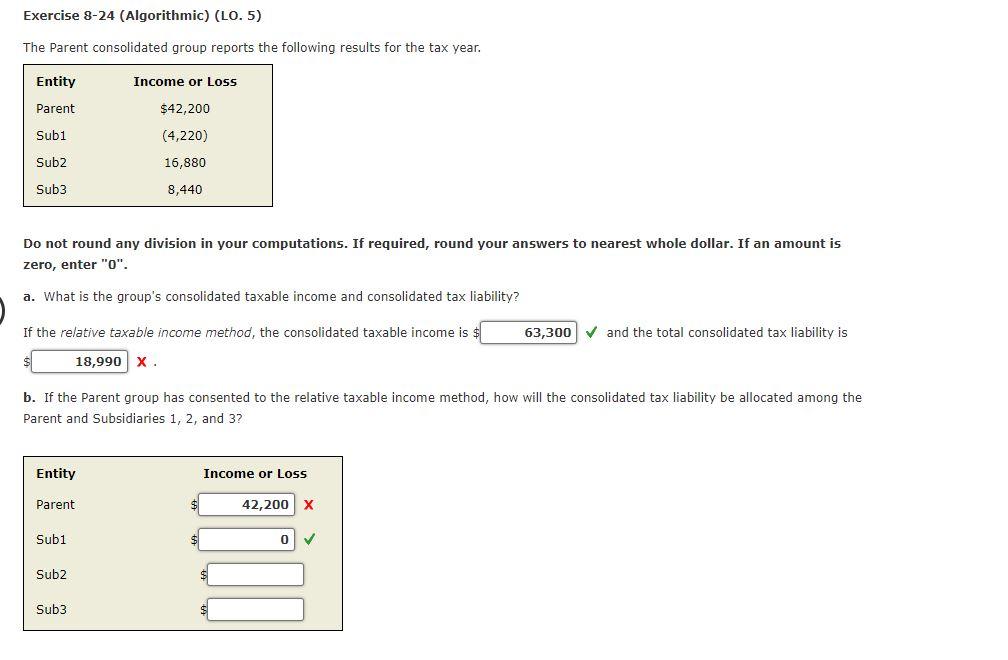

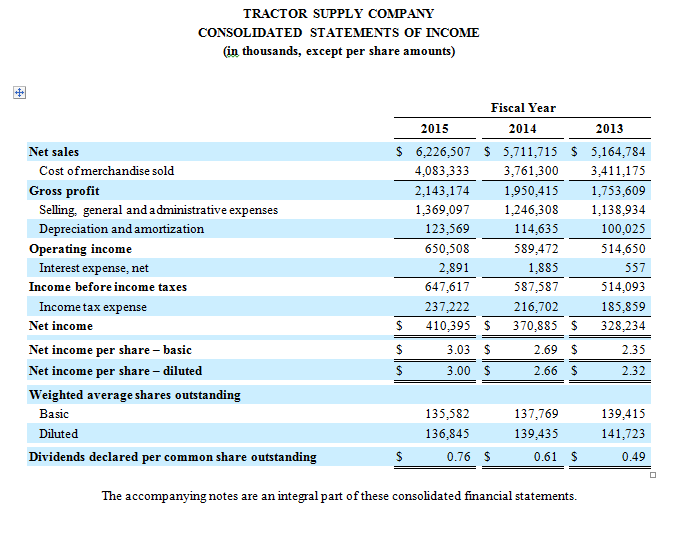

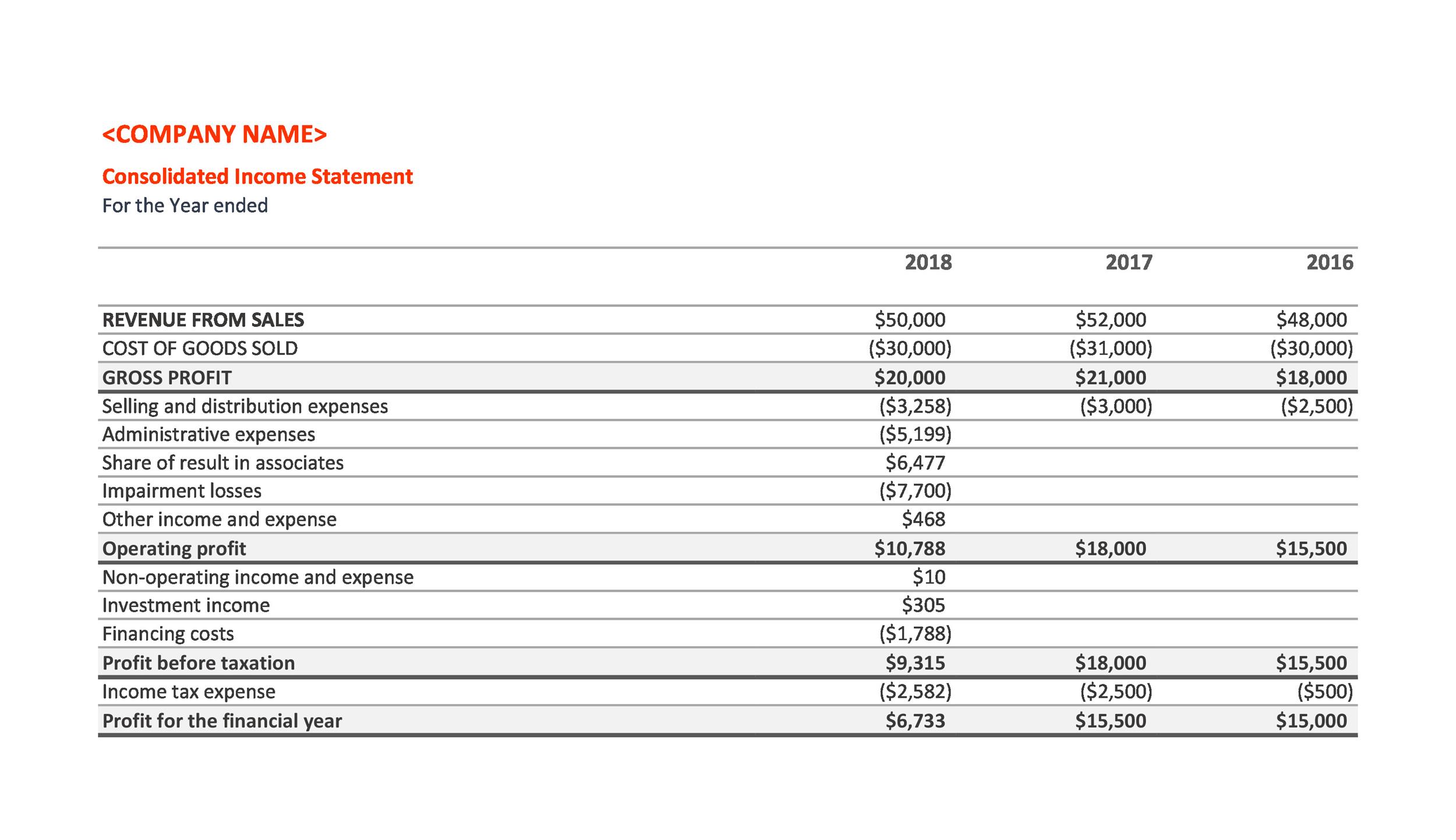

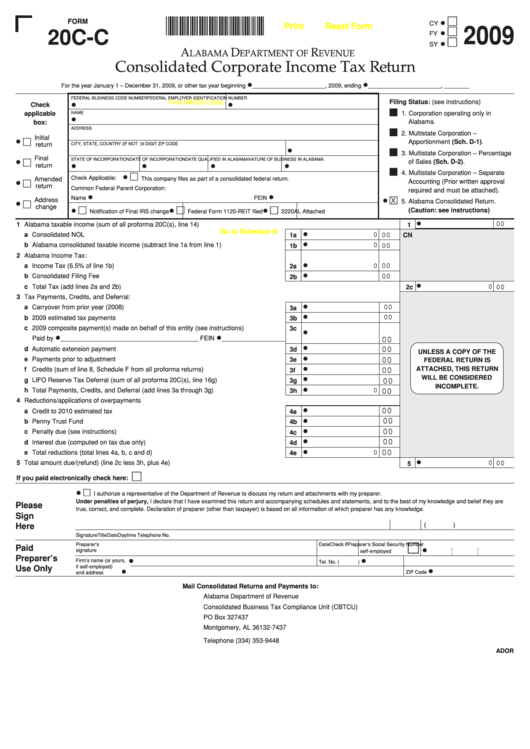

Consolidated income tax. Consolidated net income is the sum of net income of the parent company excluding any income from subsidiaries recognized in its individual financial statements. The affiliated groups choose to file consolidated returns for taxes by submitting an 1120 form. The consolidated current and deferred tax amounts of a group that files a consolidated tax return should be allocated among the group members when they issue separate.

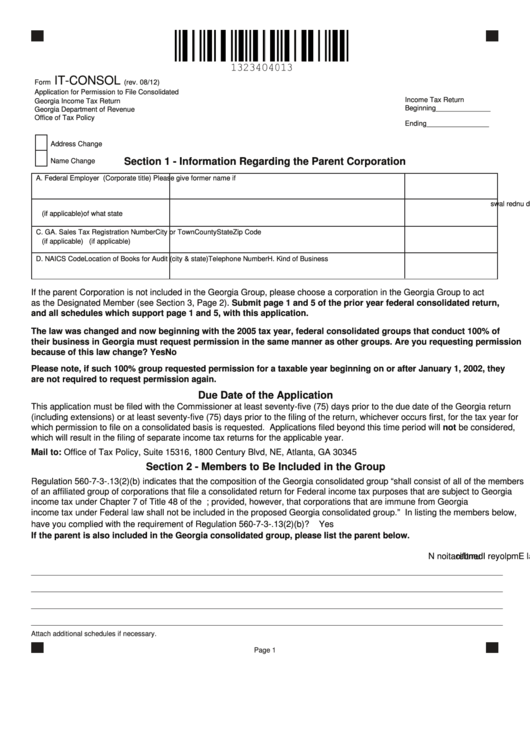

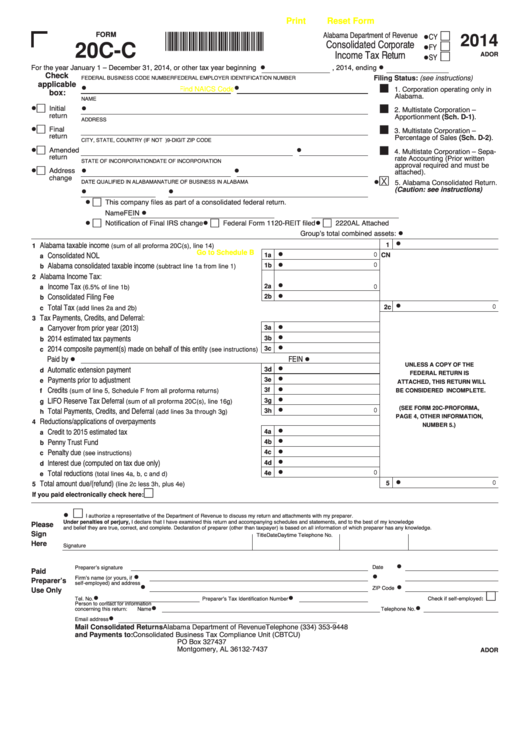

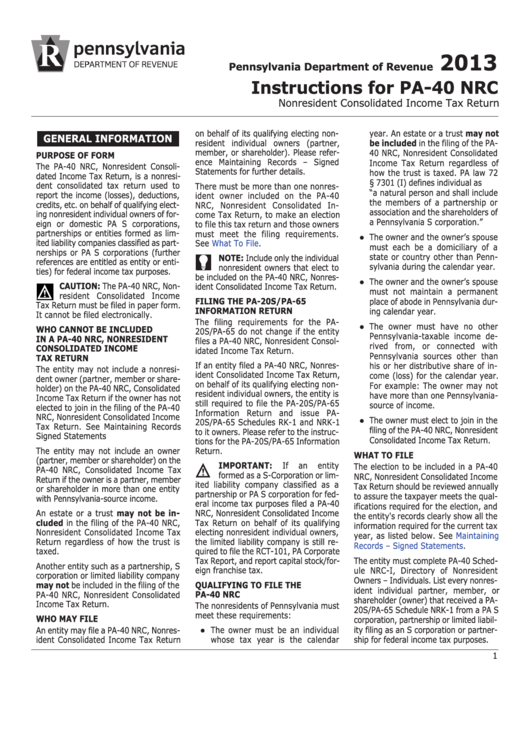

What is a consolidated tax return? Corporate income tax (cit) due dates; Consolidated returns and combined reporting (portfolio 1130) part of bloomberg tax subscription request demo the portfolio, income taxes:.

Tax subjects are liable to tax if they receive or accrue. Personal income tax (pit) due dates; The tax treatment of an insolvent debtor realizing discharge of indebtedness income under the u.s.

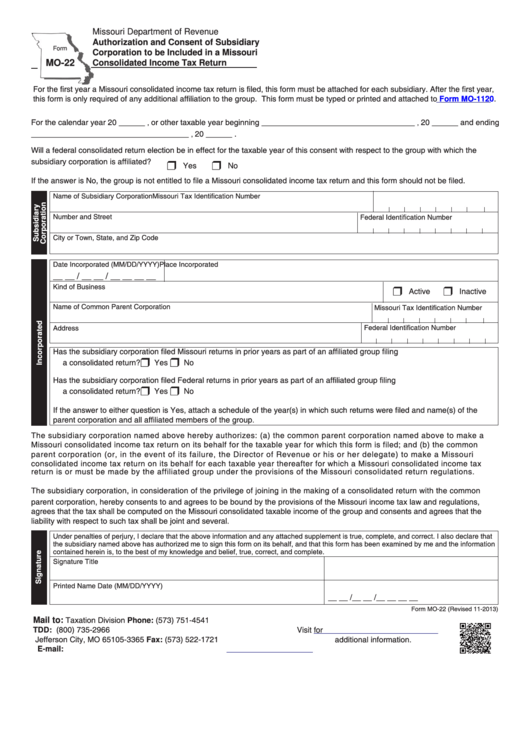

The tax accrual options aren't available for consolidated returns. This law stipulates the imposition of income tax on tax subjects in respect of income they receive or accrue in a tax year. A consolidated tax return is a form of corporate income tax return, for corporations, it is form 1120, corporate income tax.

For 1986 x and x 1 filed a consolidated federal income tax return but y and y 1 filed separate returns. A consolidated tax return is a corporate income tax return of an affiliated group of corporations that elect to report their combined tax liability on a. There is little detail as to what the rate of the consolidated income tax would be, however.

Matters covered in this issue include: Public notice (pn) regarding matters related to the 2023 annual individual income tax filing for consolidated income;.

Laura suter, personal finance analyst at aj bell, said: Proforma your parent, subsidiary, and eliminations return for each member of the consolidated group. The consequence of choosing to file consolidated returns.

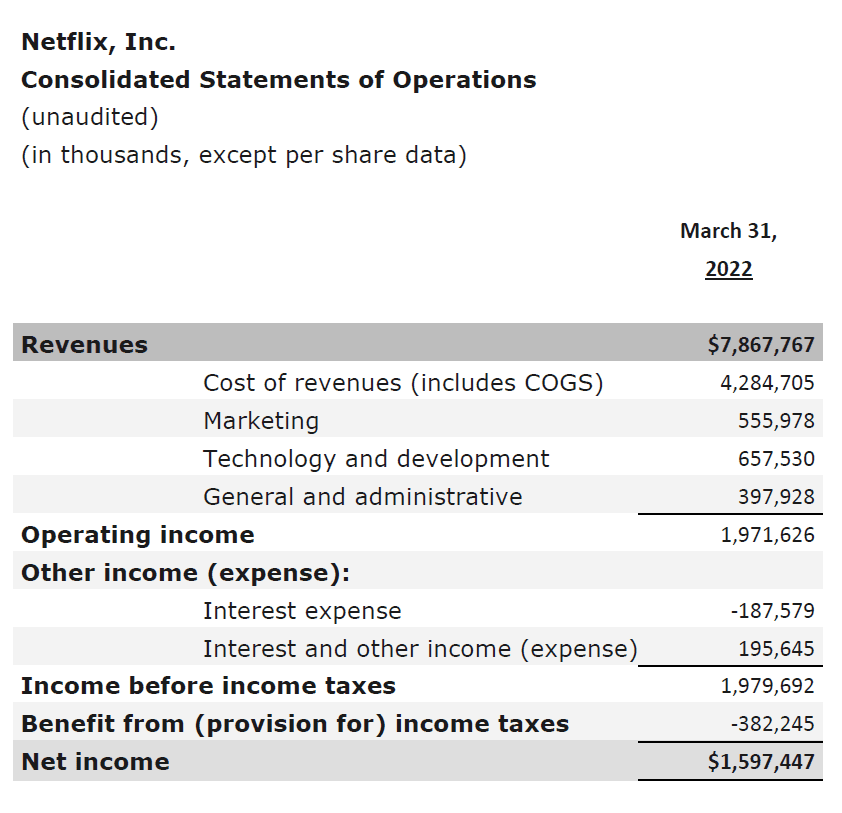

Your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. Consolidated income taxes are $76,000 ($190,000 x 40 percent tax rate). Tax consolidation, or combined reporting, is a regime adopted in the tax or revenue legislation of a number of countries which treats a group of wholly owned or majority.

In detail detailed information about consolidation. There are now 7.5 million borrowers enrolled in the save plan, of whom 4.3 million have a $0 payment. Consolidated income tax return rules can vary considerably depending on the.

An amended 2020 income tax return must be filed reflecting the decreased wage deduction, with a payment of additional income tax to the irs, before the statute. Corporate income tax (cit) rates; It could include some or all of the following five forms: