Who Else Wants Tips About Consolidated And Unconsolidated Financial Statements

As described in note 3 to the partnership’s consolidated financial statements, net interest income representing contingent interest and net residual proceeds representing contingent interest (tier 2 income) will be distributed 75% to the limited partners and buc holders, as a.

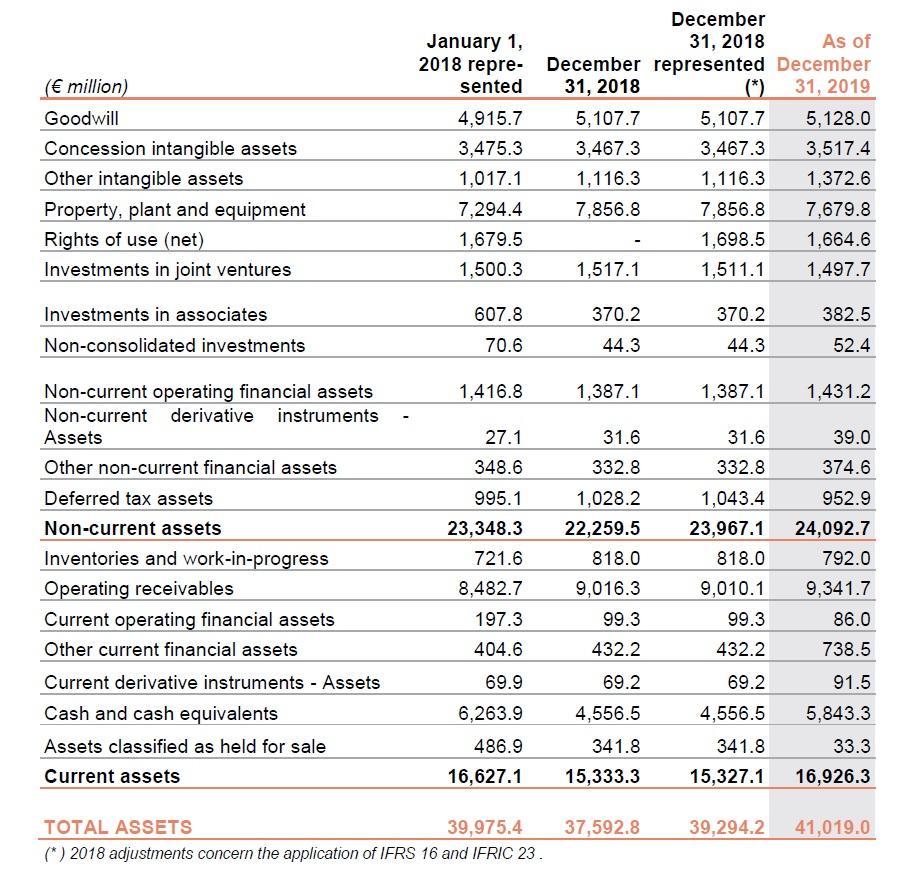

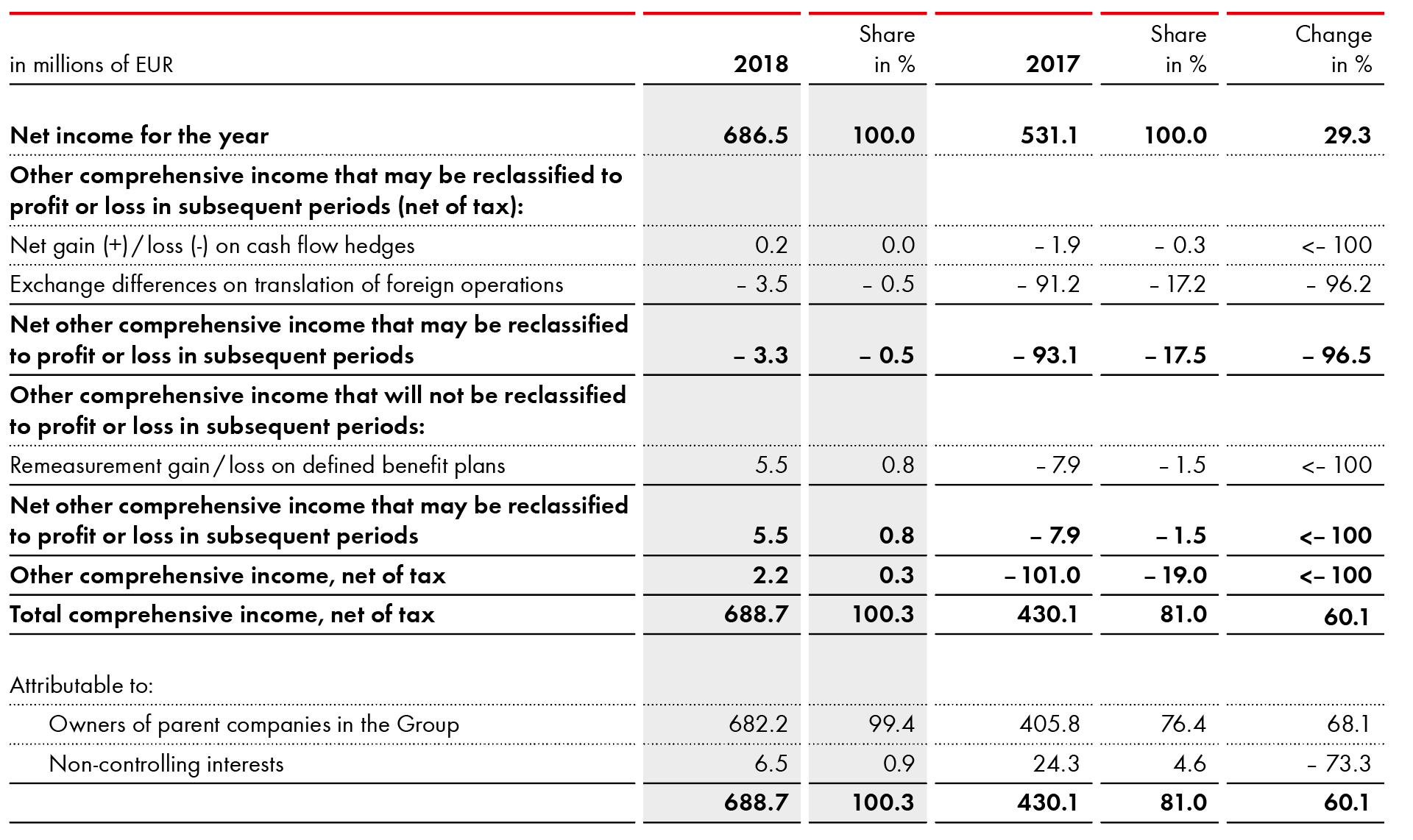

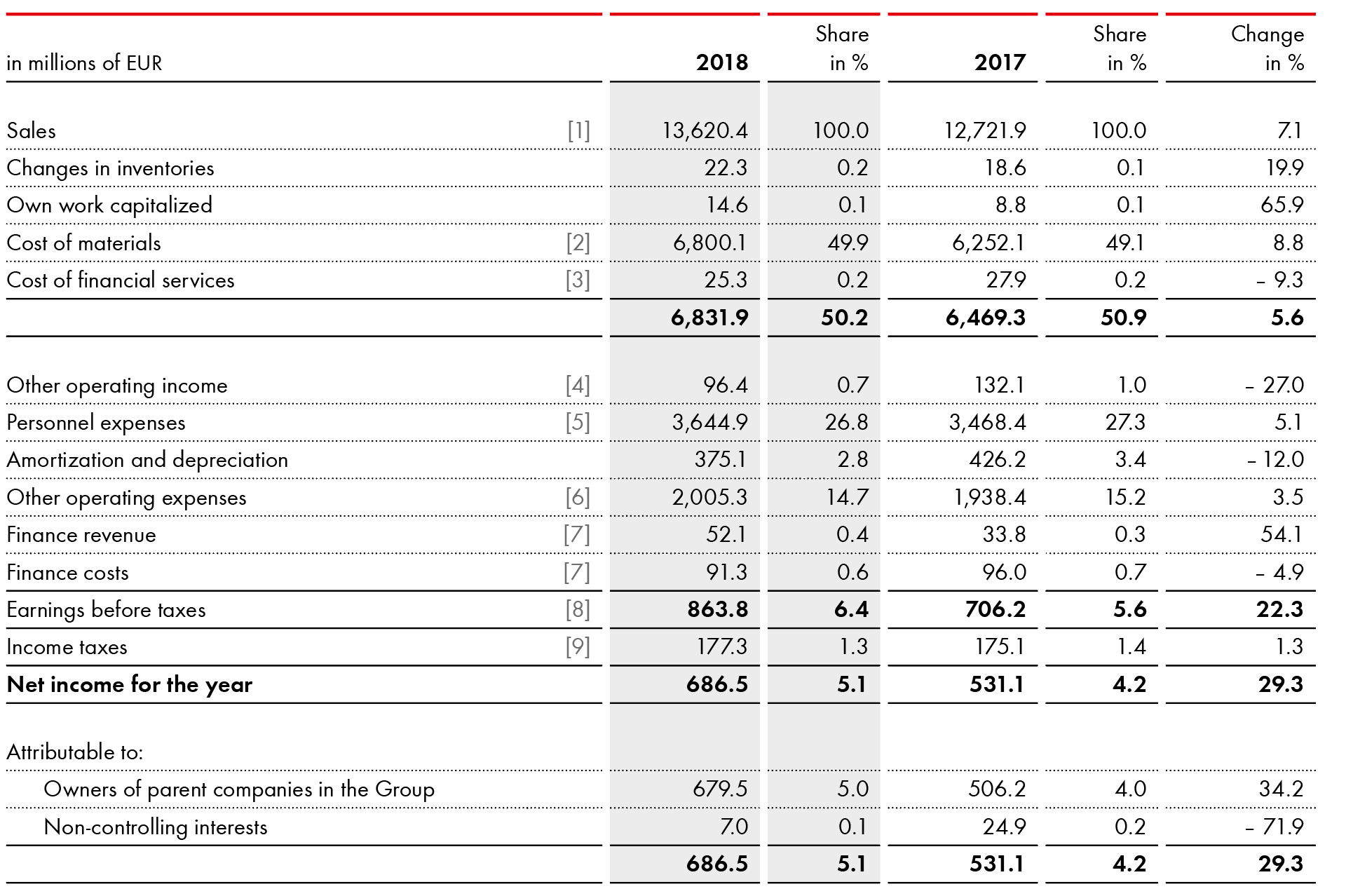

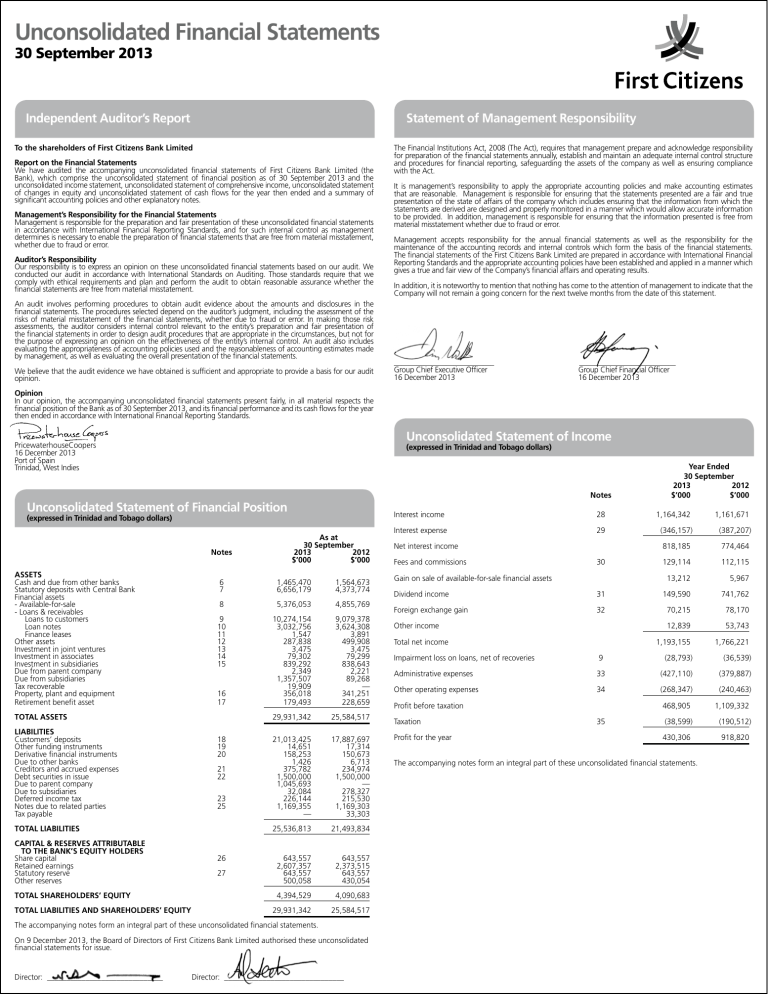

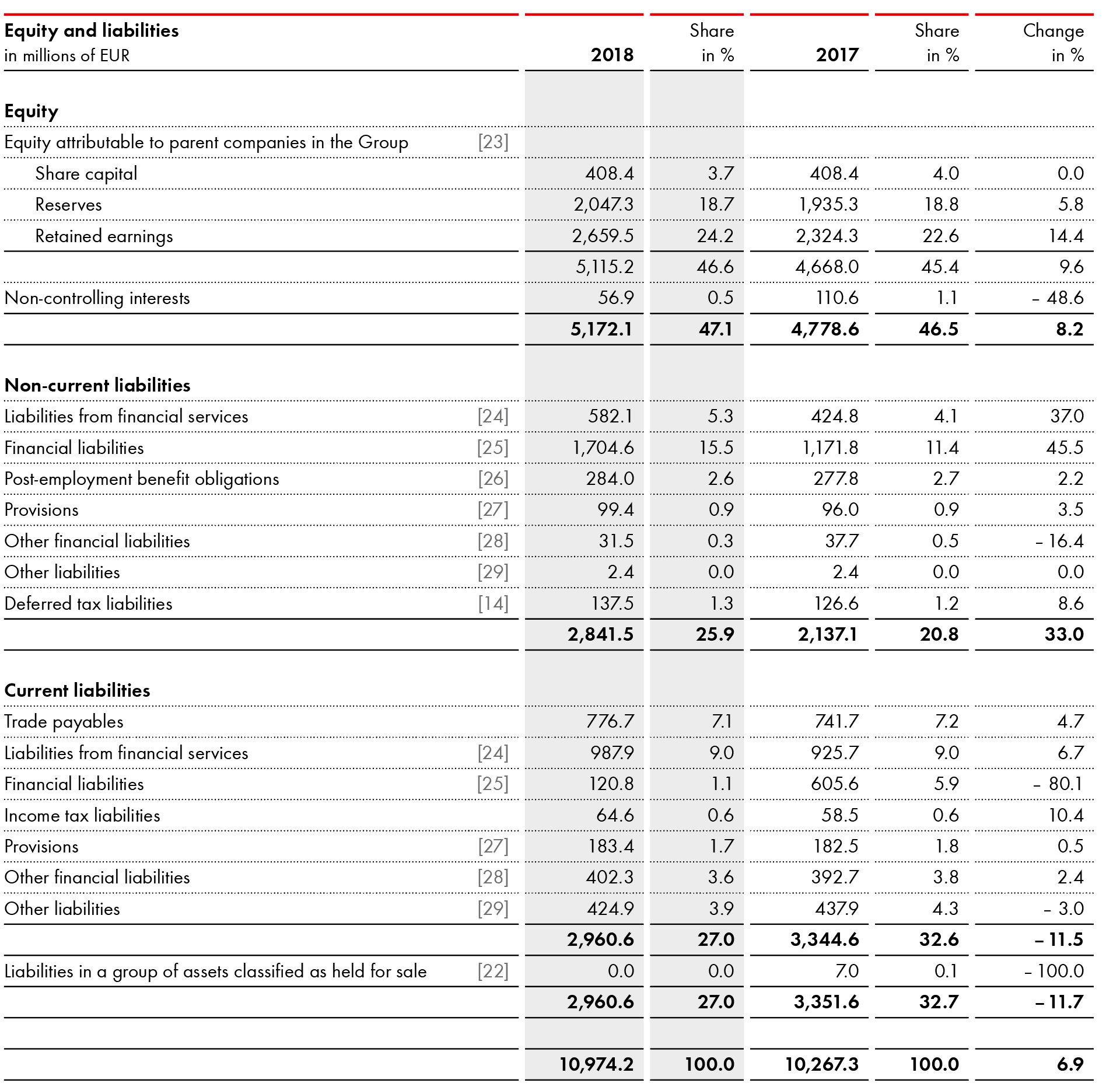

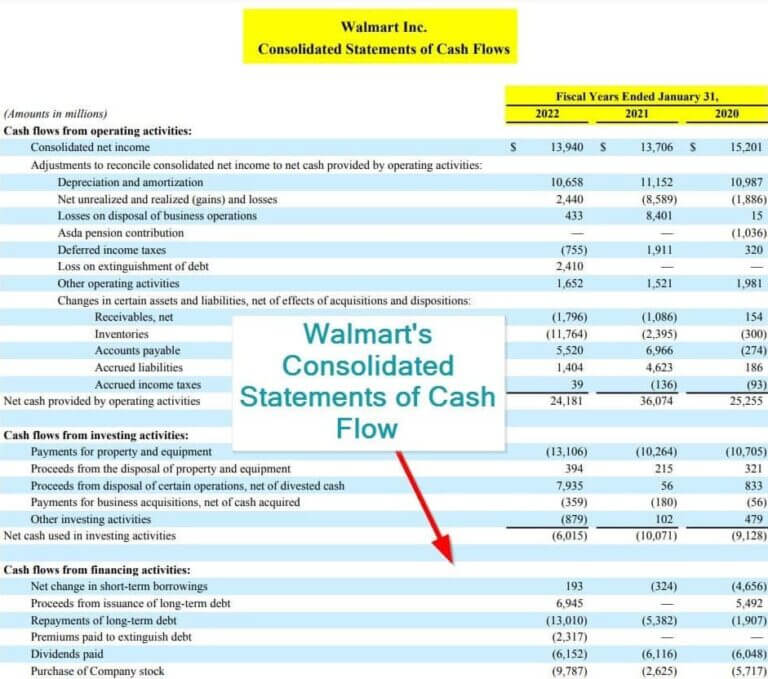

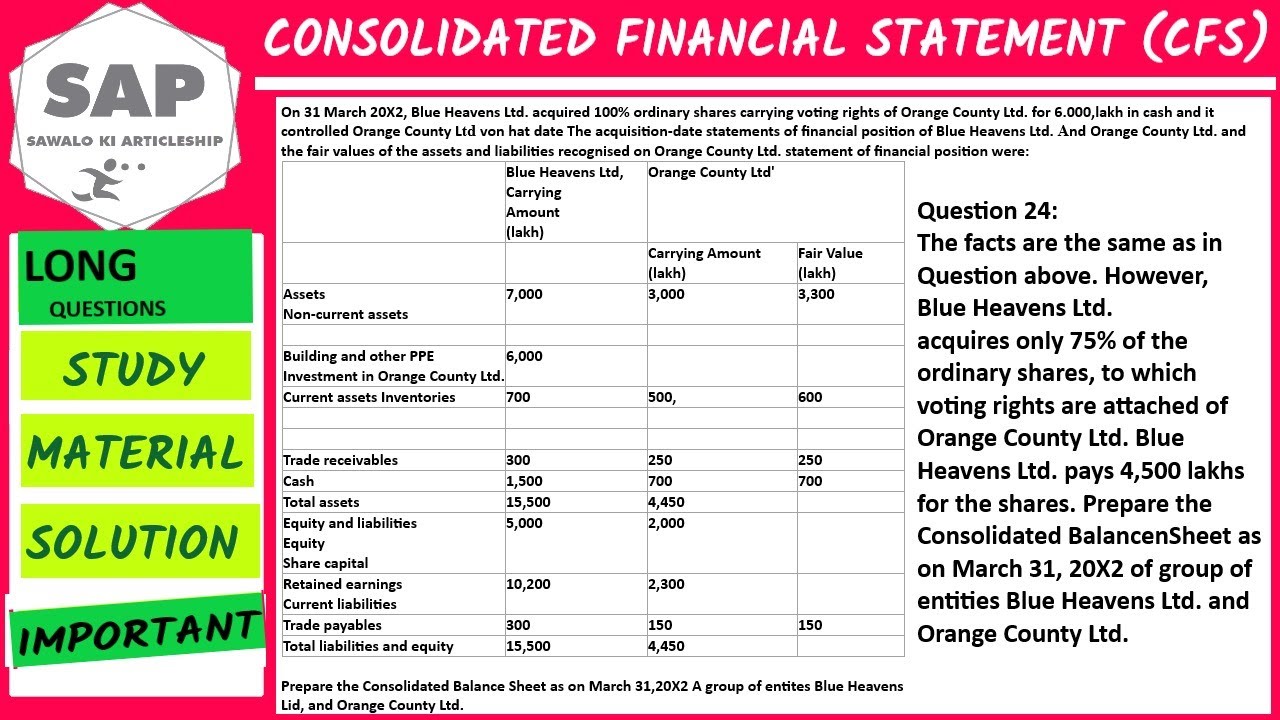

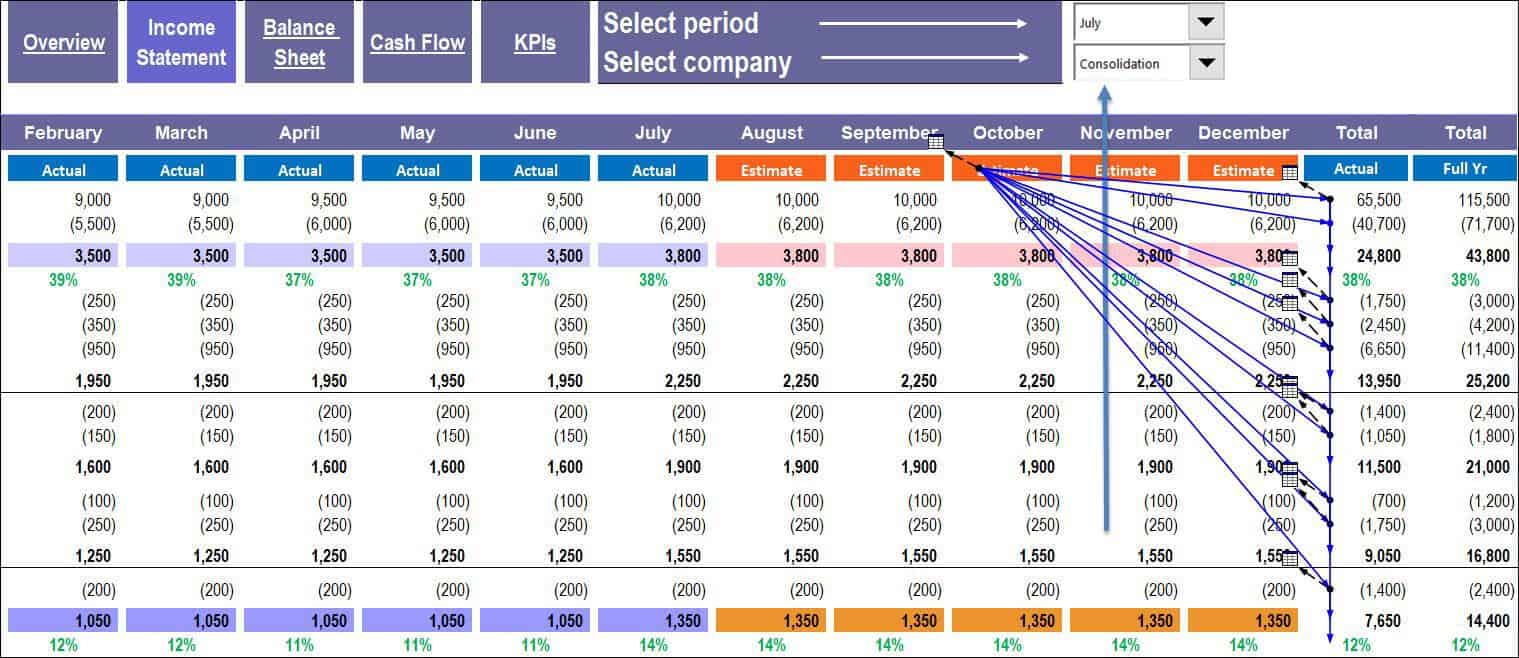

Consolidated and unconsolidated financial statements. Income, cash flow, and financial position. Consolidate financial statements by creating a balance sheet that reflects a sum of net worth, assets and liabilities. Our proportionate share of the income or loss of unconsolidated homebuilding and land development joint ventures is reflected as a separate line item in our consolidated financial statements under.

An unconsolidated subsidiary is a company that is owned by a parent company but whose individual financial statements are not included in the consolidated or combined financial. Consolidated financial statements are the overall financial statements of any entity with multiple divisions, including the parent company and all subsidiaries that are controlled by the parent company. Major instruments for preventing tax avoidance are strongly linked with consolidated financial statements.

This is done by simply adding together the separate values from the balance sheets of the parent company and the subsidiaries. Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls. Consolidated and combined financial statements are two different types of statements that help the public know whether it's worth investing in your company.

In may 2011 the board issued a revised ias 27 with a modified title—separate financial statements. Consolidated financial statements are strictly defined as statements collectively aggregating a parent company and subsidiaries. An entity, including an unincorporated entity such as a partnership, that is controlled by another entity (known as the parent).

1 citation explore all metrics abstract this article addresses the relationship between consolidated financial statements and achievement of global tax policy objectives (oecd beps) against the background of a case study. They do not incorporate financial information from subsidiary companies, reflecting the standalone financial condition of each entity. A company that owns more than 50 percent equity in another firm must consolidate, or combine, its results with the.

Although the mix of homesite sales from different communities impacted revenue comparability between the years, the average sales price increased from approximately. Ed 10 consolidated financial statements comments to be received by 20 march 2009 these draft illustrative examples accompany the proposed international financial reporting standard (ifrs) set out in ed 10 consolidated financial statements (see separate booklet). Chapter 3—financial statements and the reporting entity financial statements 3.1 objective and scope of financial statements 3.2 reporting period 3.4 perspective adopted in financial statements 3.8 going concern assumption 3.9 the reporting entity 3.10 consolidated and unconsolidated financial statements 3.15

And the audited consolidated financial statements of its ultimate parent, within 4 months of the end of the year to which the financial statements relate. A consolidated financial statement shows the financial data (liabilities, assets, income, equity, expenses, and cash flow) for various subsidiaries owned by one parent company rolled up into a single statement. Finance teams can redirect their efforts from manual consolidation to more strategic tasks.

Consolidating financial statements is the accounting process that ultimately leads to consolidated financial statements. Table of contents consolidated financial. Consolidated financial statements show aggregated financial results for multiple entities or subsidiaries associated with a single parent corporation.

Ifrs 10 consolidated financial statements addresses the principle of control and the requirements relating to the preparation of consolidated financial statements. Which should i use for my business? 2.13 article 17 ‘exemptions and variation’ of the bao allows us, on the.

Consolidated financial statements are the aggregated financial statement of a group company with multiple segments or subsidiaries. Ifrs 12 combines, enhances and replaces the disclosure requirements for subsidiaries, joint arrangements, associates and unconsolidated structured entities. A consolidated financial statement ( cfs) is the financial statement of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent company and its subsidiaries are presented as those of a single economic entity , according to international accounting standard 27 consolidated and separate financial stateme.

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)