Glory Info About Is Accounts Receivable A Revenue On An Income Statement

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/media/6af/6afe5e34-f57f-4d95-9009-bf5de0ae6080/php2E2kaW.png)

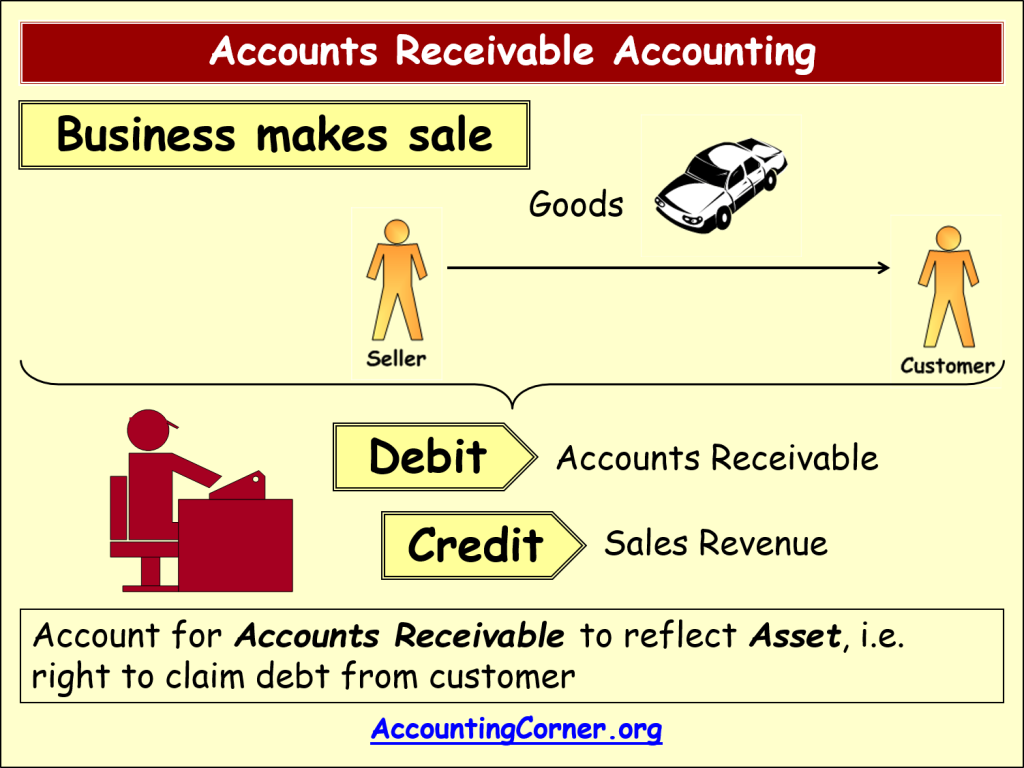

This records the increase in assets ( accounts receivable) and also recognizes revenue.

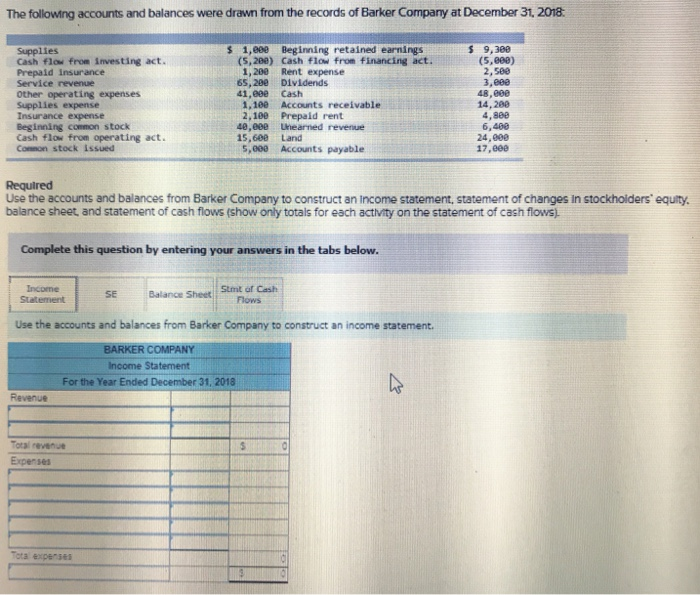

Is accounts receivable a revenue on an income statement. On an income statement, accounts receivable appears as part of net sales (revenue). Accounts receivable are not on the income statement. The accounts receivable does not go on the income statement on its own.

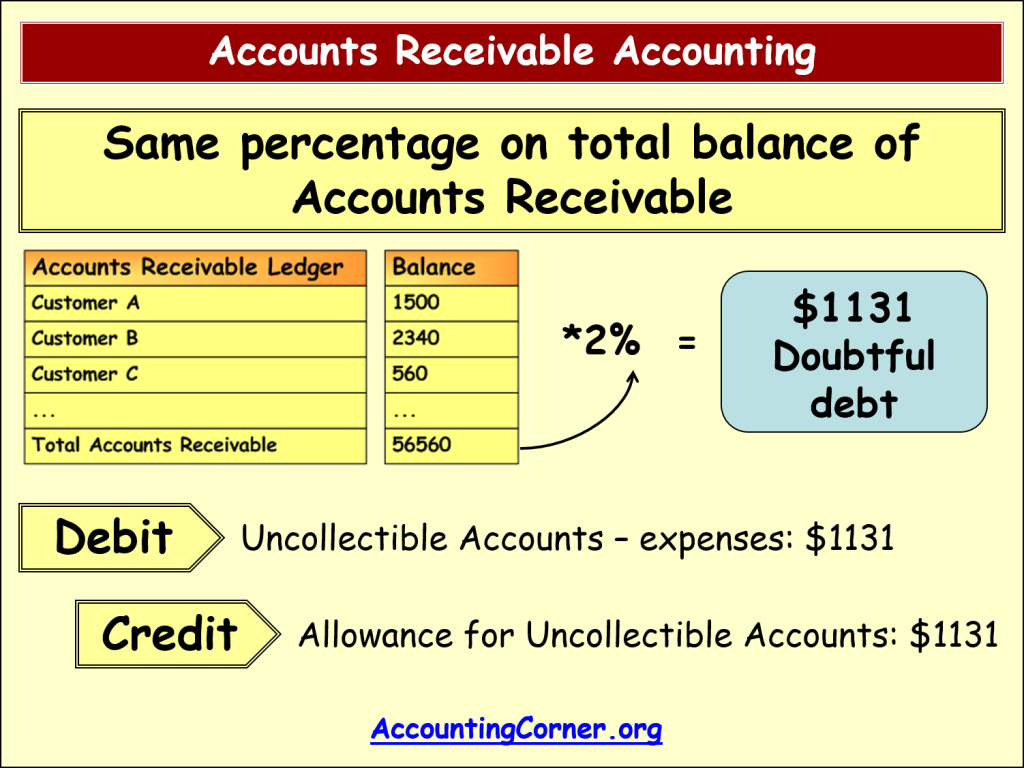

Net sales are calculated by subtracting returns and discounts from gross sales. This is because income statements are only for revenue and expenses, and accounts. Accounts receivable refers to the money that a business is owed by its customers for goods or services provided.

This is an essential part of any business’s financial dealings,. When goods or services are sold on credit, they are recorded as revenue, but since cash payment is not received yet, the value is also recorded on the balance sheet as. Yes, in accrual accounting, ar is recorded as revenue on the income statement.

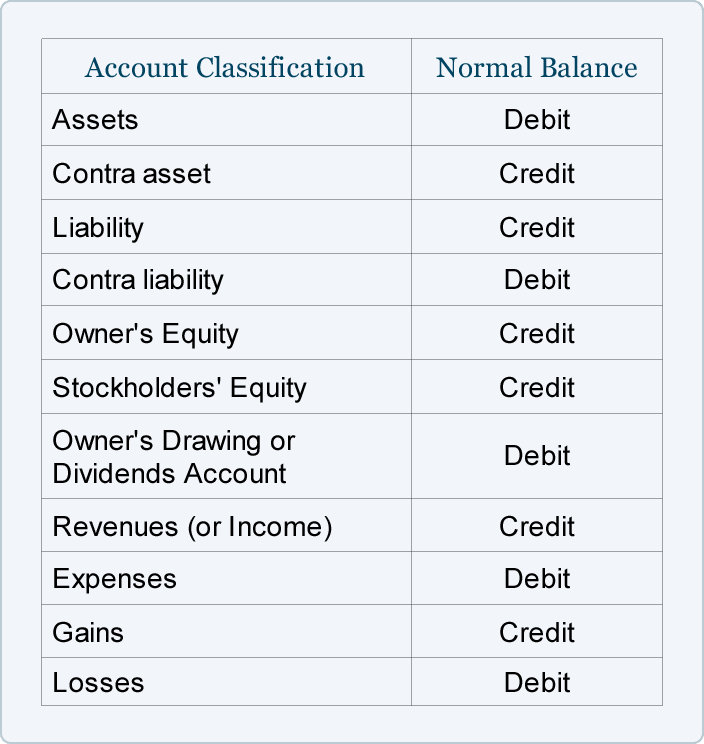

First, they debit accounts receivable and credit sales revenue for the same amount. In conclusion, accounts receivable is an asset account and not a revenue account. When accounts receivable are included on the income statement, they increase revenue and net income figures without any actual cash being received yet.

In fact, if some customers don't pay their bills, the. An income statement is another name for a profit and loss statement (p&l). On the balance sheet, it is represented as a current asset.

Revenue is the amount of money that a company actually receives during a specific period, including discounts and deductions for returned merchandise. An income statement represents revenues received, not money that hasn’t been paid yet. However, under accrual accounting, the amount is recorded as revenue at.

You wouldn't include accounts receivable on an income statement. Accounts payable (a/p) are invoices you owe to other companies. This means that accounts receivable increases.

Therefore, it becomes a part of the balance sheet and falls under assets. Types of revenue: It's considered revenue as soon as your business has delivered products or.

When a sale is made on credit, it is recorded as revenue on the income statement even though payment has not been received. The income statement is more reliable when you use the accrual method. Accounts receivable is the amount owed to a seller by a customer.

Revenue minus expenses equals profit or loss. To recognise an expense before cash is paid, businesses increase the accounts. We know that revenue is the top line due to its placement at the top of the income statement.

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/media/c50/c50cca1f-cfa5-4c81-a37f-2810754a3a83/phpTzrprB)