Supreme Info About Notes Receivable In Balance Sheet

![[Solved] classified balance sheet at December 31. (Amounts to be](https://www.smartkarma.com/assets/uploaded/2019/09/2019-08-28T0922220800-13.png)

Fv is the payment at the end of six months' time (future value) of $5,000.

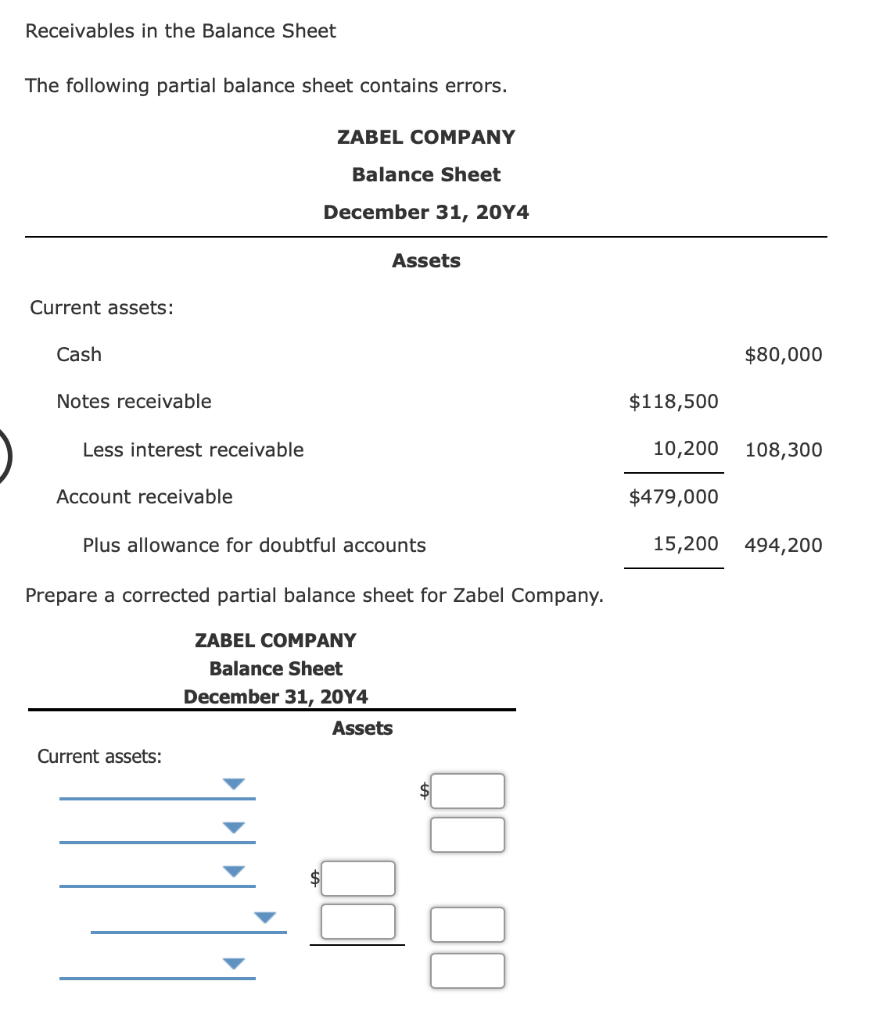

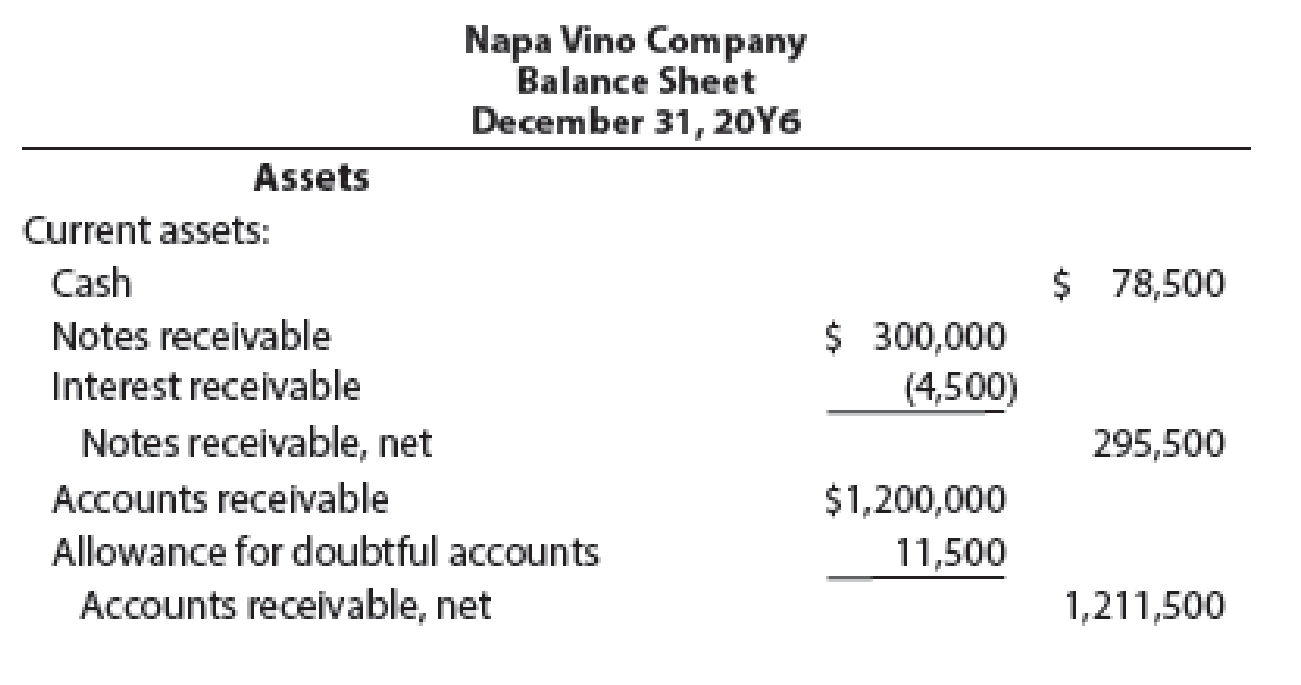

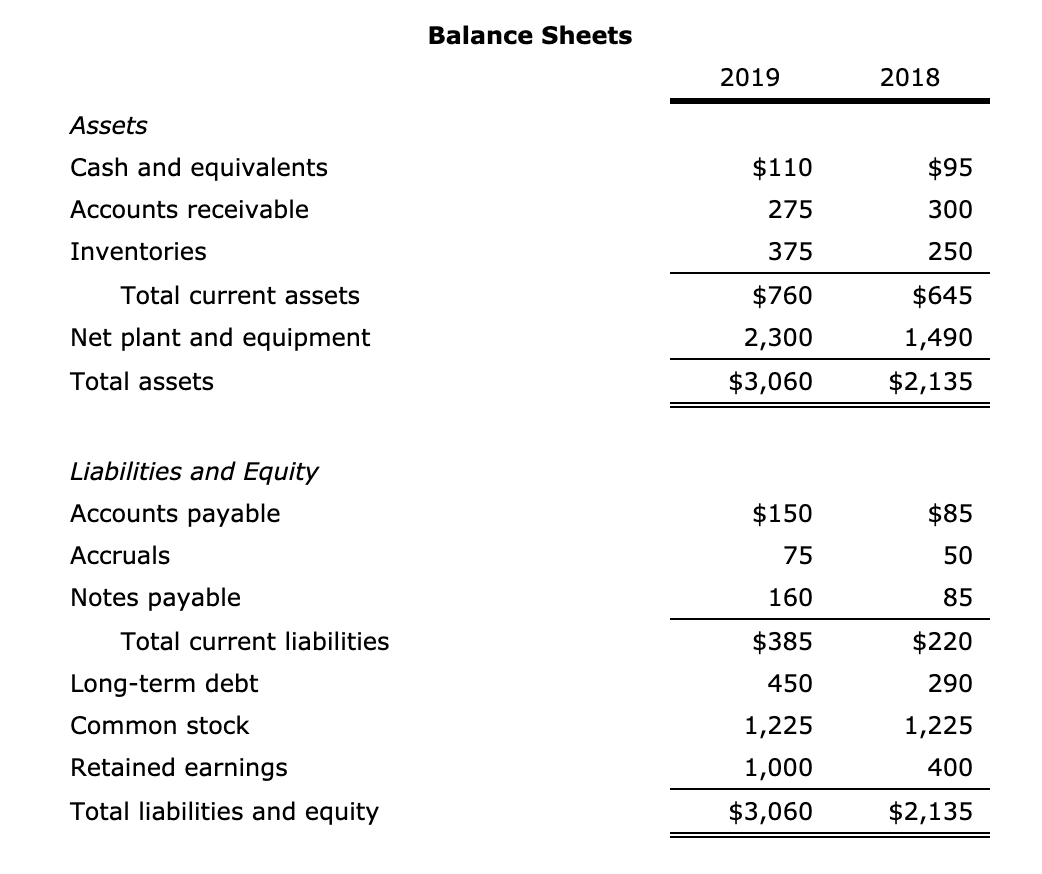

Notes receivable in balance sheet. N is for interest compounded each month for six months. Note receivable is a balance sheet item that records the value of promissory notes that a business is owed and should receive payment for. As discussed earlier, a note (also called a promissory note) is an unconditional written promise by a borrower to pay a definite sum of money to the lender (payee) on demand or on a specific date.

Notes and accounts receivable from officers, employees, or affiliated companies are required to be disclosed separately on the balance sheet. However, the document as such is a current asset if the principal is due to be received within one year of issuing the document. A customer may give a note to a business for an amount due on an account receivable or for the sale of a large item such as a refrigerator.

Comparing several years of a company’s balance sheet may highlight trends, for better or worse. Notes receivable is an asset account so it has a normal debit balance. Using an equation, the note can be expressed as:

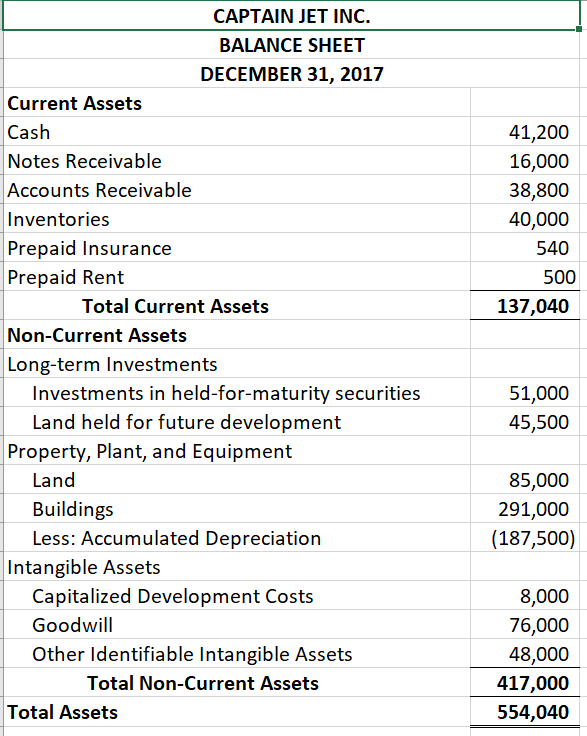

Applicable to both ifrs and aspe determine the present value (pv) of future cash flows, to record the note receivable at its fair value. A written promissory note gives the holder, or bearer, the right to receive the amount outlined in the legal agreement. It is an accounting entry that reflects a loan, debt or other amount of money due and payable to the business.

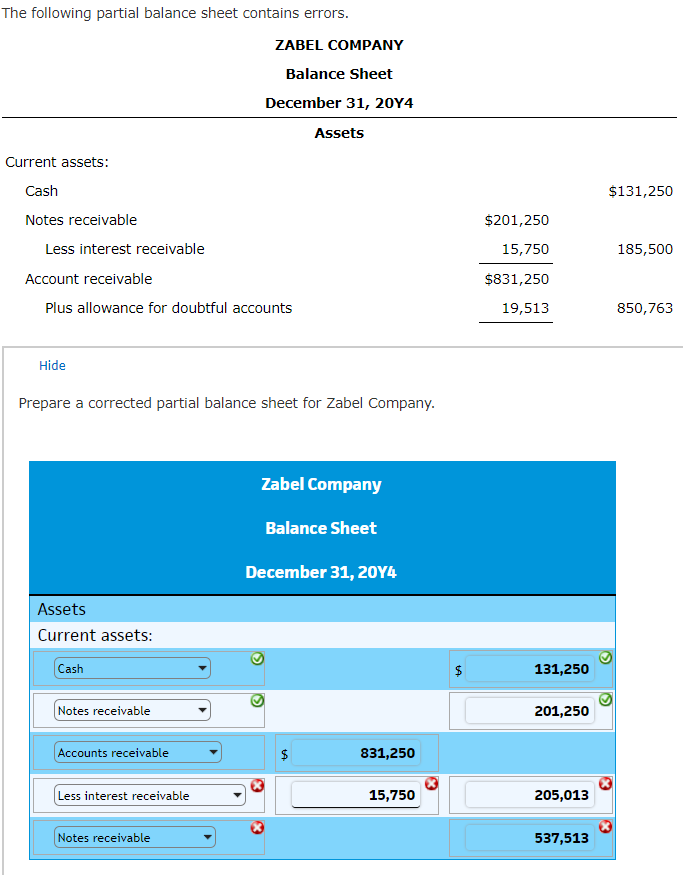

Table of contents what is notes receivable? An example of different accounts on a balance sheet: They are usually contracts specifying money owed to the company by its debtors.

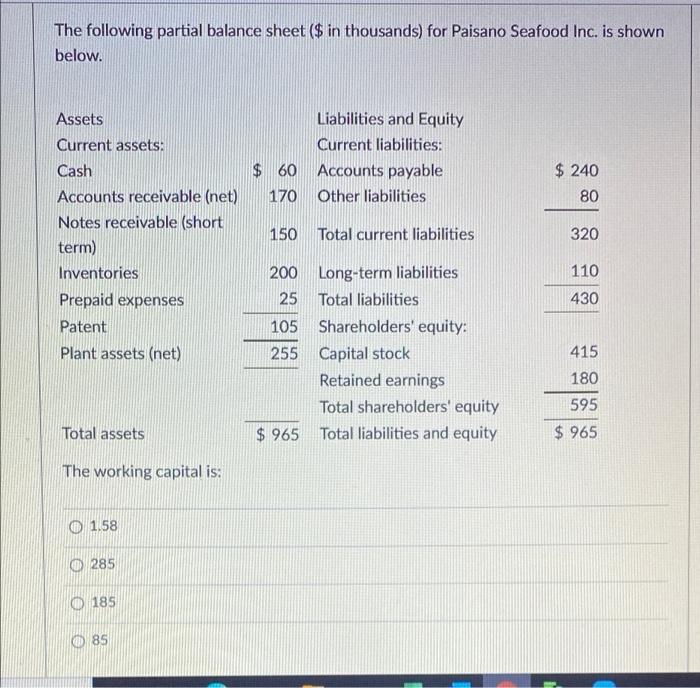

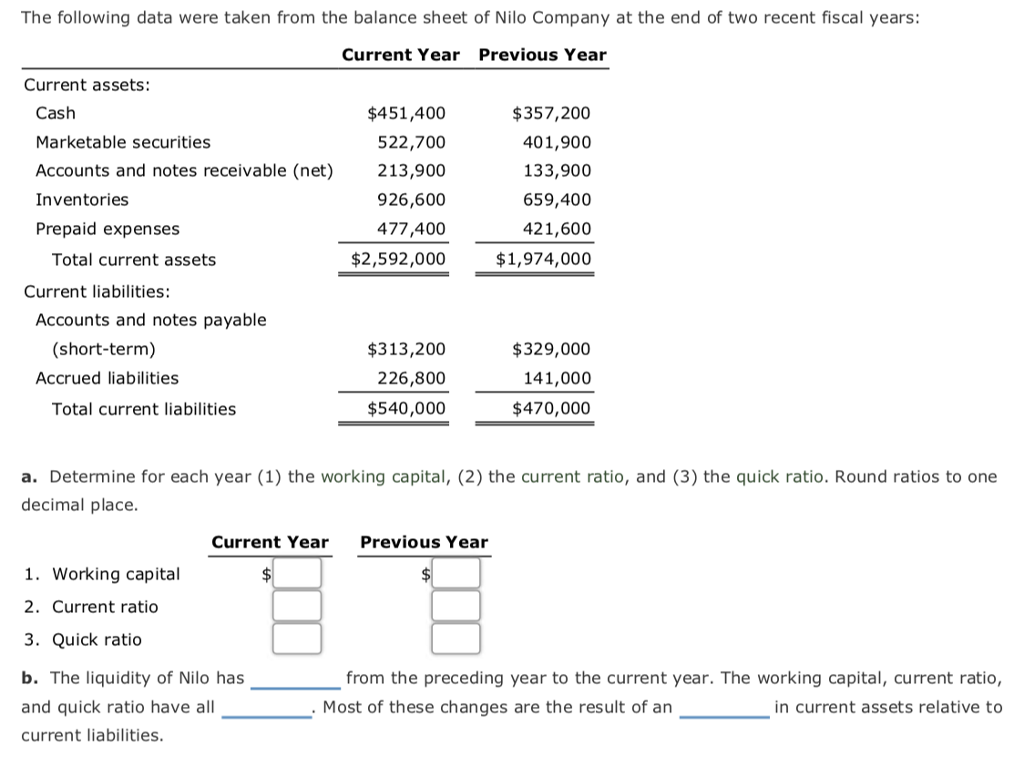

The principal part of a note receivable that is expected to be collected within one year of the balance sheet date is reported in the current asset section of the lender's balance sheet. Additionally, they are classified as current liabilities when the amounts are due within a year. Notes receivable can convert to accounts receivable, as illustrated, but accounts receivable can also convert to notes receivable.

Notes receivable are a balance sheet item that records the value of promissory notes that a business is owed and should receive payment for. They give the holder or bearer the right to receive the funds specified in the legal agreement. Doubtful notes and accounts receivable 24,700 166,460 interest receivable 2,700 claim for income tax refund 4,000 inventory 201,500 prepaid.

Discover how calculating interest, accounting, and honoring vs dishonoring a note are determined when. If a note has a duration of longer than one year, and the maker does not pay interest on the note during the first year, it is customary to add the unpaid interest. The interest earned on it shows up on the income statement.

A company’s balance sheet is a snapshot in time. A note receivable is a written promise to pay a specified amount that is recorded. You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios.

Therefore, it is recorded on the balance sheet. The notes receivable is an account on the balance sheet usually under the current assets section if its life is less than a year. Unlike accounts receivable, notes receivable involve a formal written agreement or promissory note.