Supreme Info About Pro Forma Definition Accounting

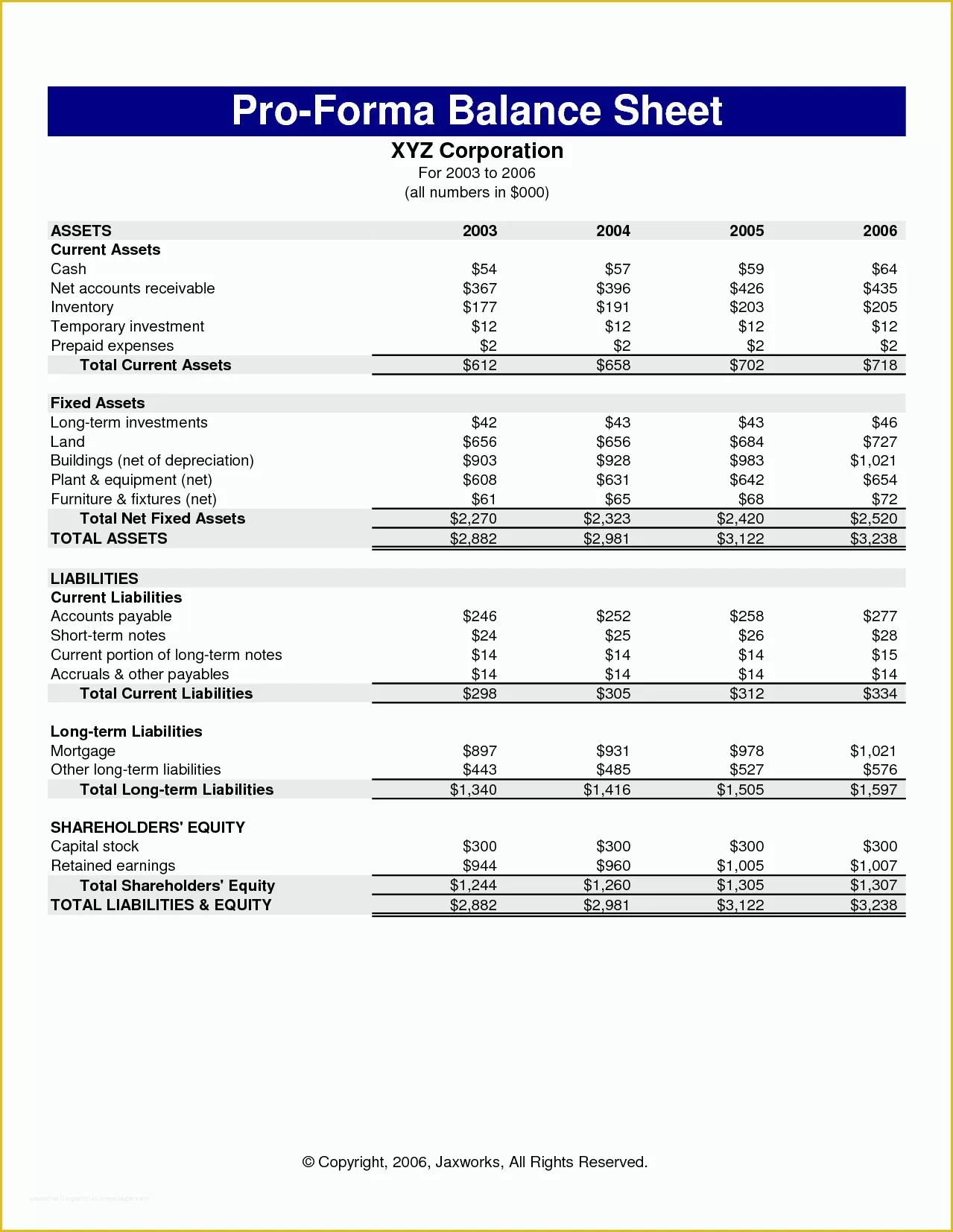

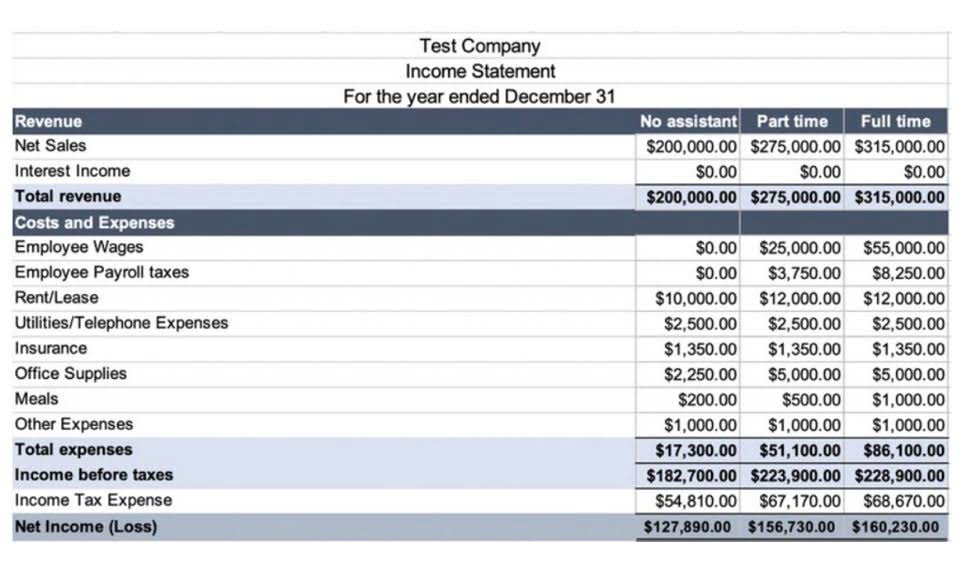

The term pro forma in financial statements refers to the act of calculating future financial results based on projections and assumptions.

Pro forma definition accounting. Define pro forma in the context of a financial forecast. In business and investing, it refers to the manner in which a firm calculates and presents its. 4.2 economic basis for accrual accounting;

Pro forma financials are not computed using generally accepted accounting principles (gaap). Financial statements based upon various assumptions. The word pro forma means “for the sake of form”.

Pro forma refers to a set of financial statements that incorporate assumptions or hypothetical conditions regarding past or future events. Pro forma financial statement definition. It means preparing something with projections or assumptions.

Pro forma financial statements are preliminary financials that show the effects of proposed transactions as if they actually occurred. What is pro forma? They’re a way for you to test out situations.

What are pro forma financial statements? We are pleased to present this publication, pro forma financial information: Pro forma is a latin term that roughly translates to “as a matter of form,” and is most often used to describe a document that is based on financial assumptions or.

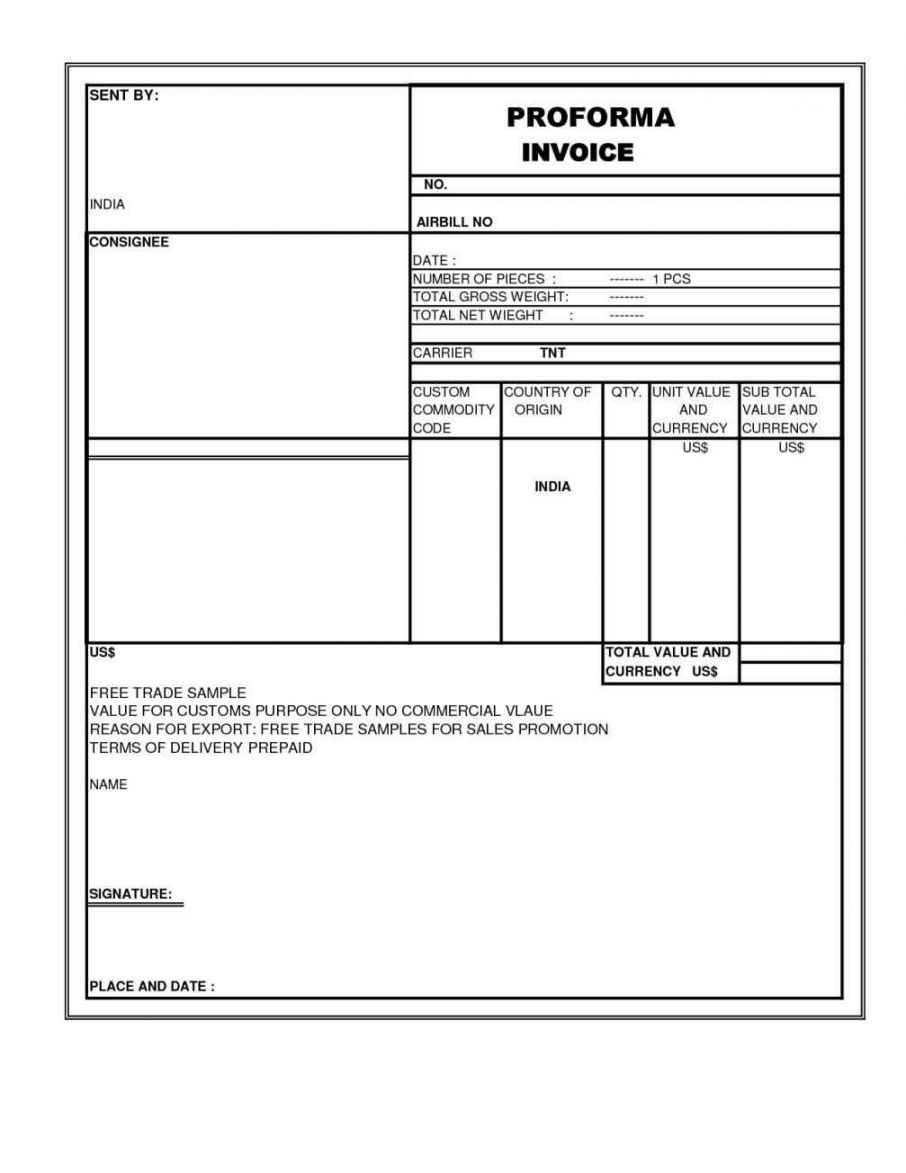

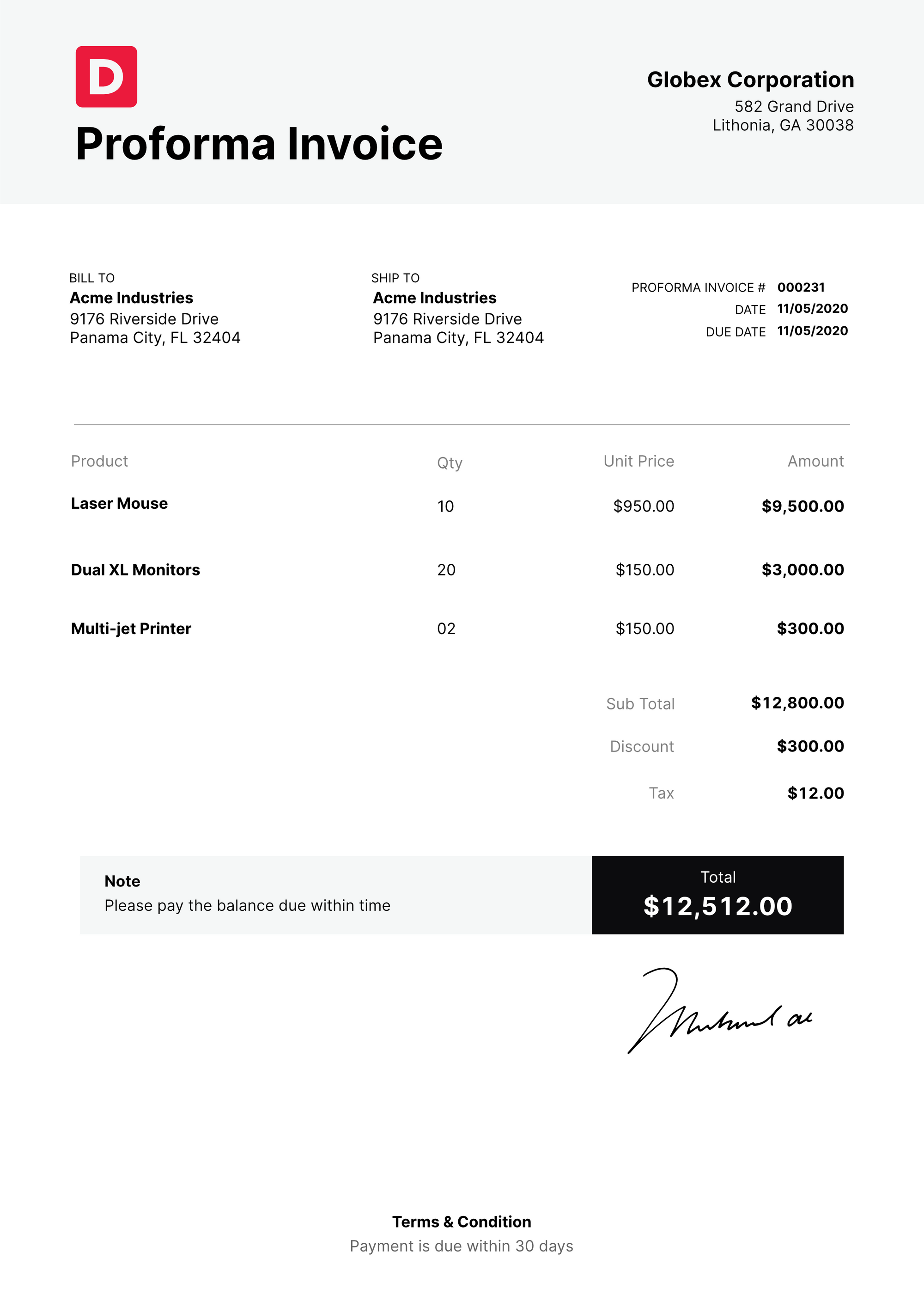

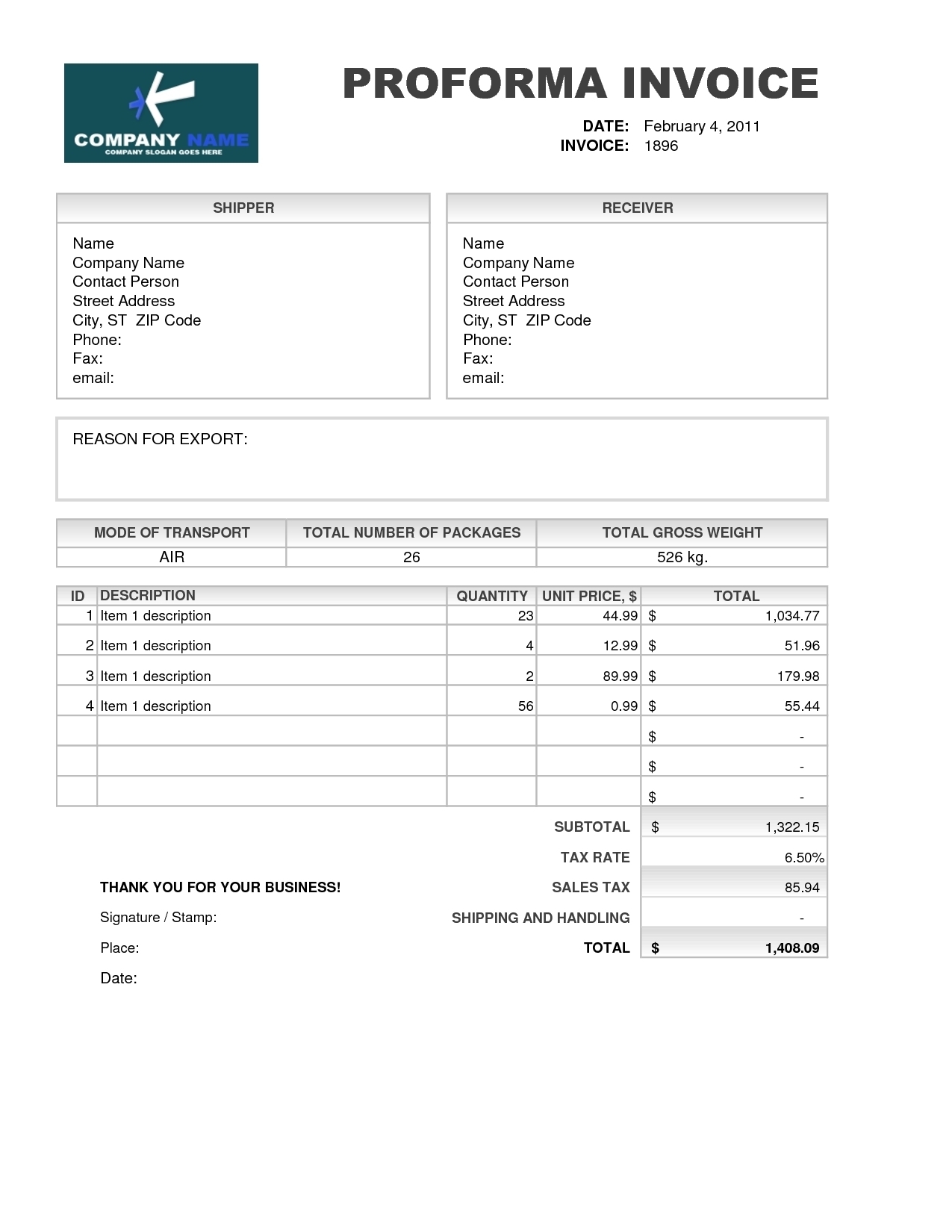

This information may be developed as part of the. Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions. In financial accounting, pro forma is used for invoices,.

When it comes to accounting, pro forma statements are financial reports for your business based on hypothetical scenarios. Our focus here, however, is. Pro forma financial statements are defined as those that do not follow generally accepted accounting principles—and that's the point of them:

A pro forma financial statement is a projection showing numbers that do not reflect the actual results from a company’s history. Pro forma is a latin phrase that means as a matter of form. Pro forma documents, in any form, are essentially like letters of intent, expressing what an invoice or transaction is anticipated to look like after completion.

4.1 cash versus accrual accounting; Pro forma cash flow is the estimated amount of cash inflows and outflows expected in one or more future periods. The pro forma accounting is a statement of the company's financial activities while excluding unusual and nonrecurring transactions when stating how much money the.

Key takeaways pro forma financial.

:max_bytes(150000):strip_icc()/Pro-Forma-V2-c9d1a7bd7843405e8de36c734e910f44.jpg)

:max_bytes(150000):strip_icc()/GettyImages-129284594-ece1aa7f51924c87865ee2ef6ec33fde.jpg)

/pro-forma-invoice--1053078376-3fb3269f97f84b93832c203f105ac972.jpg)