Real Tips About Cash Flow Statement Exemption Under Frs 102

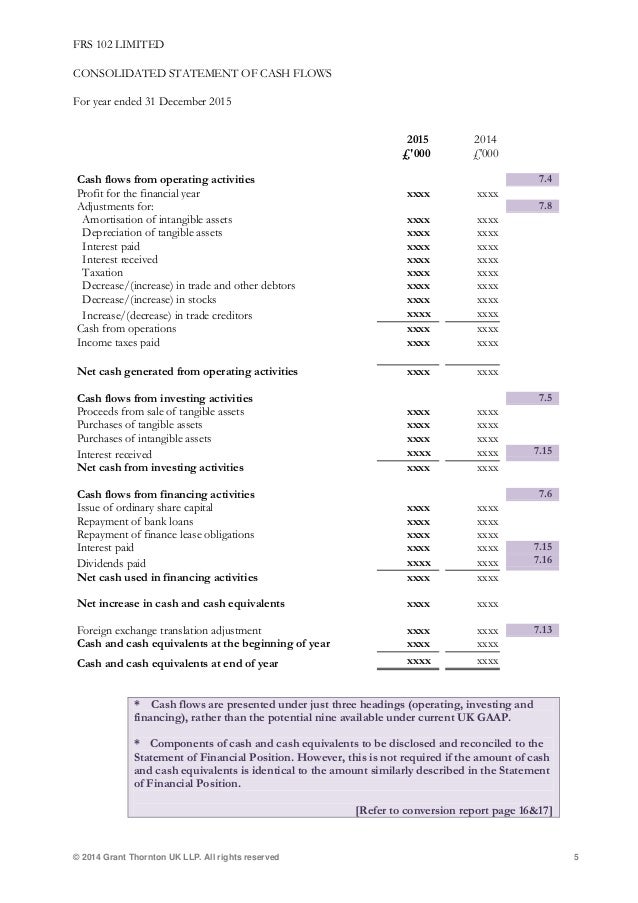

Consolidated statement of cash flows 29 notes to the consolidated financial statements 31.

Cash flow statement exemption under frs 102. Exemptions from frs 102 paragraphs for small entities (102:1a.7 and 102:1a.17) paragraph. Compared to current uk gaap (frs 1), frs 102 extends the scope of the statement of cash flows by requiring the inclusion not only of inflows and outflows of cash, defined as cash in hand and demand deposits, and of bank overdrafts repayable on demand, but also of cash equivalents. The above sections act as building blocks where the consolidated financial statements are concerned.

It looks at exemptions from presenting a cash flow statement, reporting cash flows from. They are supported by other sections of frs 102 that are relevant to the consolidated financial statements, including: If the subsidiary (or ultimate parent) meets the definition of a qualifying entity, it can claim the exemption from preparing a cashflow statement in frs 102, para 1.12(b) and para 3.17(d).

If the subsidiary (or ultimate parent) meets the definition of a qualifying entity, it can claim the exemption from preparing a cash flow statement in frs 102, para 1.12 (b) and para 3.17 (d). Frs 102, the financial reporting standard applicable in the uk and republic of ireland, has been in issuance since march 2013 and applies mandatorily for companies not eligible to apply the small companies regime in the preparation of their financial statements for. On enactment of the european directive 2013/34 by ireland, it will be possible for small irish.

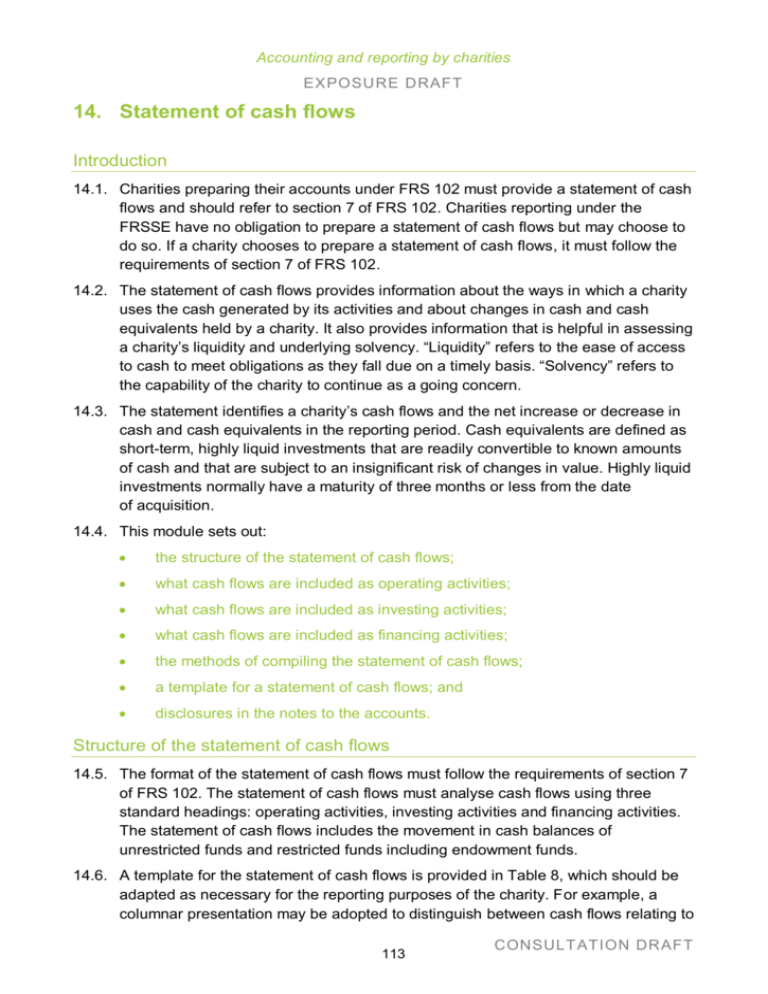

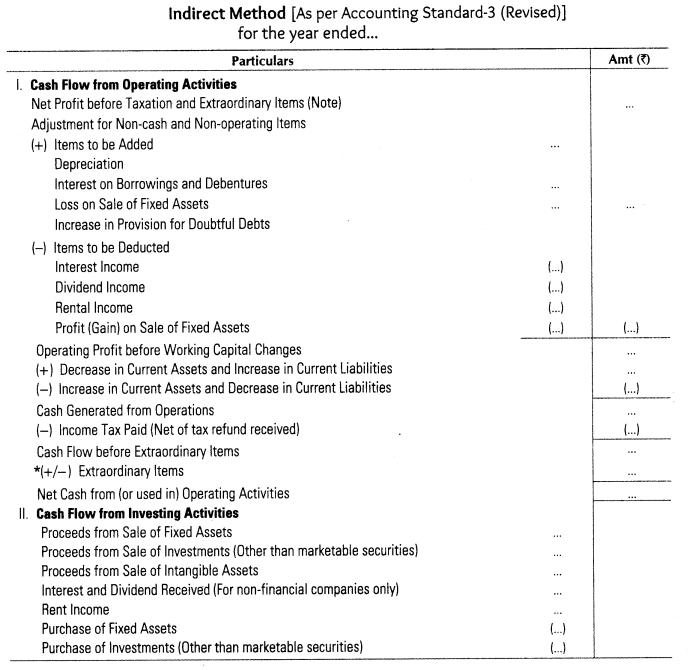

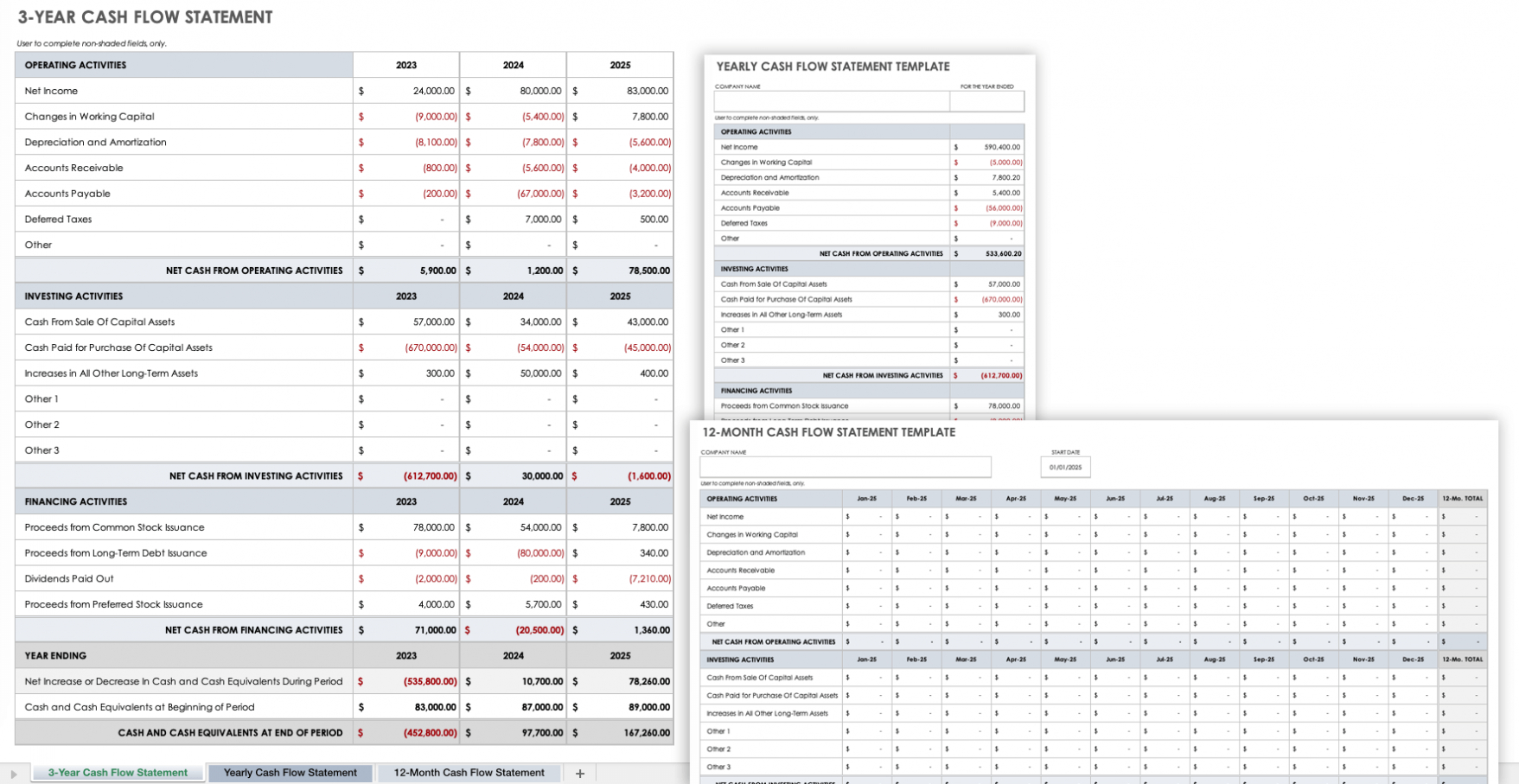

Structure of the cashflow statement. The cash flow statement is one of the primary financial statements under frs 102 that is going to need a lot of thought devoted to it in terms of classifications as cash flows as there are significantly less cash flow classifications under section 7 than. Under ‘old’ irish gaap many reporting entities were given exemption from preparing cash flow statements but under frs 102 a complete set of financial statements must now include a cash flow statement for accounting periods commencing on or after 1st.

The key exemptions are as follows: Under the small entity provisions within s1a of frs 102 small companies who are not subsidiaries can claim exemption from preparing a cash flow statement. Frs 102, section 7 presents the.

Therefore, unless the charity is able to and chooses to follow the frsse, it will have to prepare a cash flow statement. The financial conduct authority (fca) has issued a note regarding the use of the frs 102 cash flow exemption for investment funds that meet certain conditions when preparing audited financial information to include within a prospectus.

Specified disclosure exemptions can be applied, subject to. Frs 102, ‘the financial reporting standard applicable in the uk and republic of ireland’ is the new uk gaap standard, replacing existing uk standards and abstracts (‘old uk gaap’). Frs 102 allows certain disclosure exemptions to be applied in the individual accounts of the parent company and subsidiary companies where group accounts are prepared.

The purpose of this paper is to highlight the significant differences between international financial reporting standards as adopted by the european union (“ifrs”) and the recently developed frs 102 (the “new irish gaap”) as they apply to investment funds. Structure of the cash flow statement frs 102, section 7 presents the cash. Under the small entity provisions within s1a of frs 102 small companies who are not subsidiaries can claim exemption from preparing a cash flow statement.

Presentation for uk groups and uk companies reporting under frs 102 ‘the financial reporting standard, applicable in. The cash flow statement is one of the primary financial statements under frs 102 that is going to need a lot of thought devoted to it in terms of classifications as cash flows as there are significantly less cash flow classifications under section 7 than there are under. It follows the release in november 2012 of frs 100, ‘application of financial.

Explicit and unreserved statement that entity is a pbe if applying. Unlike current uk gaap, frs 102 does not contain an exemption for small entities from preparing a cash flow statement. Further details are given below: