Unbelievable Tips About Calculating Financial Ratios

Financial ratios are used in fundamental analysis to help value companies and estimate their share prices.

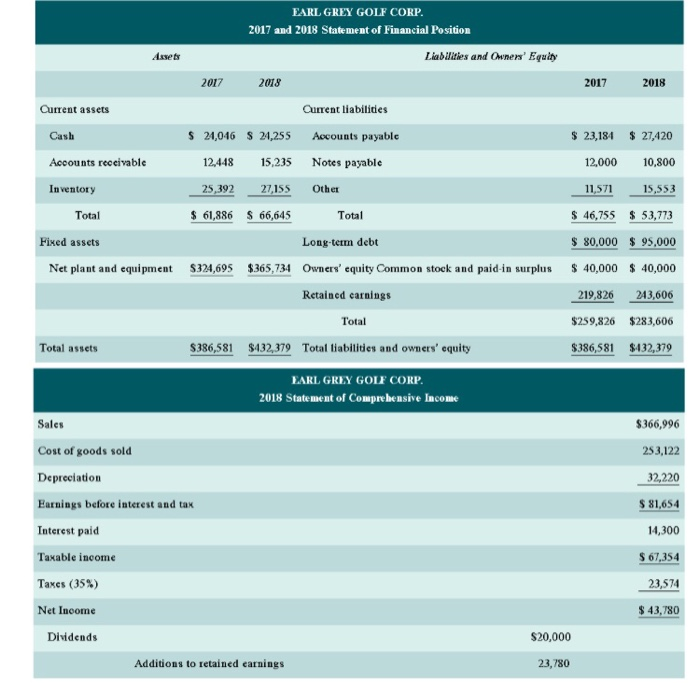

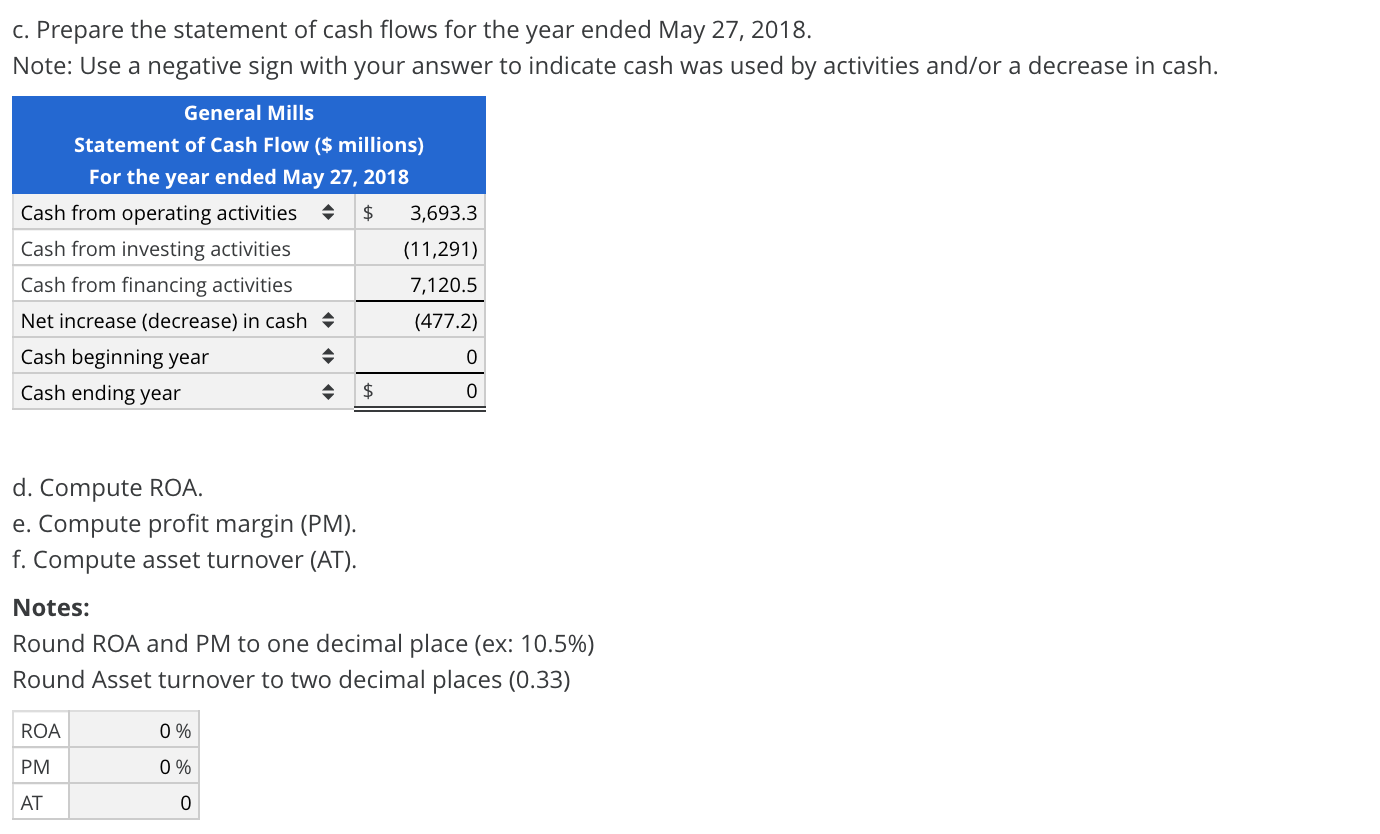

Calculating financial ratios. The bottom line. Ratios will sometimes use numbers from the same statement— the income statement, for.

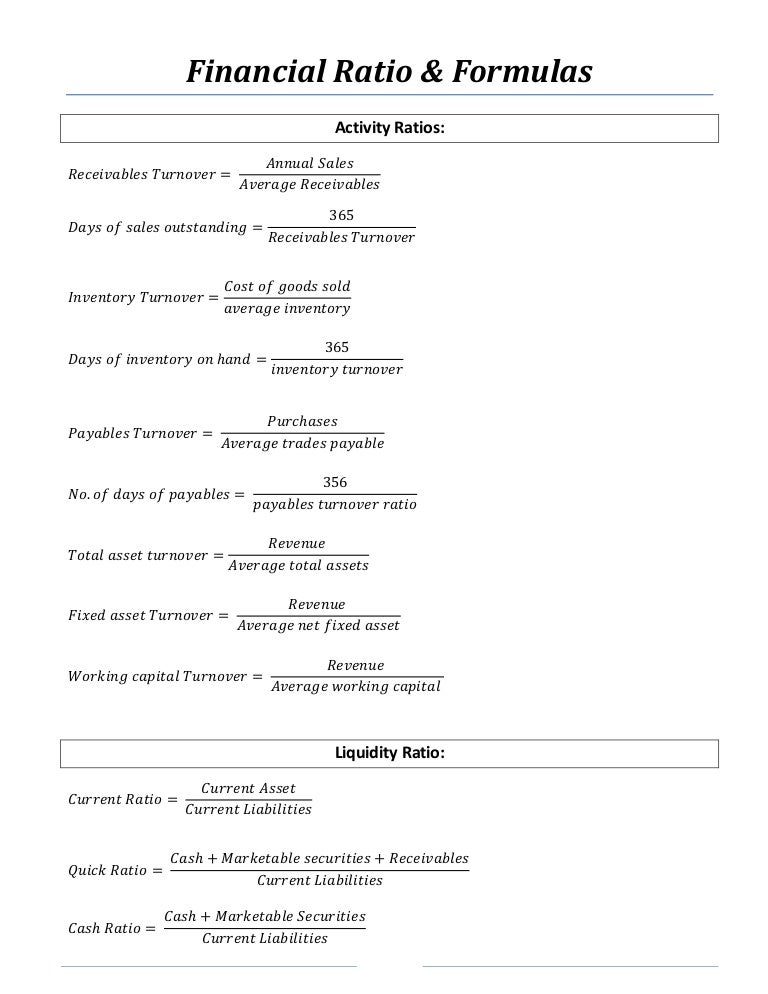

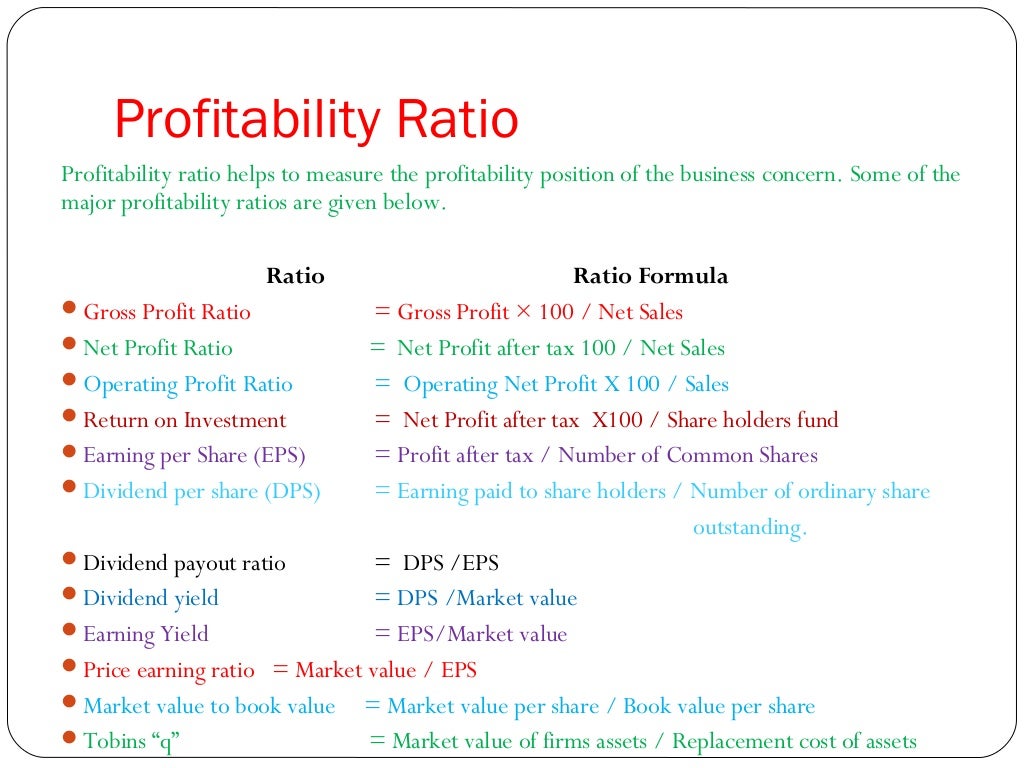

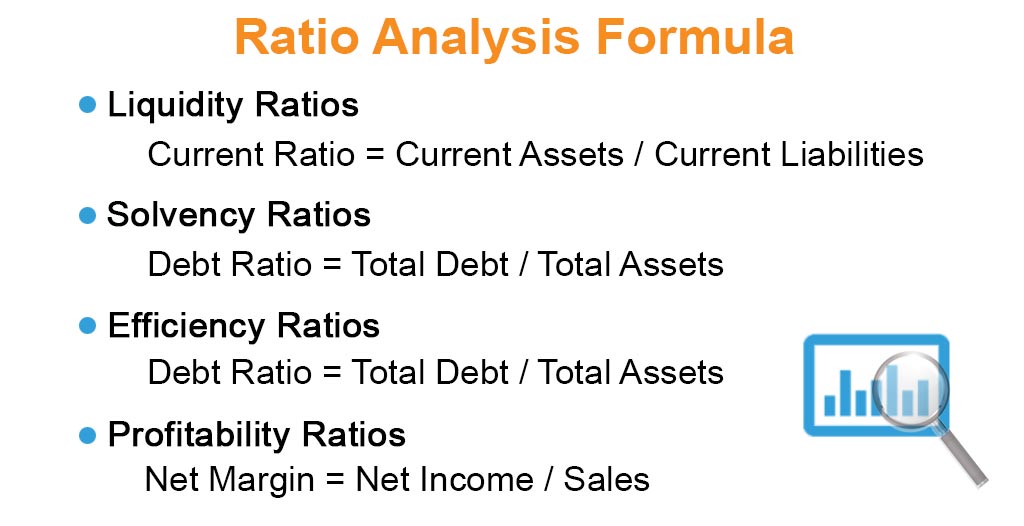

Profitability ratio, debt ratio, liquidity. The resulting ratio can be interpreted in a way that is more insightful than. These ratios are used by financial analysts, equity research analysts, investors, and.

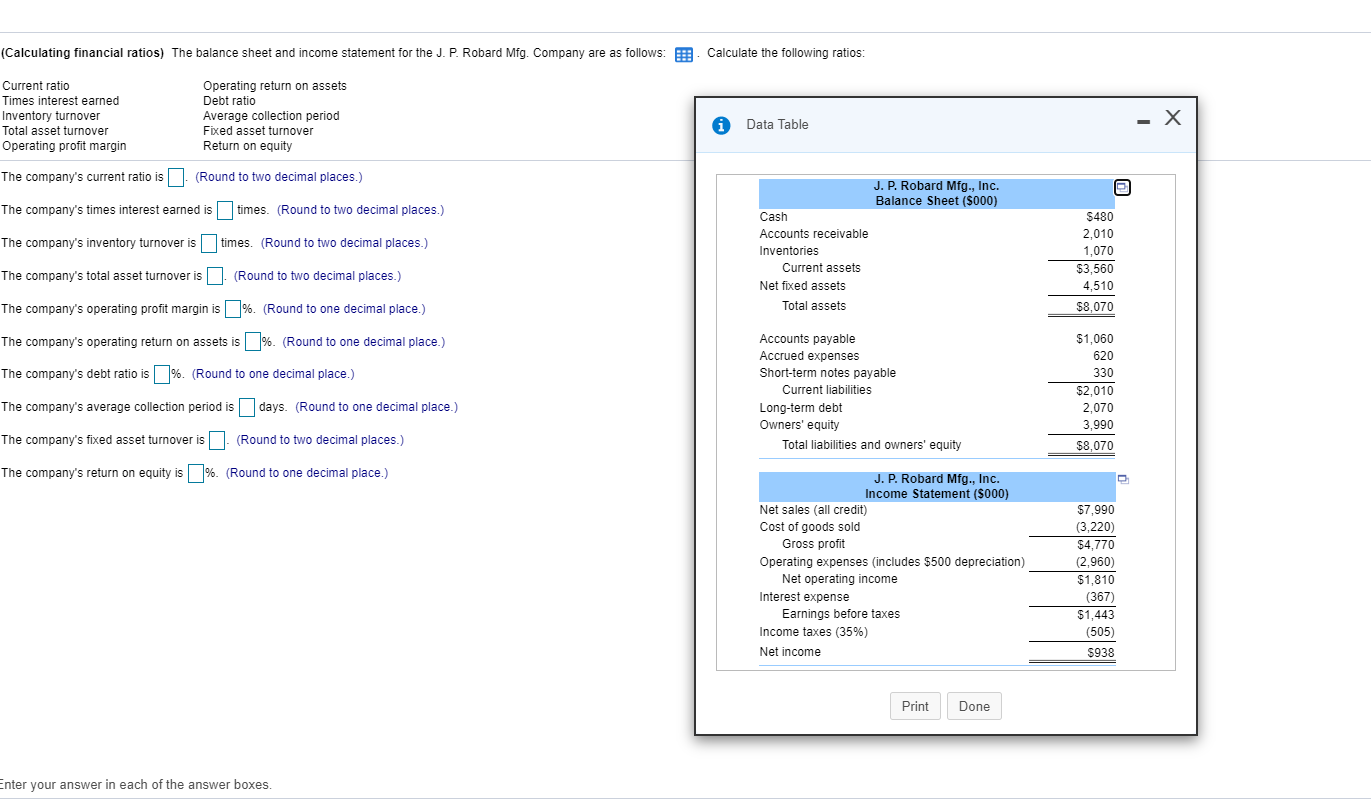

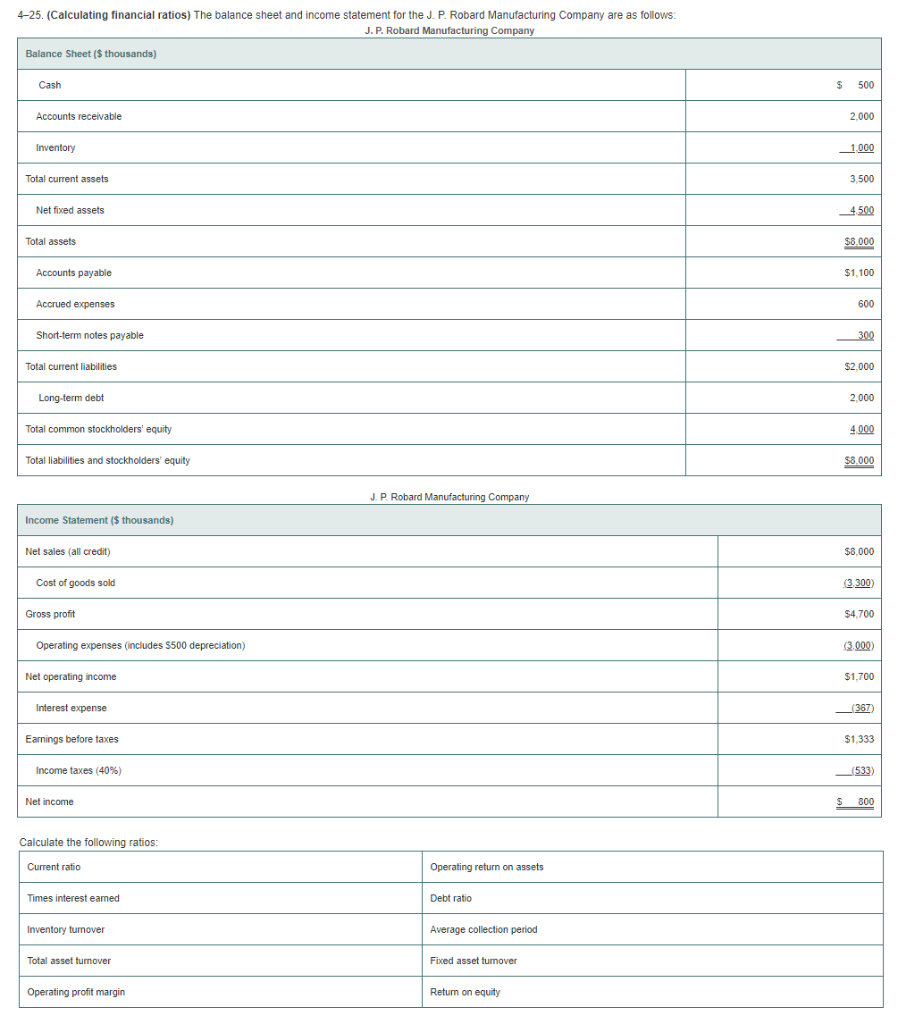

Financial ratios can be computed using data found in financial statements such as the balance sheet and income statement. Leverage ratiosmeasure the amount of capital that comes from debt. Our explanation will involve the following 15 common financial ratios:

Financial ratios for ratio analysis | examples | formulas financial ratio analysis home › finance › financial ratio analysis › financial ratio analysis financial ratios are. (investors might also refer to net. Talk to your accountant or financial adviser for advice on how to.

Eps = net profit / number of common shares to find net profit, you’d subtract total expenses from total revenue. In other words, leverage financial ratios are used to evaluate a company’s debt levels. Common leverage ratios include the following:

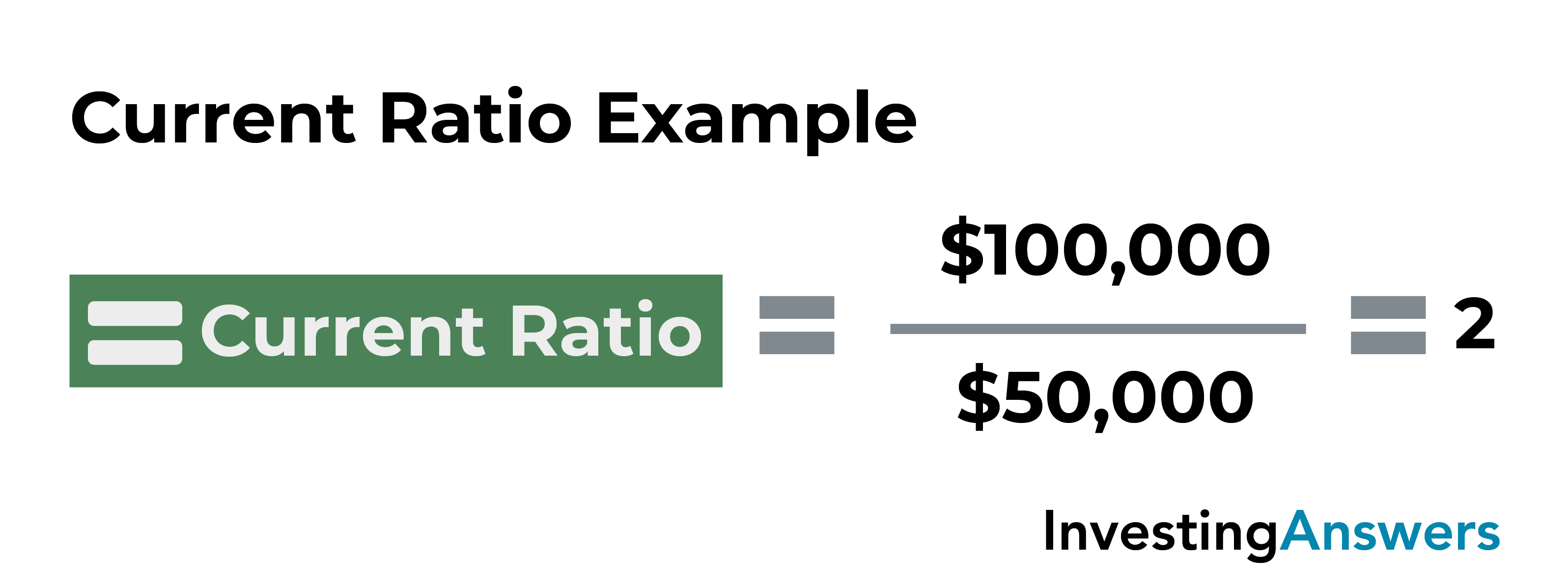

You generate a ratio by dividing one number by the other. Corporate finance ratios are quantitative measures that are used to assess businesses. Calculating and analyzing financial ratios not only helps you track how your company’s current performance compares to its performance in the past, but you can determine how.

A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements. Certain financial ratios can also be. A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans), or.

Define, calculate and explain the significance to a company's financial position and financial risk of its level of the following ratios: In general, there are four categories of. Learn how to calculate ratios using our calculators and read examples to help you apply them to your business.

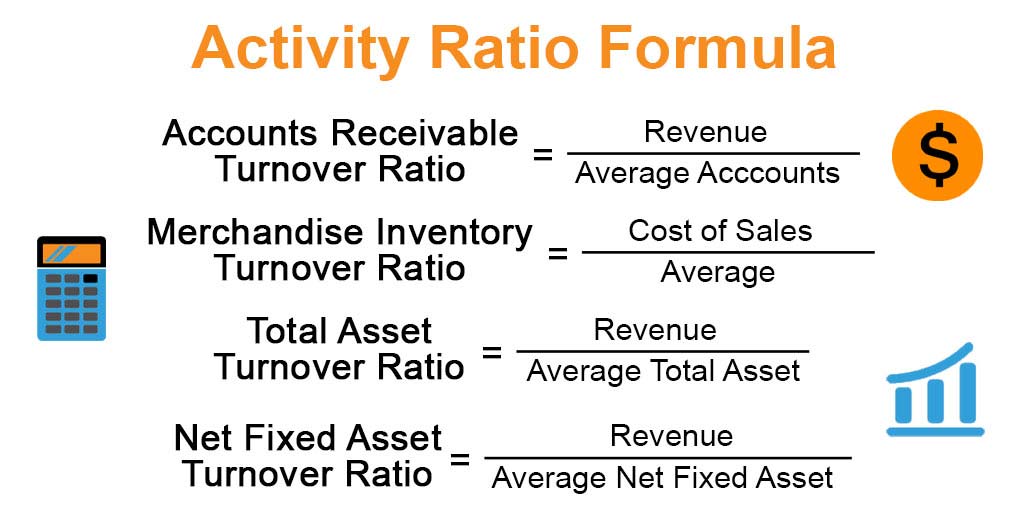

Financial ratios using balance sheet amounts. Financial ratios such as the turnover ratios and the return on ratios will need 1) an amount from the annual income statement, and 2) an average balance sheet amount. Often used in accounting , there.

Introduction financial ratio analysis is performed by comparing two items in the financial statements. The debt ratiomeasures the relative amount of a company’s assets that are provided from debt:

![Solved Problem 317 Calculating Financial Ratios (LO2] Just](https://media.cheggcdn.com/study/4ad/4adce91a-70cf-4f29-9762-d889a98fcefd/image.png)

![Solved 2. Calculating Financial Ratios [LO2] Find the](https://media.cheggcdn.com/media/a9d/a9dd033a-e898-4831-aaf7-ff8dedc1b11f/phpe11IV8.png)