Sensational Info About Bad Debt Profit And Loss

Accounting business essentials core financial accounting imagine you work at a company that provides credit to its customers.

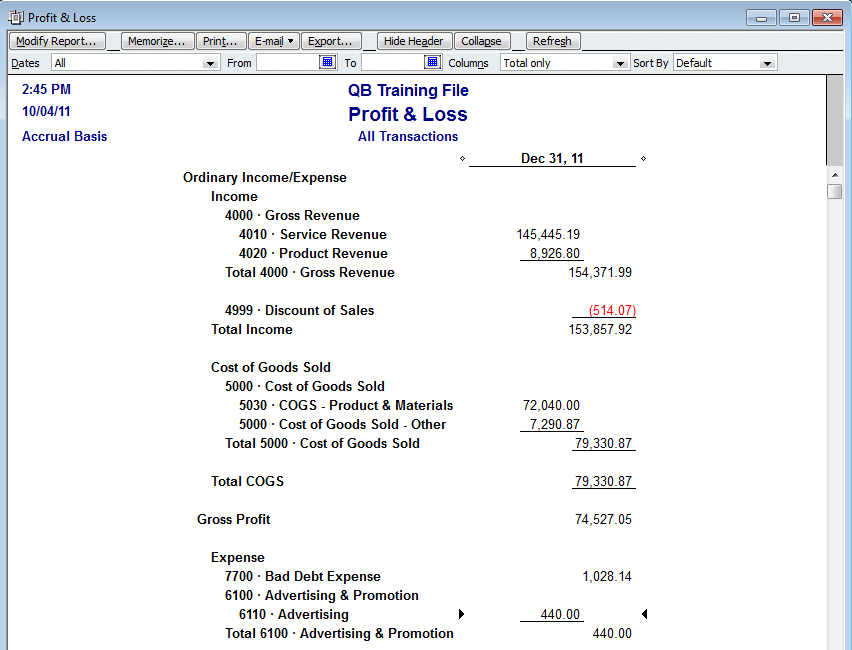

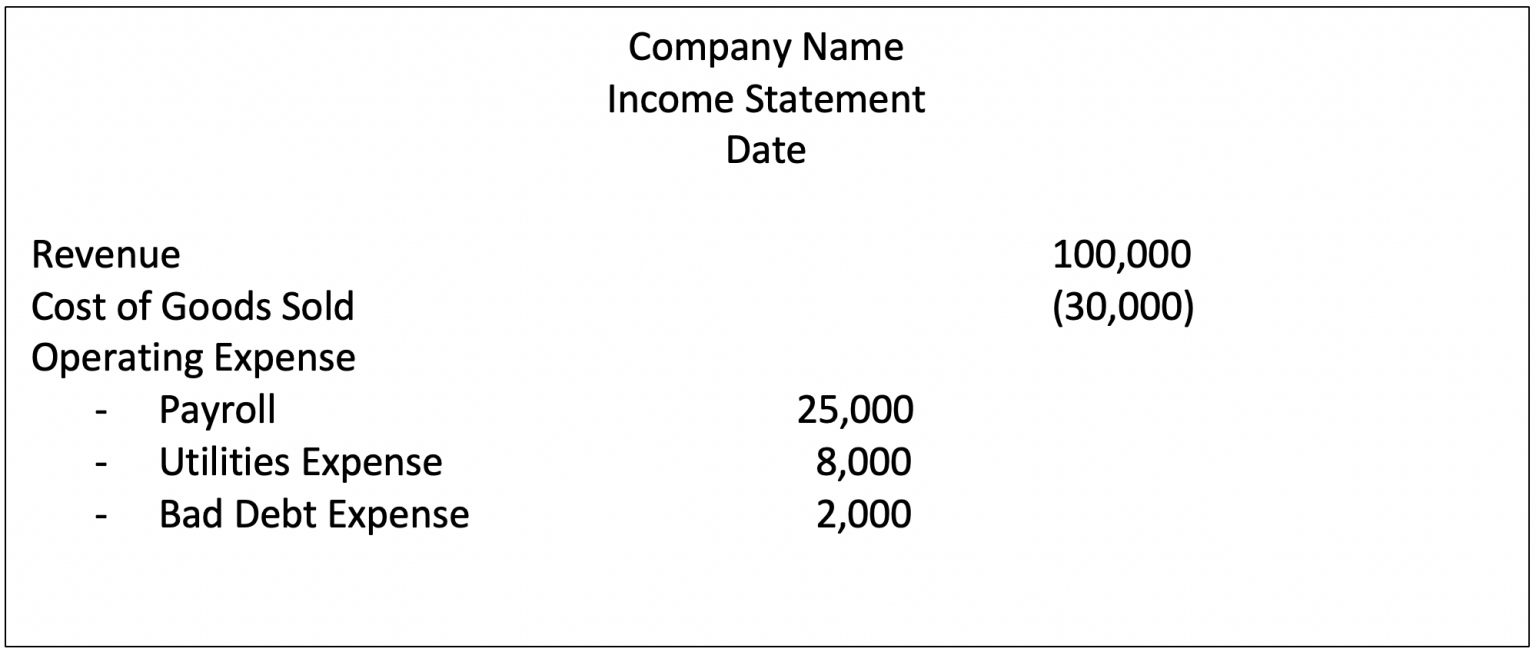

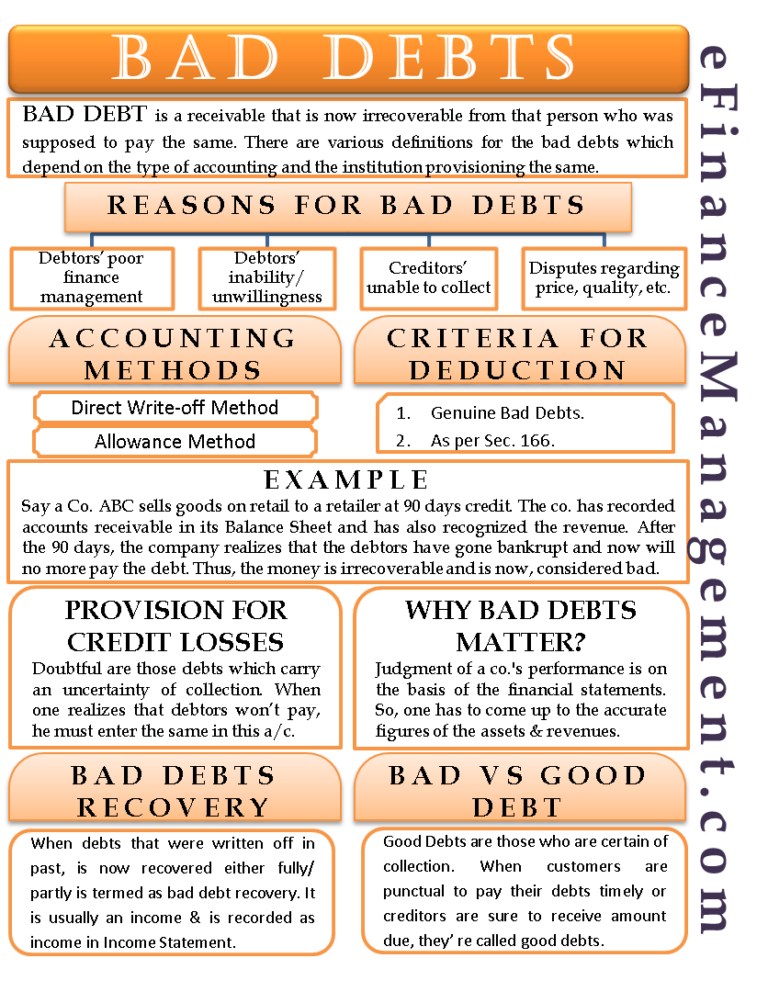

Bad debt profit and loss. The account is closed and the debt may be sold to a debt buyer or transferred to a. Bad debts are an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible and is thus. In case if bad debts are recovered, so it is again.

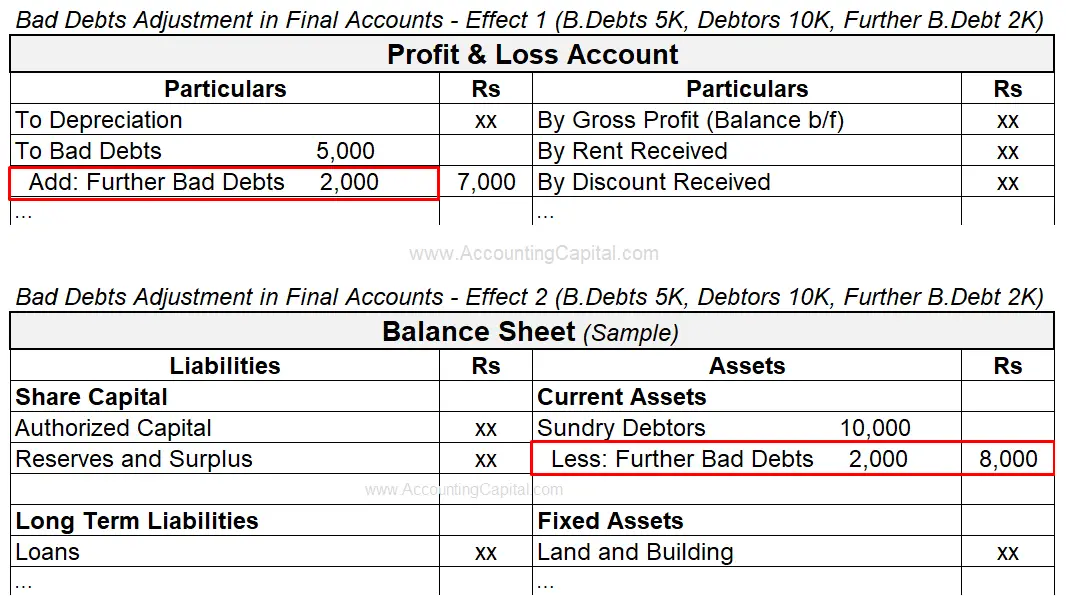

Now, if the amount of bad debt is received in any succeeding year,. Provision for doubtful debts is shown in the debit. Also called doubtful debts, bad debt expenses are.

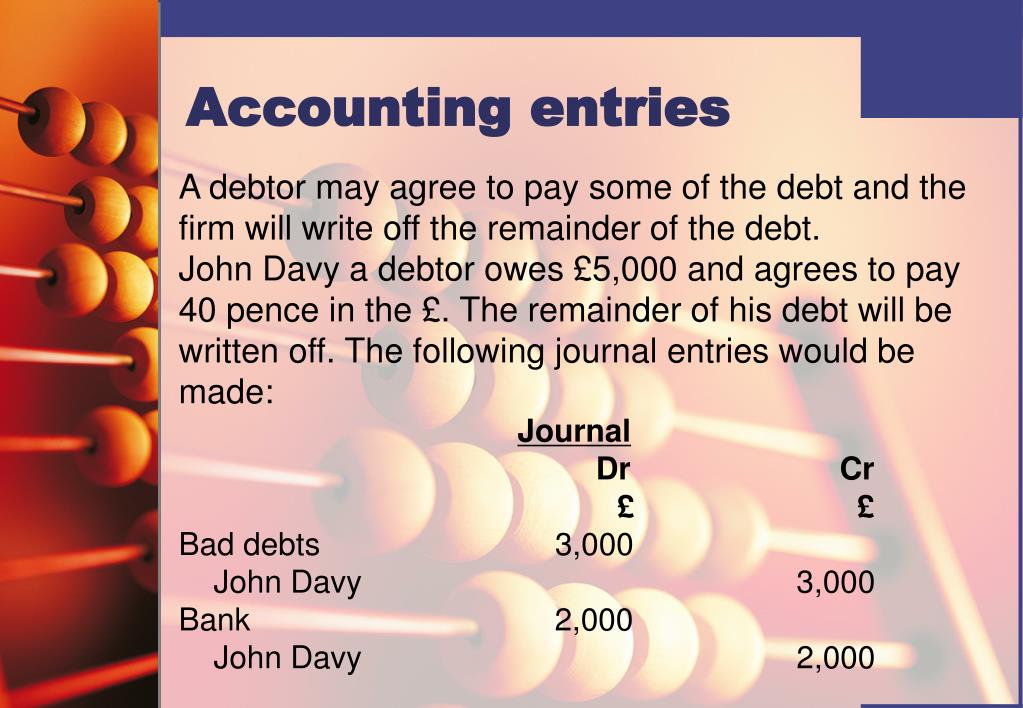

Now it is not credited to the party’s account but should be credited to bad debts recovered account. We know that bad debt is a loss and is adjusted with the current year’s profit & loss a/c. If you started with zero allowance for bad debt on the balance sheet and you recorded $500 of bad debt expense, the bad debt expense journal entry would.

Kumar was also declared insolvent last year. The following journal entry is made to record a reduction in provisions for bad or doubtful debts: The amount of bad debts is not debited to the profit and loss account since it was already debited in earlier years.

John, declared insolvent last year, has paid 9,000 this year with a cheque. When you loan money to. For example, in one accounting period, a company can experience large.

An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be uncollectible. 1.on creation of provision for doubtful debts for the first time; Provision for bad debts account;

When an account is charged off, the creditor writes it off as a financial loss. That the first provision for doubtful debt amount computed is assumed to be an operating expense hence charged. A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect.

Companies typically look at the past payment. Accounting sources advise that the full amount of a bad debt be written off to the profit and loss account or a provision for bad debts as soon as it is foreseen. And it will be shown on.

Profit and loss account cr. The average reserves at jpmorgan chase, bank of america, wells fargo, citigroup, goldman sachs and morgan stanley have fallen from $1.60 to 90 cents for. Provisions for bad debts account, with the amount of anticipated bad debts at the end of each subsequent financial year, the.

A bad debt reserve is the amount that companies set aside to cover uncollectible receivables, notes or loans.