Matchless Tips About Reconciliation Of Net Income To Cash Flow From Operations

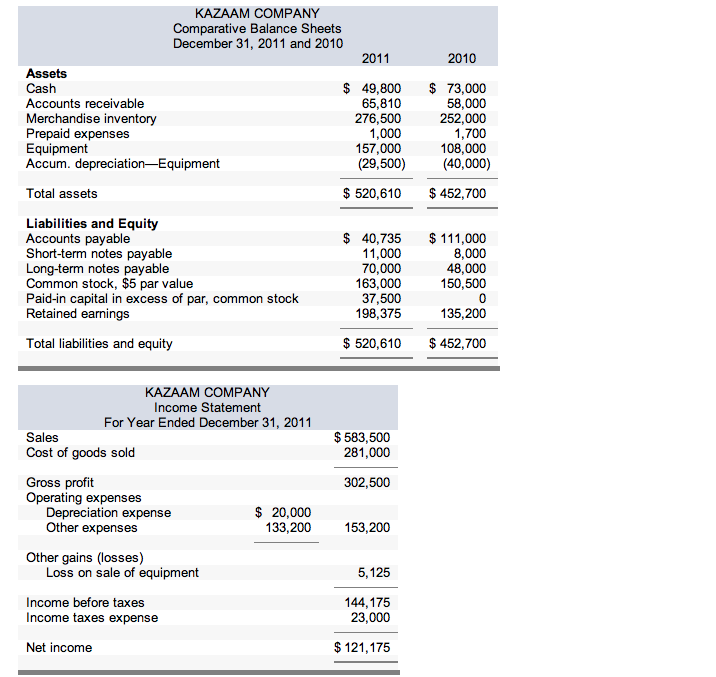

This paper demonstrates the use of the basic accounting equation to provide the logic behind the steps commonly described in current accounting textbooks to.

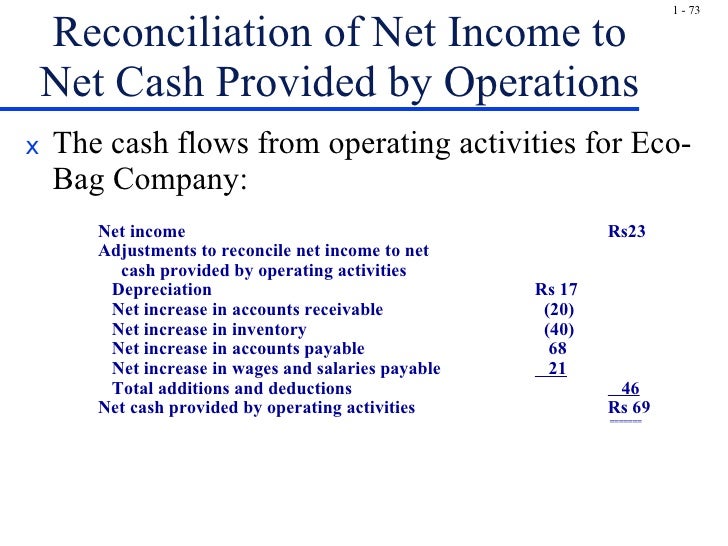

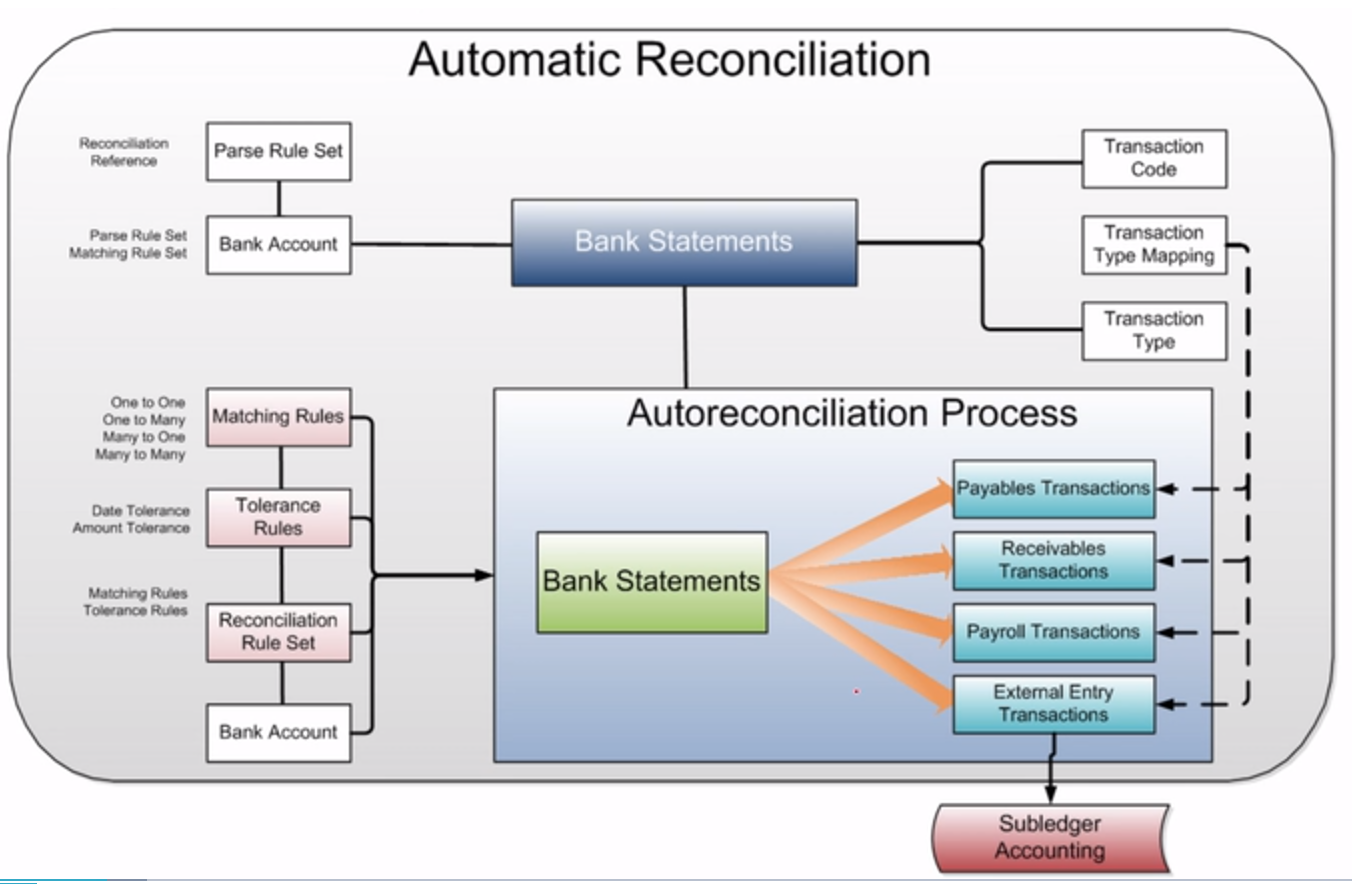

Reconciliation of net income to cash flow from operations. In reconciling net income to changes in net cash, several adjustments are needed to reflect items that are used in calculating net income but don't have an impact. Cash reconciliation is a fundamental accounting practice designed to ensure the amounts recorded from sales transactions accurately reflect the cash, checks, and. How do net income and operating cash flow differ?

The first section of the statement of cash flows reconciles net income to the cash flow from operations. For example, it is easy for students to understand cash. Murphy updated april 17, 2023 reviewed by michael j boyle fact checked by jared ecker net.

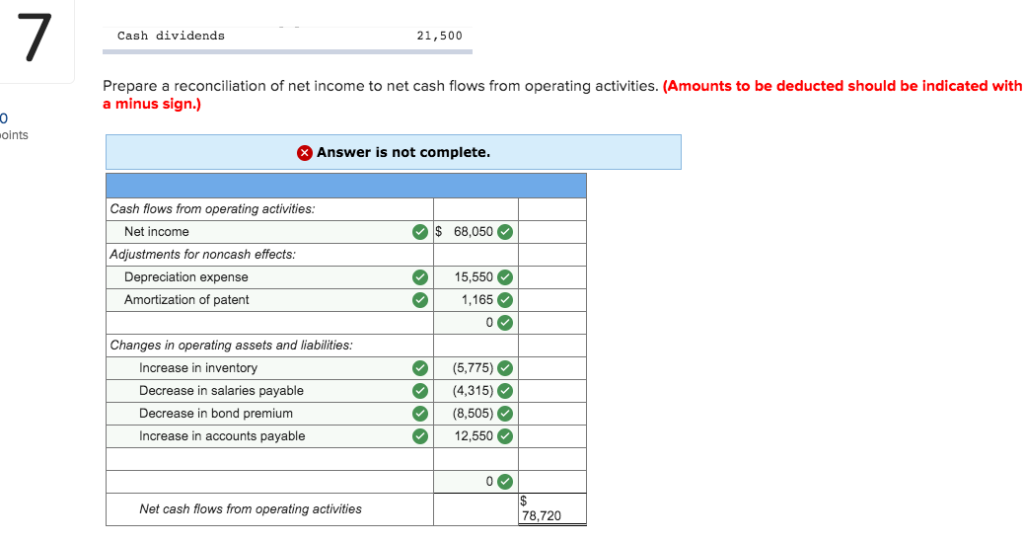

To reconcile net income to cash flow from operating activities, these noncash items must be added back, because no. In this article, i provide an analytical framework that can be used in explaining the reconciliation of net income to cash flow from operations from the first principles. Reconciling net income to cash flow from operating activities is a rather onerous task for many students.

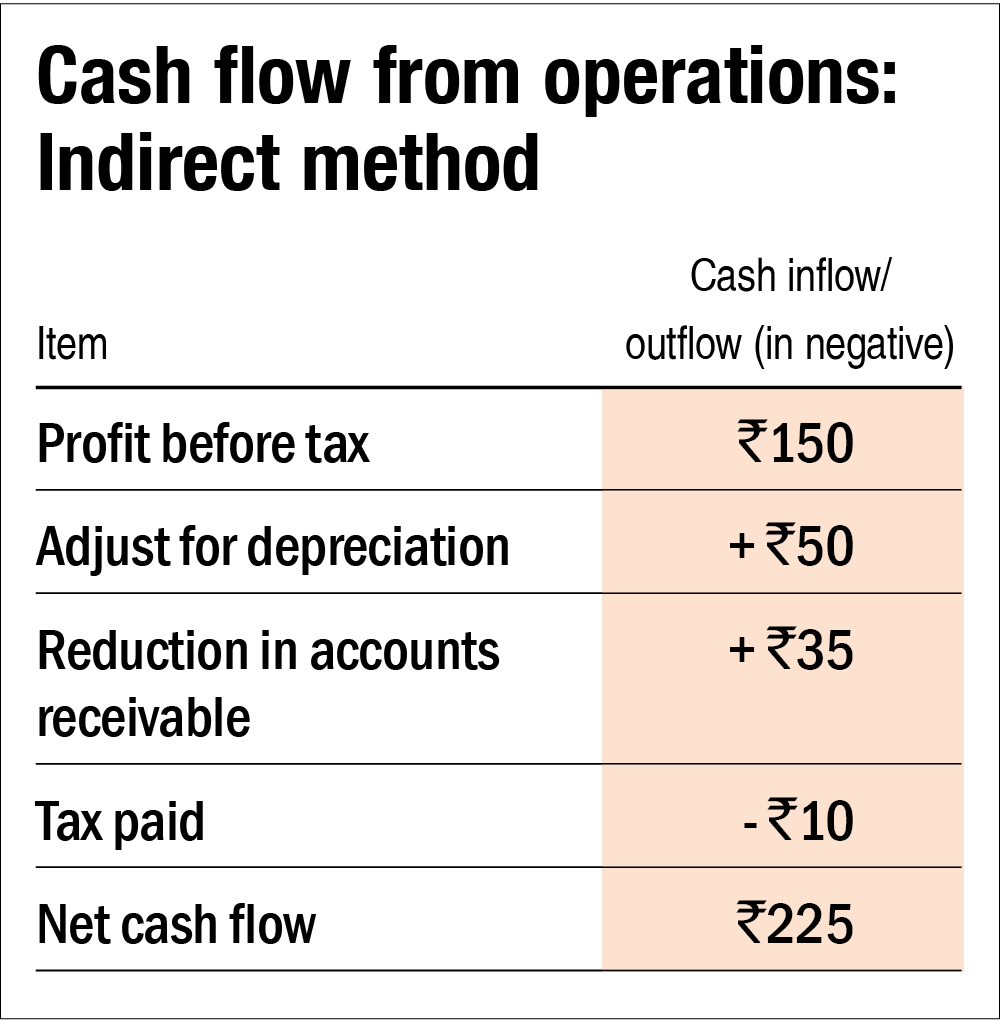

Net cash flow from operating activities is the net income of the company, adjusted to reflect the cash impact of operating activities. Reconciliation of net income to cash flow from operations: The formula for each company will be a little different, but the basic structure always consists of the three same elements:

Net income includes deductions for noncash expenses. And adjusted ebitda(1) was $480.9mm and adjusted free cash. Marathon oil corporation (nyse:

To illustrate how operating cash flows (prepared on the cash basis of accounting) relate to net income (prepared on the accrual method of accounting), as discussed in asc 230. Cash flow from operations of $1.00 billion* and strong free cash flow. The company recorded an annual net income of $48.4 billion and net cash flows from operating activities of $63.6 billion.

Net cash provided by operating activities was $543.3mm and net income was $301.6mm in 4q23; Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing. This subtotal is the difference between the cash generated.

Positive net cash flow generally. The reconciliation process requires two types of adjustments to the operating income: A reader recently wrote inside application if mortal could explain reconciliation betw net generated both cash flow from operations.

Net cash provided by operating activities was $823 million and free cash flow, defined as net cash flows from operating activities less capital expenditures, was.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)