Neat Info About Comparative Balance Sheet Percentage Formula

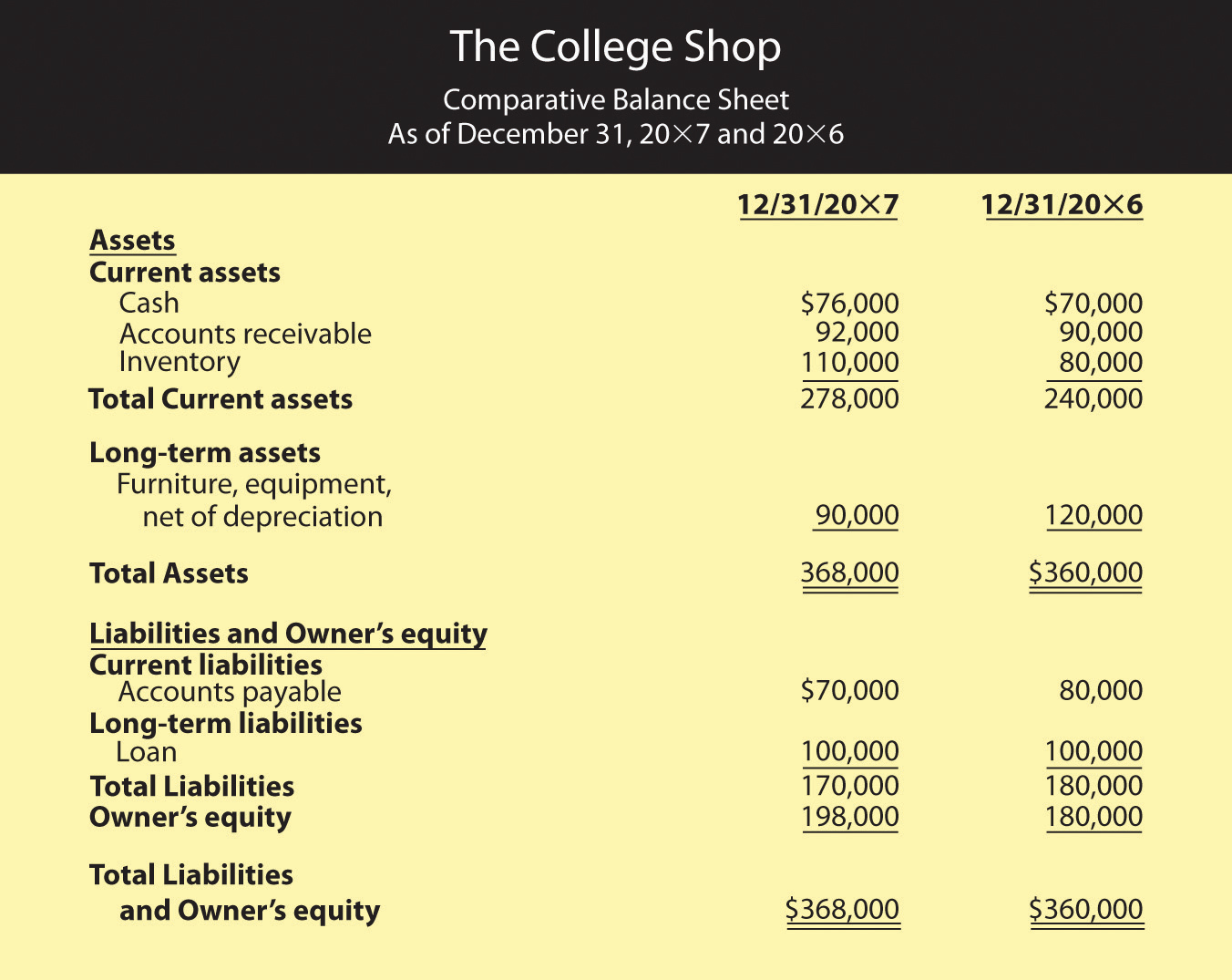

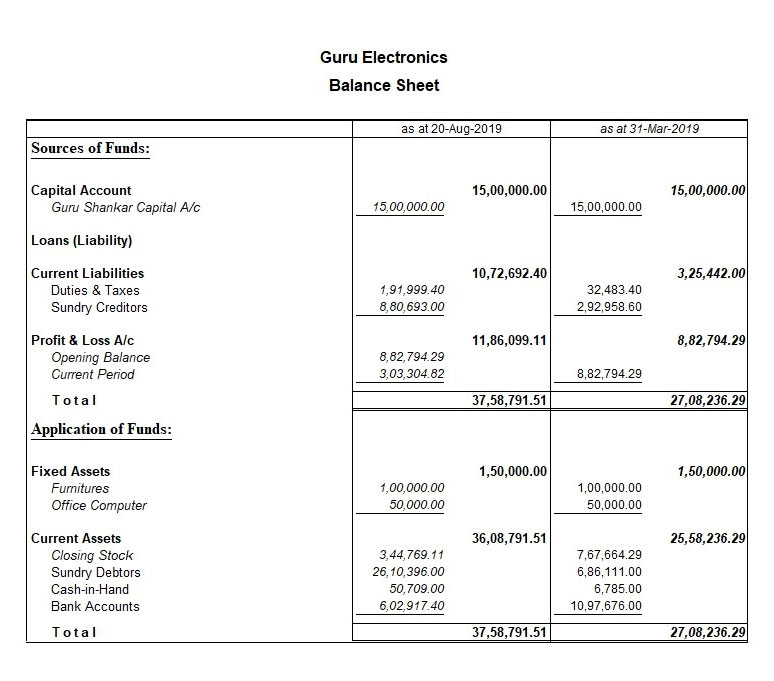

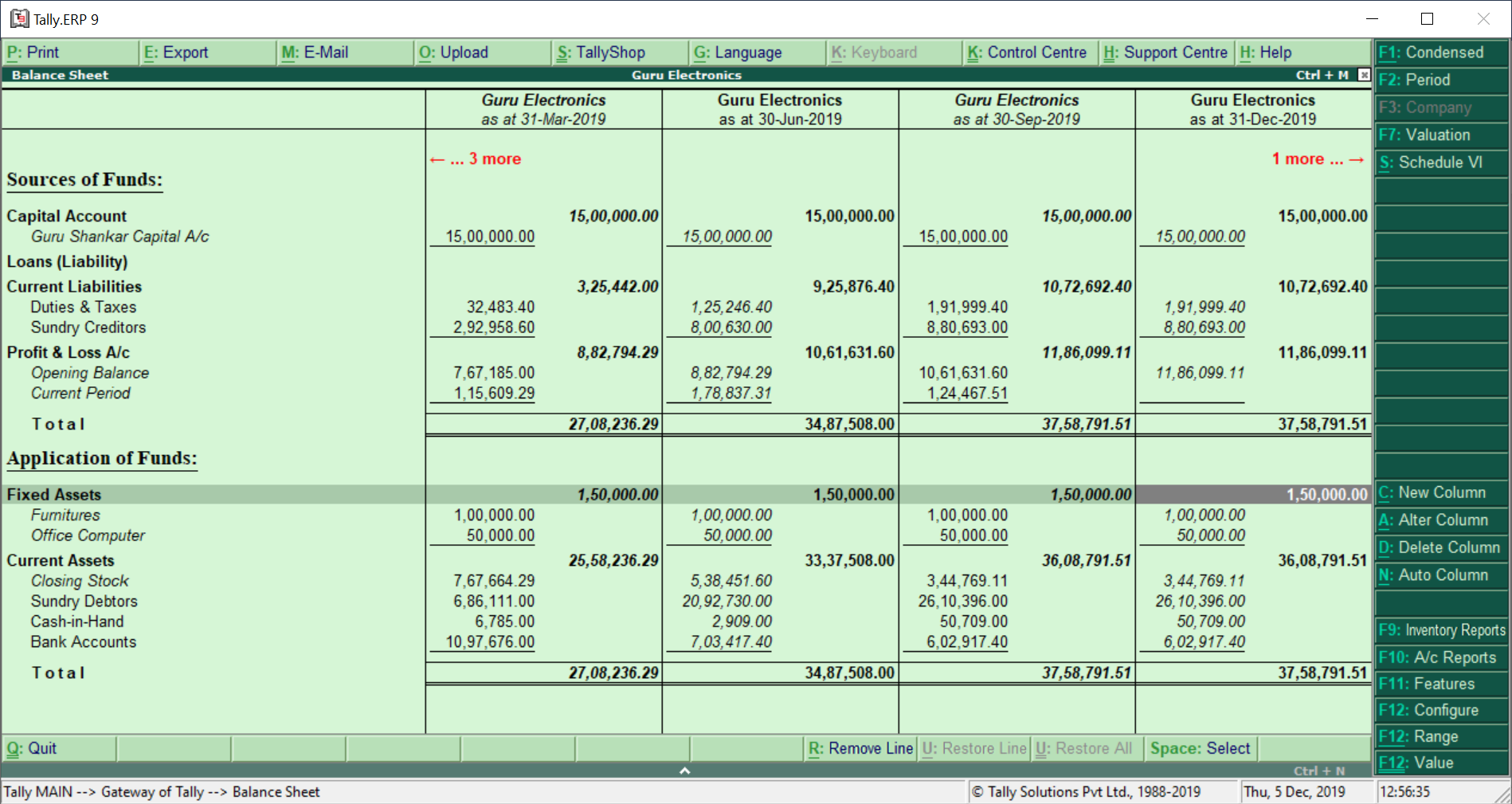

Below is the sample format of a comparative balance sheet.

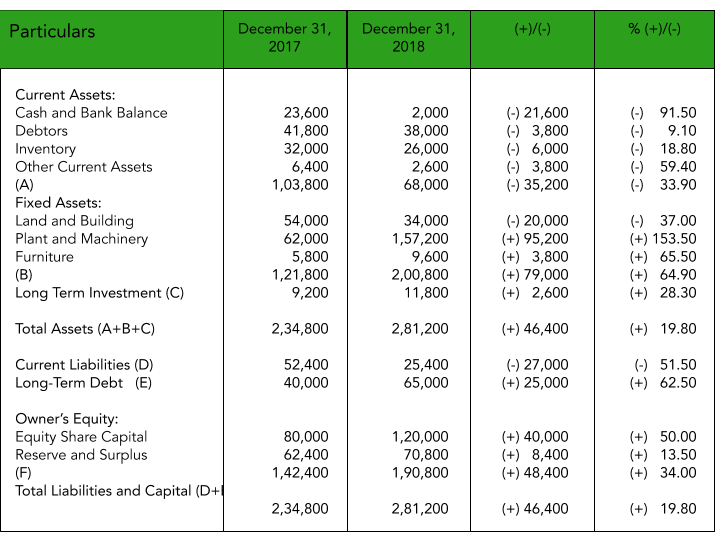

Comparative balance sheet percentage formula. This type of balance sheet may. A common size balance sheet allows for the relative percentage of each asset, liability, and equity account to be quickly analyzed. By applying formulas to the balance sheet, they.

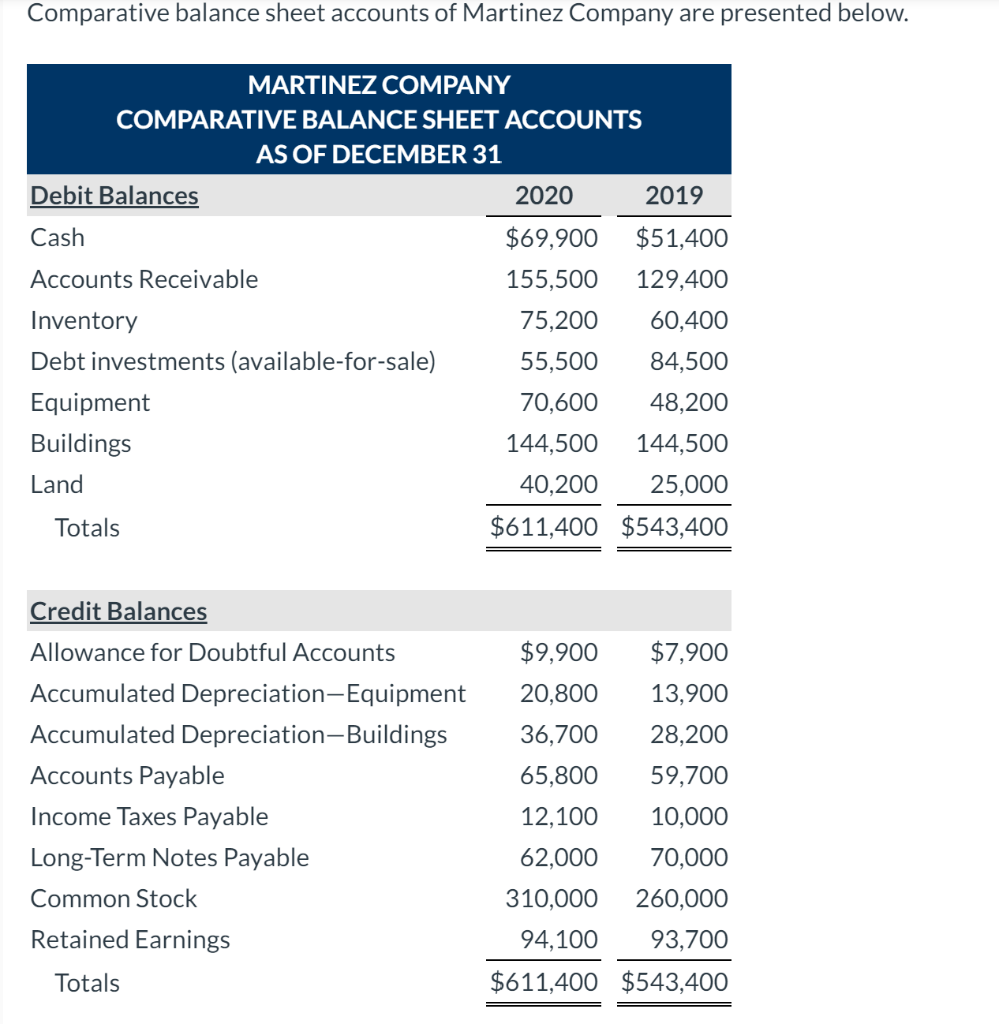

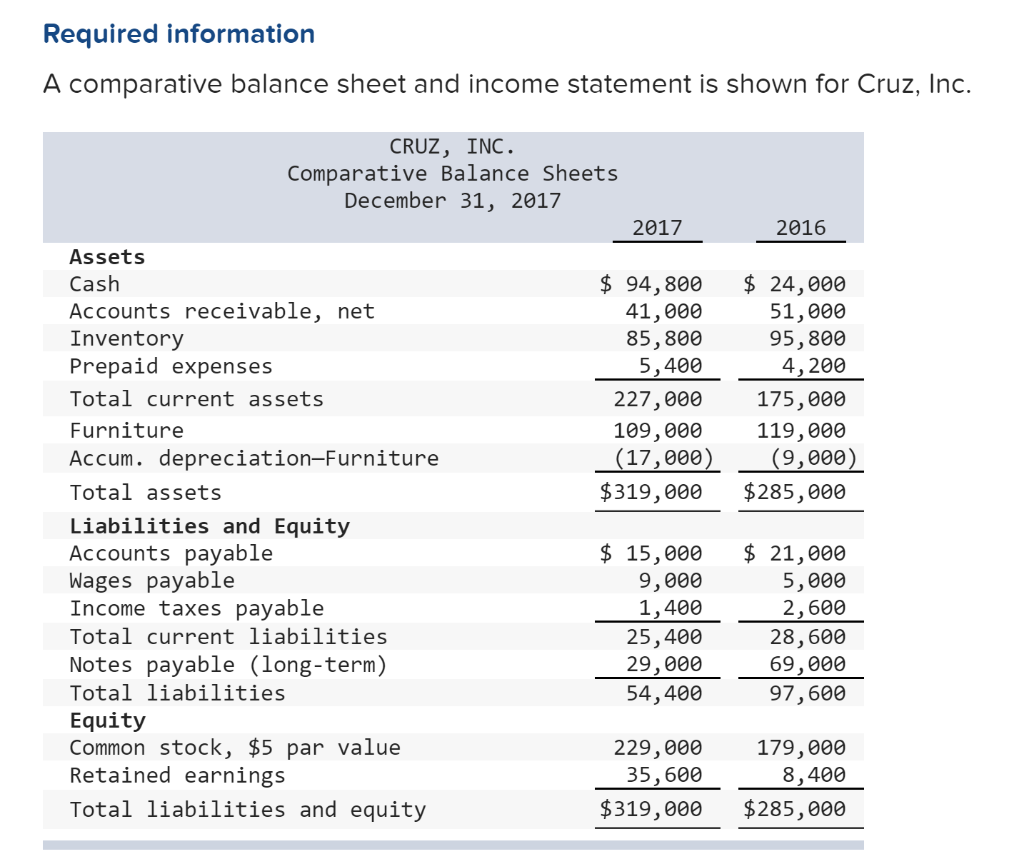

This common size balance sheet calculator works out the percentage each line item of the balance sheet is to total assets. Below is the format of a comparative balance sheet of amazon inc. The format of a comparative income statement is as follows:

Types of balance sheet ratios; Percentage change = (absolute increase or. The formula lets you determine the percentage increase or decrease.

The third column is used to display the. This ratio analyzes the company’s liquidity by using its. A statement that helps in the comparative study of the components of a company’s balance sheet and income statement over a period of two or more years,.

This percentage change in assets and liabilities is mentioned in column v of the comparative balance sheet. Current assets / current liabilities: What are comparative balance sheets?

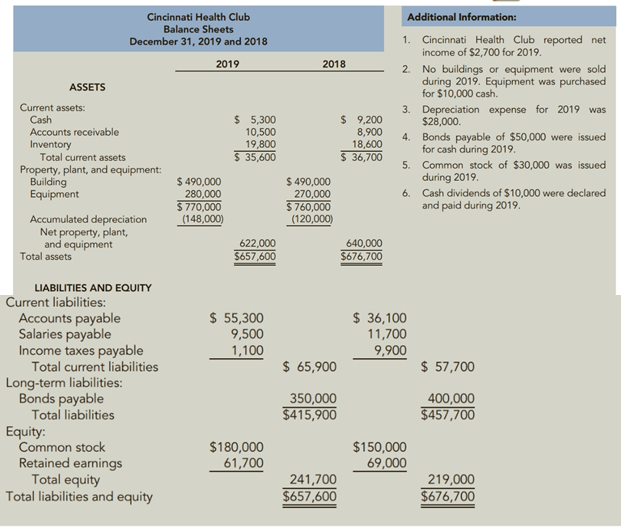

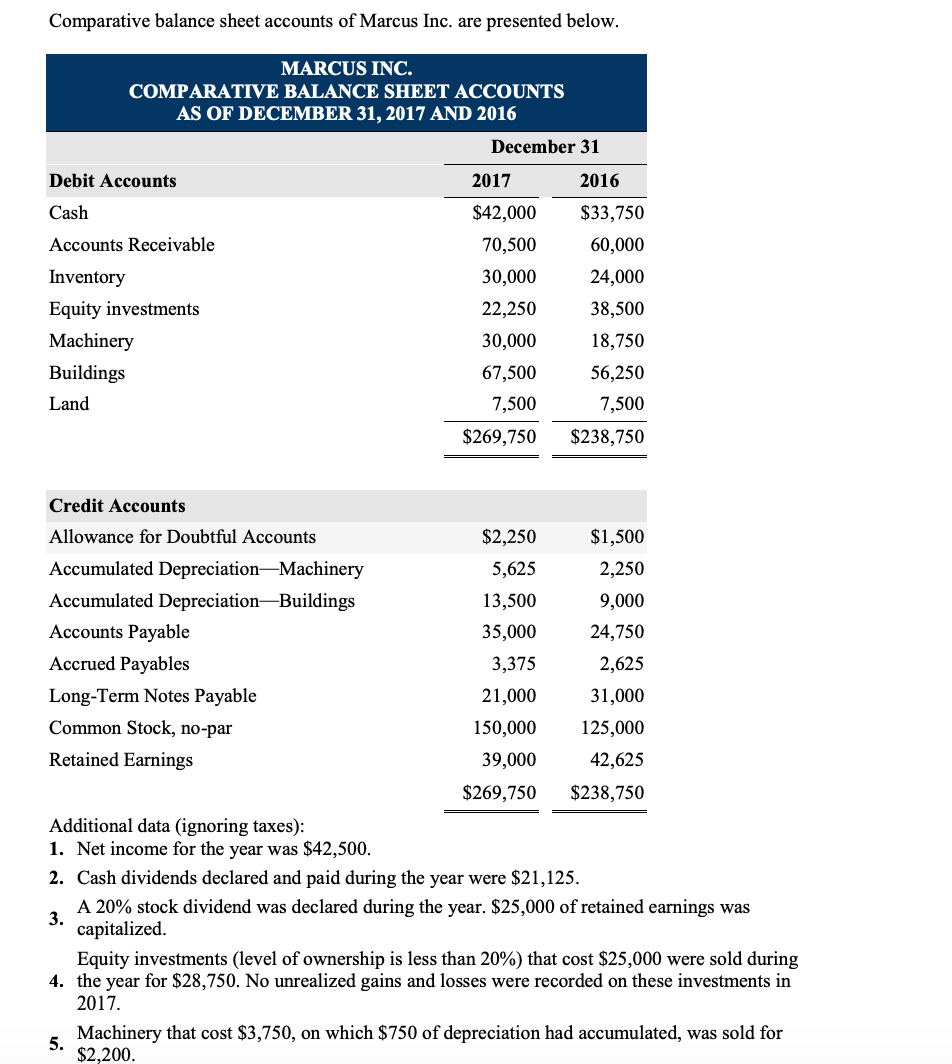

Definition investors and analysts alike use balance sheet formulas to gain insight about a company's finances. Typically, the income statements and balance sheets are prepared in a comparative form to undertake such an analysis.presenting each revenue and expense. A comparative balance provides insight into a company’s financial figures of assets and liabilities.

Comparative balance sheet. Comparative balance sheet analyses the assets and liabilities of business for the. Vertical analysis, income statement = income.

A comparative balance sheet analysis is a method of analyzing a company's balance sheet over time to identify changes and trends. A comparative balance sheet contains two columns that contain the information of the original balance sheets. Share capital percentage of balance sheet total for 2005 will be: