One Of The Best Info About Understanding Company Financials

Understanding company financial statements can appear complicated to start with.

Understanding company financials. Understanding company financial statements. How to read company financial statements (basics explained) 227,568 views 🔥 free access to our exclusive trader masterclass:. The financial statements are used by investors, market analysts, and creditors to grading a company's financial health and earnings potential.

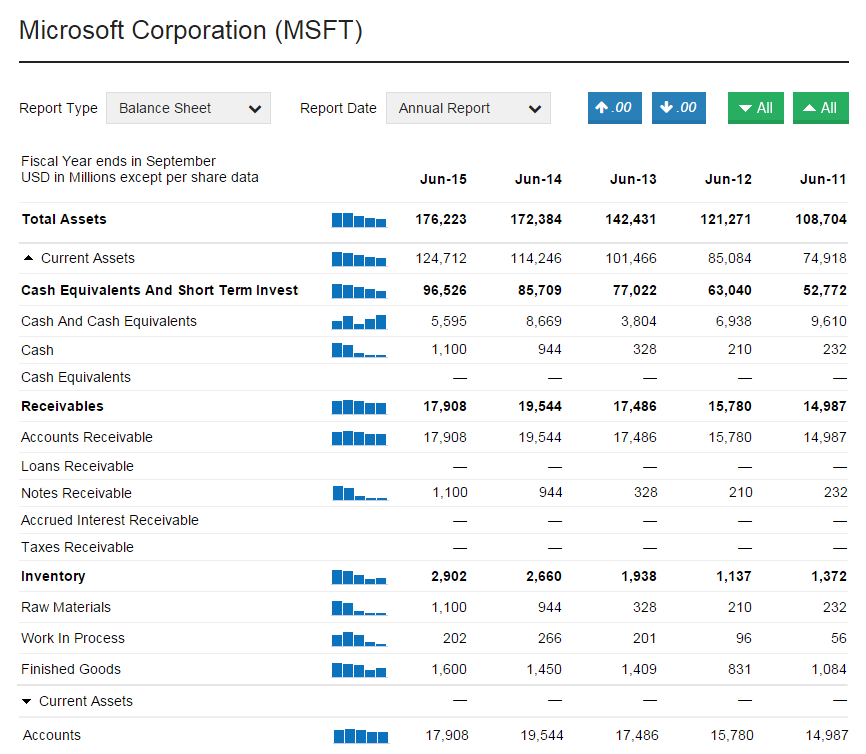

This concise and informative guide to. On the top half you have the company’s assets and on the bottom half its liabilities and shareholders’ equity (or net worth). One of the main tasks of a financial analyst is to perform an extensive analysis of a company’s financial statements.

Understanding the phenomenon of retik finance (retik) retik finance (retik) has witnessed a remarkable surge in its price, experiencing a staggering 400%. The financials of a company are split into three key sections. Getting to grips with financial.

This usually begins with the income statement but also. The three major financial opinion. Uber inked a memorandum of understanding to explore joining the open network for digital commerce to try and standardize online transactions and finance.

Now, let us understand the different financial statements of a company. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). A balance sheetconveys the “book value” of a company.

It allows you to see what resources it has available and how they were financed as of a specific date. Learn how to read these documents, and you will gain insight into your own finances and those of any. A financial statement is the report card of a business.

Understanding the financials of a company to invest in (from an indian perspective) rahul kapoor · follow published in illumination · 7 min read · may 31,. Understanding company financial statements. To understand and value a company, investors examine its financial position by studying its financial statements and calculating certain ratios.