First Class Info About Revenue And Expense Ledger

![[Solved] How do I determine what goes on the statement for Rapid](https://templatearchive.com/wp-content/uploads/2017/05/Income-and-Expense-Ledger-38.jpg)

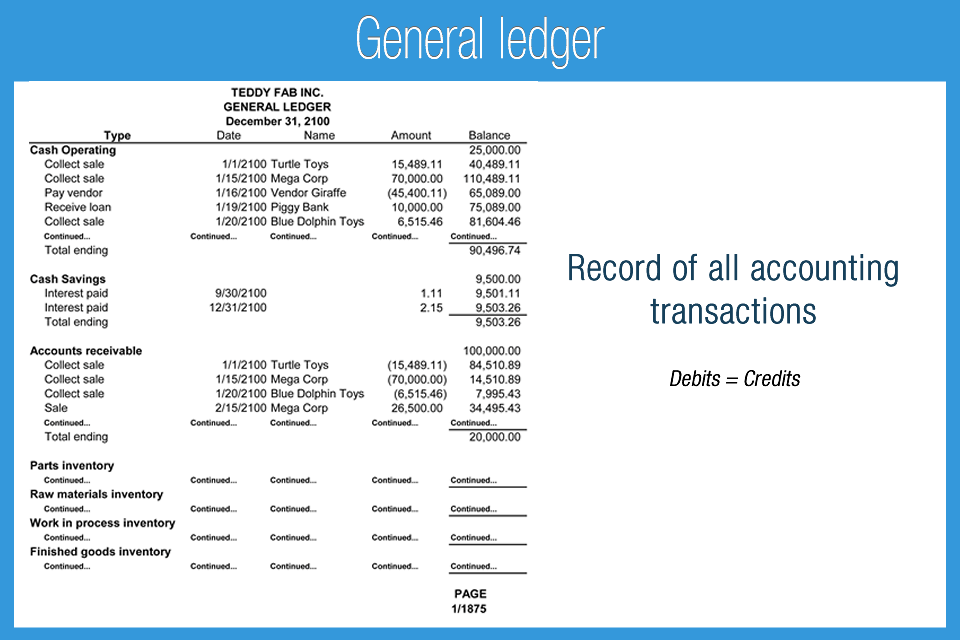

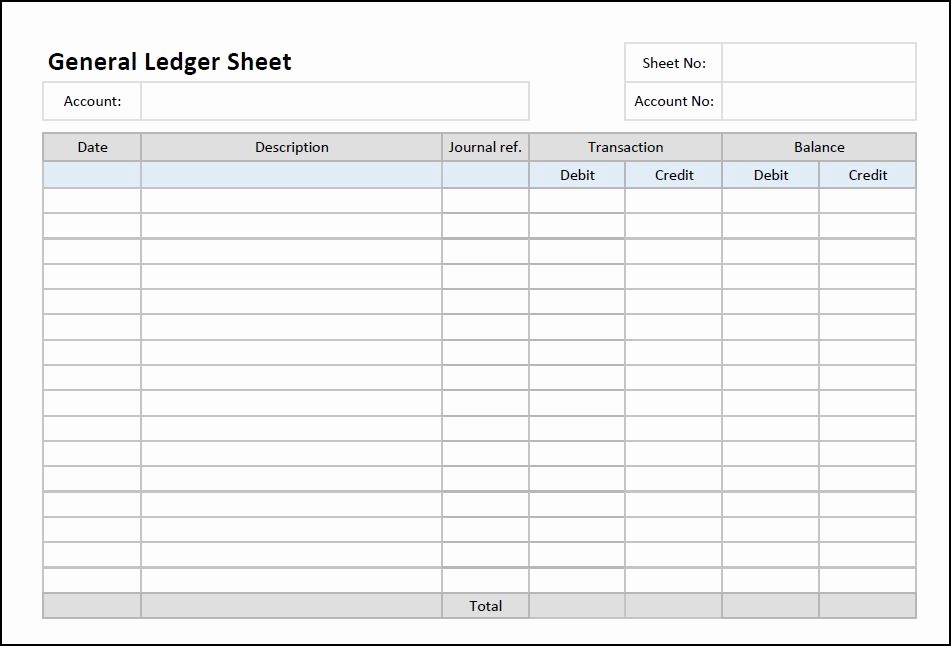

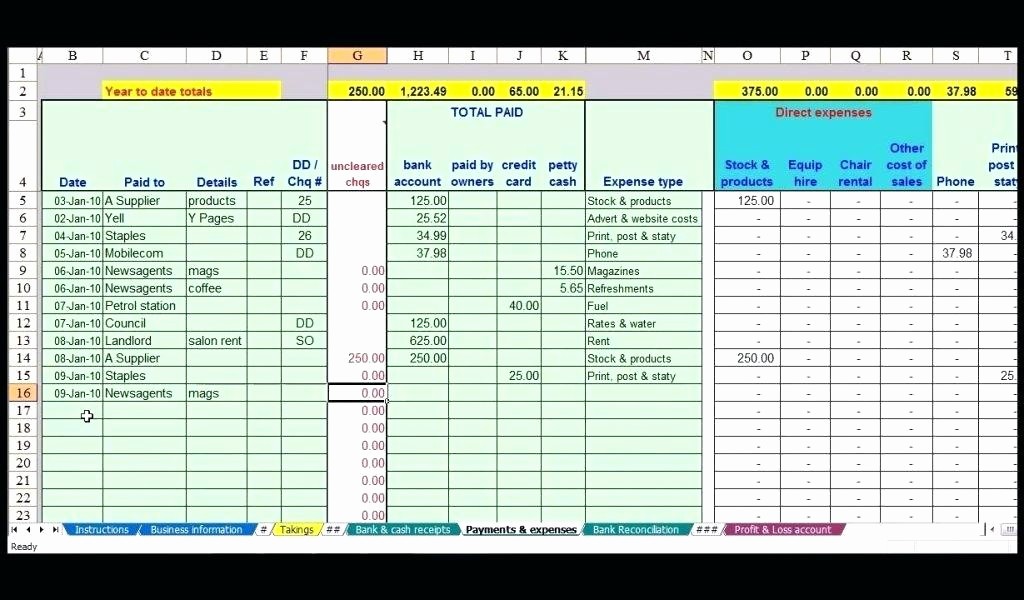

Accounting ledgers might be recorded by hand in a written format, but it’s more common for them to.

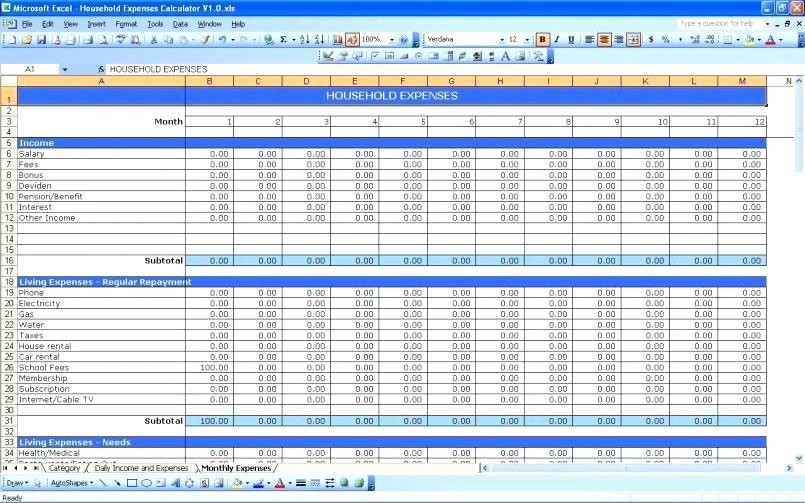

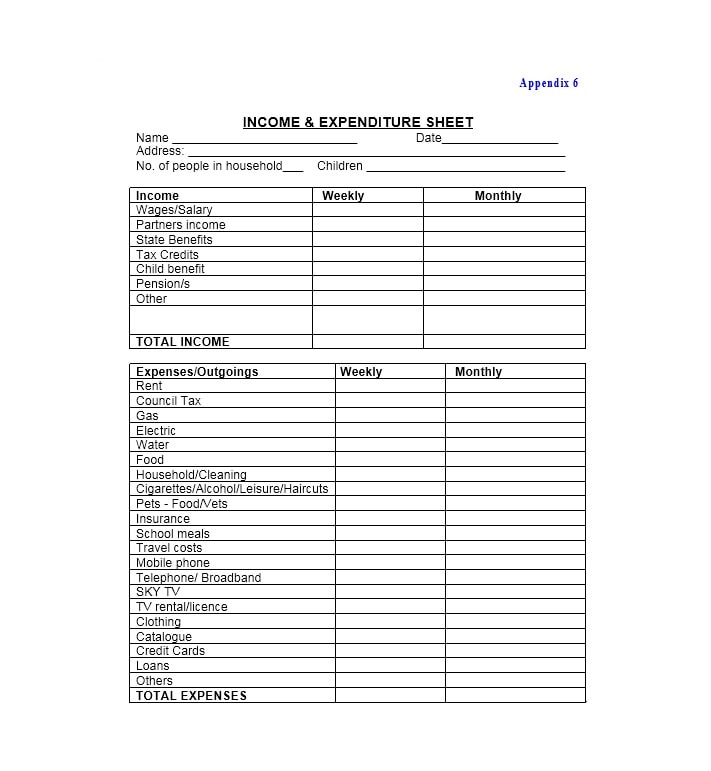

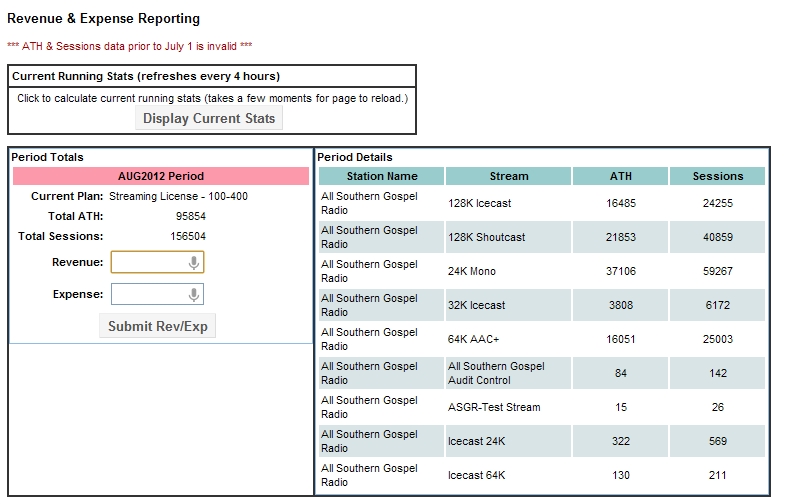

Revenue and expense ledger. The new accounts in the equity section of the. The ledger contains the business’s income and expenses, which can be used in the budget formulation process. Closing the revenue accounts:

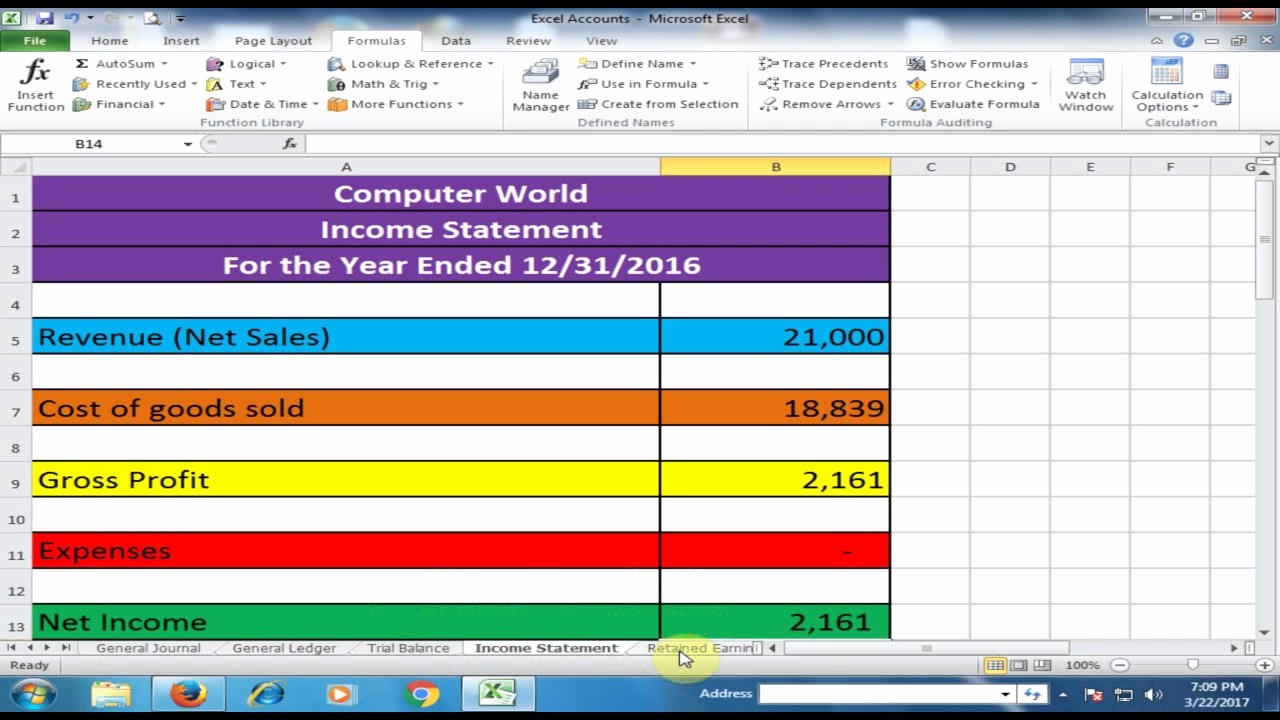

Total revenues are $10,240, while total expenses are $5,575. Chapter 5 the expanded ledger: As an example, assume that on.

What is a general ledger account? Closing entries must be posted to the ledgers to impact the revenue, expense, and retained earnings account balances. In addition, you can use the previous entries of the ledger to predict.

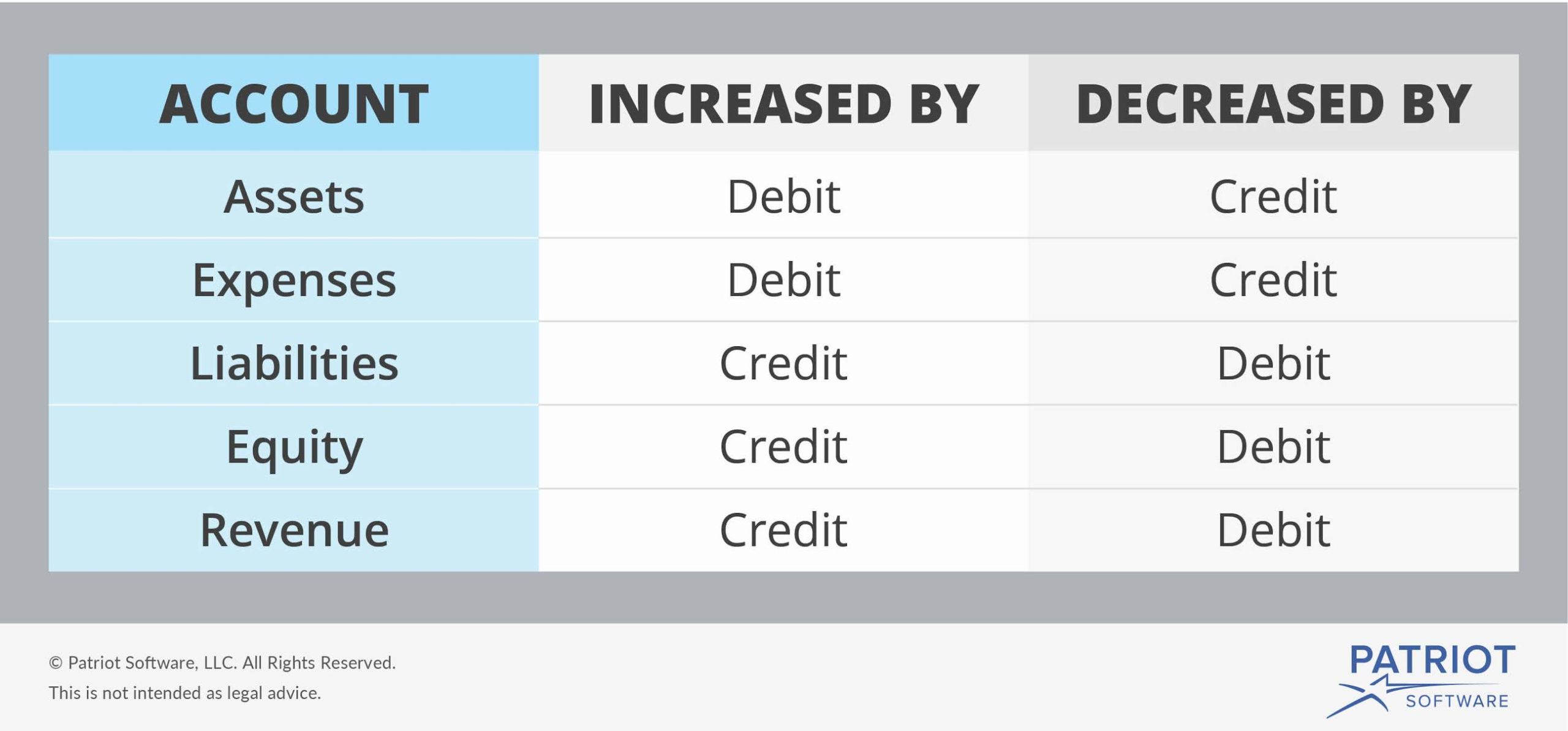

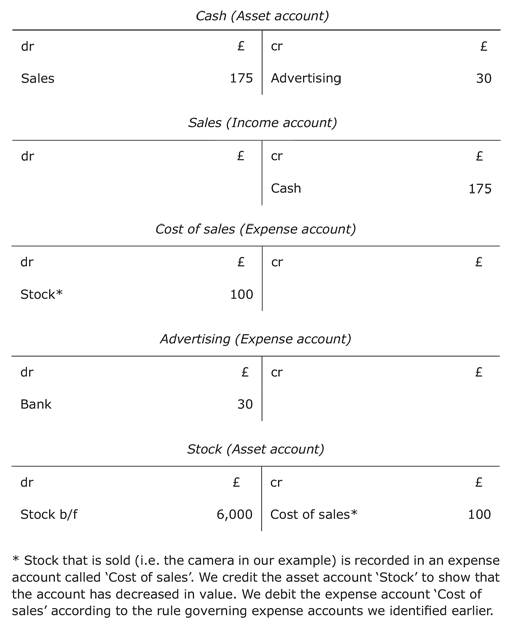

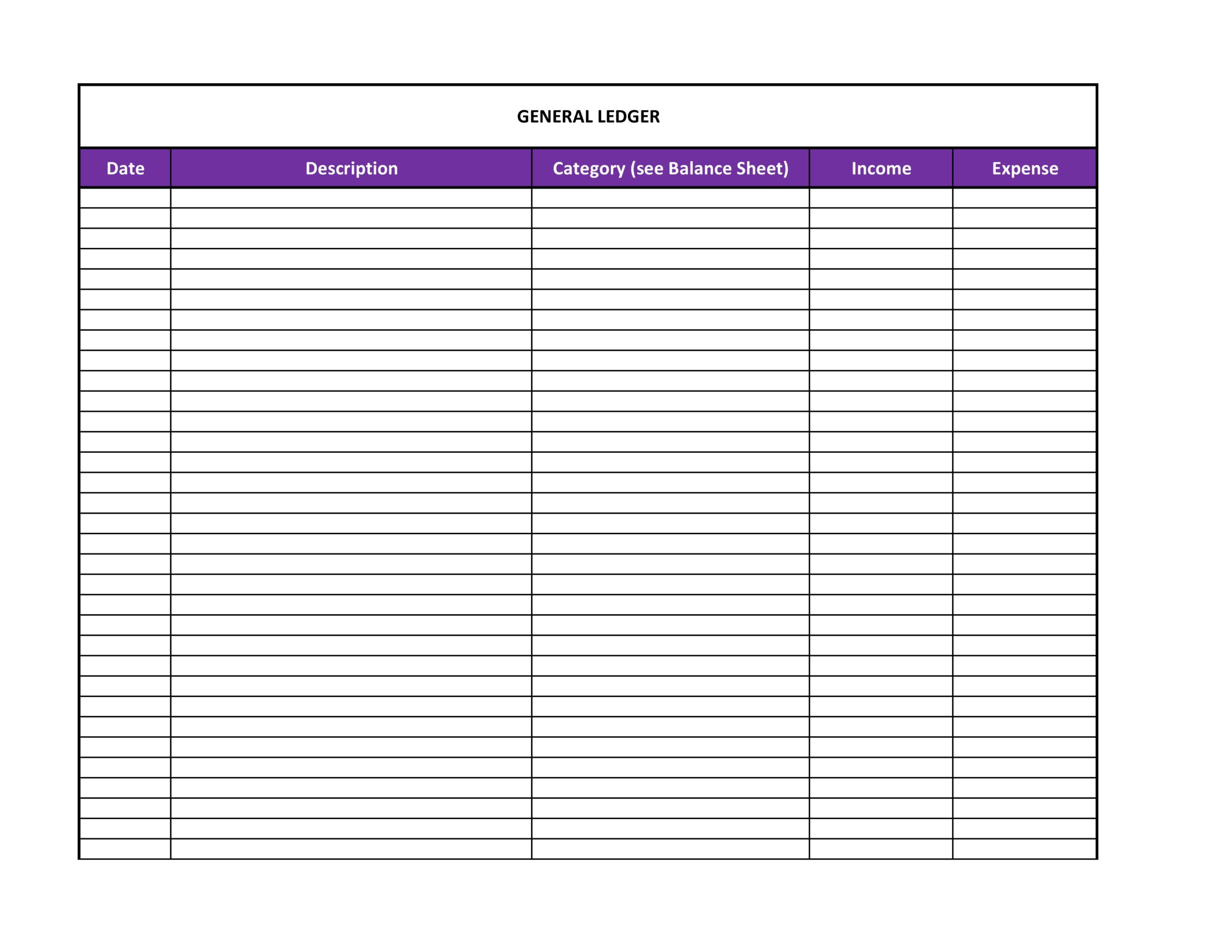

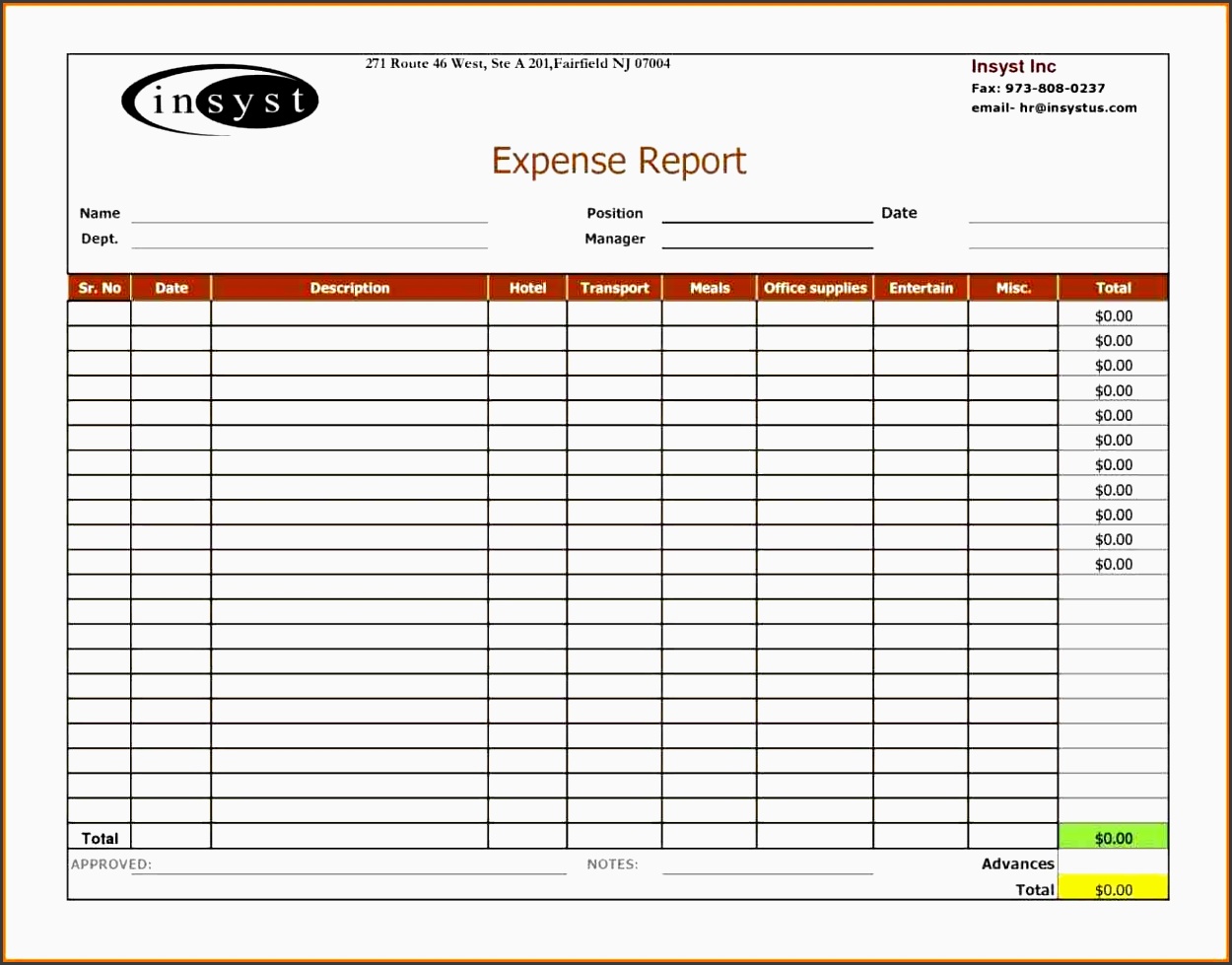

Flawlessly and cheaper than you think! Transferring the credit balances in the revenue accounts to a clearing account called income summary. A ledger is a record of accounting entries that contains information about business transactions in the form of debits and credits.

It consists of a comprehensive record of bookkeeping entries and organizes your business's transaction data into different accounts like assets, liabilities, revenues, expenses, and. A general ledger account, or gl account, is one of the basic elements of financial accounting. It is divided into different accounts like.

The general ledger functions as a comprehensive. Do you run a one person company or a small. Section 5.1 review questions (page 140) 1.

A general ledger (gl) is a central accounting record that contains all the financial transactions of a business. You take care of your company, we will take care of your revenue and expense ledger. The ledger contains accounts for all items listed in the accounting equation, i.e.

Revenue and expense information is taken from the adjusted trial balance as follows: These transactions are usually classified by type into.