Top Notch Info About Reconciliation Of Absorption And Variable Costing

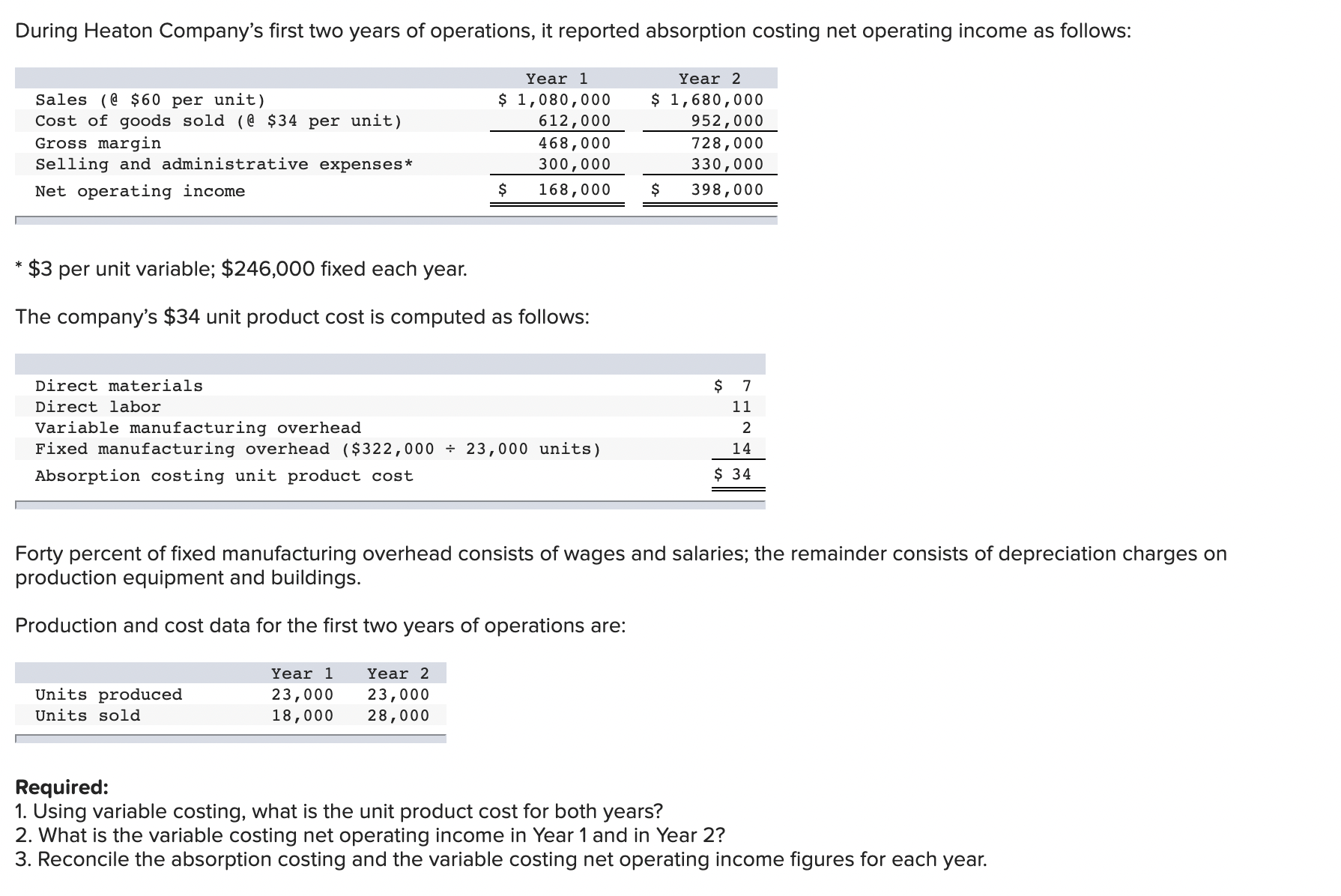

The variable cost per unit is $22 (the total of direct material, direct.

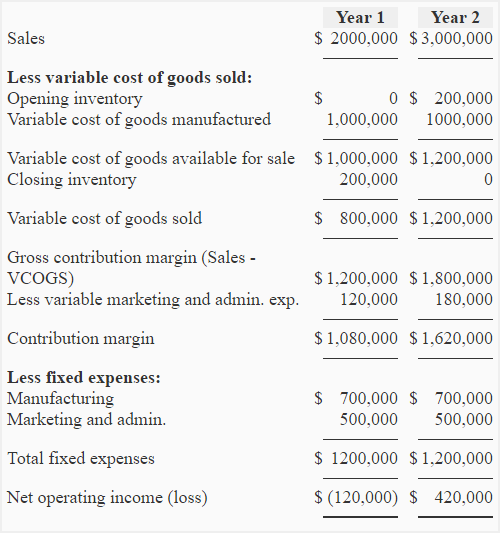

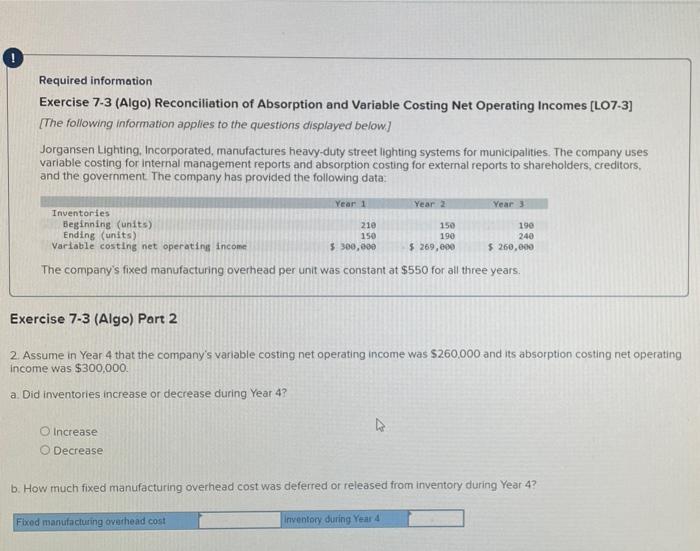

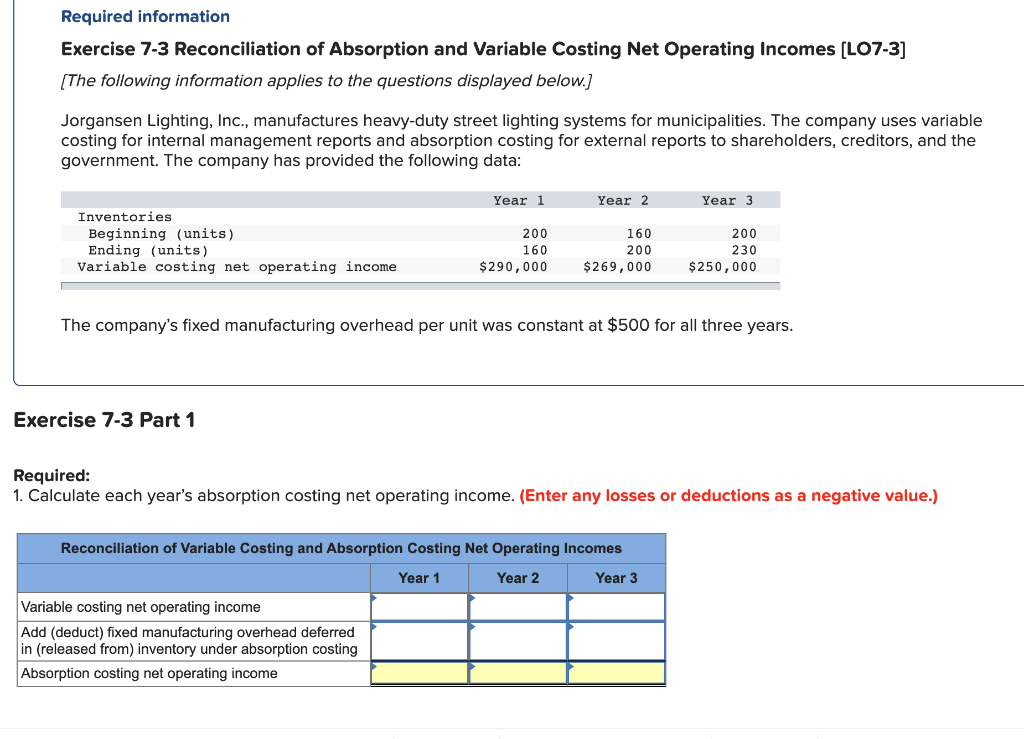

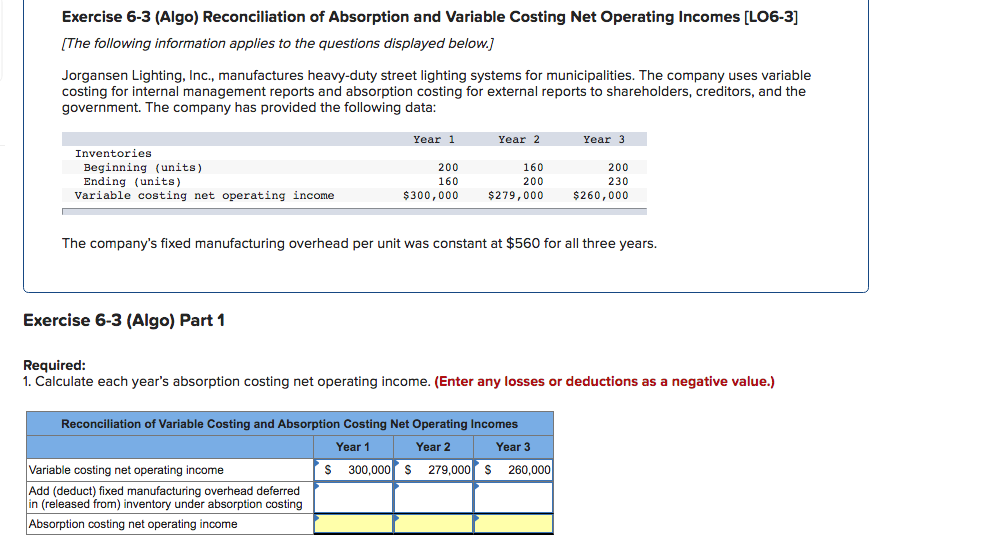

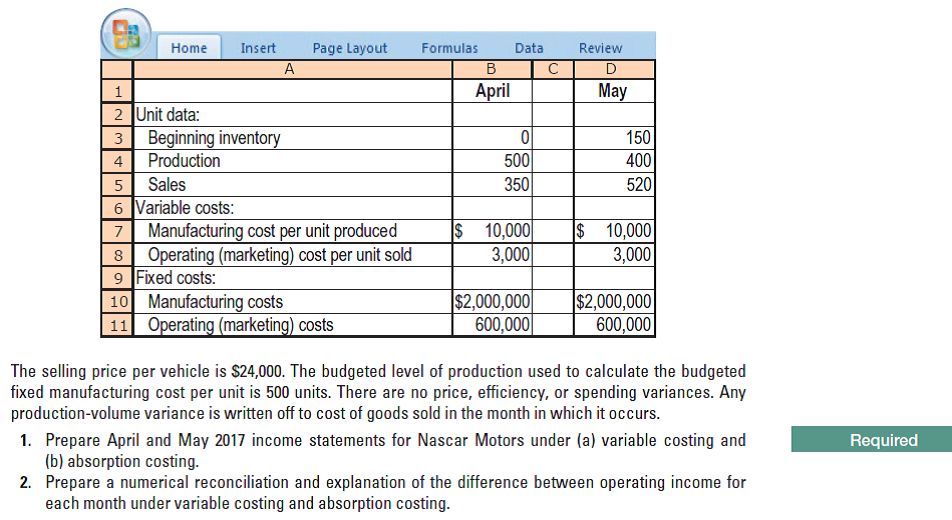

Reconciliation of absorption and variable costing. Both absorption and variable cost methods are based on the accrual concept of accounting. Prepare the profit statements for january and february using absorption costing; Reconciliation of budgeted and actual profit.

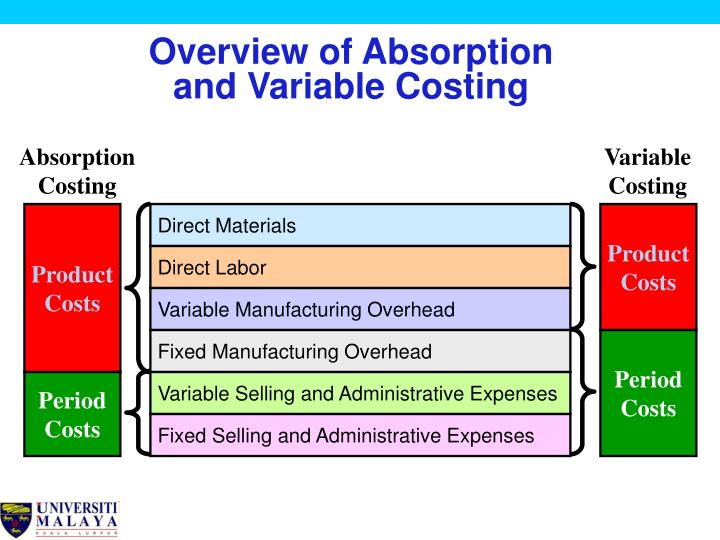

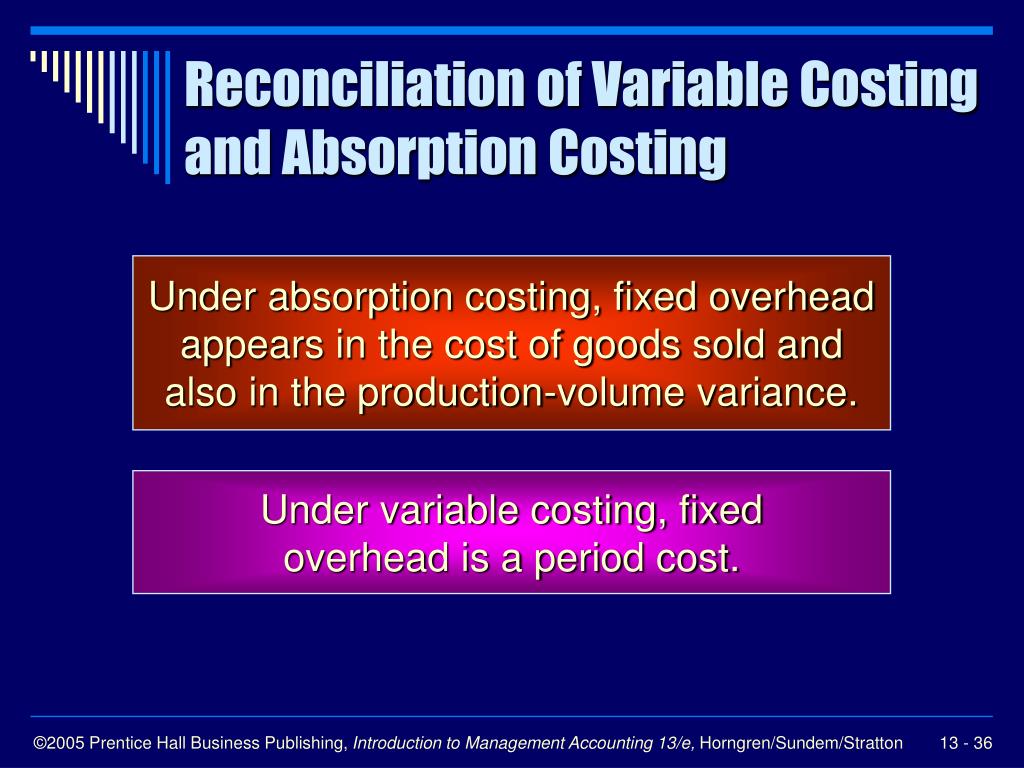

How to reconcile the profits? Under absorption costing, all manufacturing costs are considered as product costs. B only to variable costing.

Reconciliation of absorption and variable costing income. An introduction to acca ma e3a. Set out statements of profit for the months of january and february using.

Difference between absorption costing vs variable costing. In variable costing, costs are bifurcated into variable and fixed categories regardless of whether they are product costs or period costs, while in absorption. Fixed overhead in the beginning inventory xxx total xxx.

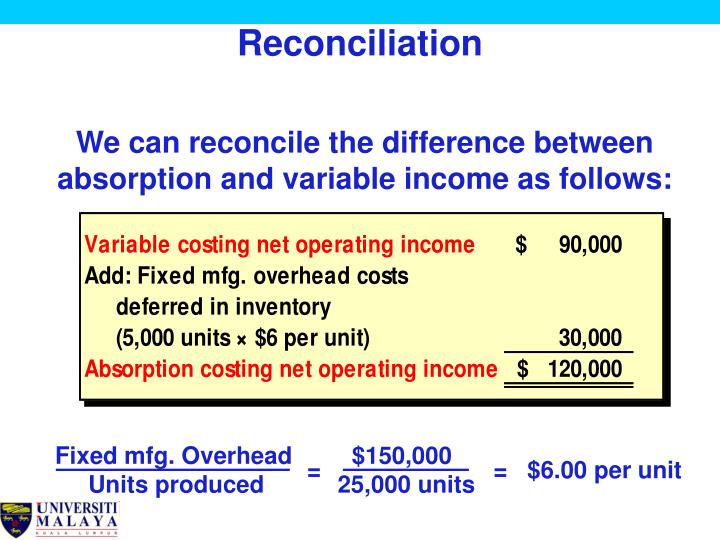

Absorption costing income xxx add: Variable and absorption costing problem the unit product cost under variable costing is computed as follows: Absorption costing and variable costing are methods used to value companies' work in progress and inventory, for accounting purposes.

Has all absorption and variable costing questions. How much would each unit cost under both the variable method and the absorption method? Reconcile profits under absorption as documented in the.

Understanding the difference between absorption costing and variable costing allows us to quickly determine the effects of switching from method to the other, we call this. C to both absorption costing and variable costing. Net income under absorption costing can be reconciled with net income under variable costing by (a) subtracting the manufacturing overheads carried forward (absorbed by closing inventories) and (b) adding the manufacturing overheads brought in (absorbed by opening inventories).

Determine which of the nine statements: Under variable costing, only variable costs are treated as product costs.