Perfect Tips About Project On Cash Flow Statement Of A Company

What is a cash flow statement?

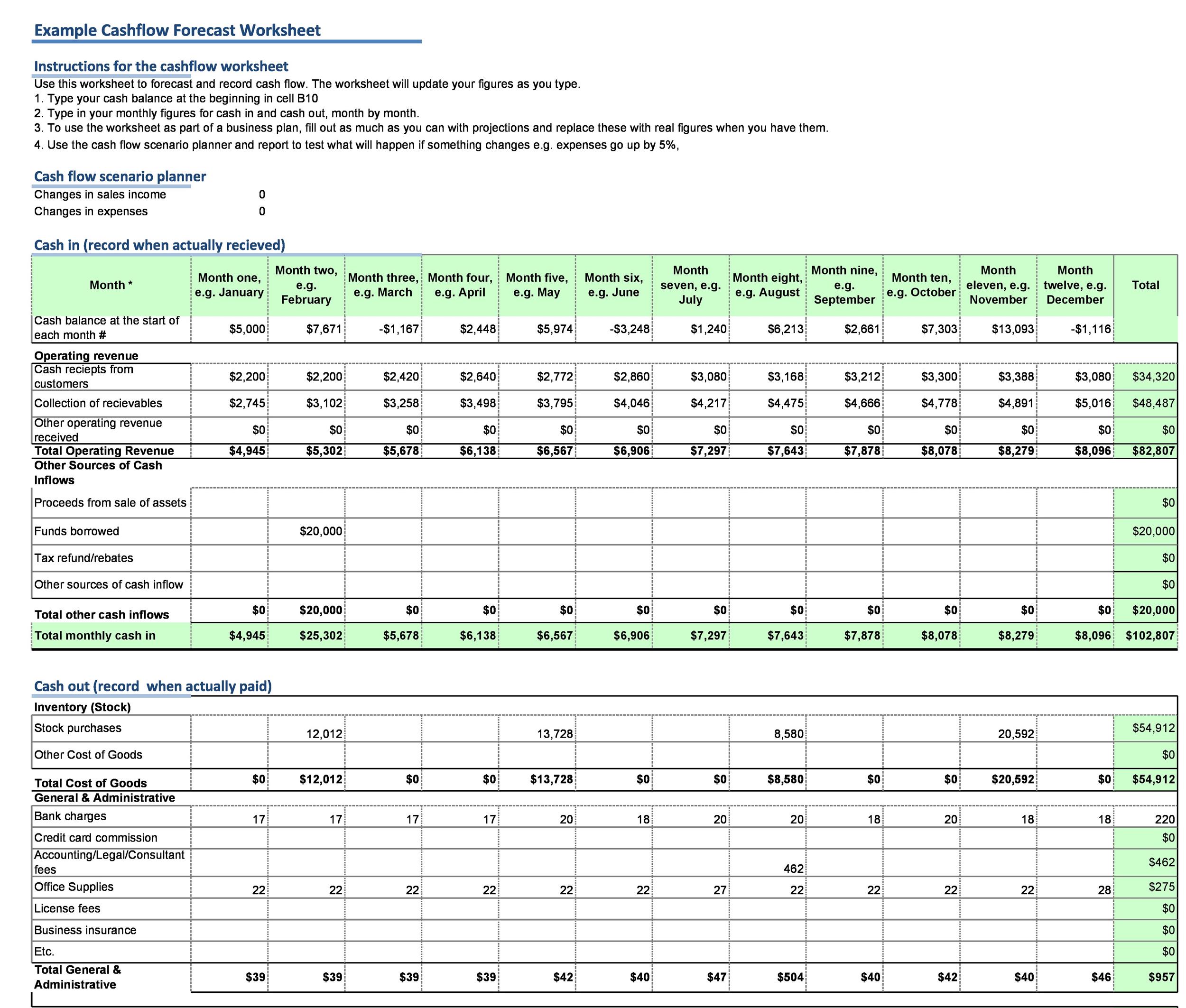

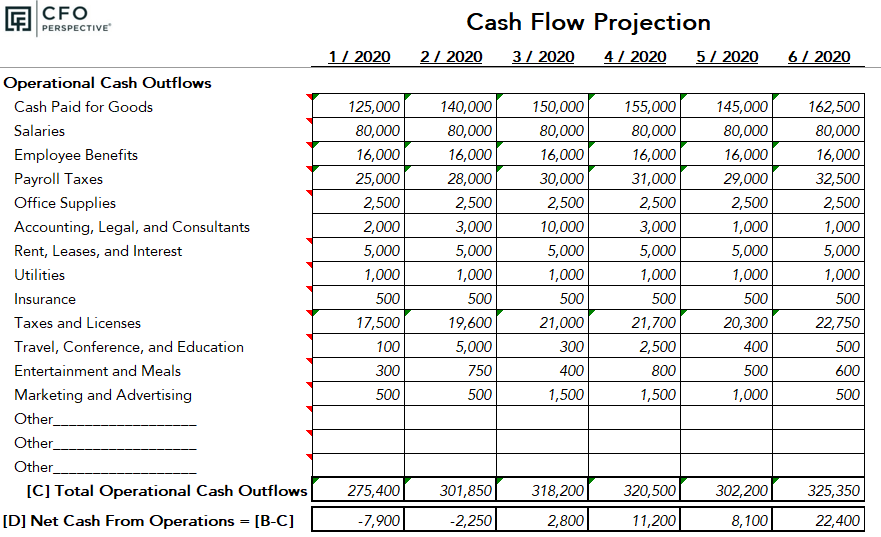

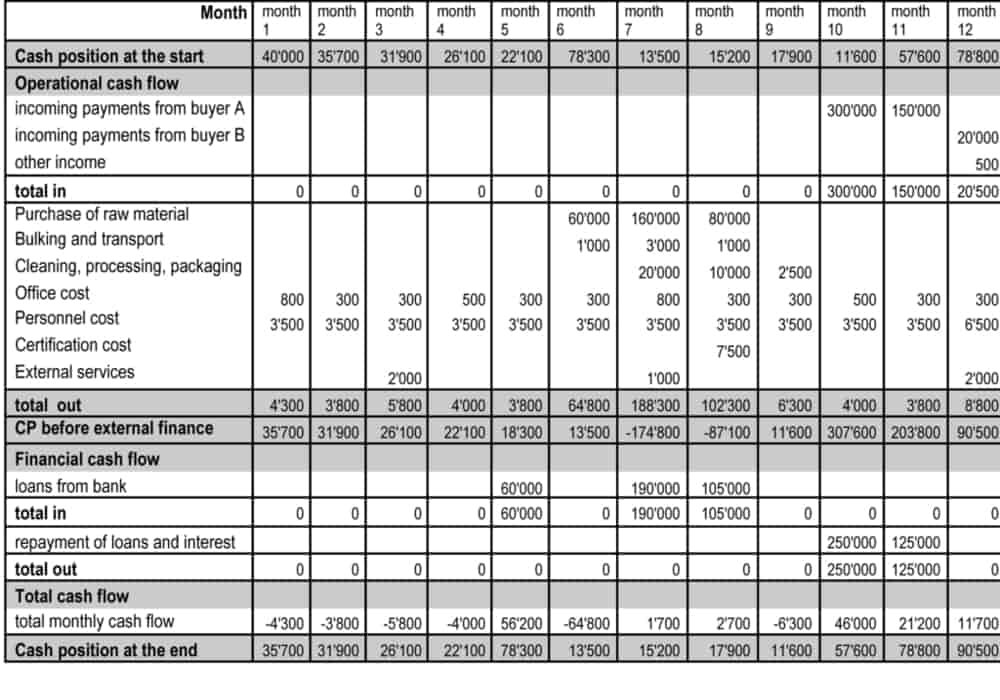

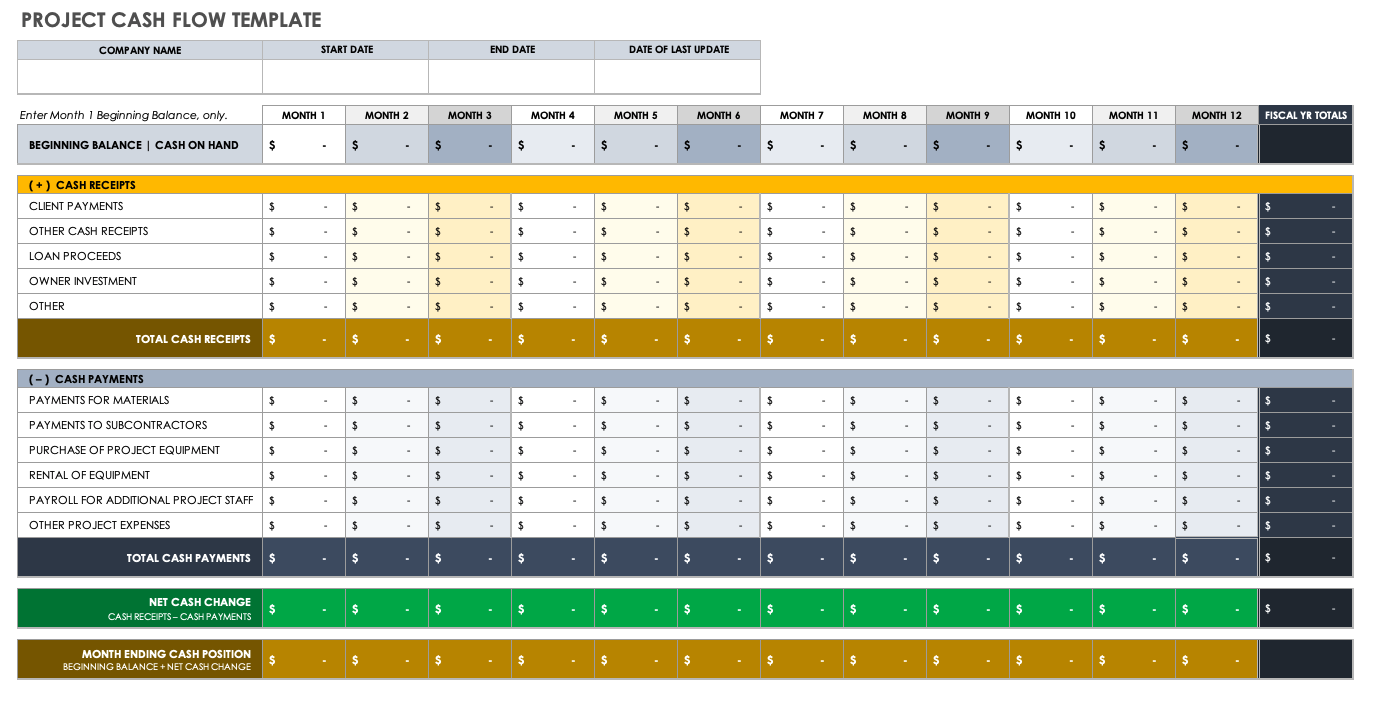

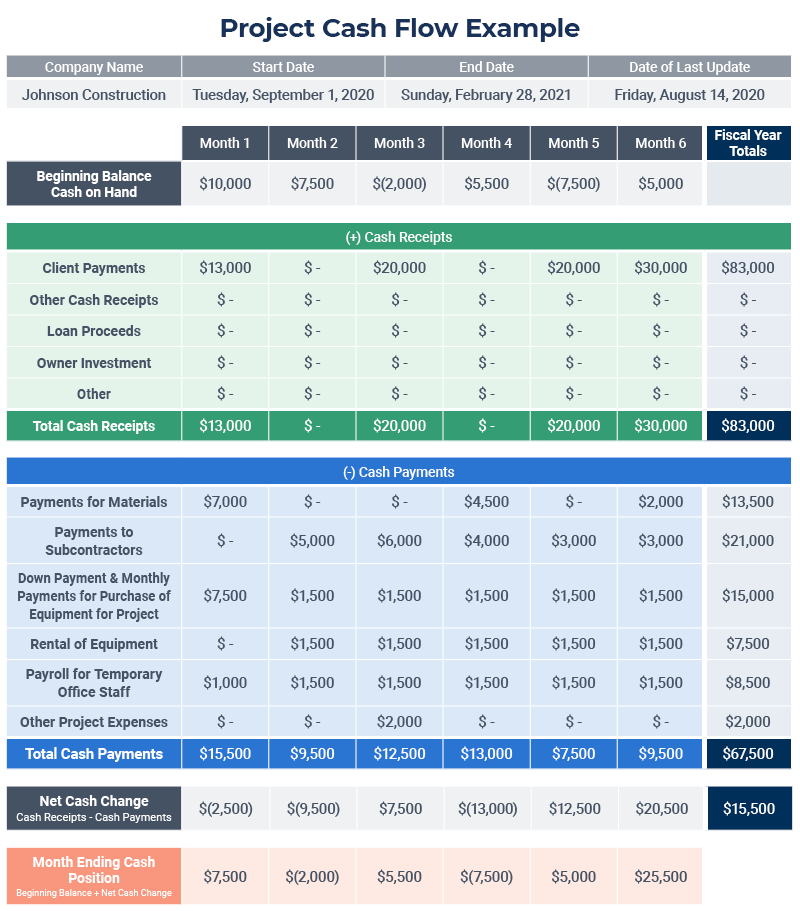

Project on cash flow statement of a company. The first step to managing your project’s cash flow is to understand the cash flow of your project. Identify all project cash inflows. The cash flow statement is typically broken into three sections:

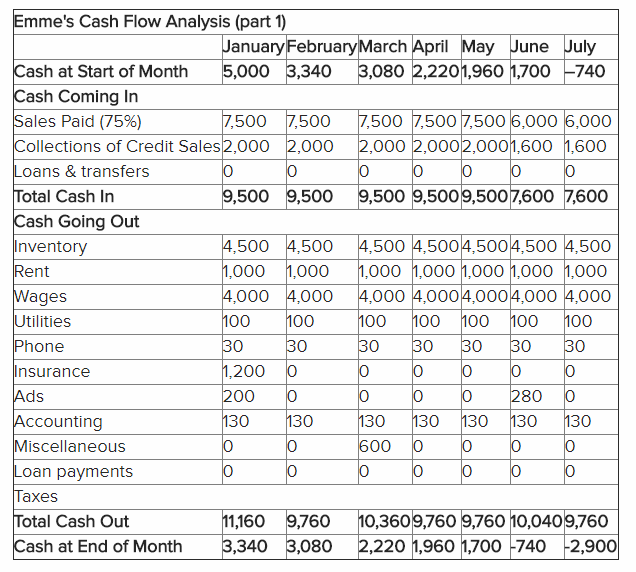

Cash flow is the net balance of cash you have coming in and out of your business across a specified timeframe. So, your monthly cash flow is the amount of cash you have moving into and out of your company that month.

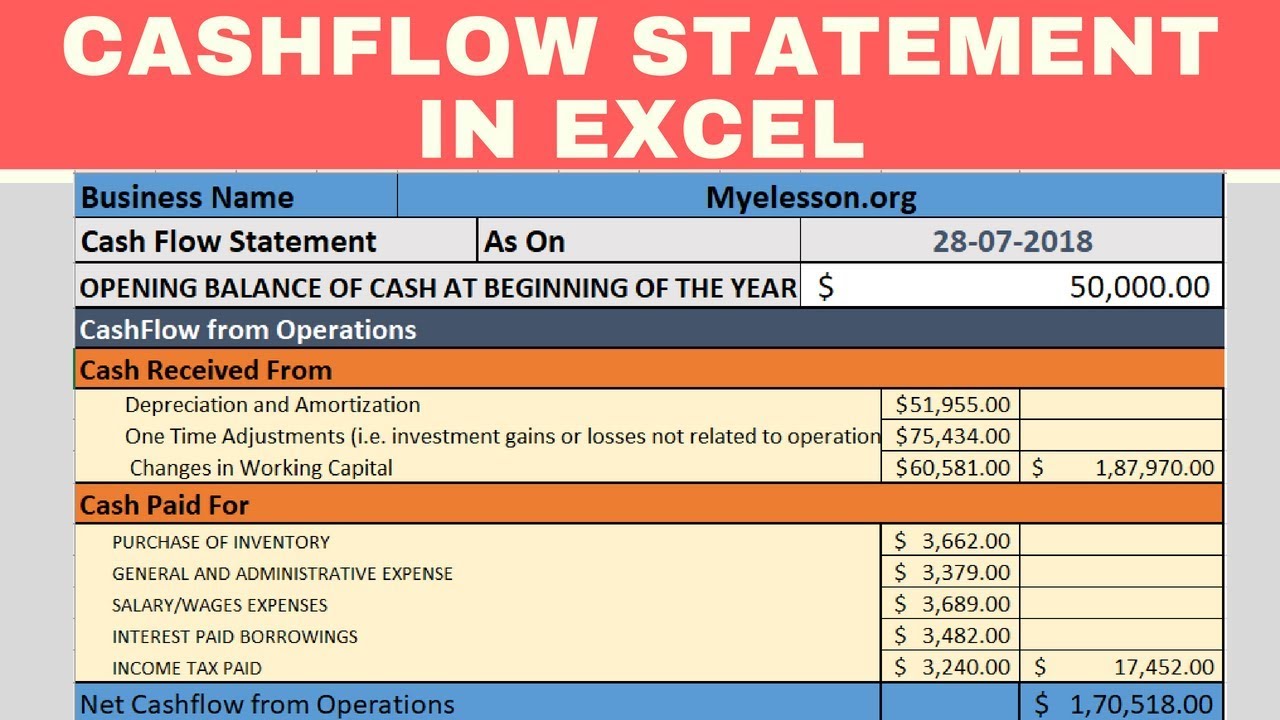

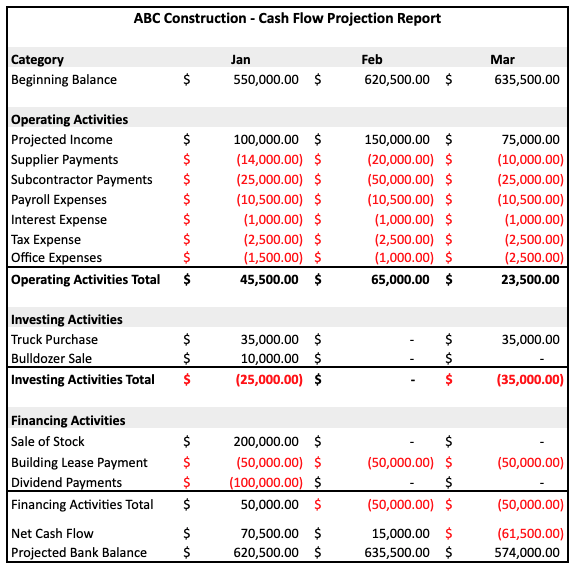

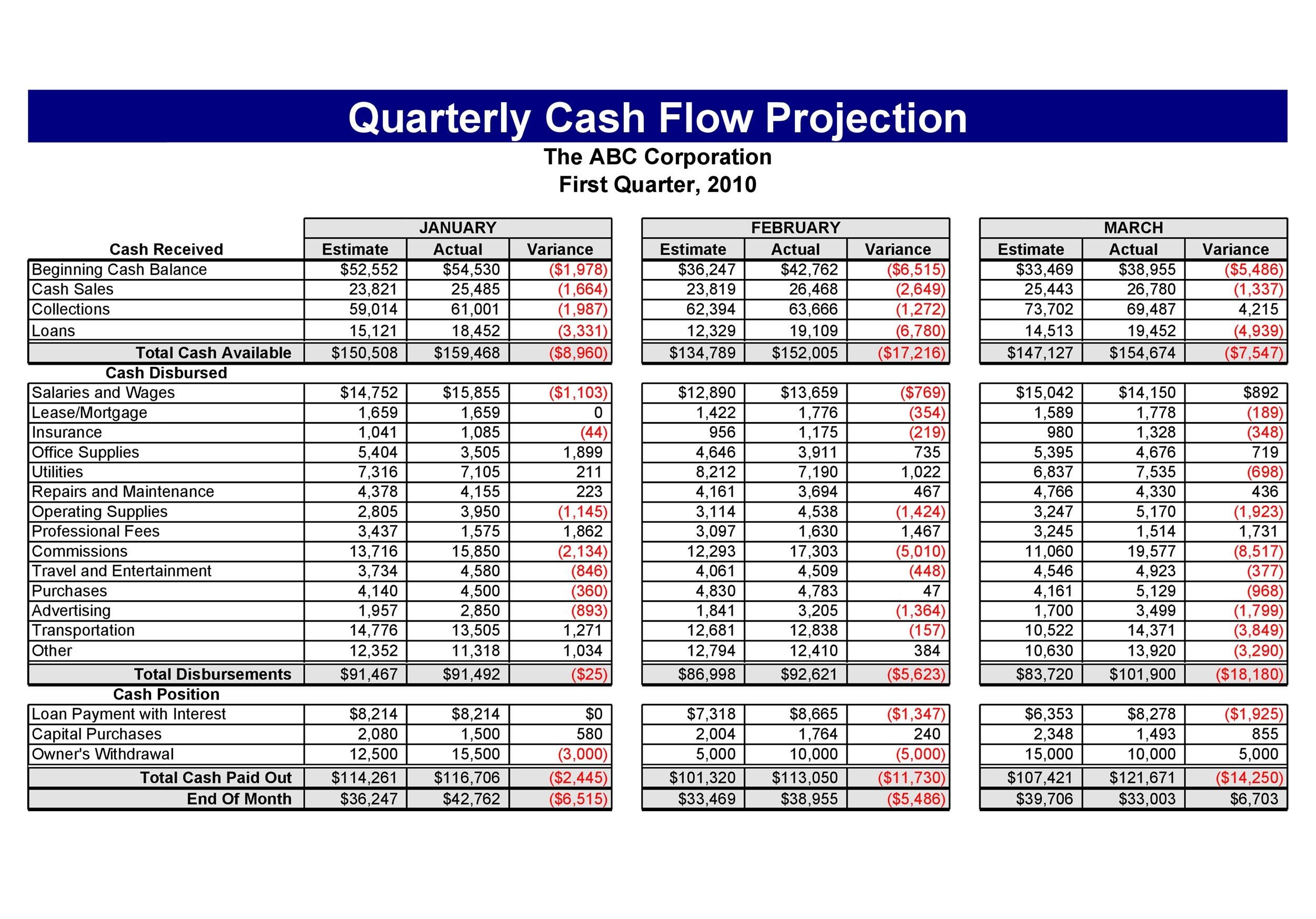

The cash flow analysis refers to the examination or analysis of the different inflows of the cash to the company and the outflow of the cash from the company during the period under consideration from the different activities, which include operating activities, investing activities, and financing activities. It can denote changes in cash position during three financial years.the main purpose. According to the online course financial accounting:

Project cash flow is used to measure the outflow and inflow of money from the project to the organizations.

The cash flow statement is often viewed as the most essential among the financial statements simply because it paints a clear picture of a company’s lifeblood. Strong increase in revenue and recurring operating income which are expected to continue in 2024 paris, february 15, 2024 fy 2023 adjusted data revenue: Forecast expected payments to suppliers and vendors.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). For positive cash flows, and to provide a return to investors, a. The cash flow statement is a financial statement.

That can be anything from revenue from customer payments, cash receipts from sales, funding, taking out a loan, returns or dividend payments from investors and interest income. How to prepare a cash flow statement Cash flow from operations was $11.6 billion for the full year, up 5%;

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. To better understand the liquidity and profitability of the company.

Cash flow statement is an important tool to analyze the cash position of a business organization. A cash flow statement tells you how much cash is entering and leaving your business in a given period. It is not easy to do budgeting with the cashflows, if you are not experienced and do not have any knowledge of budgeting then the project is.

Here are some details to consider when performing a project cash flow analysis: A cash flow projection statement is a financial record that both records a company's current cash flow and estimates cash flow in the future. Cash flow analysis example.