Neat Info About Supplies Expense In Balance Sheet

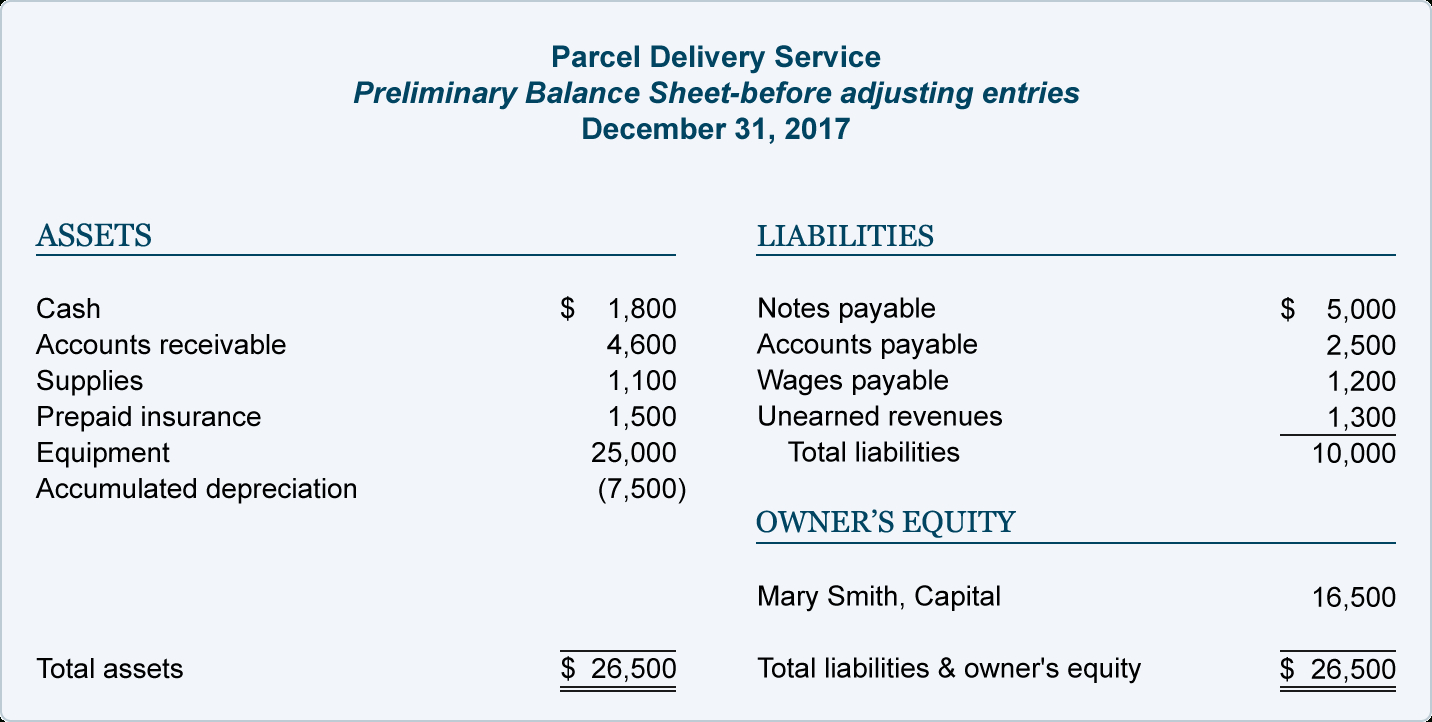

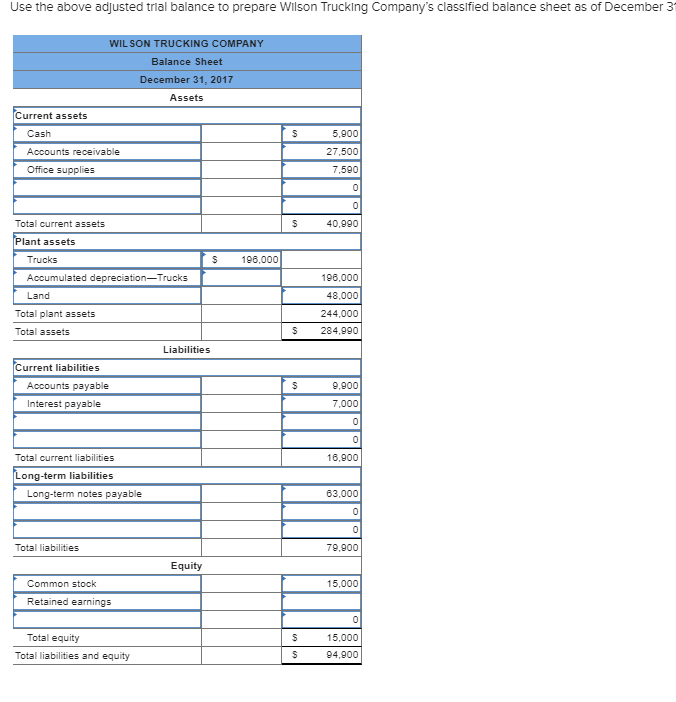

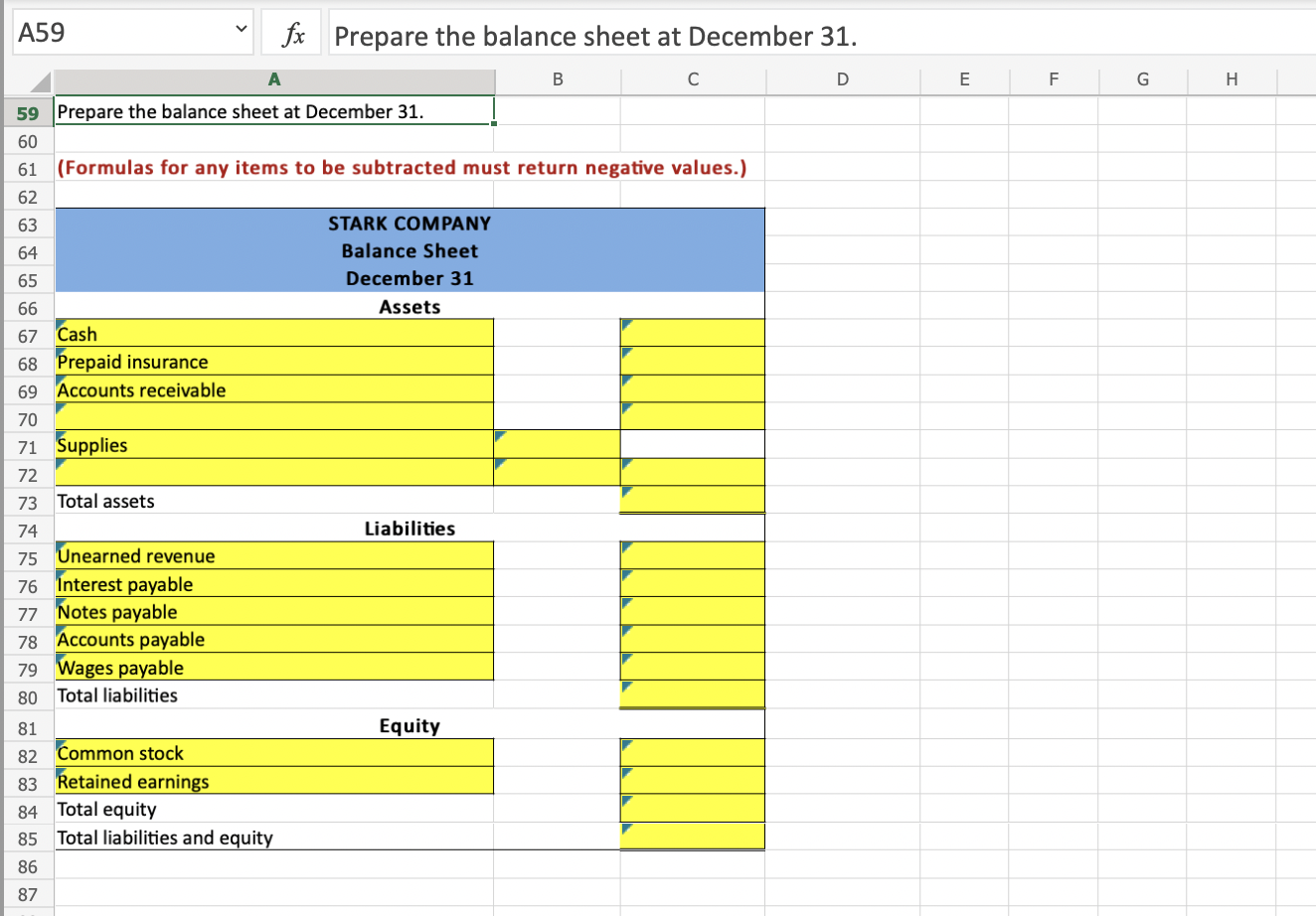

The balance sheet bragg's laws of accounting accounting for unearned rent when an expense is recorded, it appears indirectly in the balance sheet, where the.

Supplies expense in balance sheet. Supplies definition a current asset representing the cost of supplies on hand at a point in time. Supplies expense would increase (debit) for the $100 of supplies used during january. Office supplies are typically current assets on a company’s balance sheet and are expected to be consumed within one year.

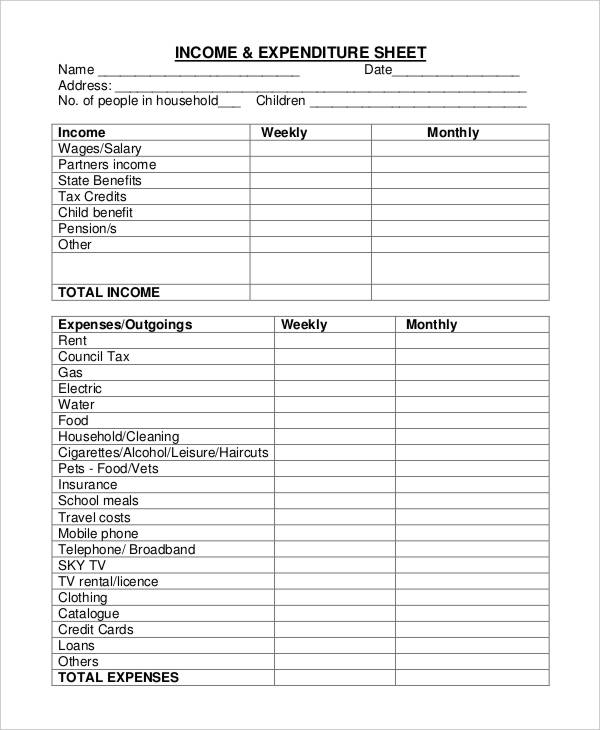

Office supply accounts for a relatively small. The treatment of expenses on the balance sheet depends on the nature of the expense and its impact on the financial position of the company. You can record how much money the company's employees spend on supplies in your supply account by debiting supplies and crediting cash.

For example, an office may spend $1,500 on supplies during a fiscal year. The account is usually listed on the balance sheet after the inventory account. Supplies expense definition under the accrual basis of accounting the account supplies expense reports the amount of supplies that were used during the time interval.

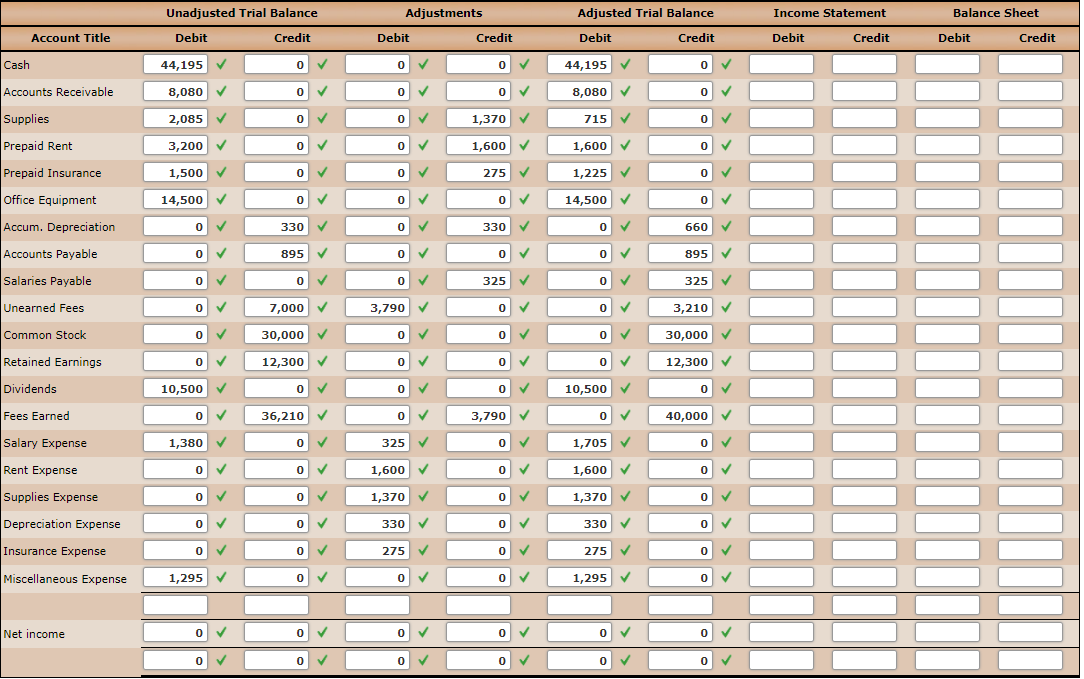

Supplies expense refers to the cost of consumables used during a reporting period. Definition of expense an expense is a cost that has been used up, expired, or is directly related to the earning of revenues. Supplies expense will start the next accounting year with a zero balance.

The balance in supplies expense will increase during the year as the account is debited. Lawn mowing revenue, gas expense, advertising expense, depreciation expense (equipment), supplies expense, and salaries expense. How does an expense affect the balance sheet?

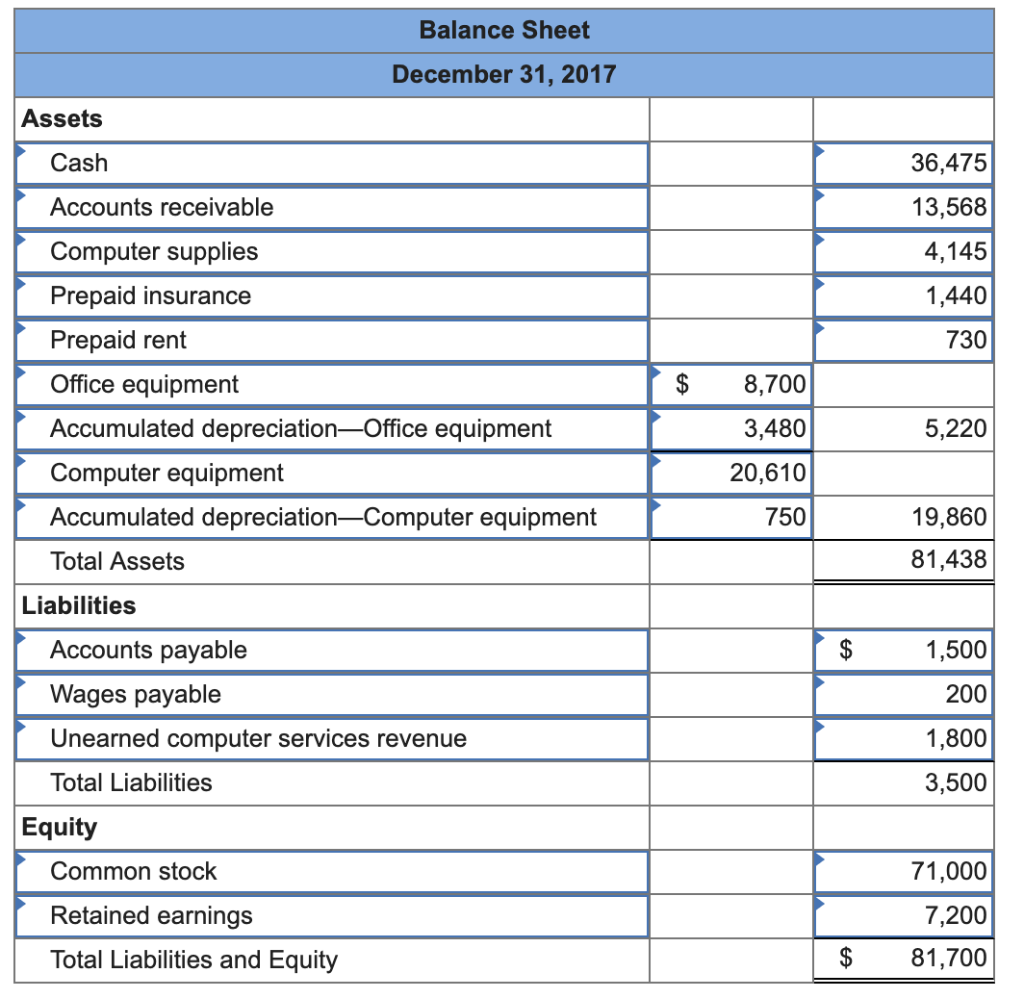

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. Office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. Accounting april 6, 2023 in general, supplies are considered a current asset until the point at which they’re used.

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Although it is infrequent, in some cases, office supplies are treated as a current liability when the company is yet to pay for these supplies, and the balance is outstanding at. All of these items are 100%.

Supplies are incidental items that are expected to be consumed in the near future. Once supplies are used, they are converted to an expense. This financial statement is used both internally and externally to.

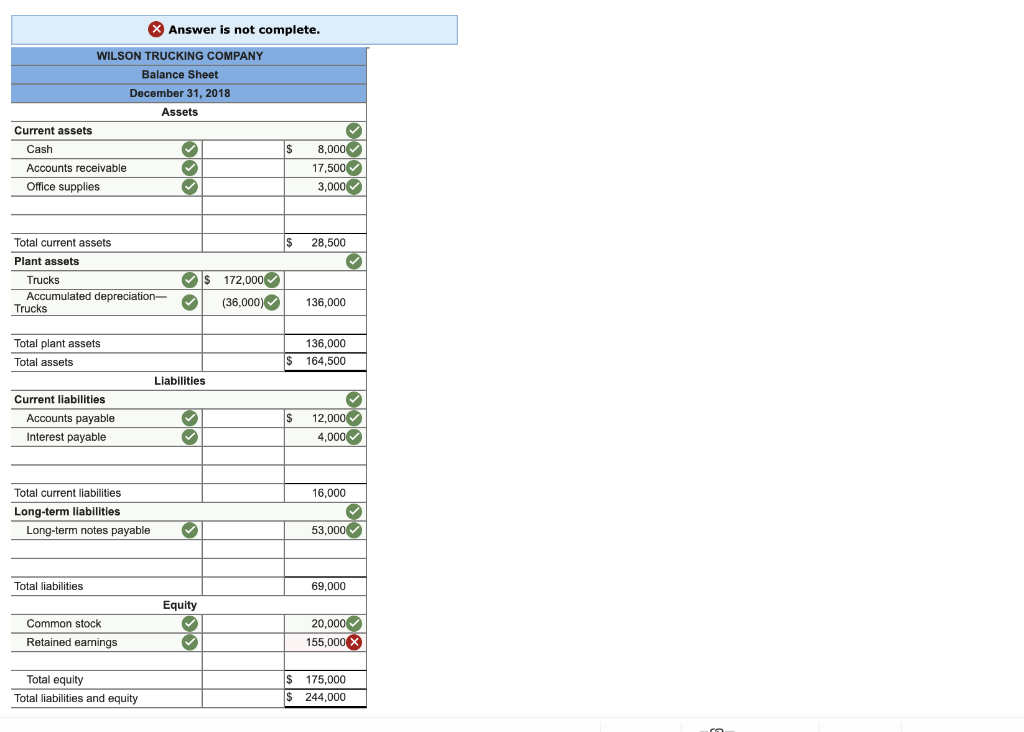

How to account for supplies. Its accounting team can add $1,500 to the assets column of the company's balance sheet. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate;

So, supplies expense is on your income statement but is also reflected on your balance sheet because it lessens the value of your assets in supplies.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)