Fabulous Tips About Trial Balance And Financial Statements

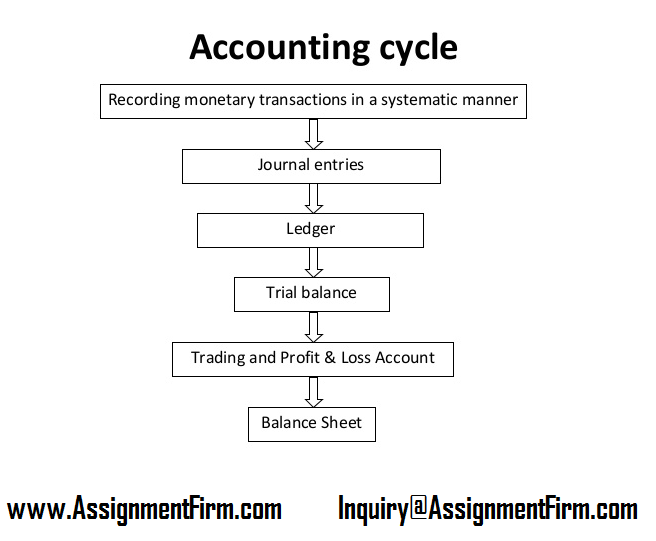

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

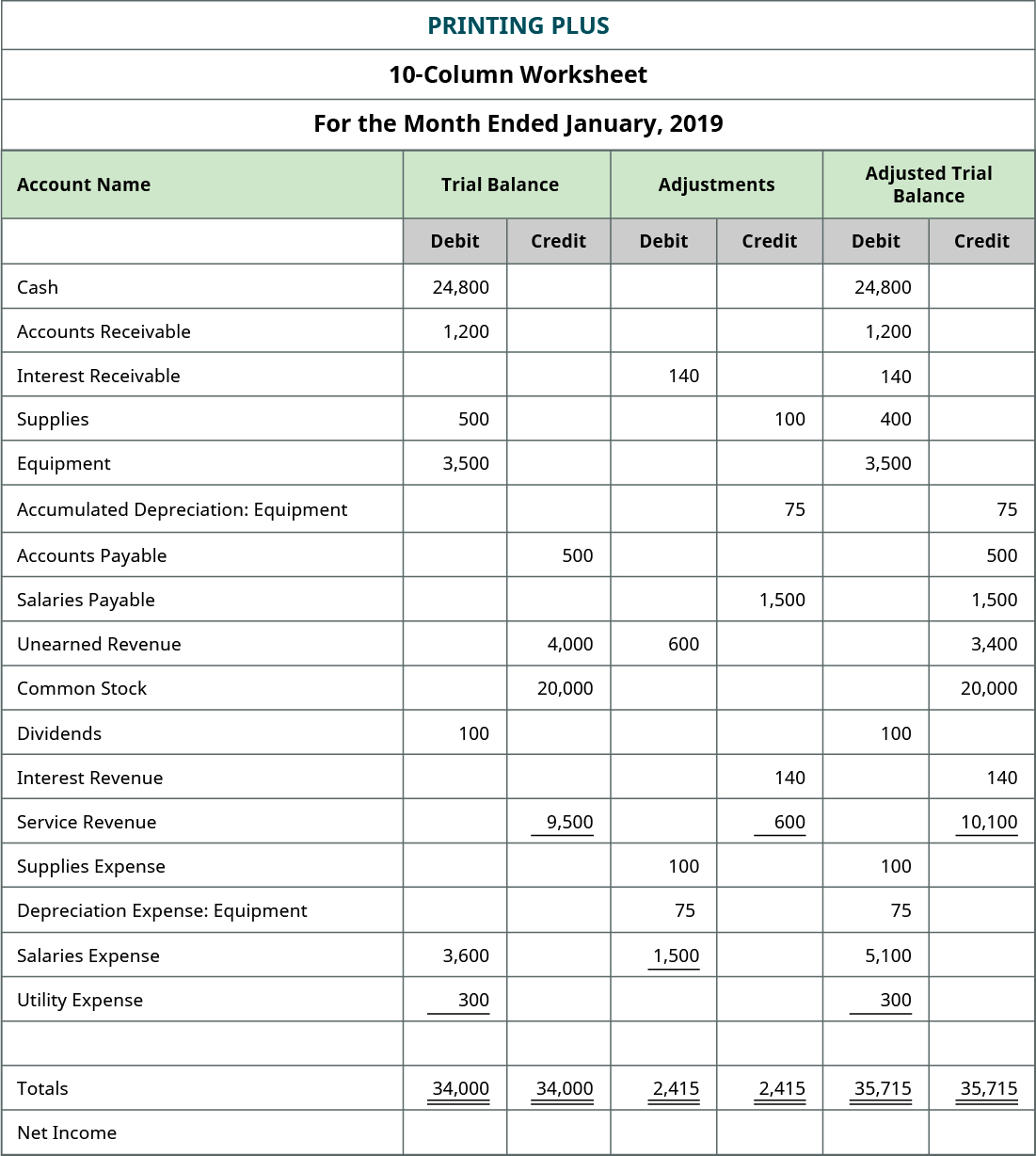

Trial balance and financial statements. Remember that we have four financial statements to prepare: Trial balance and financial statements home / trial balance and financial statements by [email protected] september 21, 2014 lesson 4 difficulty level: In this article, we will show you how to prepare three financial statements from an adjusted trial balance in excel.

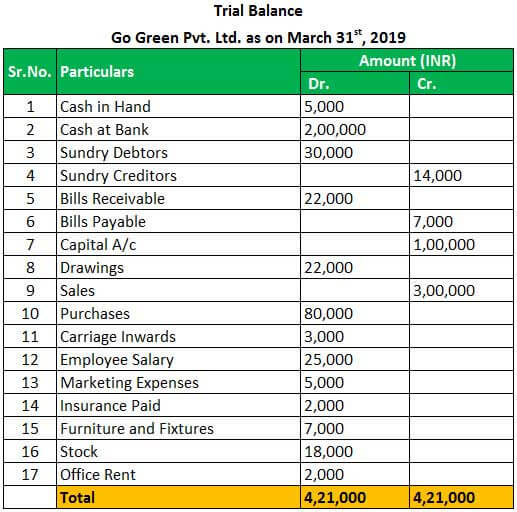

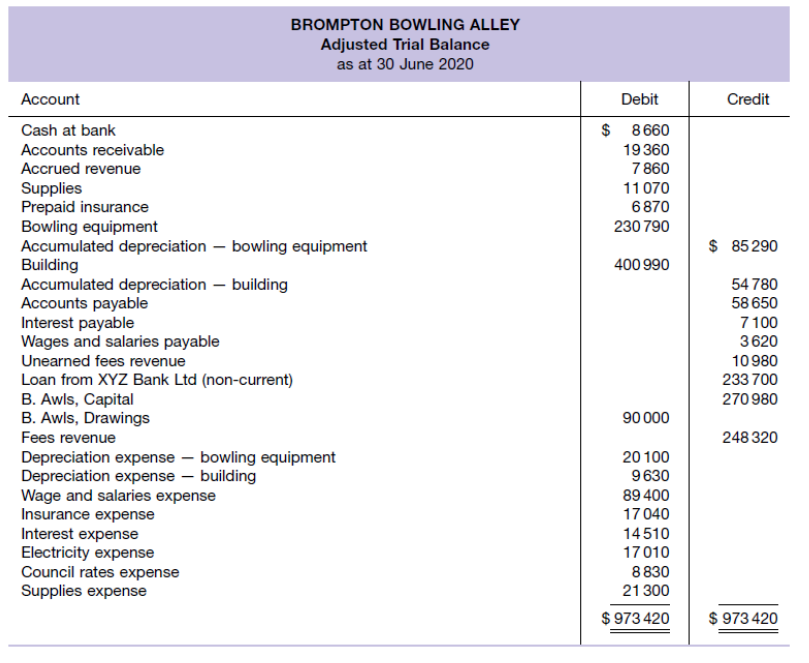

A trial balance typically consists of two columns: One for the debit balances and one for the credit balances. The trial balance mapping process.

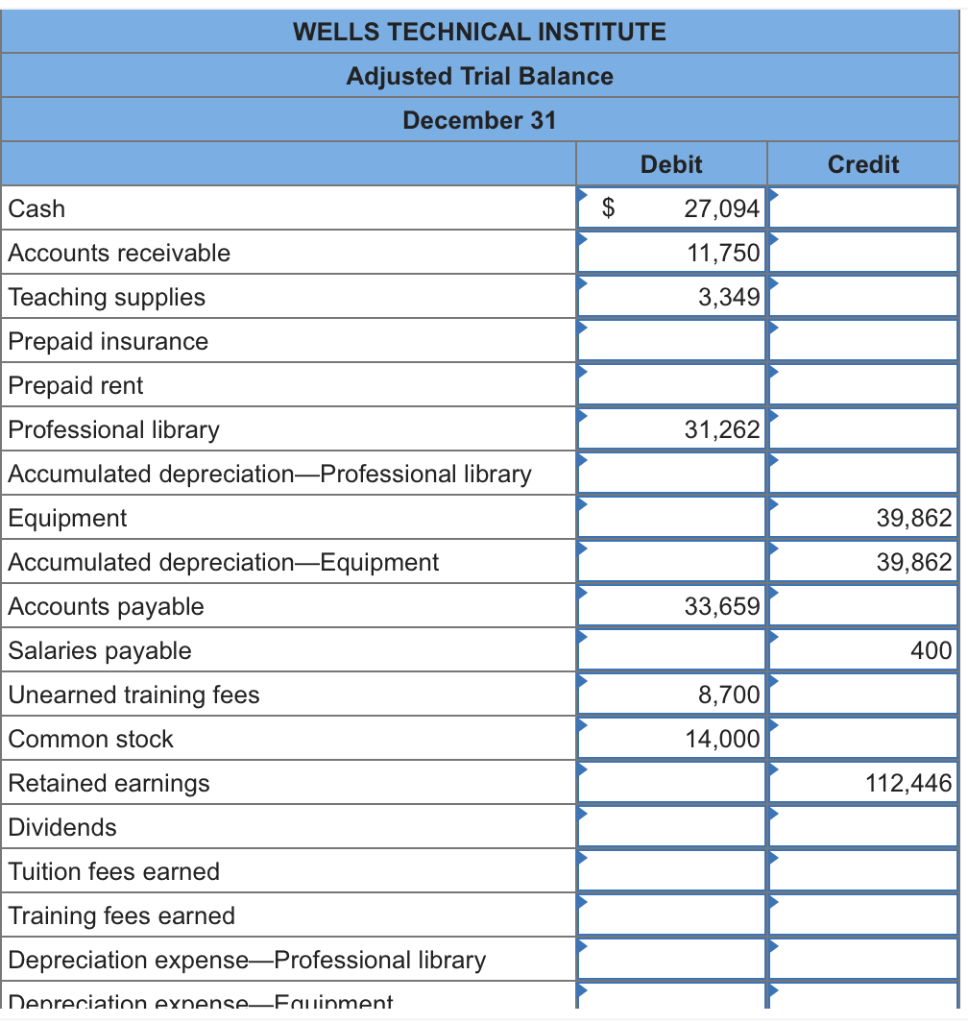

The trial balance serves as a crucial step in the preparation of financial statements, as it shows the closing balances of all accounts during a specific point in time. 3.1 describe principles, assumptions, and concepts of accounting and their relationship to financial statements; Income statement s will include all revenue and expense accounts.

Dec 19, 2023 get free advanced excel exercises with solutions! This will involve adjusting for the following items: A company prepares a trial balance.

In finding that the defendants were able to purchase the old post office in washington, d.c., through their use of the fraudulent financial statements, justice engoron rules that the. Export the relevant data from our system and get it to excel; Closing inventory depreciation accruals and prepayments irrecoverable debts and the allowance for receivables.

The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. Preparing financial statements is the seventh step in the accounting cycle. Accounting articles trial balance trial balance a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in creating financial statements.

Trial balance and financial statement we have talked about creating journal entries and posting to general ledgers. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct.

1 trial balance in this chapter we will bring together the material from theprevious chapters and produce a set of financial statements from a trialbalance. Build out our statement structure in excel; Table of contents expand financial statement

The total debits should equal the total credits, which signifies that the accounting equation (assets = liabilities + equity) is in balance. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. In terms of mapping our trial balance to the financial statements, we can follow this overall guideline.

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. 3.2 define and describe the expanded accounting equation and its relationship to analyzing transactions;

![Solved [20] QUESTION TWO The trial balance and additional](https://d2vlcm61l7u1fs.cloudfront.net/media/f5c/f5c66eed-4d83-425c-9798-4a85c15258eb/php5z9sHV.png)