Have A Info About Prepare The Income Statement For Garcon Company

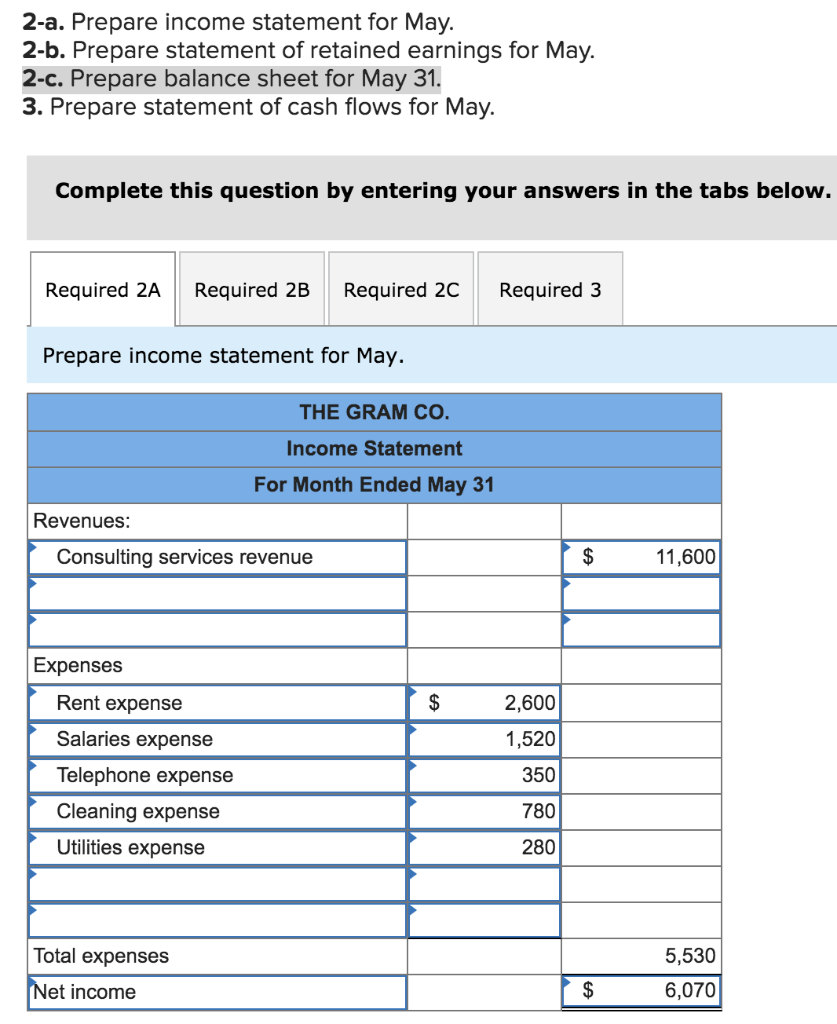

Here is a question for the students.

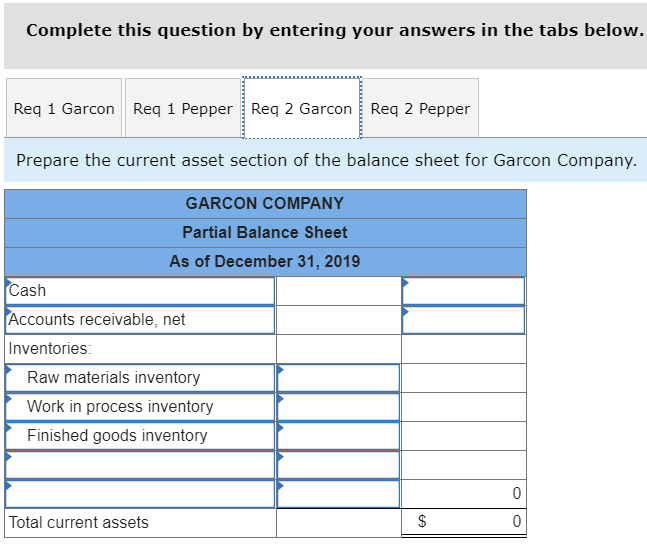

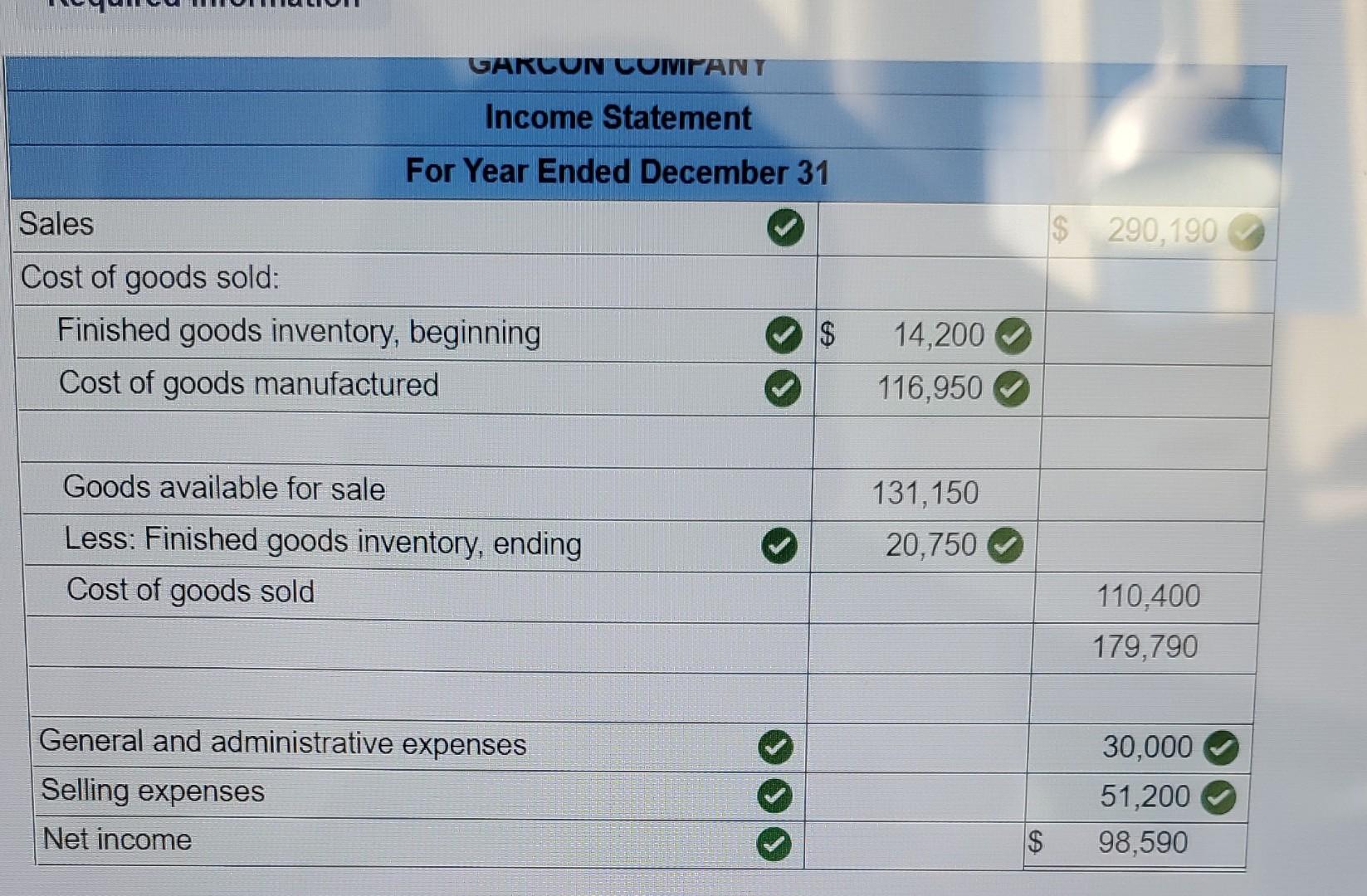

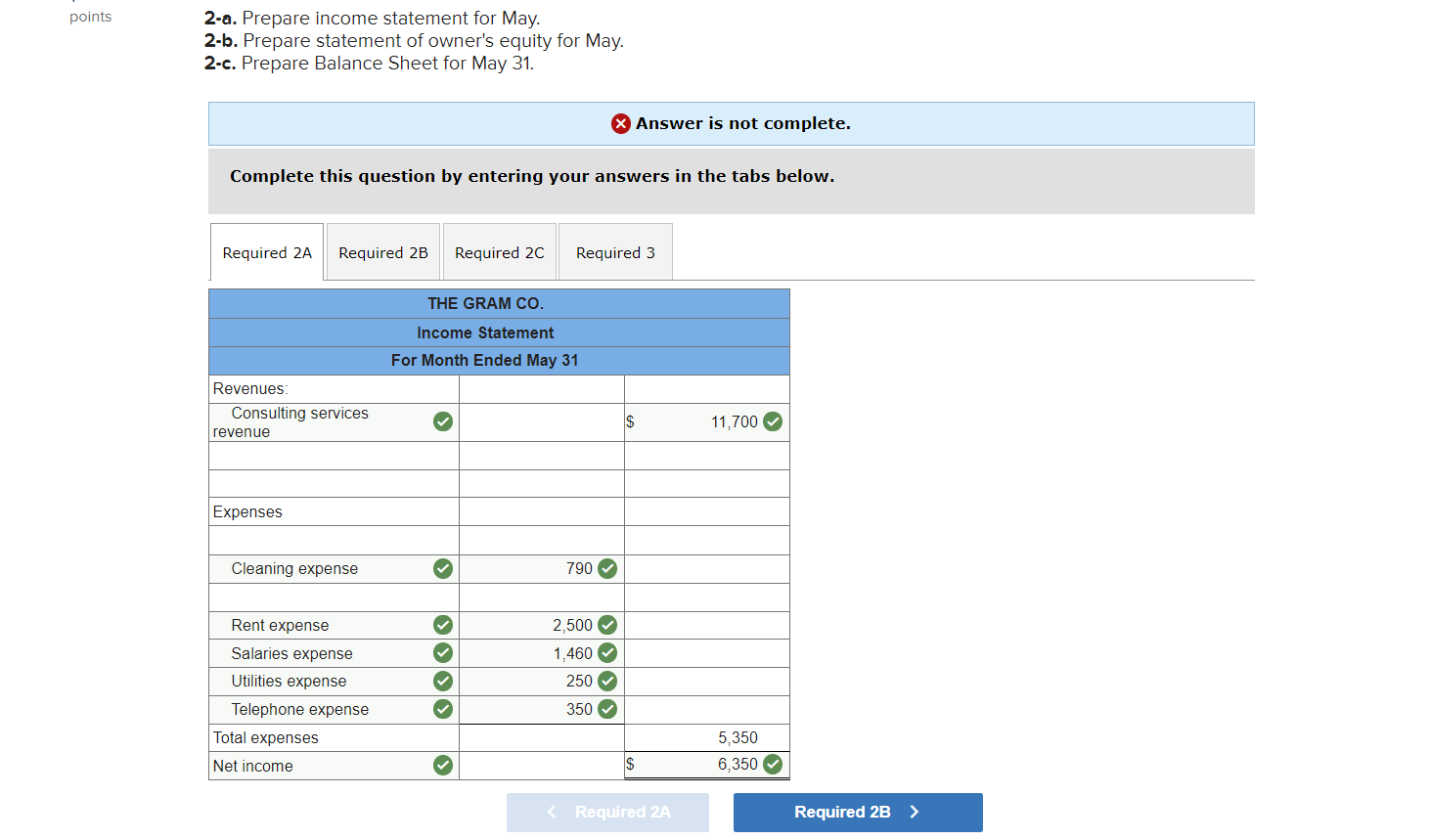

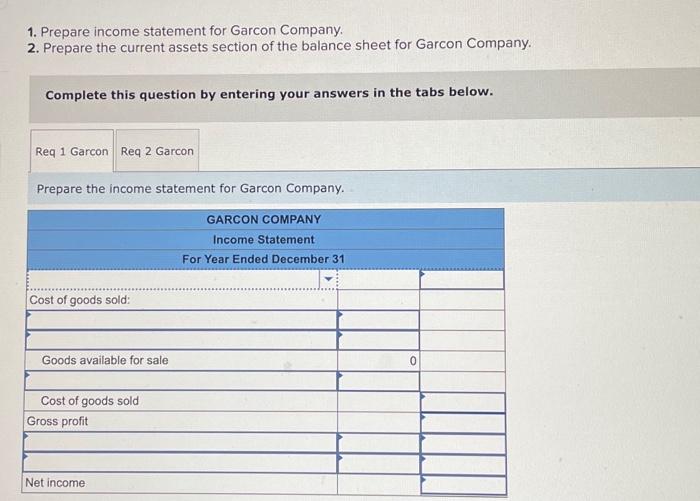

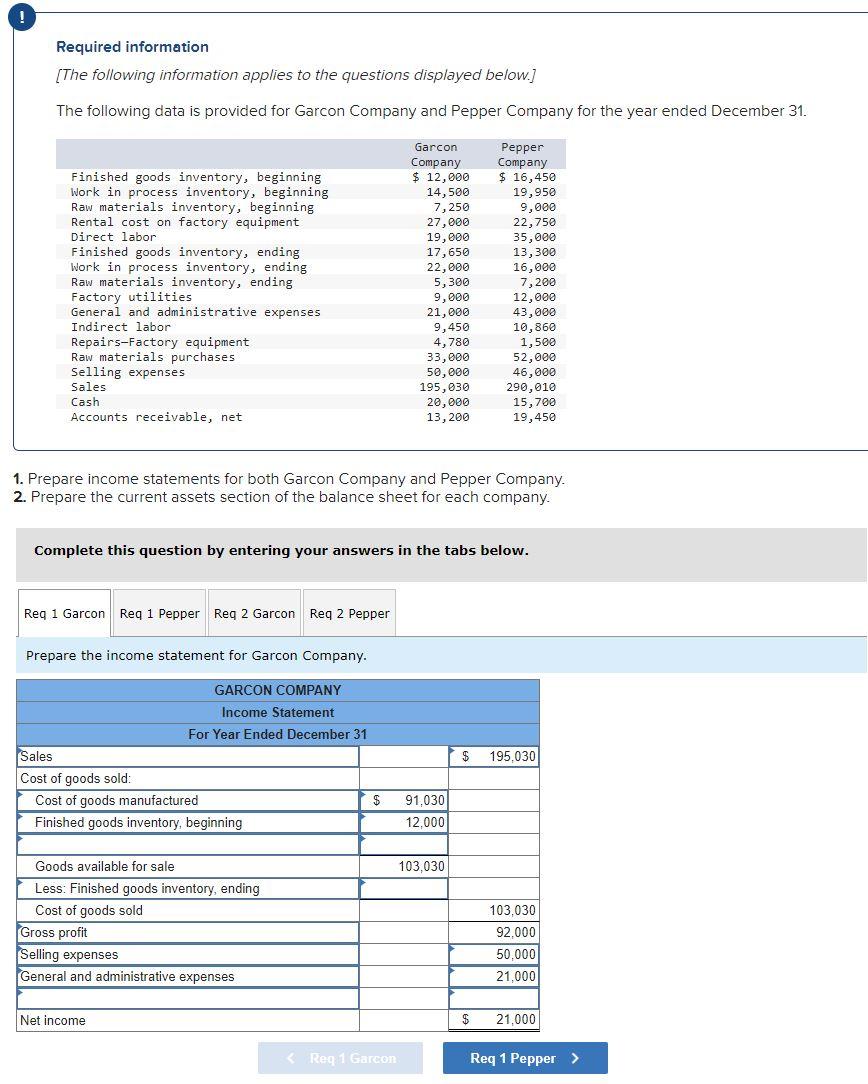

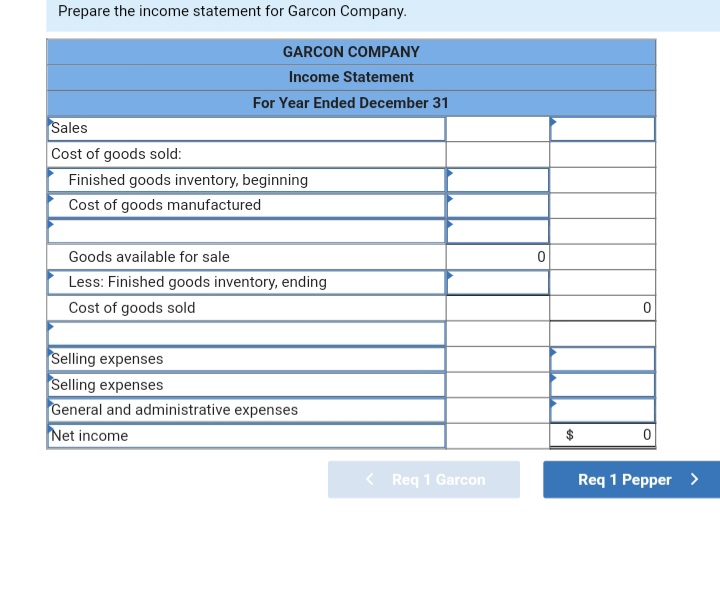

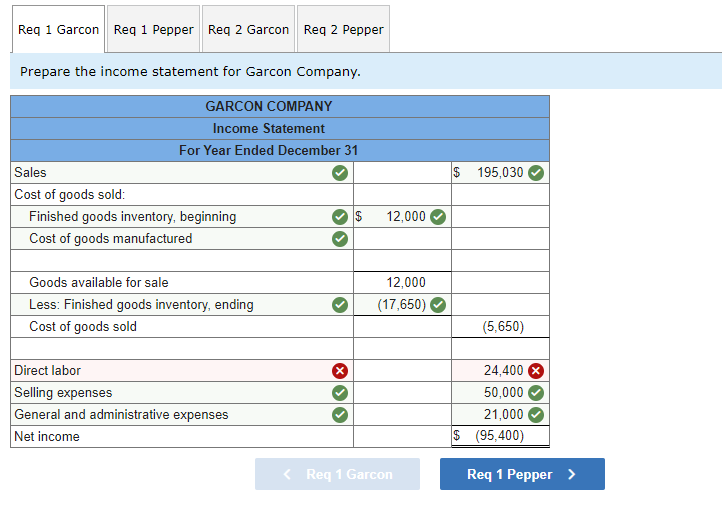

Prepare the income statement for garcon company. Prepare income statements for both garcon company and pepper company. Answer is complete and correct. Prepare income statements for both garcon company and pepper company.

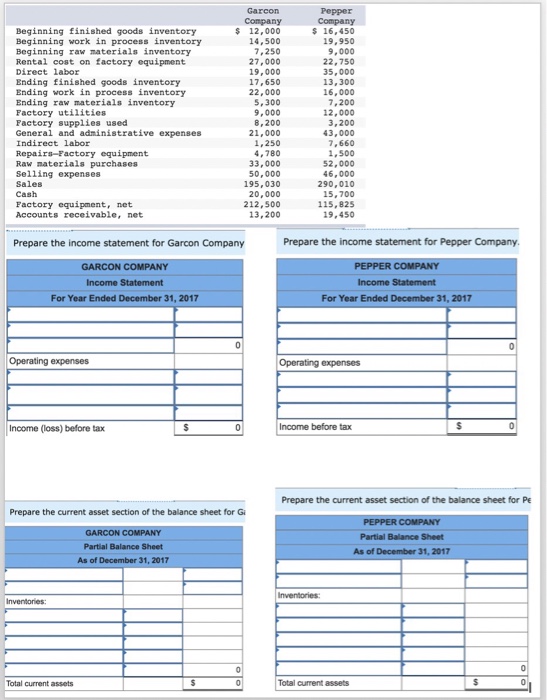

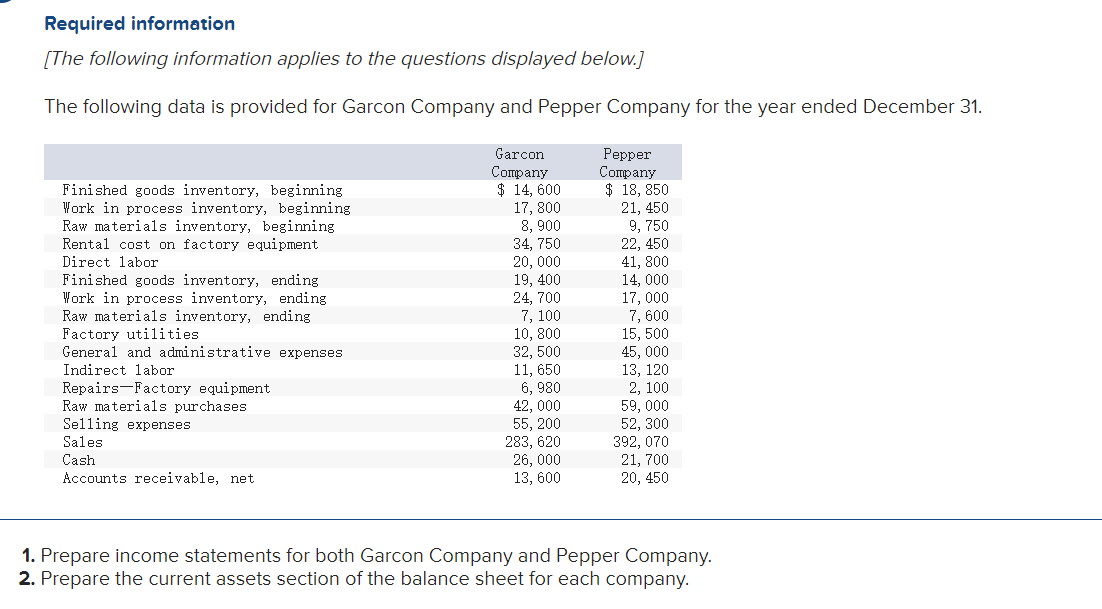

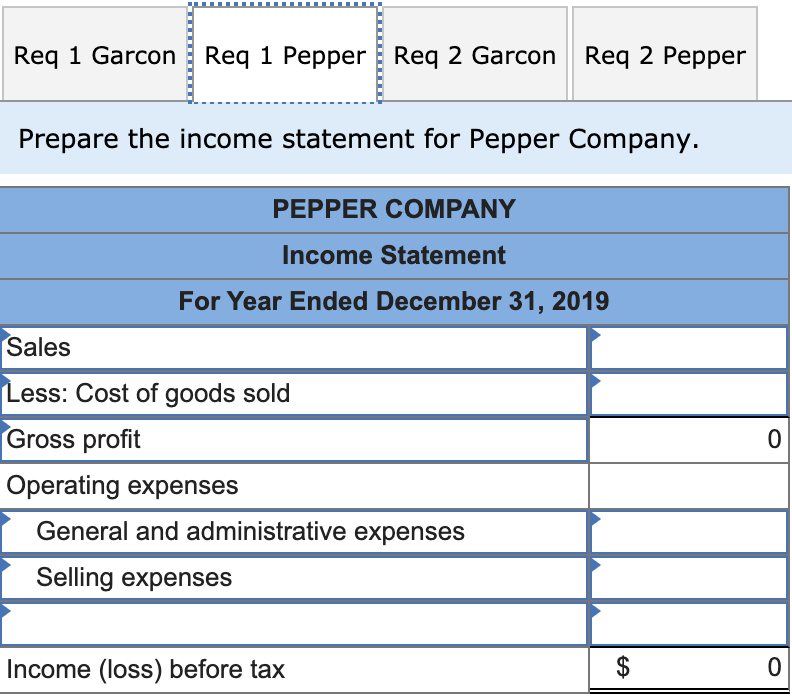

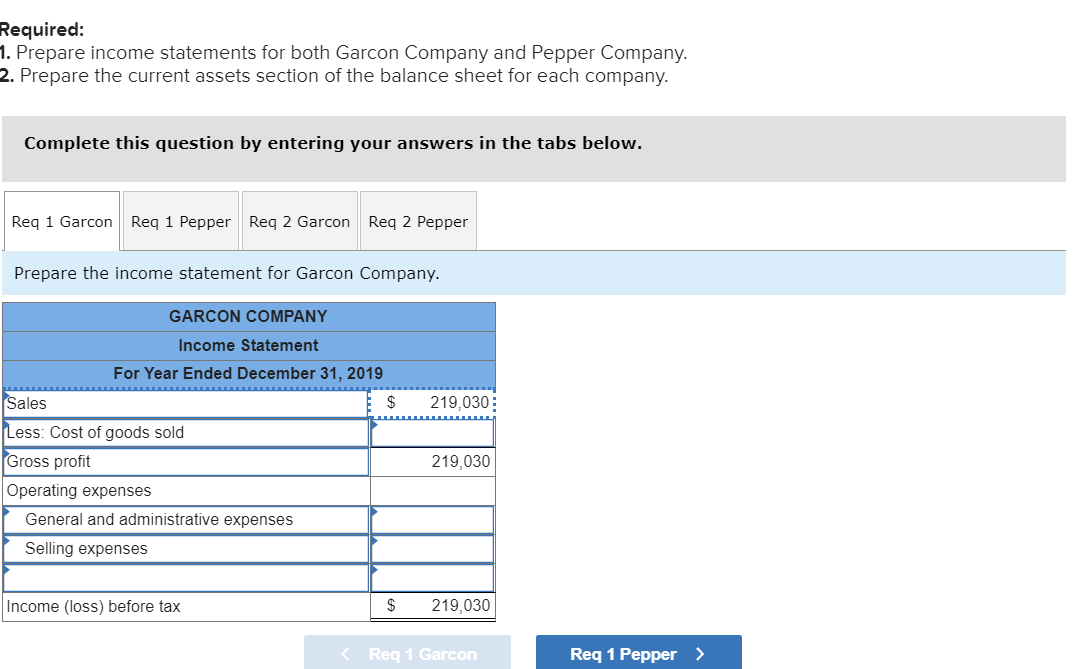

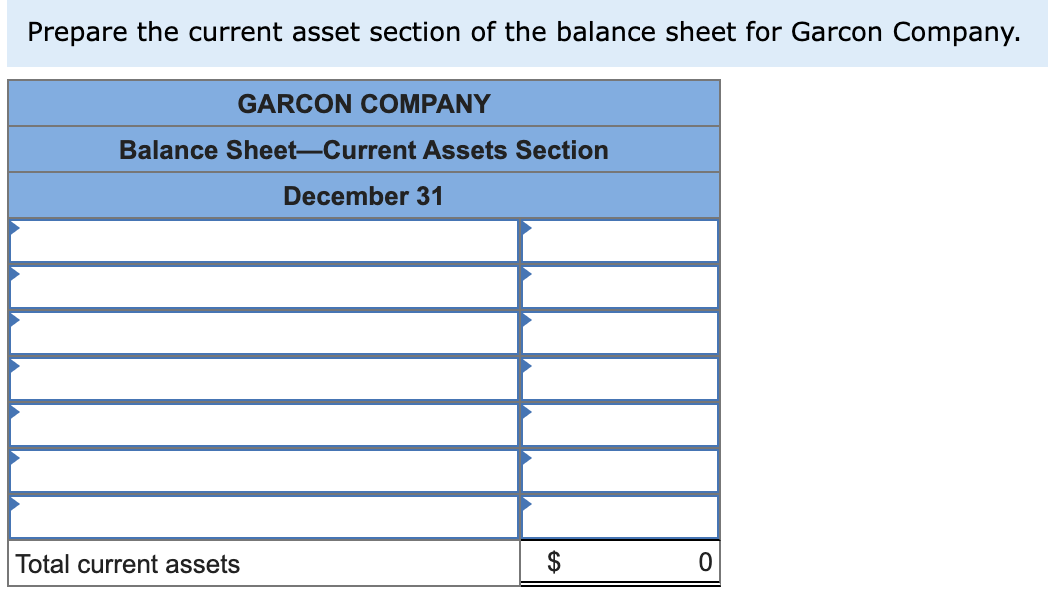

Prepare income statements for both garcon company and pepper company. Prepare the current assets section of the balance sheet for each company. Prepare income statements for both garcon company and pepper company.

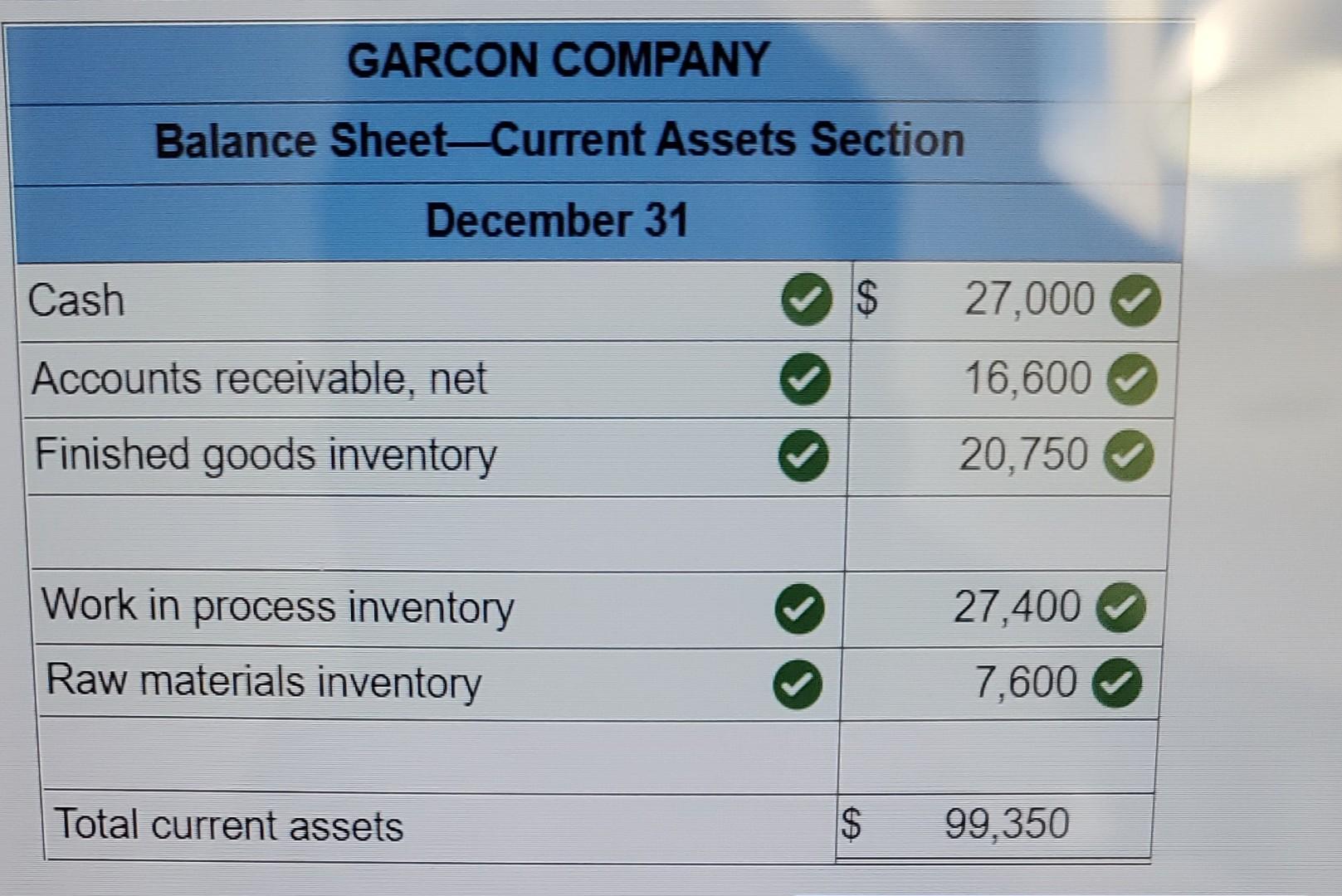

Prepare the current assets section ofthe balance sheet for each company. Prepare income statements for both garcon company and pepper company. Prepare income statements for both garcon company and pepper company.

Prepare the current assets section of the balance sheet for each company. Prepare the income end of preview Prepare income statements for both garcon company and pepper company.

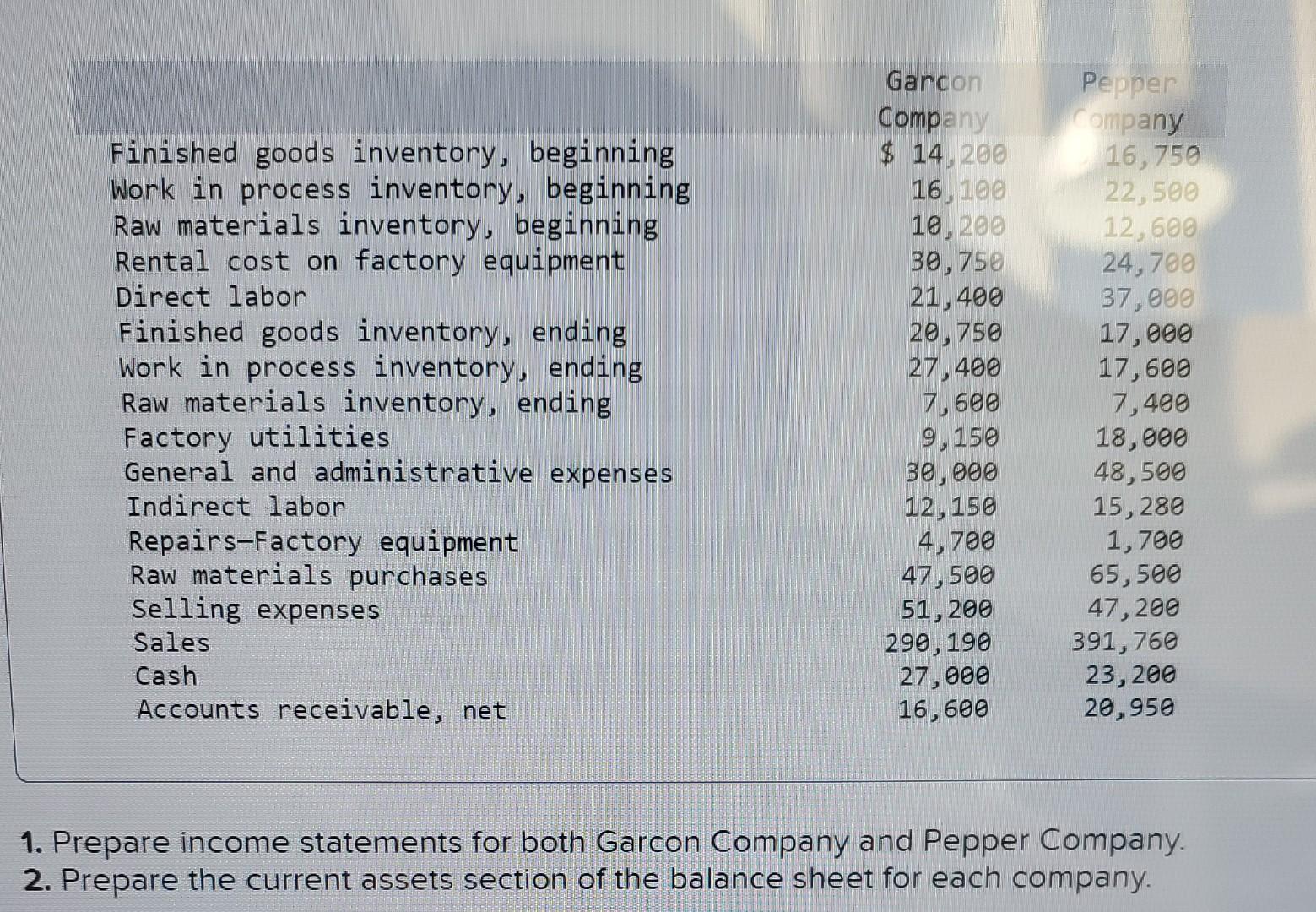

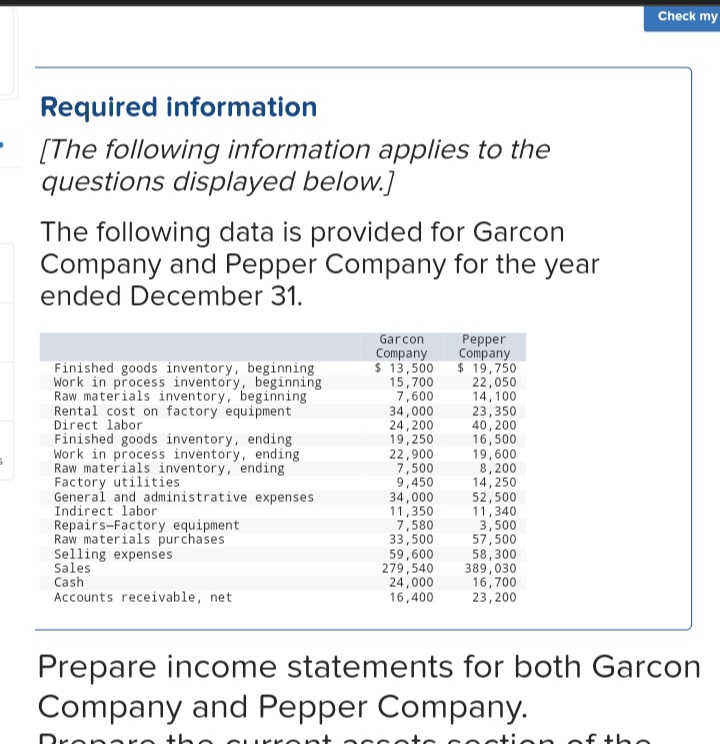

Using the following data from both garcon company and pepper company for the year ended december 31, 2019, prepare (1) an income statement and (2) the. The following data is provided for garson company and pepper company. Prepare the income statement for garcon company.

Prepare the current assets section of the balance sheet for each company. Prepare income statements for both garcon company and pepper. The following data is provided for garcon company and pepper company for the year ended december 31.

To prepare income statements for both garcon company and pepper company, you need to gather revenue and expense data and follow the. Prepare income statements for both garcon company and pepper company. Identify which set of numbers relates to the manufacturer and which to the merchandiser.

Prepare the current asset section for each company from this information. Prepare the current assets section of the balance sheet for each company. Prepare income statements for both garcon company and pepper company.

Prepare income statements for both garcon company and pepper company. Prepare income statements for both garcon company and.

![[Solved] The following data is provided for Garcon Company](https://media.cheggcdn.com/study/387/387388ee-d83a-45d9-aa3e-6354648e5ba0/image)