Neat Info About P&l Of A Restaurant

A p&l is one of the building blocks of your restaurant accounting and should be updated on a regular basis, though the exact timing is up to you.

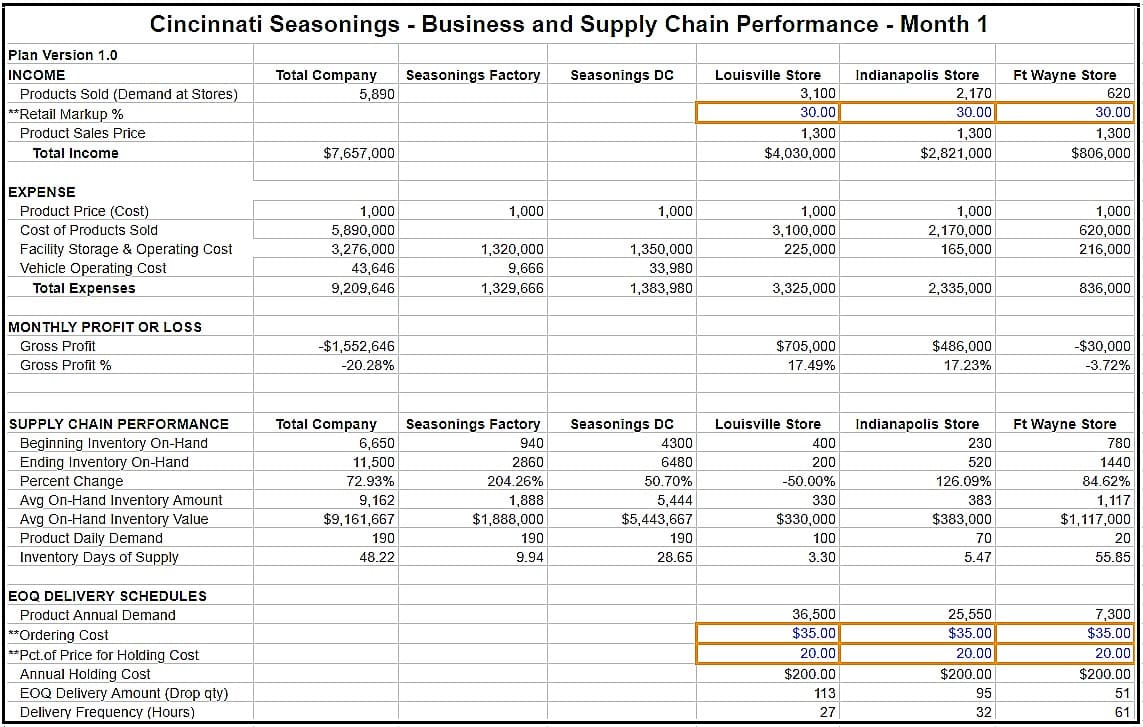

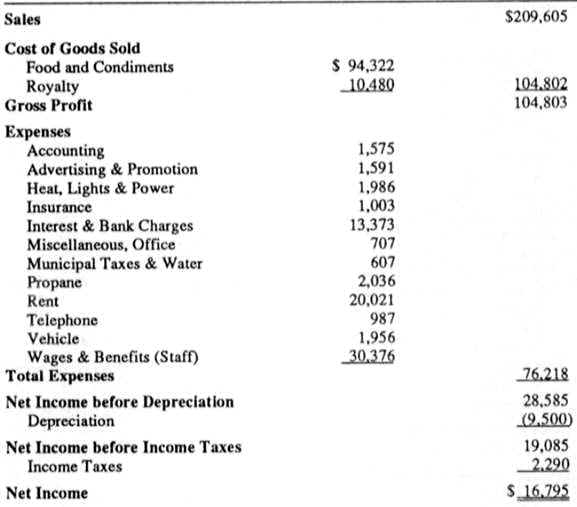

P&l of a restaurant. Net profit or loss p&l statement also enables you to calculate food cost percentage, gross profit, and net profit or loss. Cost of goods sold (cogs) 3. This is also different than a balance sheet.

A restaurant profit and loss statement also referred to as a restaurant p&l, shows your business’ costs and revenue (net profit or loss) during a specified period of. As we go through a restaurant p&l example, think of your sales equaling 100% or $1, and think of your cost % as pennies taken away from that dollar. In general, you should accomplish the following:

Your prime costs will roll up into your profit and loss statement (see below); 750 subscribers 1.7k views 1 year ago the tip share many operators don’t fully understand how to read a restaurant's profit and loss statement (p&l). What’s included in a restaurant profit and loss statement?

Download it now summary a great tool for managing your restaurant is a profit and loss statement but solely depending on. You should use your p&l to analyze your restaurant’s operations, budget, and growth. It’s a snapshot of your restaurant’s performance and whether you’re earning a profit or sustaining losses.

A great tool for managing your restaurant is a profit and loss statement but solely depending on it to run your business is not ideal. Check out my 19 point restaurant audit checklist!

A p&l gives you a clear view of what happened in your restaurant over any period of time. In contrast, a balance sheet. A restaurant p&l is a financial statement that provides a comprehensive overview of a restaurant’s revenue, costs, and expenses over a specific period of time, typically on a.

Watch this video as i show you. In this video we will take you through an example, top to bottom, of a p and l statement, as well as discuss the best practices on how to utilize your weekly profit and loss. The p&l breaks down how much your restaurant is making.

A restaurant profit and loss statement, also called a p&l or income statement, is a financial document that details a business’s total revenue and expenses over a specific time. A restaurant p&l statement—also known as a restaurant profit and loss statement or a restaurant profit and loss statement—is a document that details the. A p&l statement is similar to a cash flow statement in that it details changes in accounts over a set period.

In a restaurant, the profit and loss statement, often called p&l, outlines the revenue, costs, and expenses incurred during a specific period. If you’re generating a p&l only once per month, however, you should at least be generating a.

![Restaurant Profit and Loss Complete Guide [Free template]](https://sharpsheets.io/wp-content/uploads/2022/12/Screenshot-2022-12-16-at-17.10.04.png)

.jpg)