Build A Info About Sundry Expenses In Profit And Loss Account

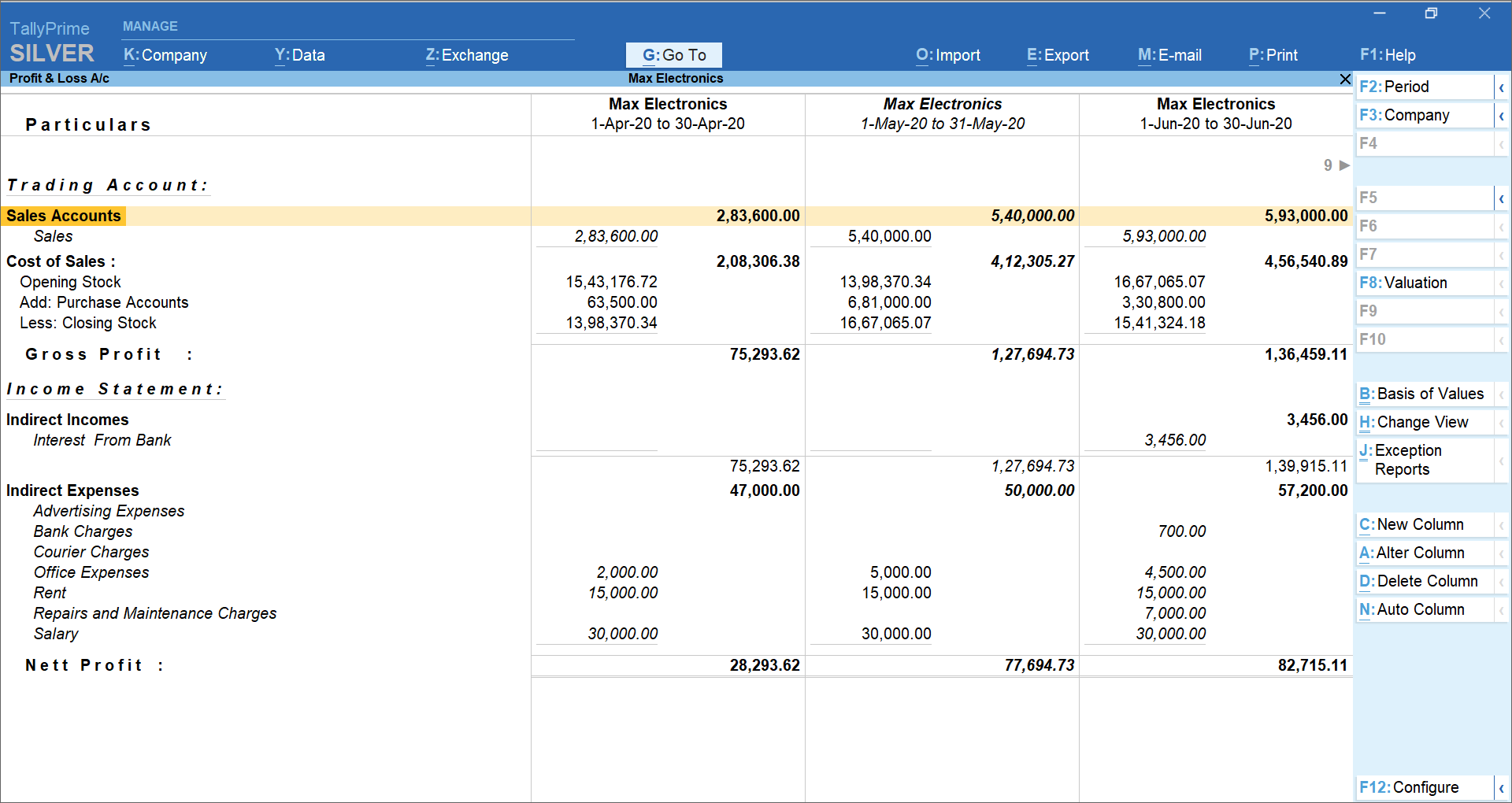

Sundry expenses are shown on the expenses side (left) of a profit and loss account (income statement).

Sundry expenses in profit and loss account. A credit represents an increase in. A company’s statement of profit and loss is portrayed over a period of time, typically a month, quarter, or fiscal year. Size, industry practice & nature of an expense plays an.

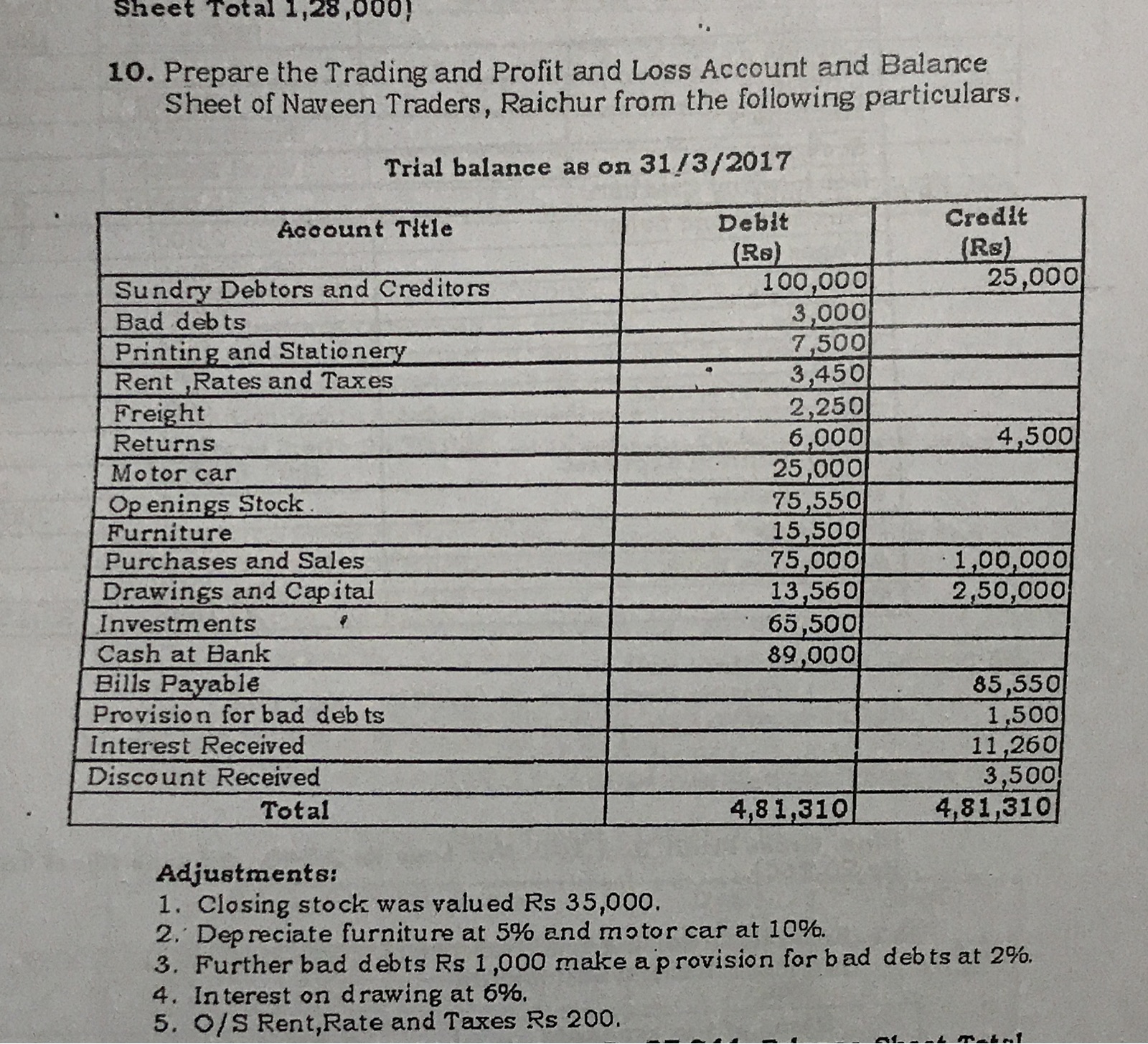

These are small, random expenditures that don’t happen very often and are typically unusual in nature. Sundry income debit or credit in profit and loss account in a profit and loss account, sundry income is recorded as a credit. Sundry debtors in balance sheet.

Sundry expenses in the ledger account. Place your sundry expenses on the expenses side (left) of your profit and loss account (income statement). Many such debtors combined together are known as “sundry debtors”.

Profit and loss account is made to ascertain annual profit or loss of business. The only utility of a sundry column is to account for expenses that are too vague or nominal to be properly classified. Expenses included in the profit and loss account.

The main categories that can be found on the p&l include:. Those expenses are deducted from profit or added to a gross loss and thus, the resultant figure will be net profit or a net loss. Size, industry practice & nature of an expense plays an important role to determine whether it should be included in sundries or be given a separate ledger account.

In the books of daniel constructions note: There are a couple of different ways yo u can record your company’s sundry expenses, meaning you can choose the. Sundry expenses may only be for.

What is the definition of sundry expenses? Profit and loss statement (p&l):

Back in the days of manual. Definition of sundry expenses in accounting and bookkeeping, sundry expenses are expenses that are small in amount and rare in occurrence. Sundry costs will appear in the statement of profit & loss (sopl) as they are an ‘outflow of economic.

All the items of revenue and expenses. Sundry income in profit and loss account accountants will show a credit for sundry income in an income statement, also known as a profit and loss statement. Creditors in the books of axis.

When producing your profit and loss account or general ledger, you need to report sundries on the expenses side of your chart of accounts. What counts as sundry expenses depends. Recording sundry expenses in accounting.