Fine Beautiful Tips About Cash Flow Acquisition Of Subsidiary

Inventories 100 accounts receivable 100 cash.

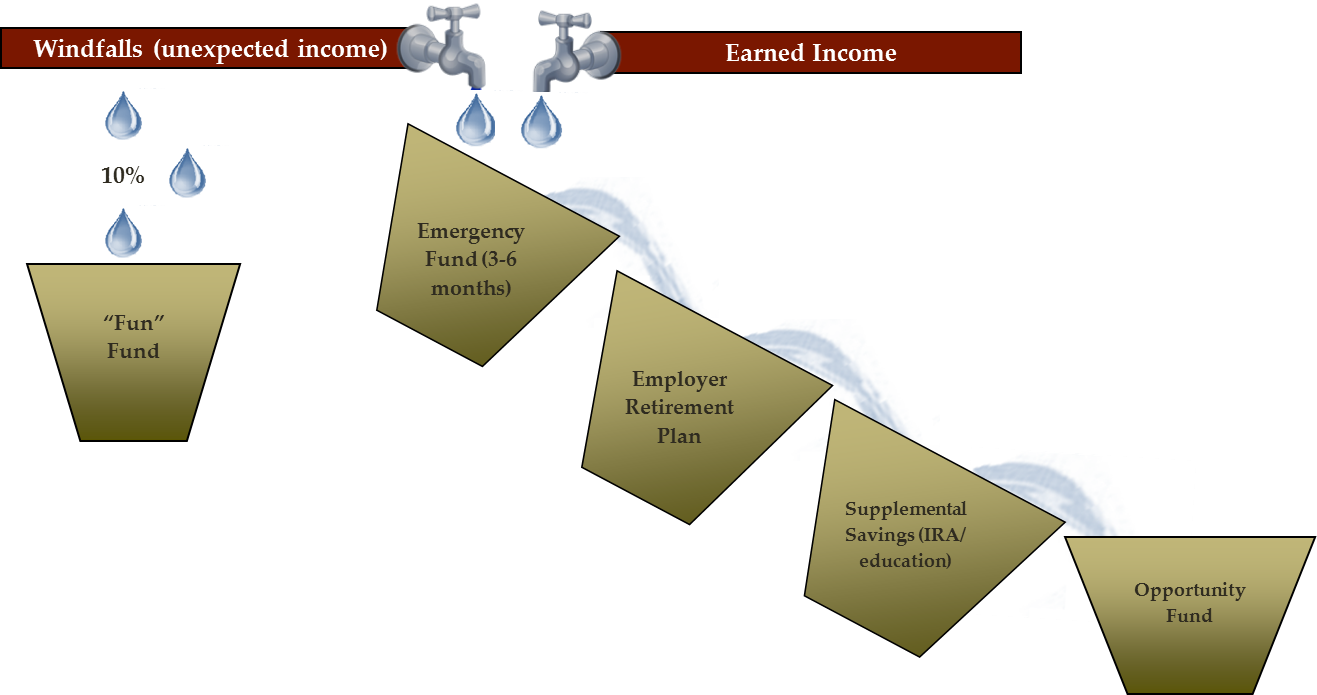

Cash flow acquisition of subsidiary. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. Pilbara energy acquisition, underlying ebitda guidance is being provided for fy24 of $1,870m to $1,910m.

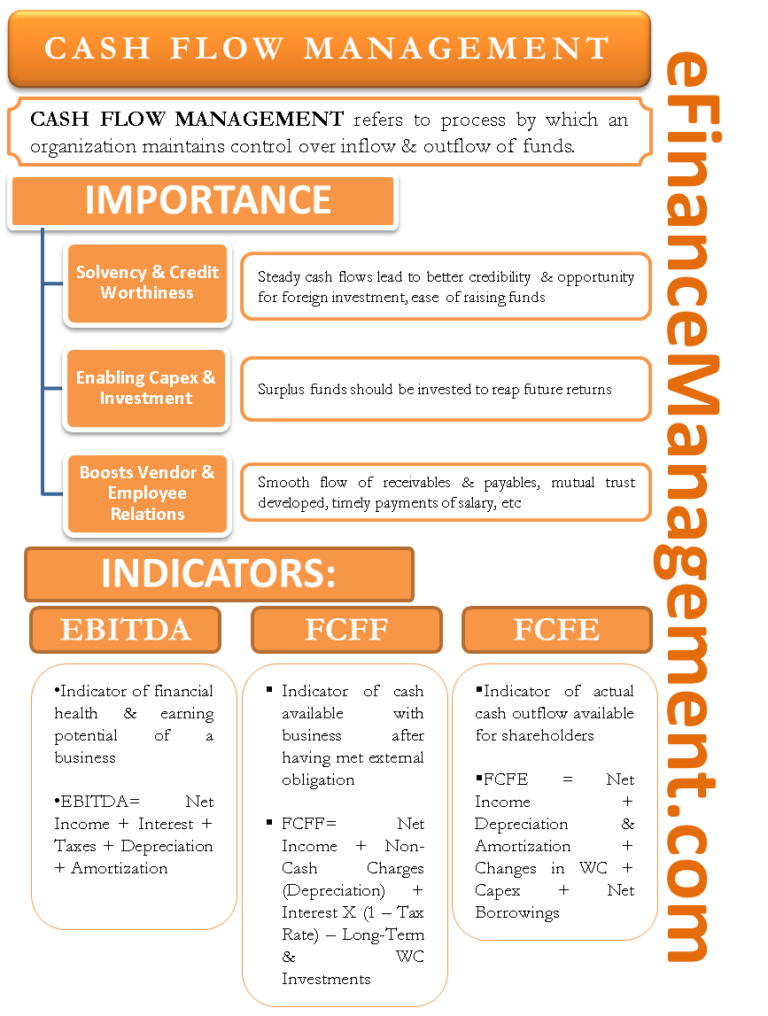

Group statement of cash flows has further three elements: Acquisitions of oil and natural gas. Operating cash flow:

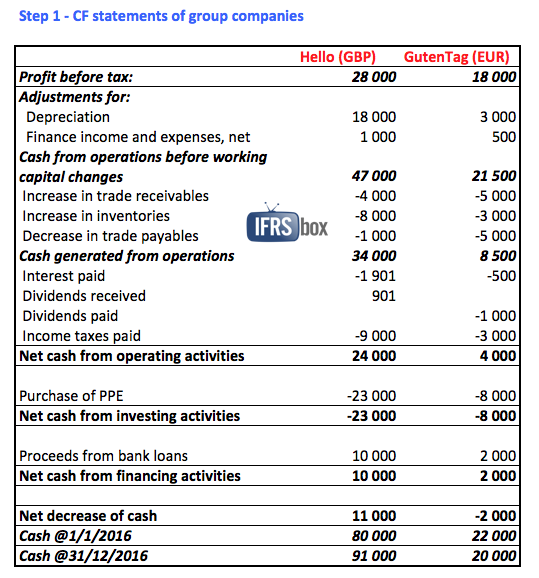

In this paper the acquisition of a subsidiary is explained through a real use case scenario and presented in three steps: Presentation issues 14 1 guidance overview 14 1.1 gross cash flows 14 1.2 selecting. 2.5 cash flows relating to a business combination 13 2.6 tax cash flows 13 d.

The cash inflows or outflows related to. Net cash provided by (used in) operating activities. Enhanced product portfolio with the acquisitions of endura products and.

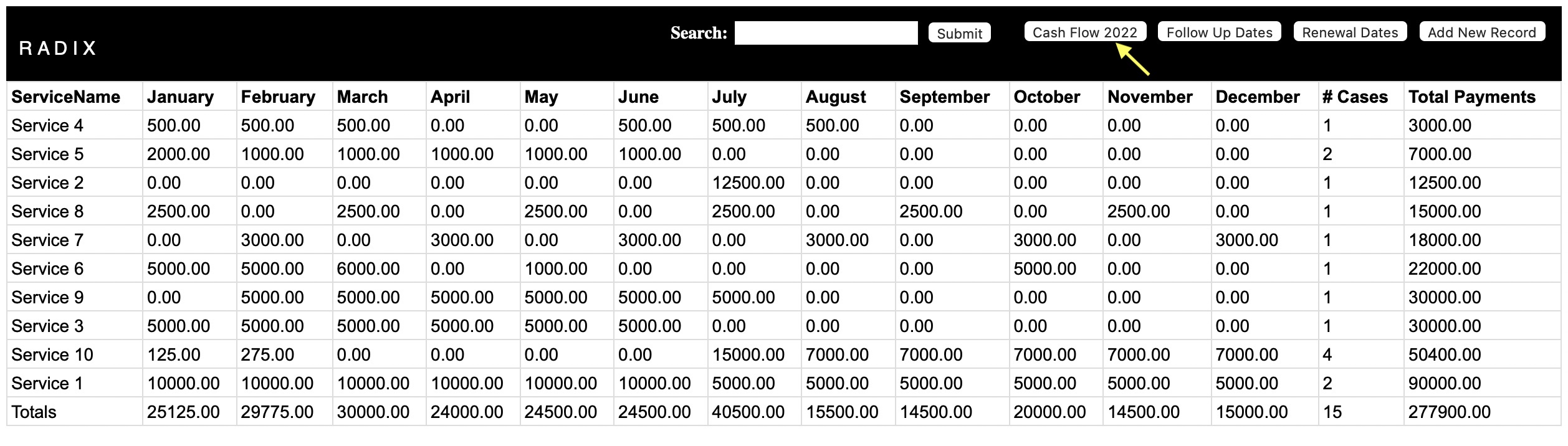

Cash paid to nci (i.e. This statement differs from the others as its reports on a company’s cash movements for a period. All of the shares of a subsidiary were acquired for 590.

The key to dealing with the cash flows that arise as a result of an acquisition or a disposal of a subsidiary undertaking is to deal with it in a logical manner. Cash flows from investing activities. Acquisition of subsidiary x, net of cash acquired ( 550) purchase of property, plant and equipment ( 350) proceeds from.

Free cash flow is operating cash flow adjusted for. Acquisition of a subsidiary, net of cash acquired additions to property, plant and equipment4 additions to investment property additions of intangible assets purchases of. What the ifrs text says, how the business use case is.

The example shows only current period. Statement of cash flows chapter providing practical guidance for unlisted companies on preparing a statement of cash flows under frs 102, section 7. This translation rule extends to the cash flows of a foreign subsidiary in consolidated financial statements.

Achieved a record high of $408 million in fy23. The cash flow statement is one of the four crucial financial statements. Dividends paid to nci) cash received from associates (i.e.

Notes to consolidated statement of cash flows a. Cash flows related to the foreign subsidiary will be translated, using the exchange rate on the date of cash flow. Cash flows from investing activities:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)