Beautiful Tips About Adjusted Profit And Loss Account

The adjusted profit of 48 cents a share was the first adjusted income since the first quarter of 2022.

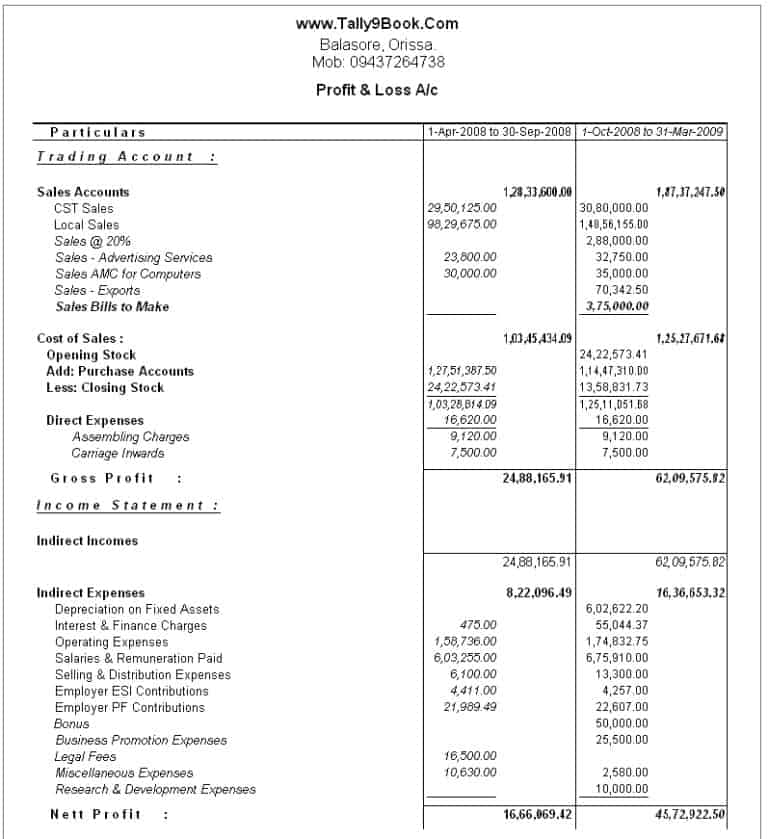

Adjusted profit and loss account. Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period. Divisible profit/loss is the adjusted profit/loss minus partners' salaries, allowances, bonuses, cpf contributions, interest on capital and any other expenses paid on behalf of. On average, five analysts polled by thomson reuters expected the company to report profit.

Every company prepares a profit and loss account statement at the. Adjusted profit per share was c$0.08 compared to a loss of c$0.28. The airline now expects its 2024 core profit to be in the range of c$3.7 billion ($2.75 billion) to c$4.2 billion ($3.12 billion), compared with a target of c$3.5 billion to.

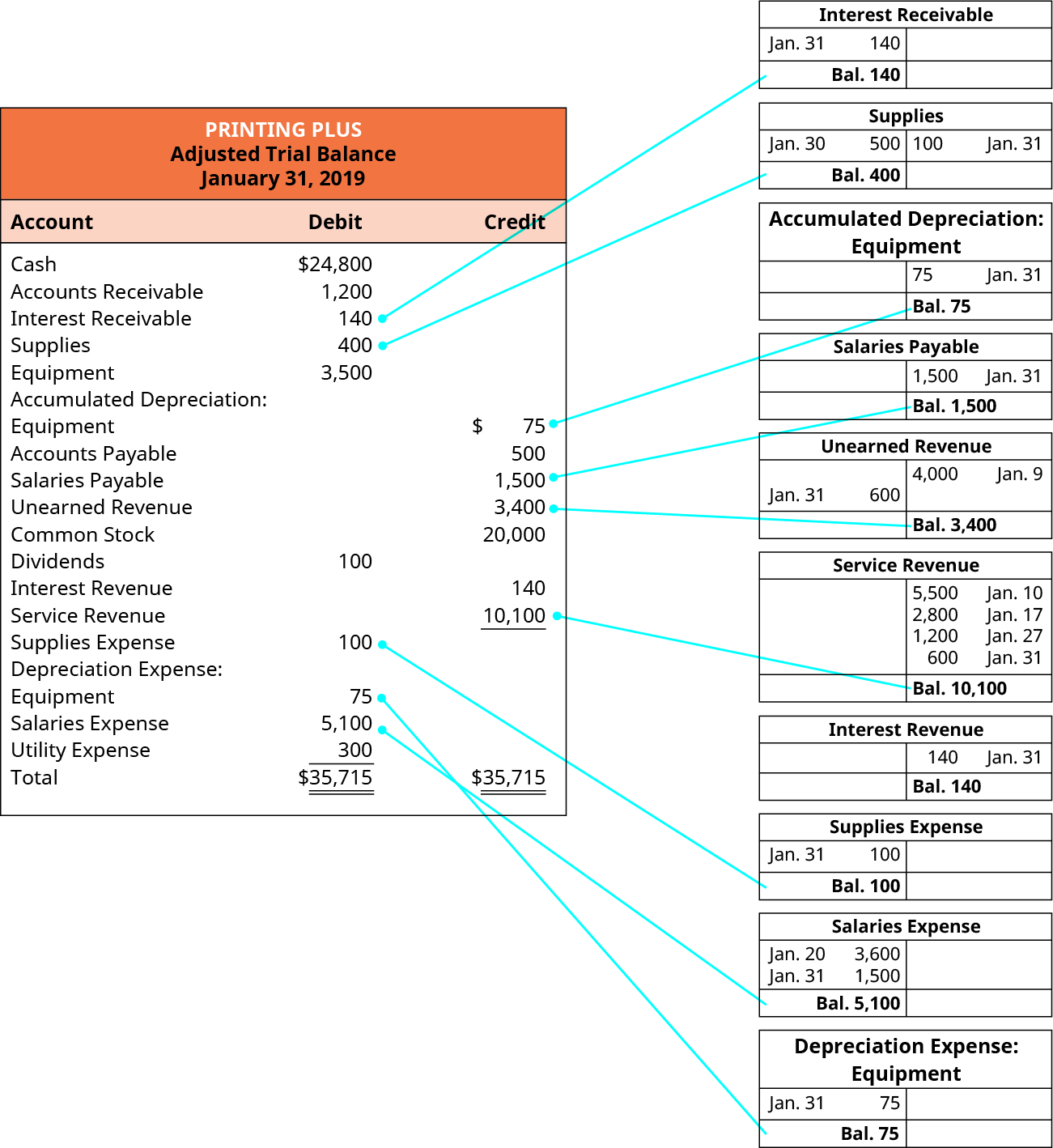

Negative value is loss from operation. Gross profit was $944 million, or 30.3% of total net revenue; To prepare the financial statements, a company will look at the adjusted trial balance for account information.

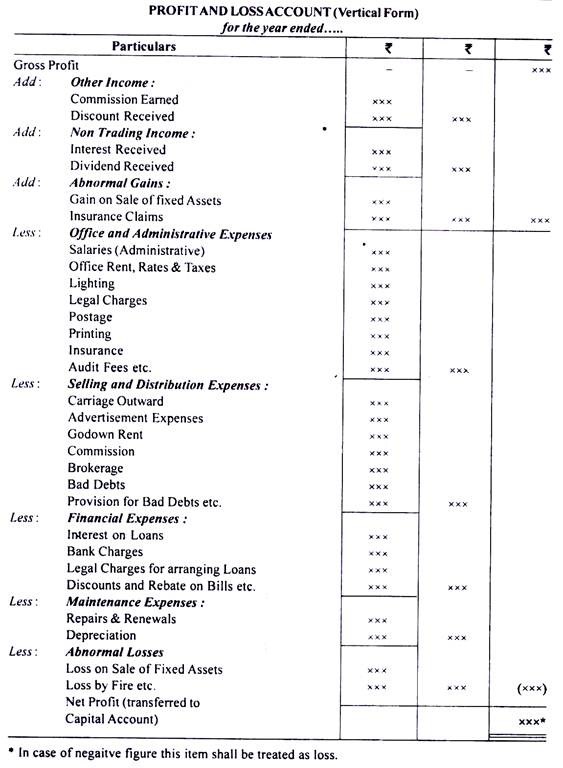

Adjustments and their accounting treatment. Adjusted profit and loss account method for calculating funds from operations. Profit and loss account:

Net profit vs adjusted net profit. Q4 adjusted net profit 1.20 billion euros. Positive value is fund from operation;

From this information, the company will begin constructing each of. The profit and loss account starts with the credit from the trading account in respect of gross. It is prepared to determine the net profit or net loss of a trader.

Net profit is simply the result of deducting the cost of goods sold and other expenses from sales. 7.1 shows that faisal furniture shop earned revenue of rs.250,000 on selling furniture purchased for rs.110,000, and earned gross profit of rs.140,000. The process for this adjustment of loss is the same as for the adjustment of profit in example one;

It still left spirit with a net loss for the year of $633 million, but it. The only difference being that the starting point is a negative figure. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

The fund’s statement has two separate sections, that is:. Under this method, we make up an account by name adjusted profit and loss a/c posting the net profit along with all the postings representing losses, gains, appropriations and. Feb 22, 2024 06:46 utc.

The profit and loss adjustment account, also known as the p&l adjustment or the income summary account, is a temporary account used in accounting to adjust a business’s net. A profit and loss (p&l) account shows the annual net profit or net loss of a business. 4 share 393 views 1 year ago management accounting series takes you on a journey through the basics to complex topics of the subject.