Build A Info About Capital Expenditure From Balance Sheet

Using capital expenditures in your accounting.

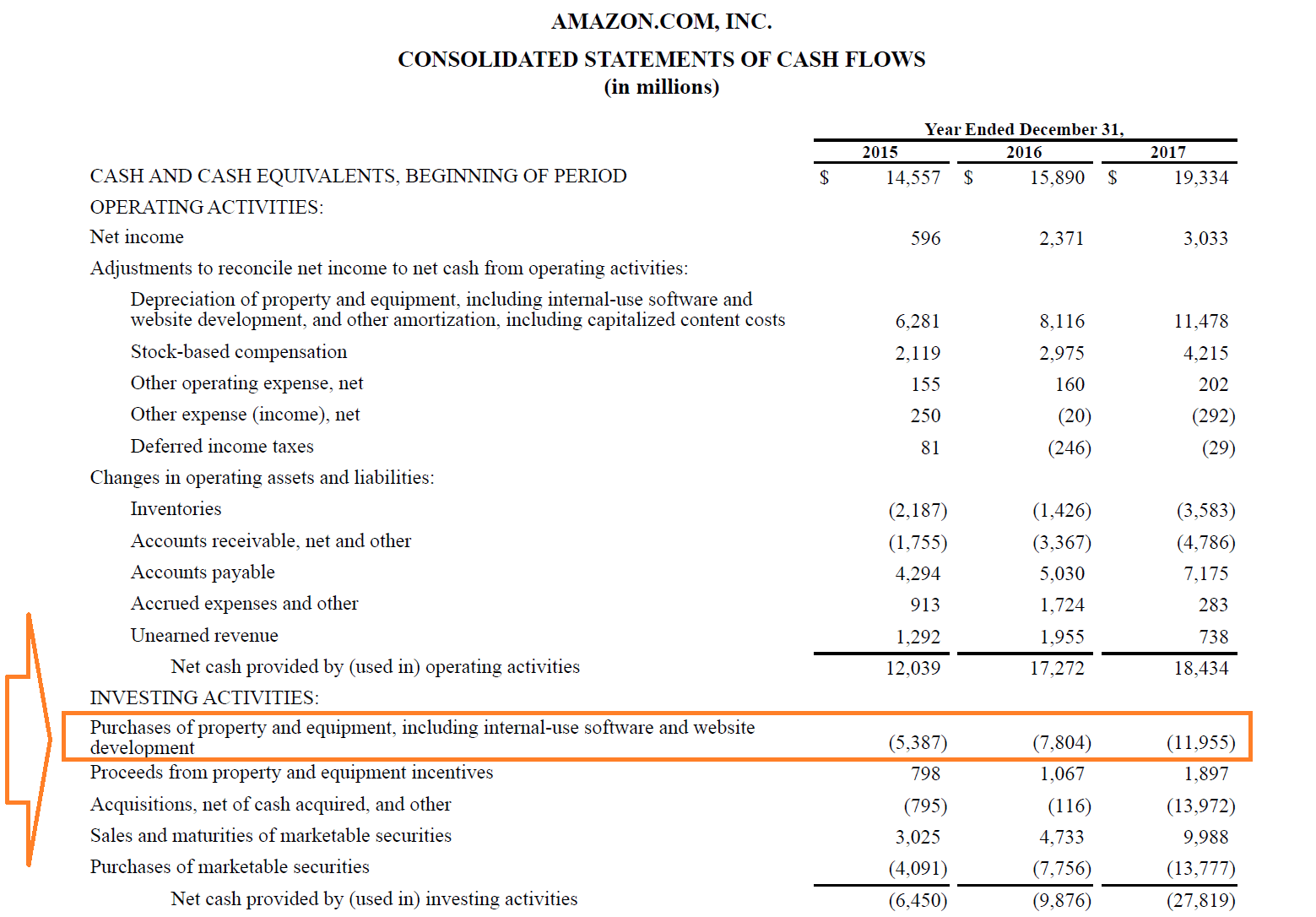

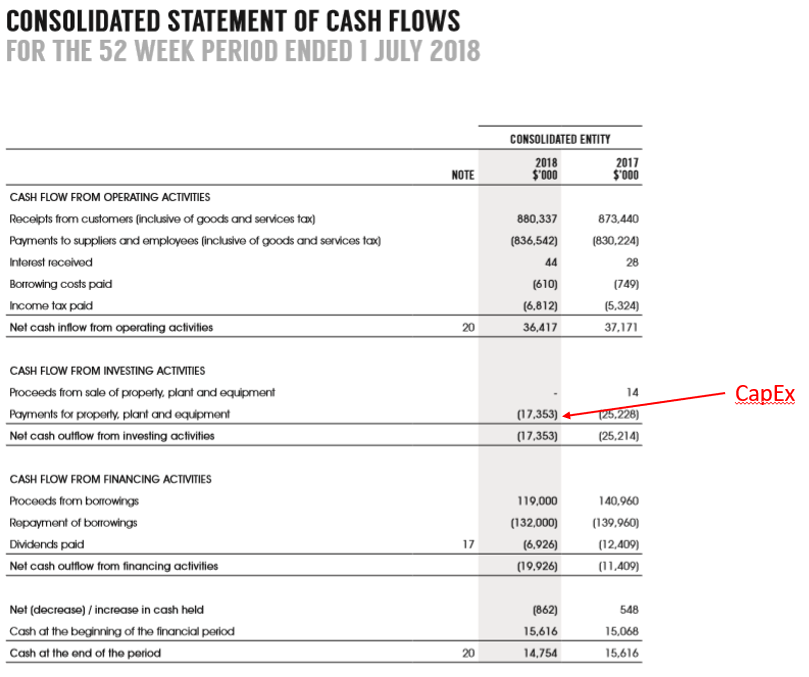

Capital expenditure from balance sheet. Capex is usually going to get included in your cash flow. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment. This means that the company has incurred a cost that will benefit it in the future.

Obtain your company's financial statements to calculate capital expenditures, you'll need your company's financial statements for the past two years. The capital expenditure formula is super simple: Follow these steps to calculate capital expenditures (capex):

As such they will be. Capex is any money that you invest in either acquiring, improving or maintaining your fixed assets. Unlike operating expenses, which are recorded on your income statement, capital expenditures are always recorded as an investment on your balance sheet and.

Only the depreciation of a piece of capital equipment appears on the income statement. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances. Capital expenditures show up on the balance sheet;

Capital expenditures are cash outlays for a specific accounting period, so they’re recorded on a cash flow. This is done to enhance the. The expenditures are capitalized (i.e., not expensed directly on a company’s income statement) on the balance sheet and are.

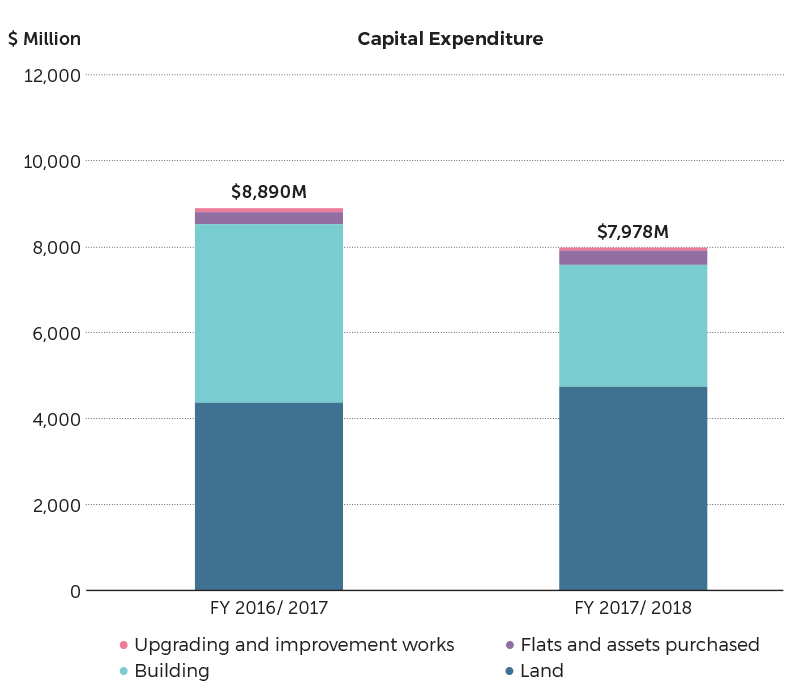

Capital expenditure or capital expense represents the money spent toward things that can be classified as fixed asset, with a longer term value. Locate depreciation and amortization on the income statement locate the current period. Capex = δpp&e + depreciation.

Capital expenditure is recorded on a company’s balance sheet as an asset.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-02-0538cfc8437b4b2ba4724c9443c6d393.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)