Breathtaking Tips About Advantages Of Preparing Trial Balance

All advantages and disadvantages of trial balance.

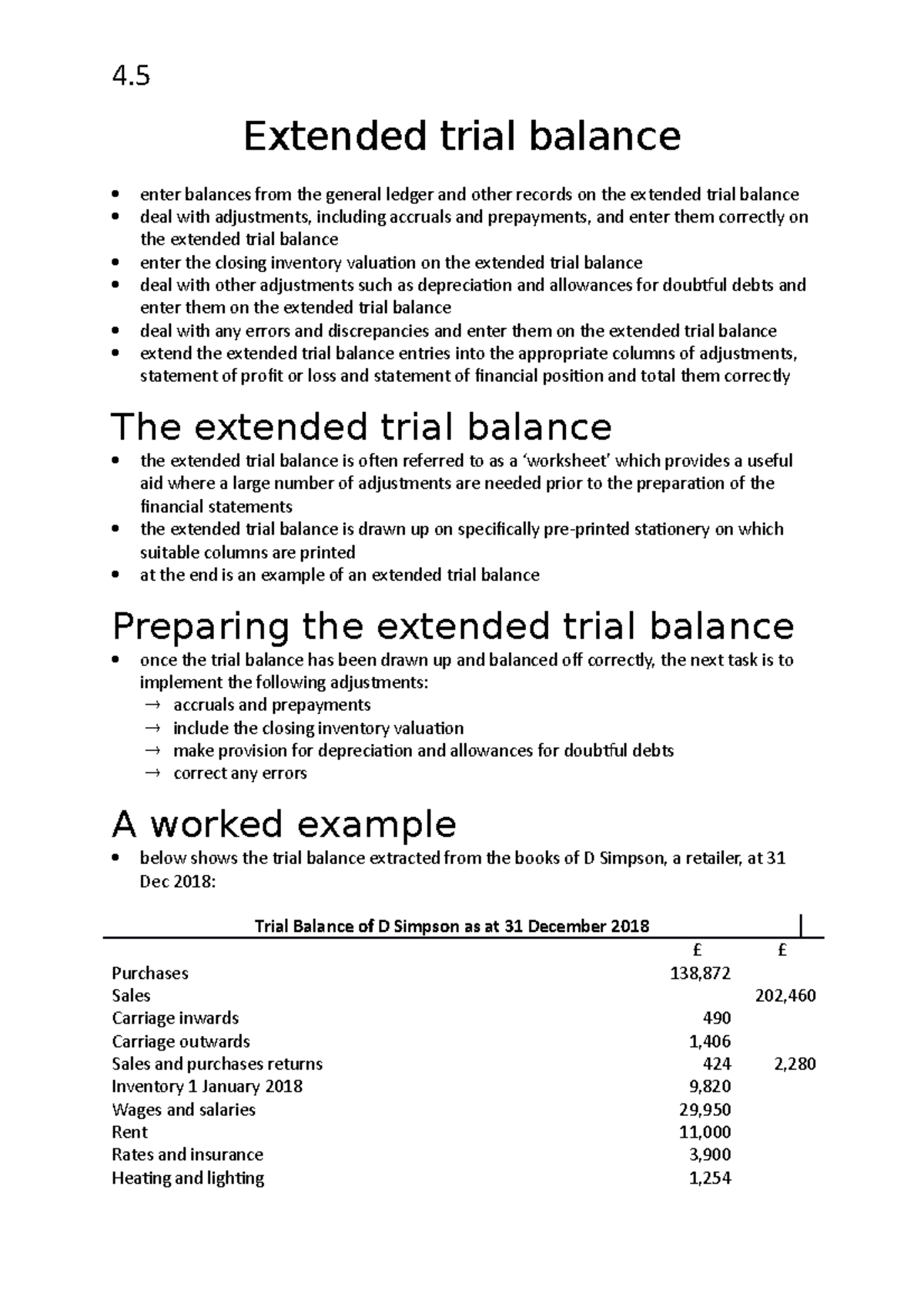

Advantages of preparing trial balance. Understanding the components of a trial. Preparing a trial balance without adjustments is the fourth phase in the accounting cycle. However, this does not qualify that it is free of mistakes.

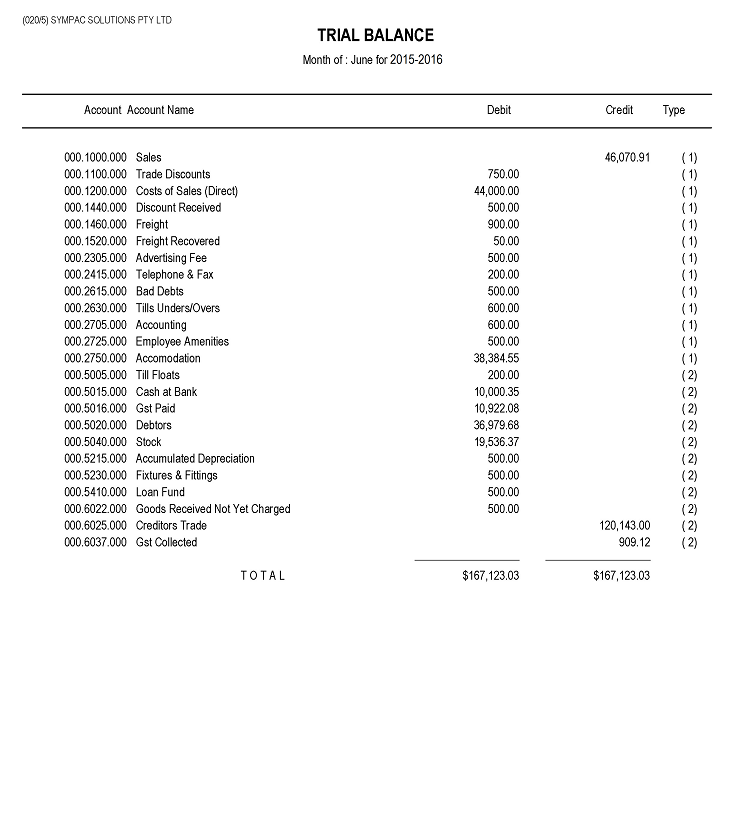

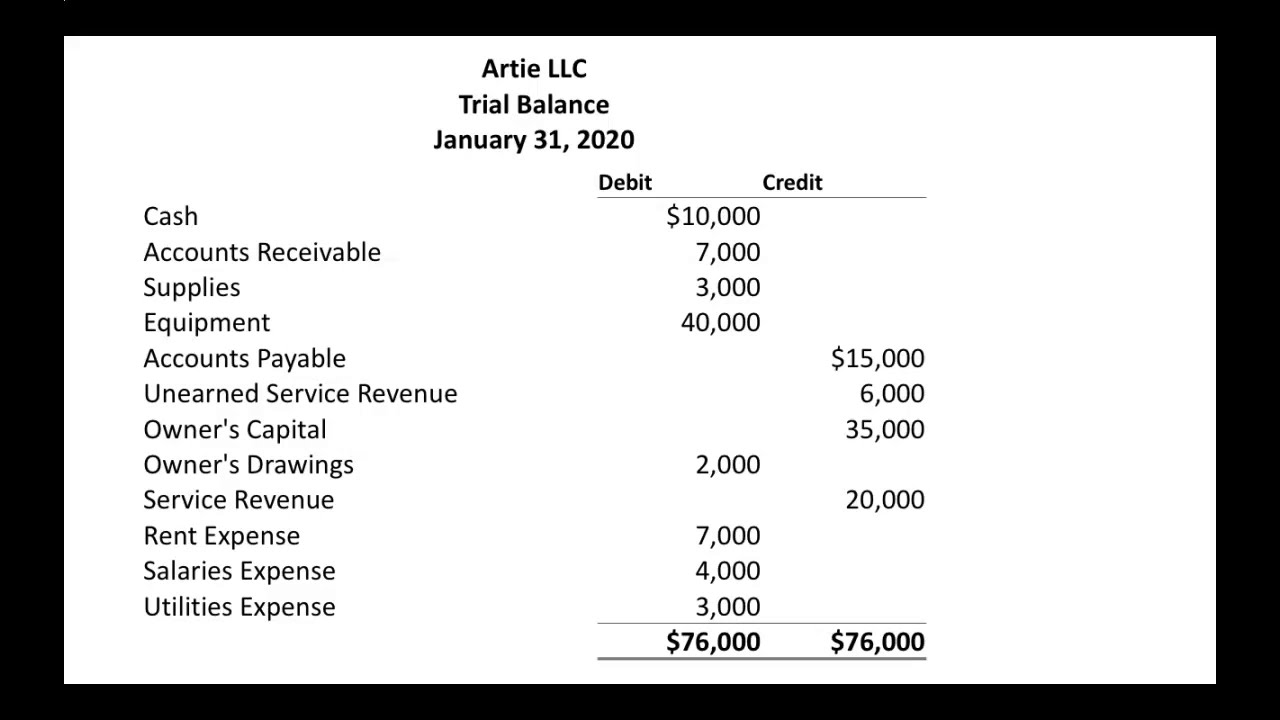

Helps prepare final accounts financial statements are normally prepared to refer to the trial balance; It helps in ascertaining arithmetic errors that occur while preparing accounts. A trial balance is a statement that shows the total debit and total credit balances of accounts.

In a trial balance statement, where the debit and credit side of it is equal, it is considered balanced. The basic purpose of preparing a trial balance is to test the arithmetical accuracy of the ledger. Identifying errors one of the primary advantages of trial balance is that it helps in identifying errors in the accounting records.

It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct. The objectives or the significance of trial balance is as follows: The main objectives of a trial balance are as follows:

The totalling of the accounts is done and all the accounts are balanced. It summarizes the result of all transactions during a period. Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double entry accounting system.

It summarizes the ledger accounts: Some of the errors are highlighted by trial balance and these can be rectified before the preparation of final accounts. In accounting, there are three kinds of trial balances.

A trial balance is an accounting report that states the ending balance in each general ledger account. This is the most important part of accounting so generally, it has a variety of advantages but there also some disadvantages of trial balance. Looking at all the pros and cons, it is very clear that preparation of trial balance has a lot of benefits and hence its preparation has become mandatory for closure of books of accounts.

If the total debits equal the total credits, the. Purpose of preparing a trial balance. Even today the trial balance provides an excellent base for preparation of financial statements and analysis of business.

So, all the debit and credit side balances of ledgers are transferred to the debit. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. What are the methods of preparing trial balance?

It helps in preparing the financial statements of a company at the end of a financial year. It helps in ascertaining the accuracy of journal and ledger postings. There are several advantages of preparing a trial balance:

![Procedure for Preparing a Trial Balance [Notes with PDF] Trial Balance](https://everythingaboutaccounting.info/wp-content/uploads/2020/01/Procedure-for-Preparing-a-Trial-Balance-1.png)