Here’s A Quick Way To Solve A Tips About Cash Flow Statement Income Tax Paid

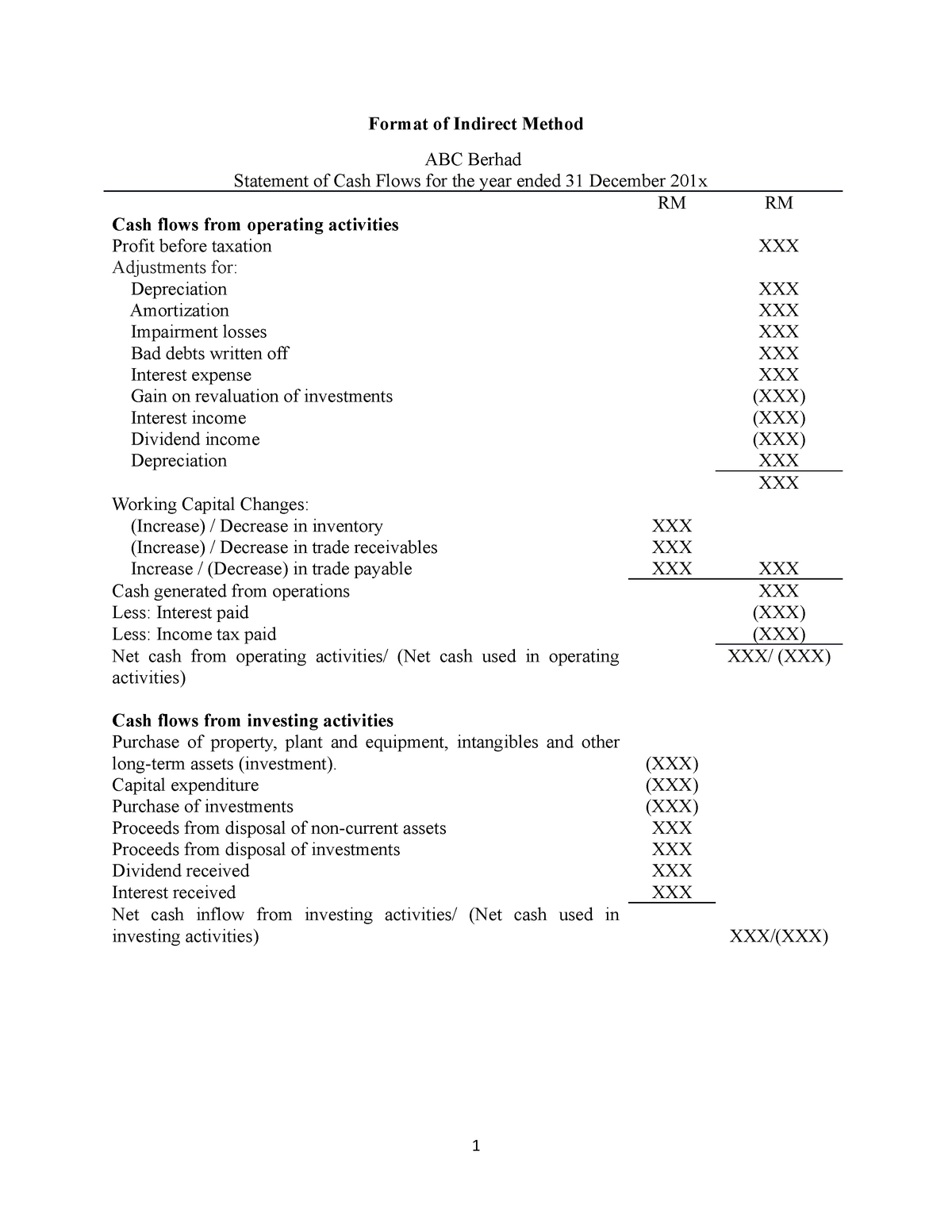

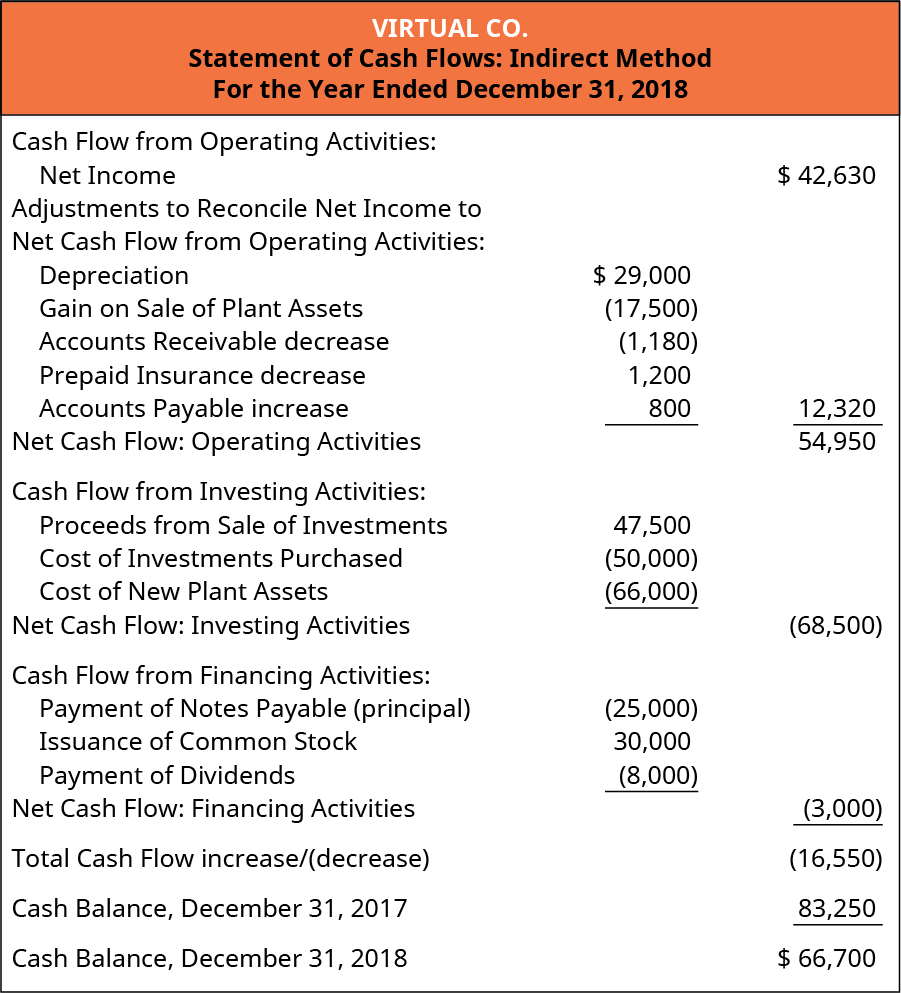

The operating cash flows section of the statement of cash flows under the.

Cash flow statement income tax paid. The cash flows from financing activities section reports the cash flows associated with the issuance and repurchase of a corporation's bonds and capital stock, the payment of. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial. The direct method shows each major class of gross cash receipts and gross cash payments.

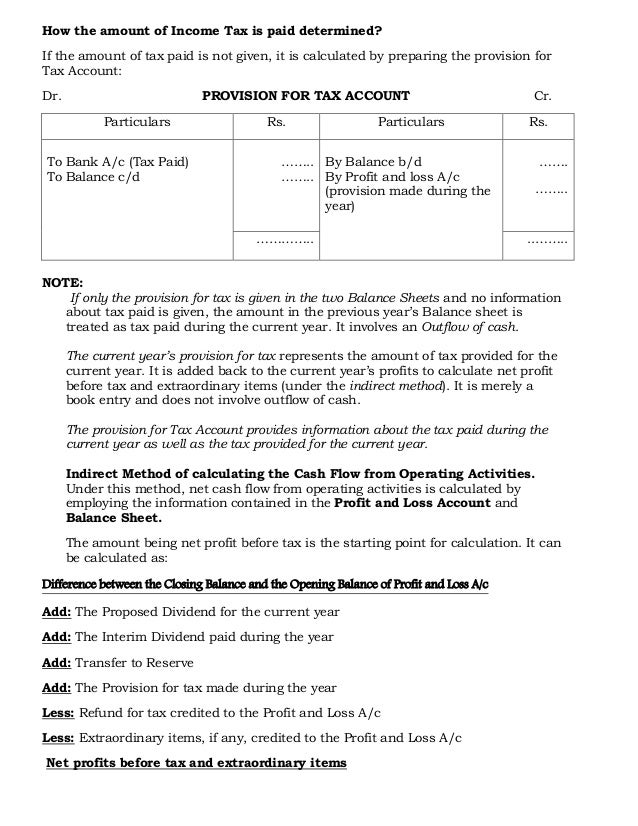

Tip you report income tax payable on your current profits as a liability on the. Any cash paid or received as a refund of income tax; Adjusted extraordinary items (+/ ) (f) xxx:

The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of. Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement. Taxes paid are generally classified as operating cash flows.

Sfas 95, statement of cash flows, classifies income tax payments as operating outflows in the cash flow statement, even though some income tax payments relate to gains. The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a.

Cash paid to suppliers for purchase of goods or services;

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)