Great Tips About Balance Sheet Review Checklist

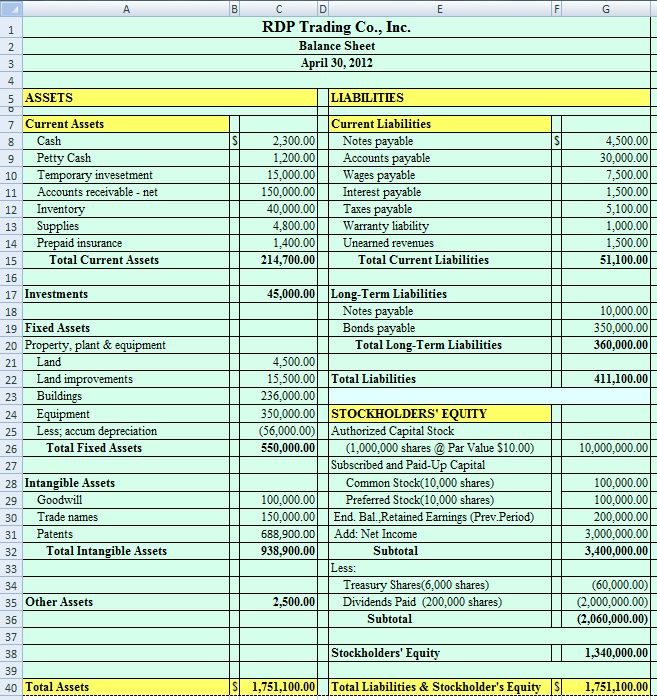

Basic equation of a balance sheet:

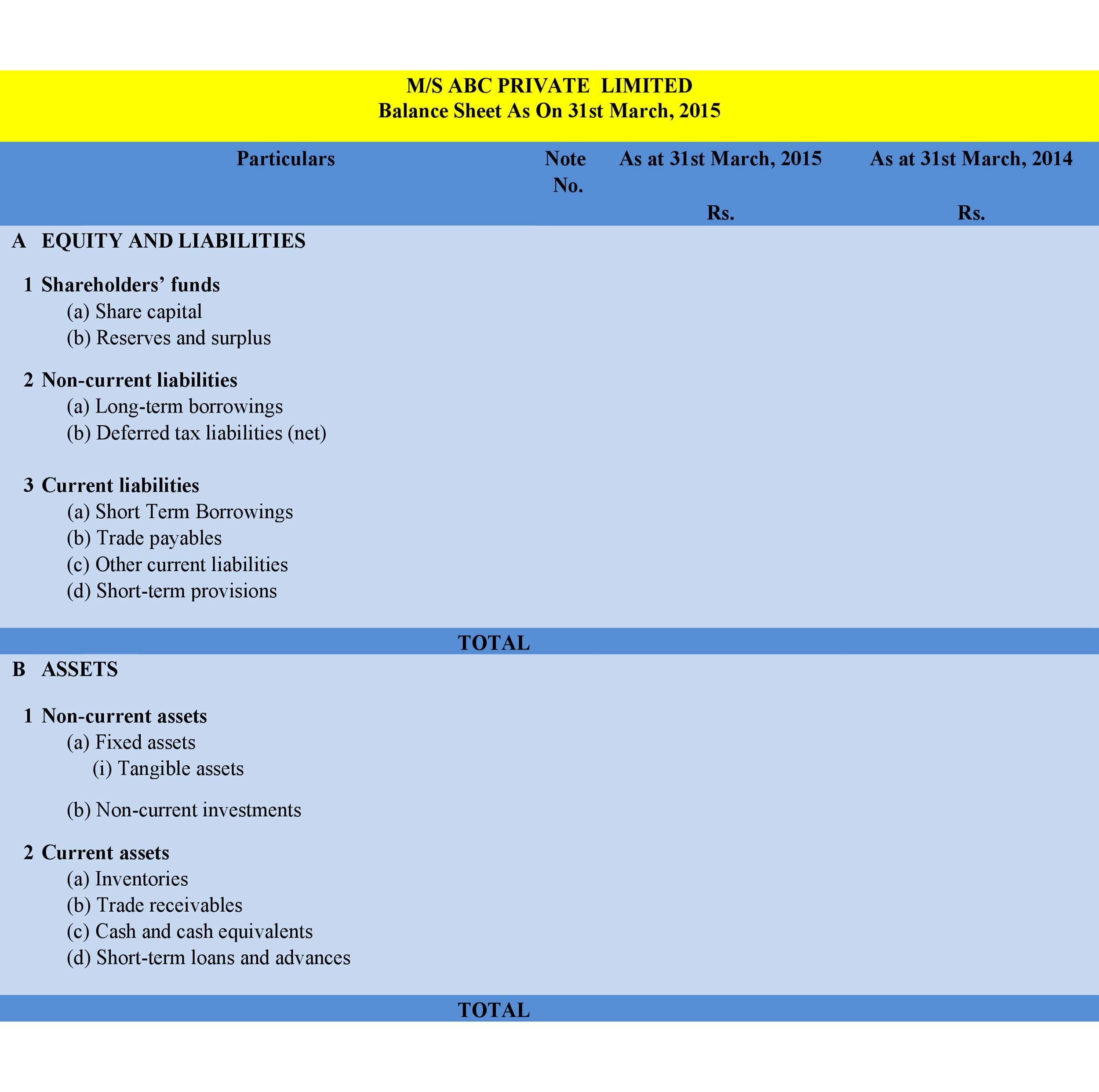

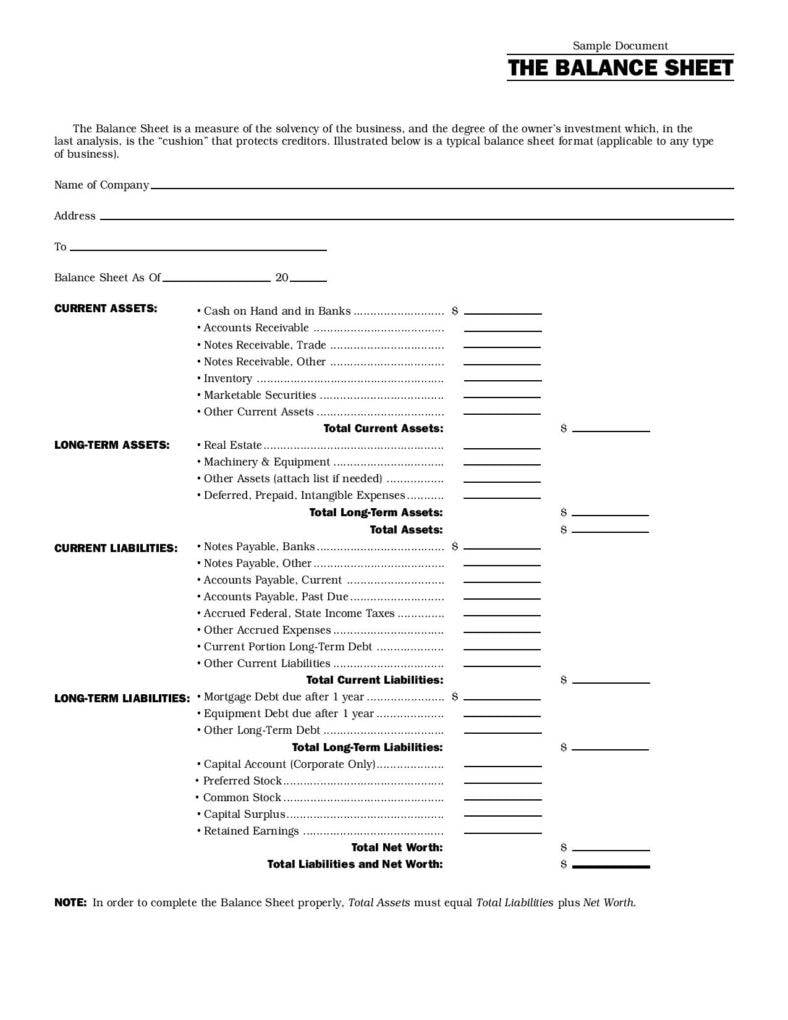

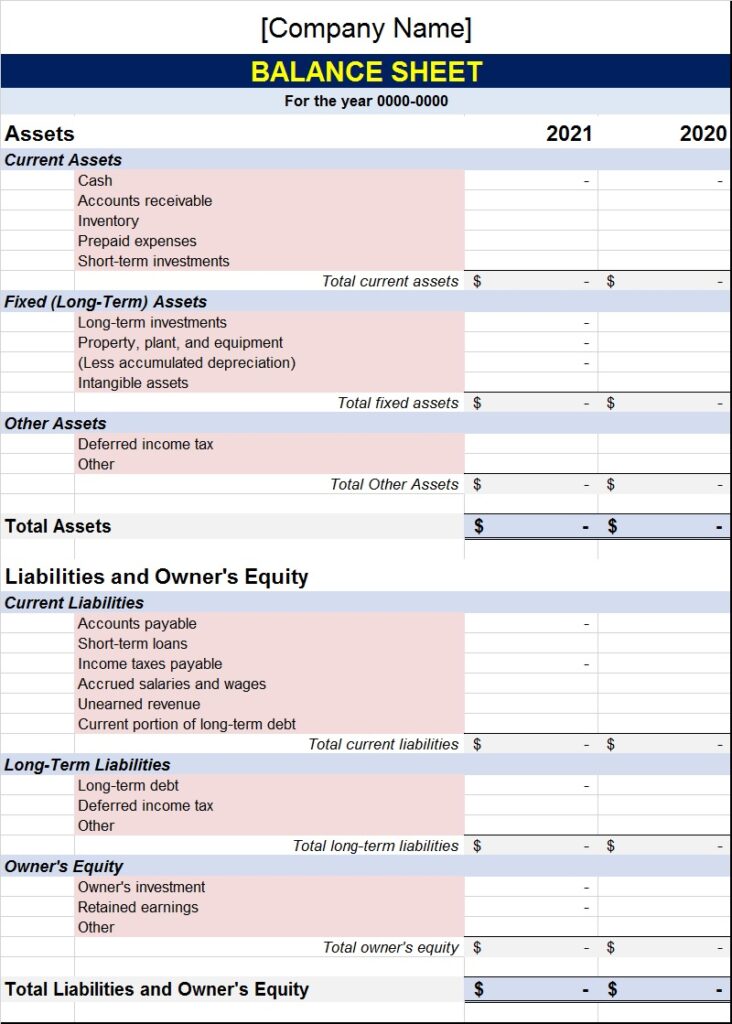

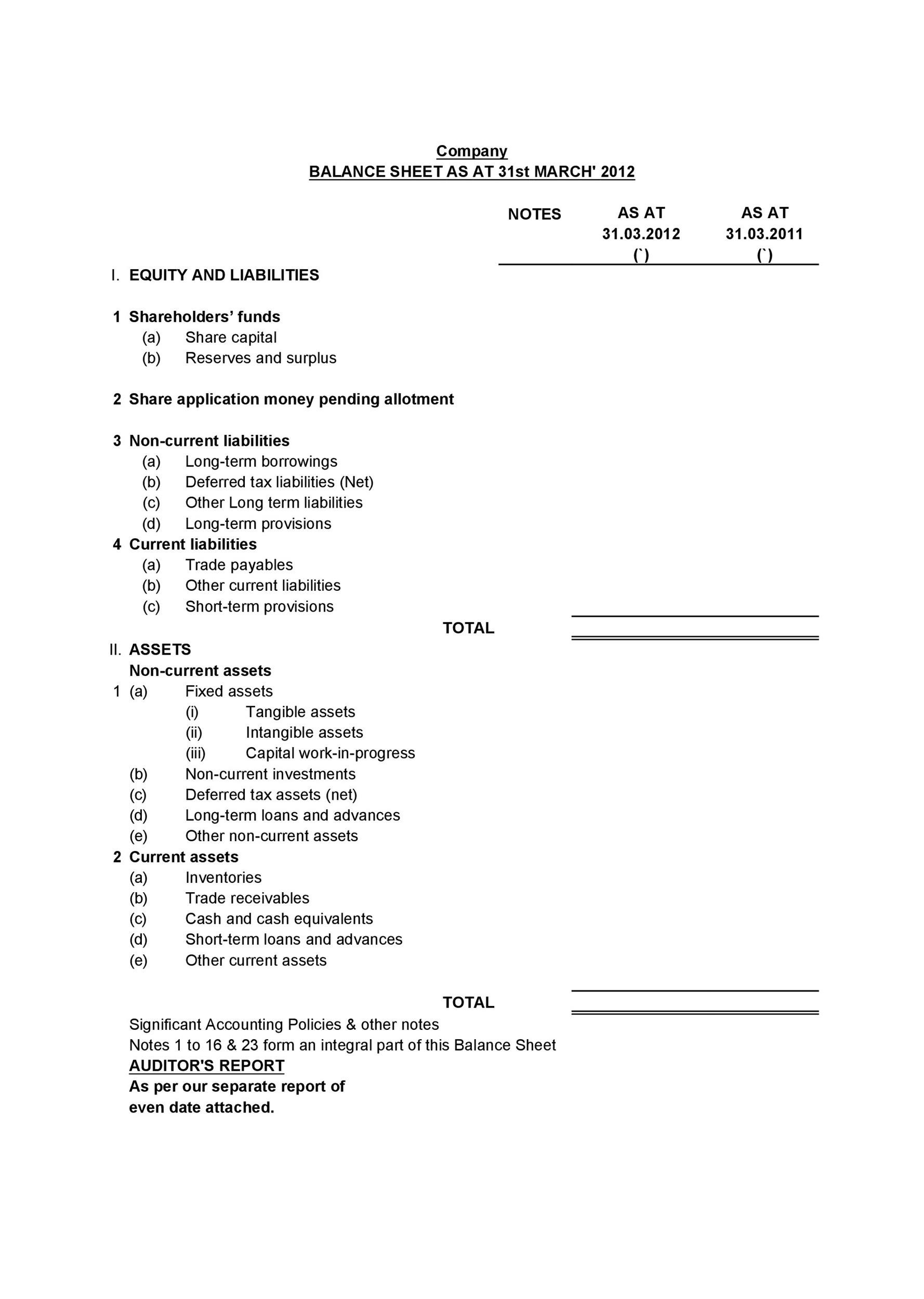

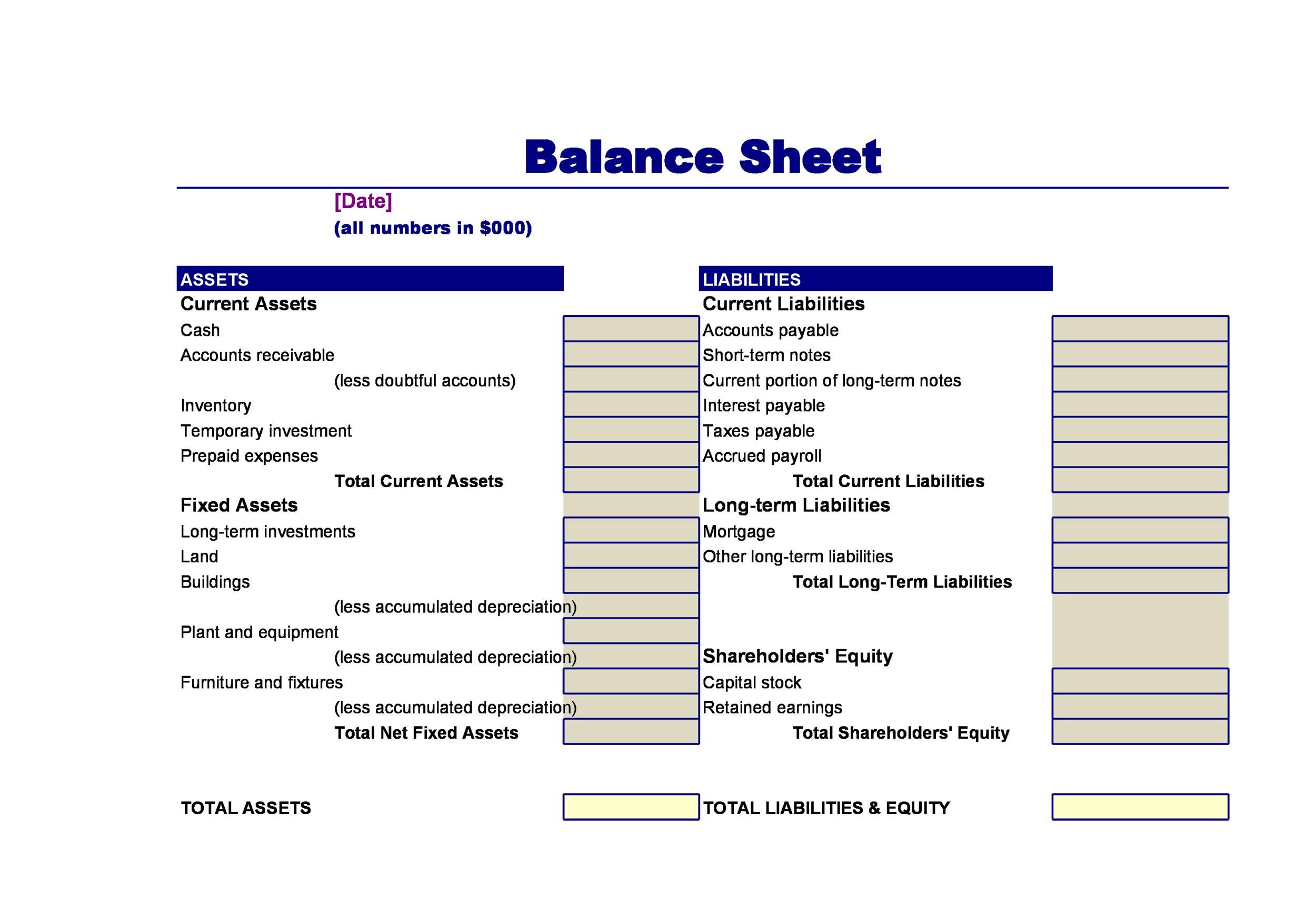

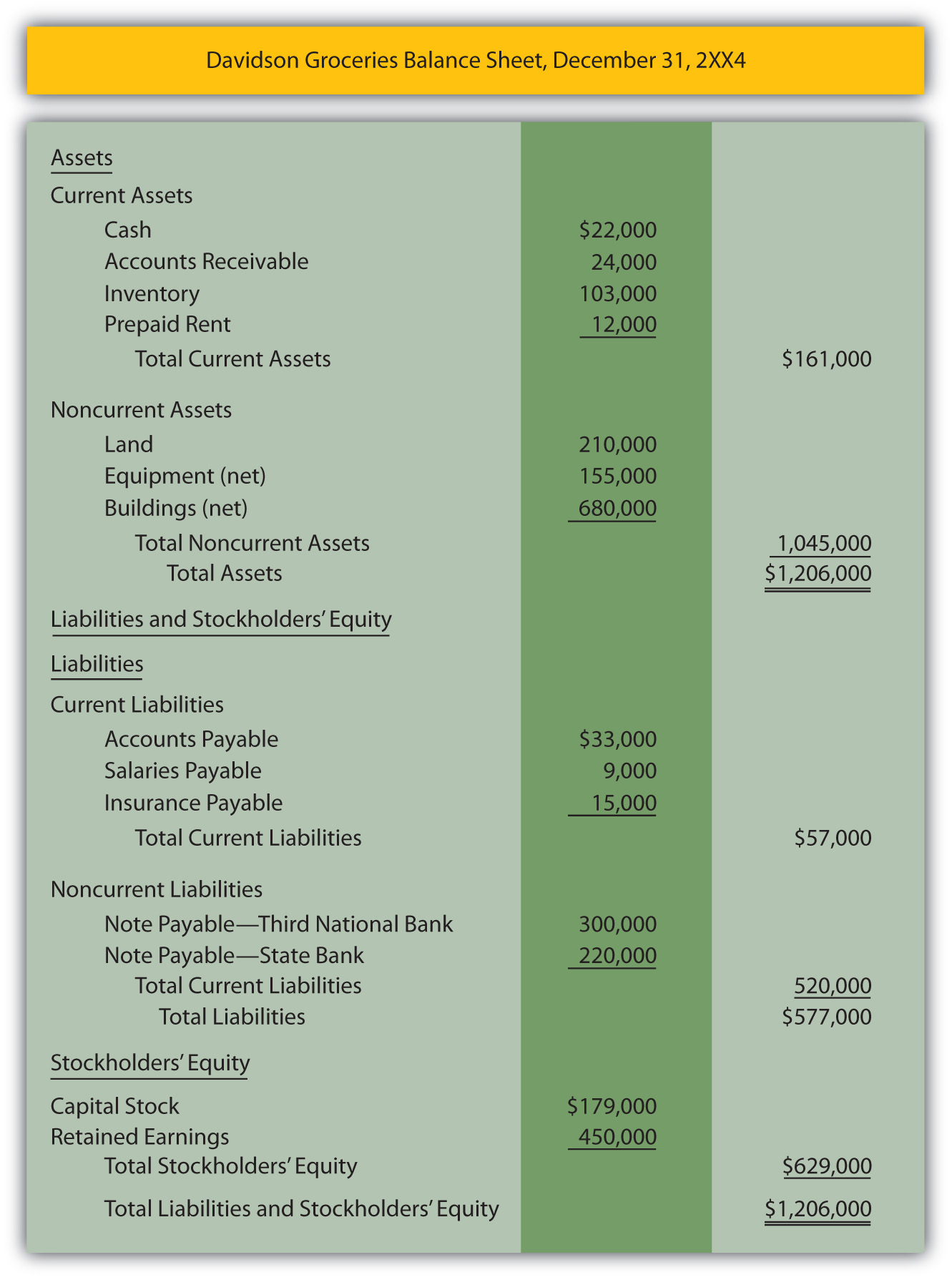

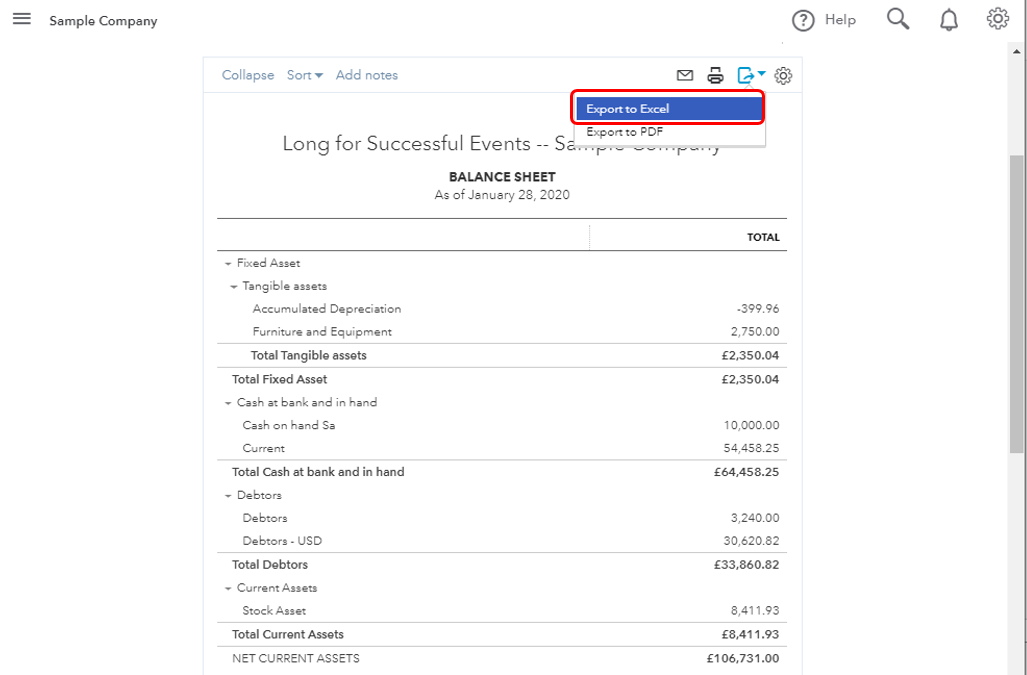

Balance sheet review checklist. Balance sheet critical part of any financial review should be an assessment of your business’s net worth — its assets and liabilities and how leveraged and liquid it is. When a lender or investor asks you for your balance sheet they are probably asking for a current balance sheet. As we have learned, the balance sheet, also known as the statement of financial position, encompasses a company's holding information inclusive of its assets, liabilities.

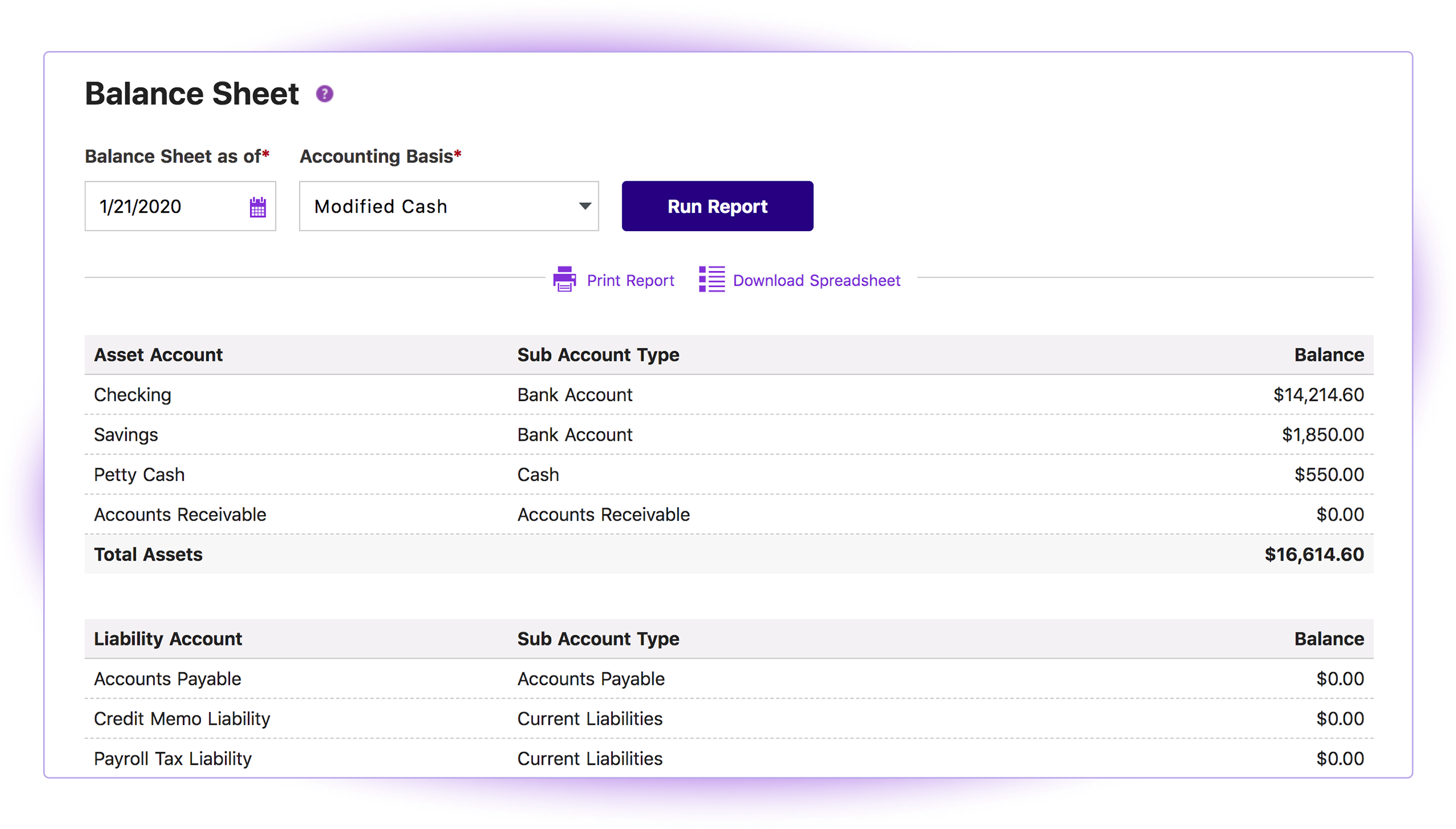

Balance sheet reconciliation: Determine a reporting date for the balance sheet. With this information consolidated in one area, you’ll be able to make important financial decisions that will directly impact your business’s growth.

Thus, the header of a balance sheet always reads “as on a specific date” (e.g., as on dec. What is the balance sheet reconciliation checklist? The book of order does not require that the annual review of the financial records of a congregation be conducted by a professional accountant or attorney.

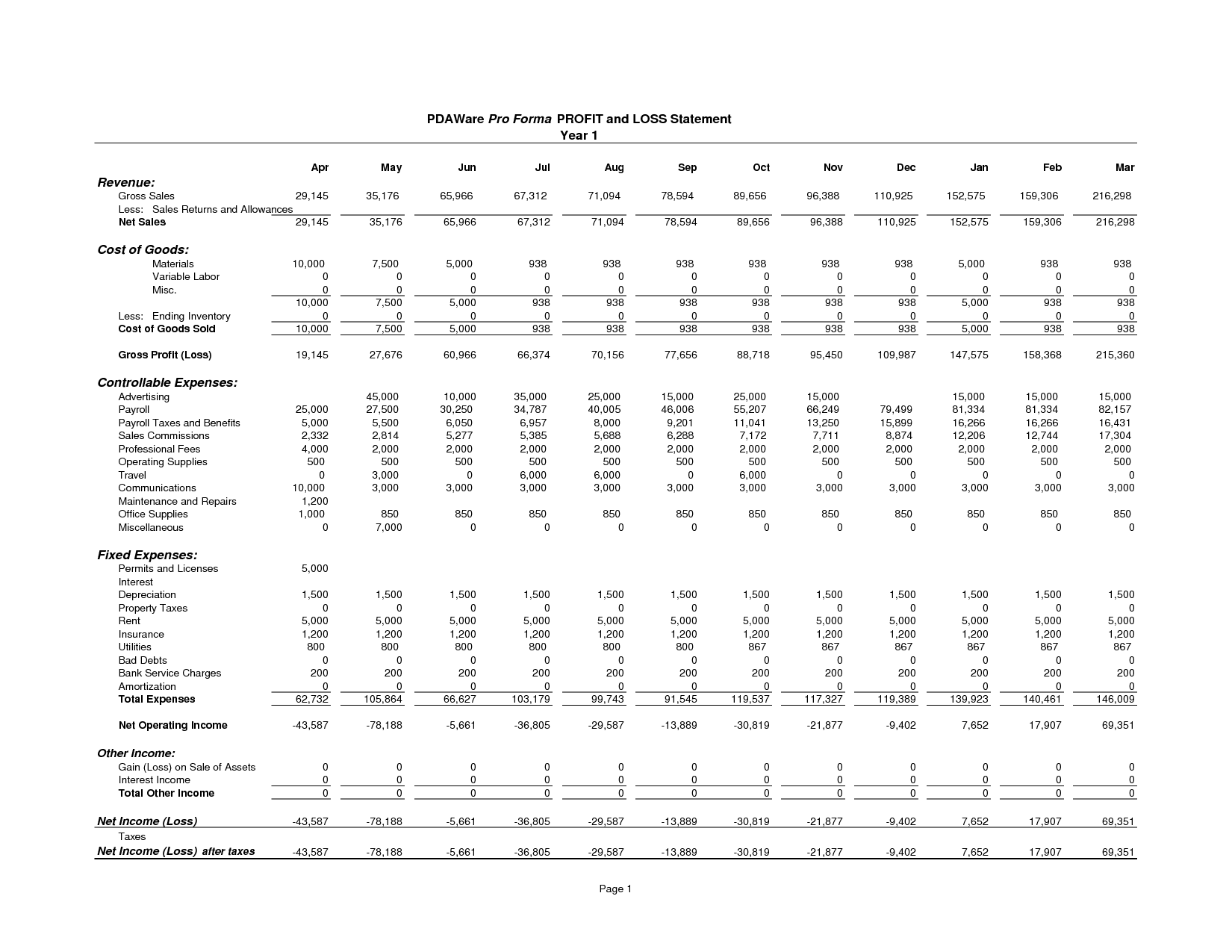

While there are many ratios you can review for your business, there are two in particular that relate to the balance sheet and will give you important insights into your business. Account reconciliation is the process of matching internal accounting records to ensure they line up. The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

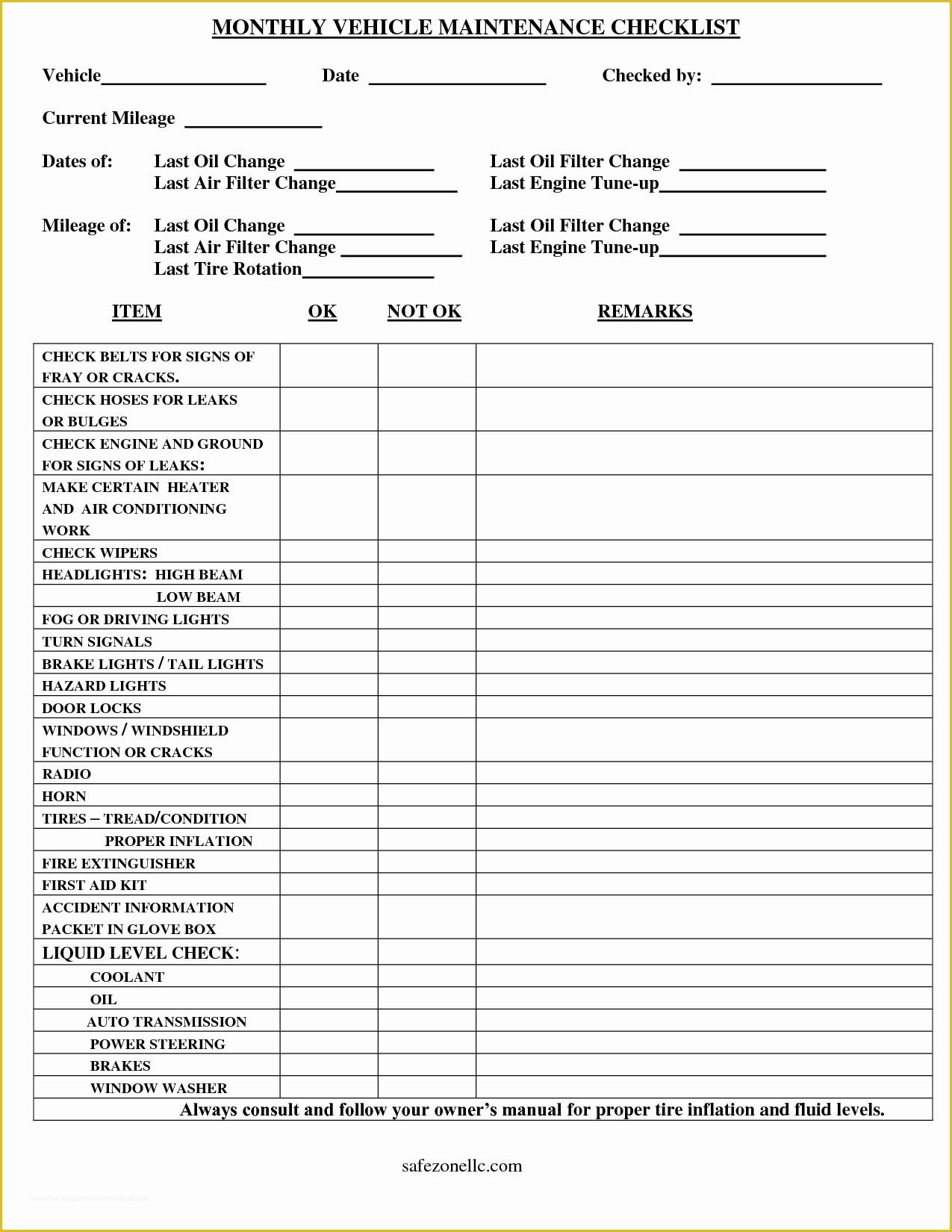

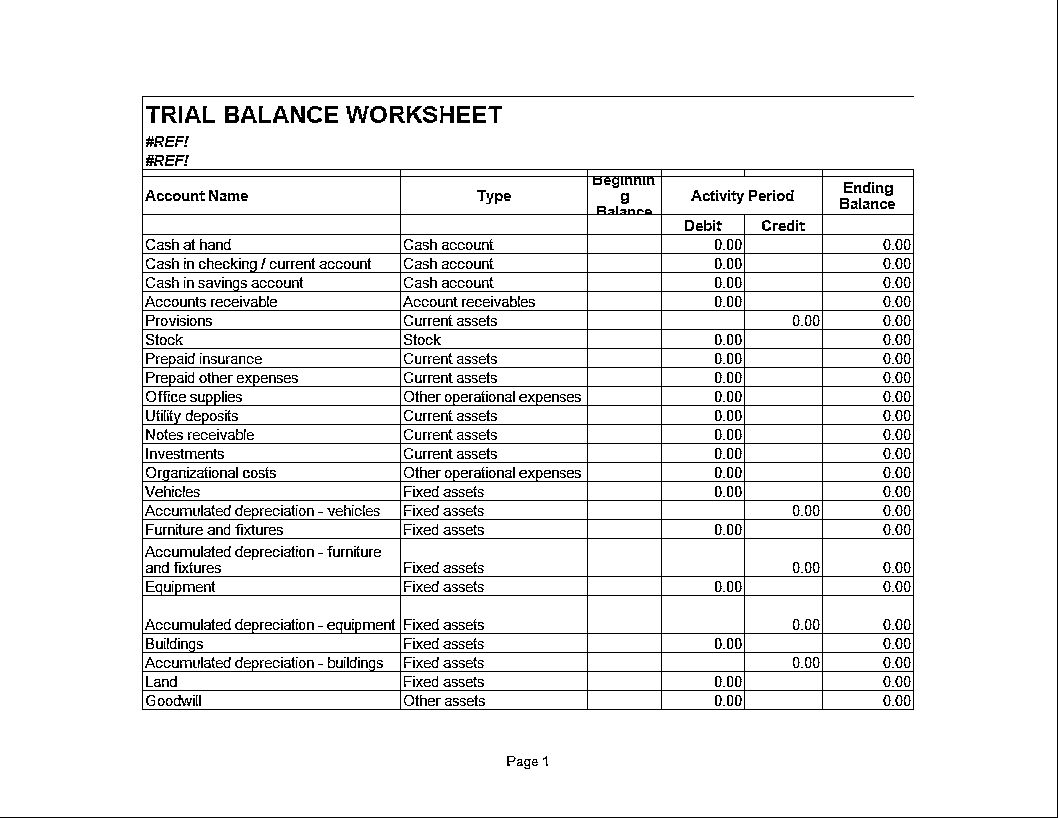

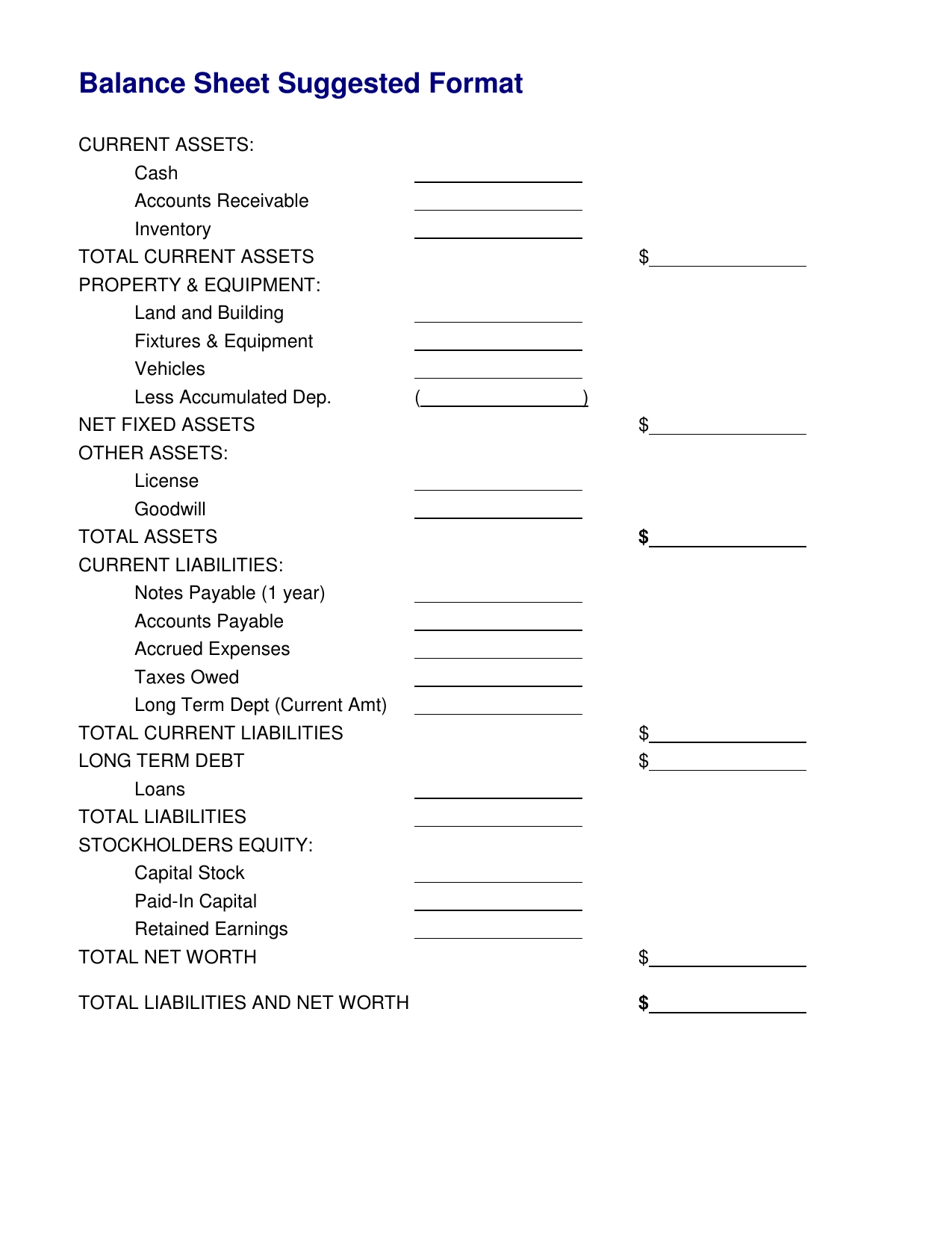

Balance sheet reconciliation checklist: This checklist will guide you through the balance sheet creation process from gathering important financial documentation to reviewing and verifying a completed statement. Prepare initial draft of balance sheet.

In combination with the financial statement and cash flow inventory, the balance sheet is the cornerstone of a company's. And, you’ll have to gather information to make comparisons and catch errors. Gather and verify all financial data.

Analyze and categorize gathered data. Bottom line what is account reconciliation? Updated january 20, 2022 reviewed by margaret james fact checked by pete rathburn fundamental analysts, when valuing a company or considering an investment opportunity, normally start by examining.

[1] asset = remember that an asset adds worth to a business. A current balance sheet as of a particular date, and a future balance sheet. Without a concise balance sheet, you'll never interest a serious investor and no lender will extend you a significant line of credit.

A financial statement review checklist is a document that includes all of the important financial information you need to gather to paint that financial picture. The income statement reports results, but the balance sheet can be a better predictor of the future. Completion of this checklist should satisfy the requirement of the.

When reconciling balance sheet accounts, look at things like your business’s current and fixed assets, current and noncurrent liabilities, and owner’s equity. Our template balance sheet workflow provides a comprehensive procedure for compiling, verifying, reviewing, and auditing financial data; And equity, or net worth.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)