Wonderful Tips About Cash Flow From Financing Activities Meaning

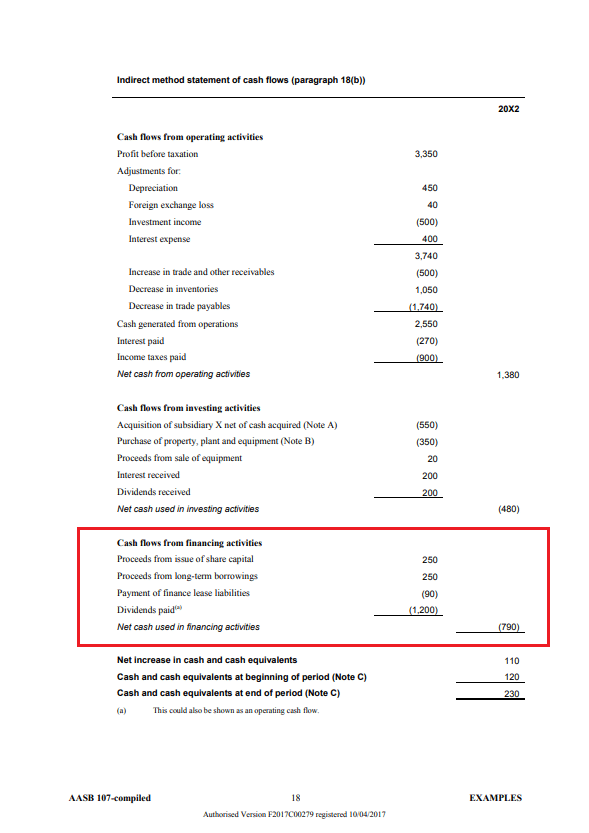

The section of the cash flow statement titled cash flow from financing activities accounts for inflows and outflows.

Cash flow from financing activities meaning. It is calculated by analysing the change in. This means that the loan instalments are financed. What is cash flow from financing activities?

Fact checked by melody kazel what is cash flow? Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Cash flow from financing (cff) is the cash that a company generates from its financing activities.

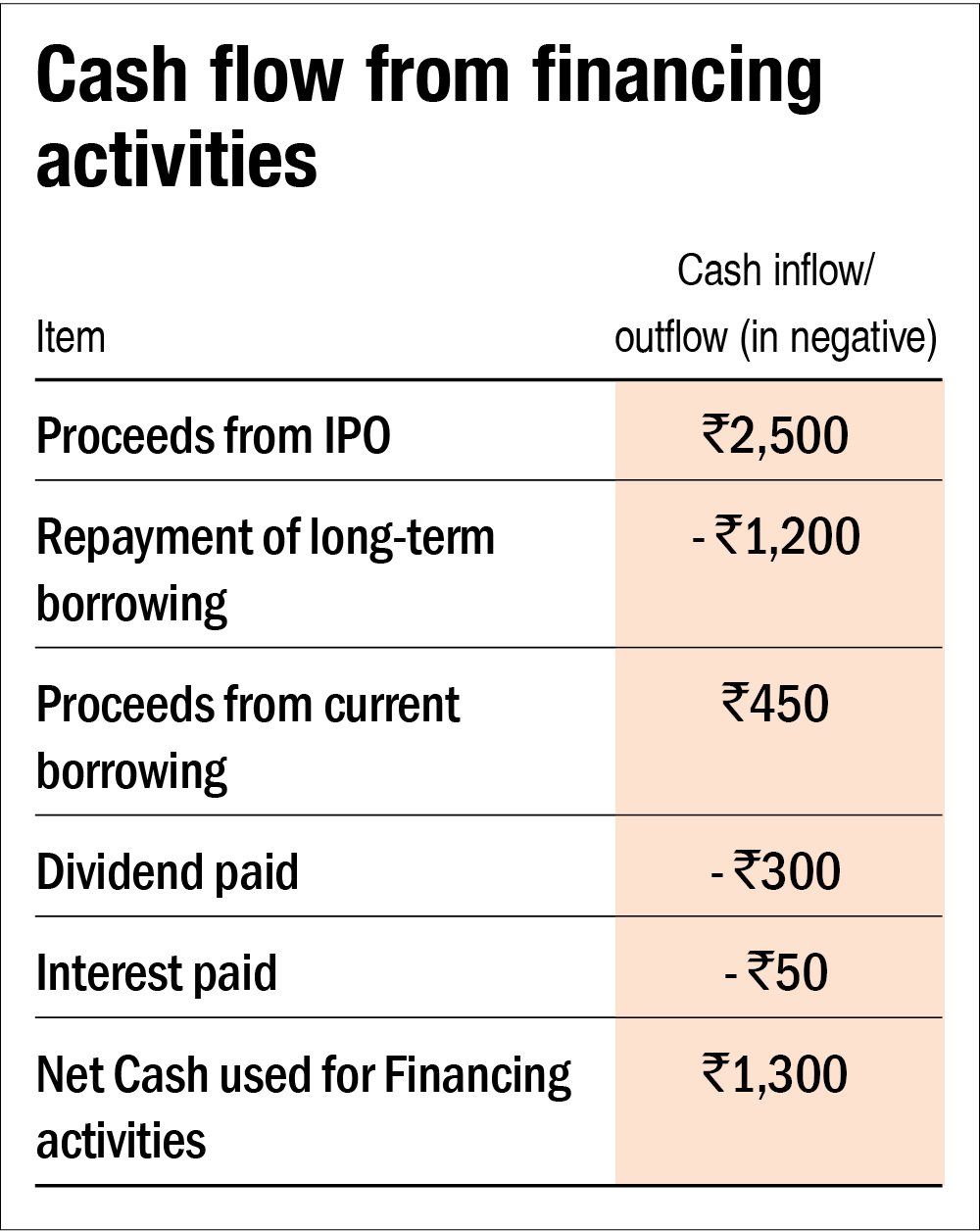

Cash flow financing is the financing of a loan through incoming cash flows. Cash flow from financing activities provides investors with insight into a. Positive cff reflects a financial influx,.

The net cash impact of raising capital from equity/debt issuances, net of cash used for share buybacks, and debt. Cash flow from financing activities (cff): Financing activities include transactions involving debt, equity, and dividends.

Finance activities include the issuance and repayment of equity,. The cash flows from financing activities line item is one of the more important items on the statement of cash flows, for it can represent a substantial source. Cash flow from financing (cff) what about free cash flow?

In other words, it enumerates the flow of cash to and from an organisation’s capital and the means through which a company raises funds for its operations. This includes issuing new equity, taking out loans, and repaying. Cash flow from financing activities is the net amount of funding a company generates in a given time period.

Cash flow is the net amount of cash that moves in and out of your business. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets. Cash flow from financing activities refers to the inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of.

Cash flow from financing activities helps the lenders of funds in estimating their claims on cash flows in the future. Cash flow from financing activities (cff) is the compass guiding investors through a company’s financial stability. Here's the formula for calculating cash flow from financing activities:

The cash flow from financing activities (cff) section is critical to the business since it reflects the cash inflows and outflows from a business’s financing. The cash flow from financing activities (cff) is part of a company’s cash flow statement that explains where the cash for the company came from.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)