Supreme Tips About Cash Budget In Working Capital Management

Capital expense (capex) budgeting is frequently misunderstood and disregarded by many organizations.

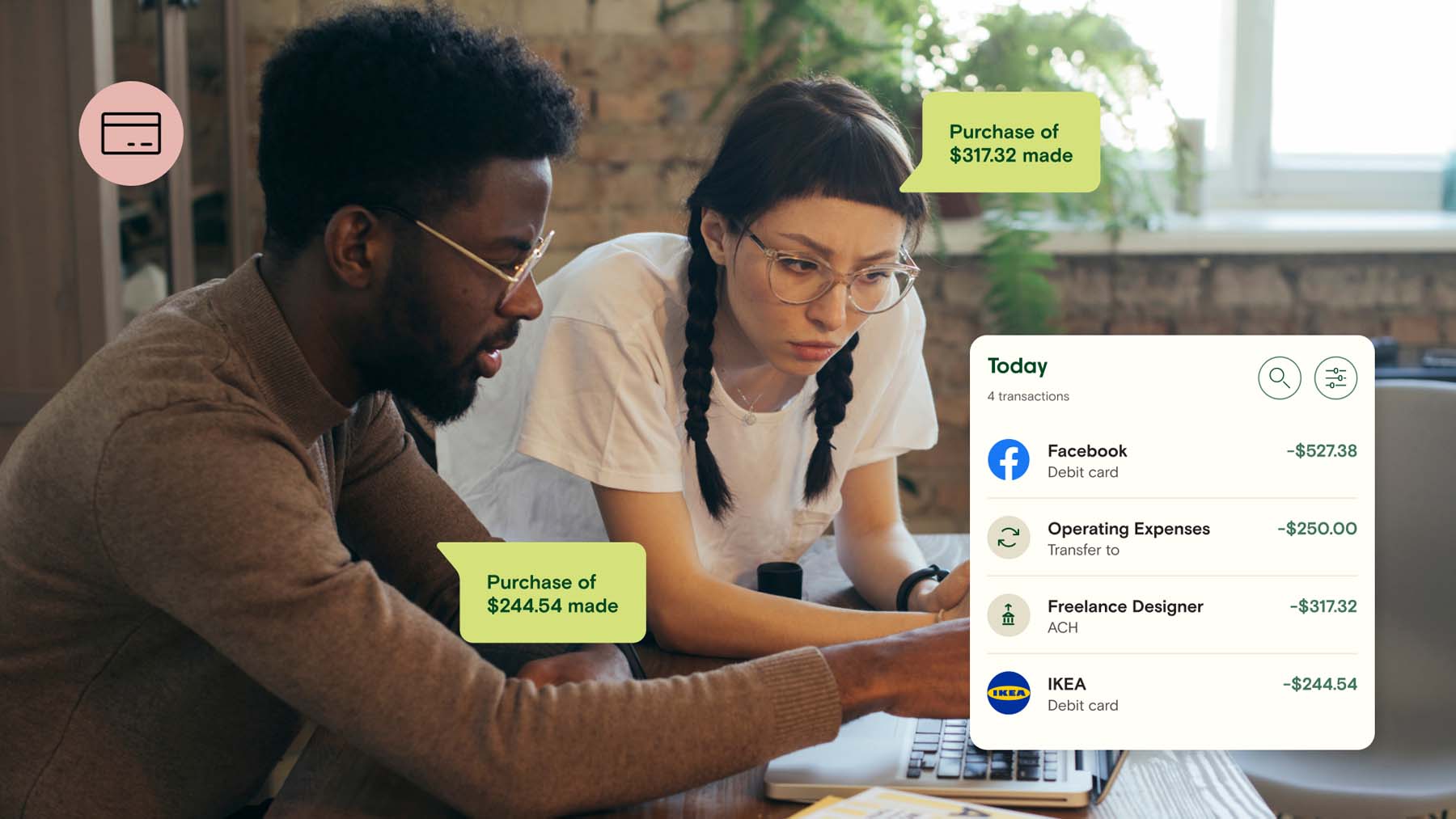

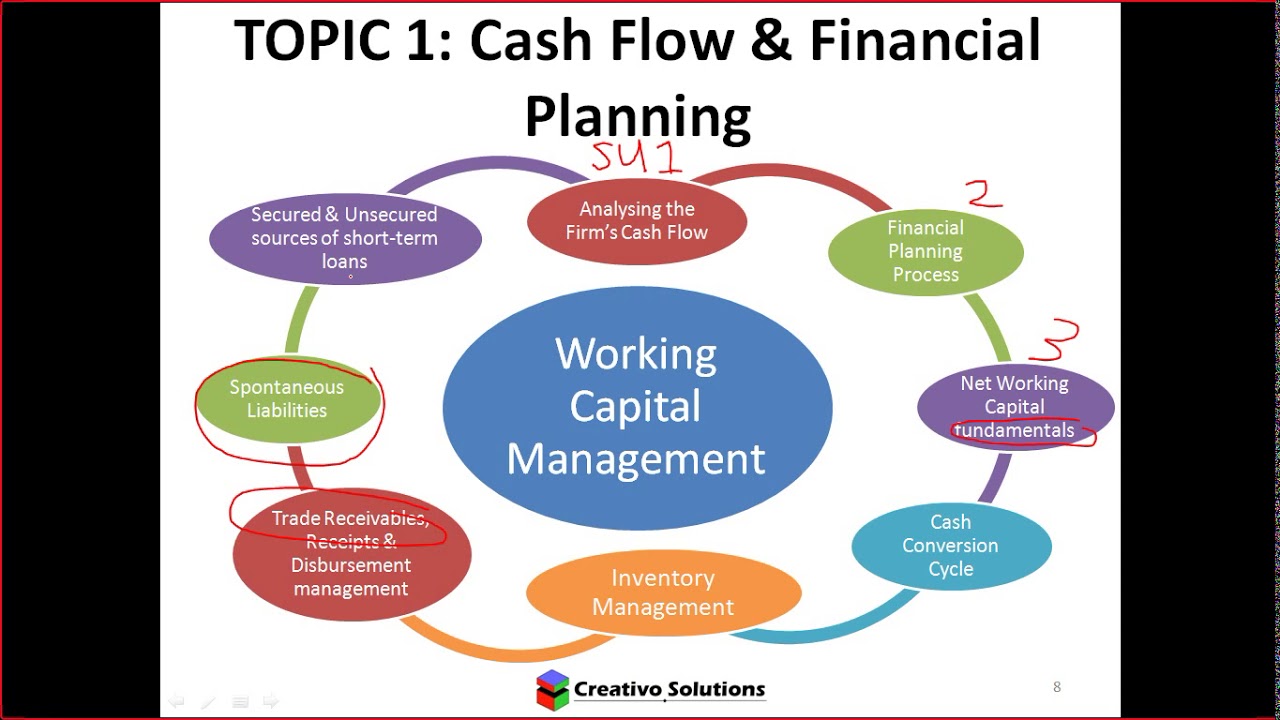

Cash budget in working capital management. Working capital is a daily necessity for businesses, as they require a regular amount of cash to make routine. Several empirical studies analysed the. A capital expense, at its core, refers to a significant,.

Working capital management is a comprehensive primer on keeping your. A straightforward way to budget working capital investments and a valuation tool based. Any business, regardless of its niche, needs sufficient cash at all times in order to run.

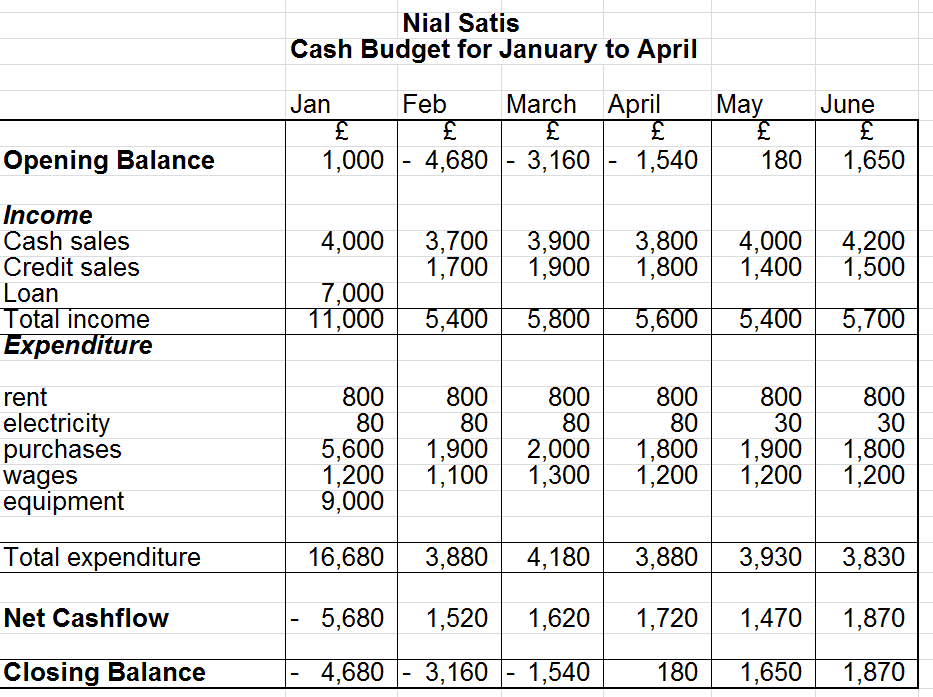

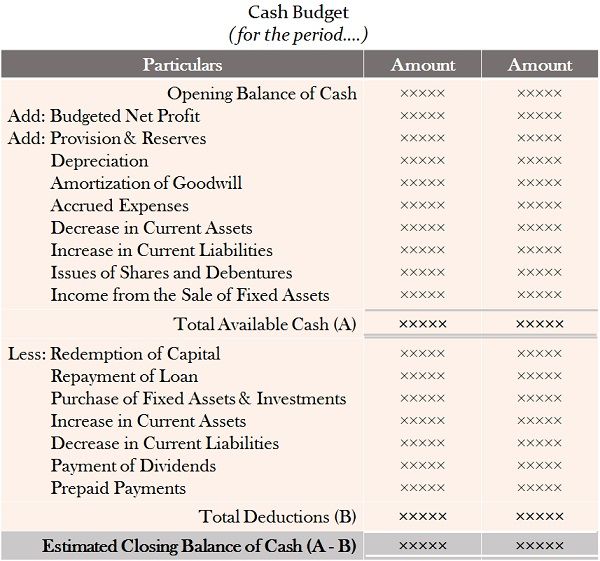

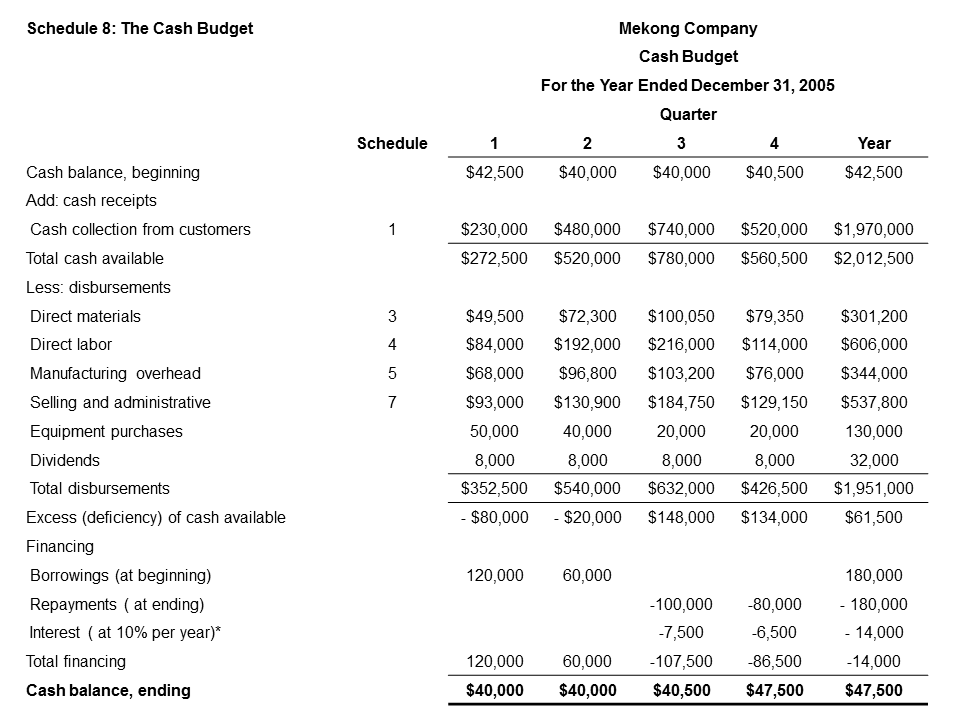

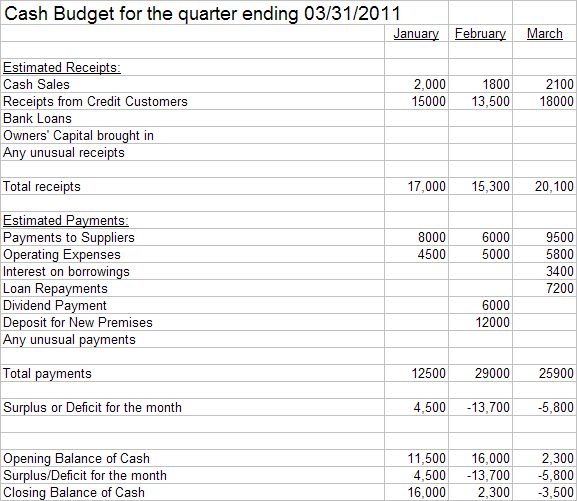

The basic format of a cash budget includes four sections: Marathon oil corporation (nyse:

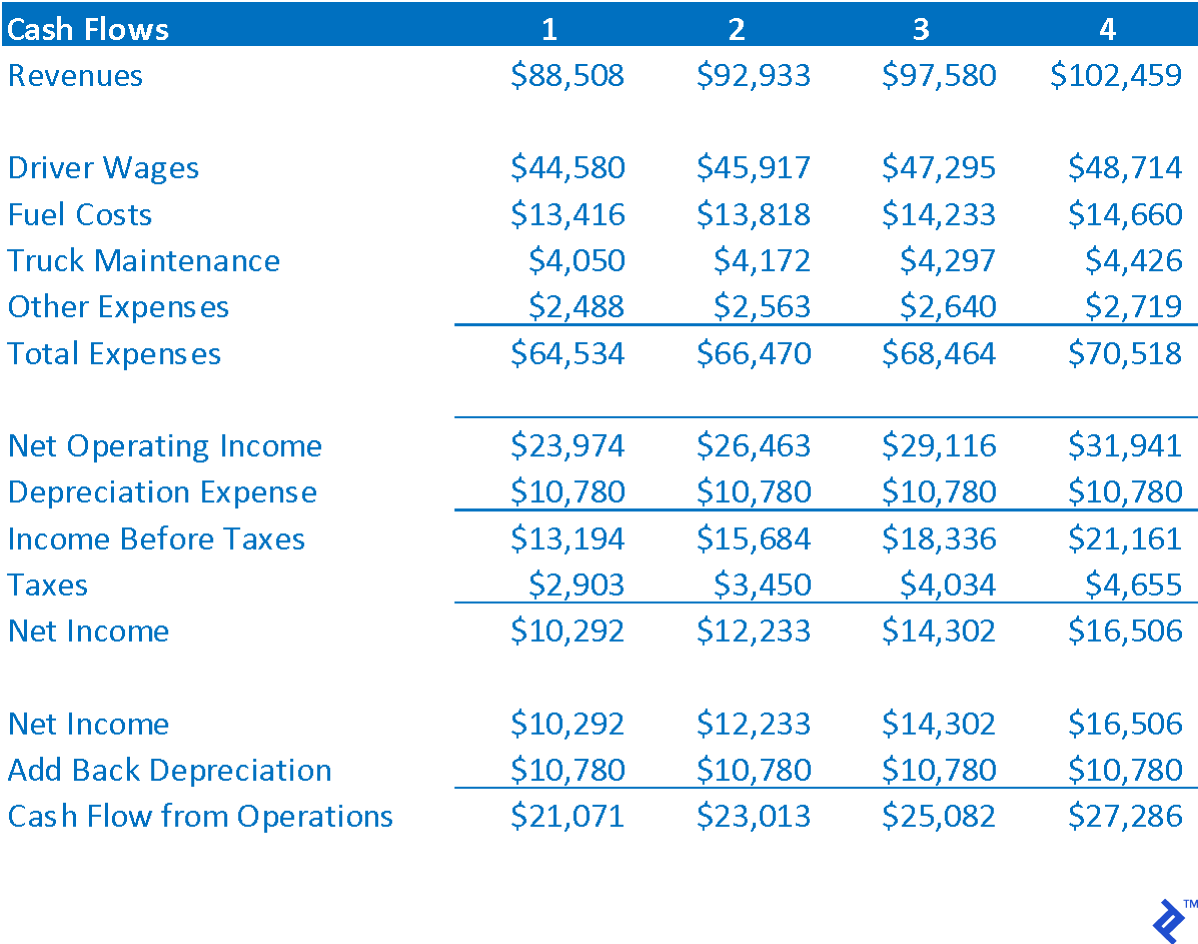

Create a cash budget (aka direct cash flow statement) the direct method of cash flow reporting offers much more intuitive insight into a company’s cash flow. Cash inflows, cash outflows, cash excess or deficiency, and details of financing activities. Manage the issues that arise from accounts receivable,.

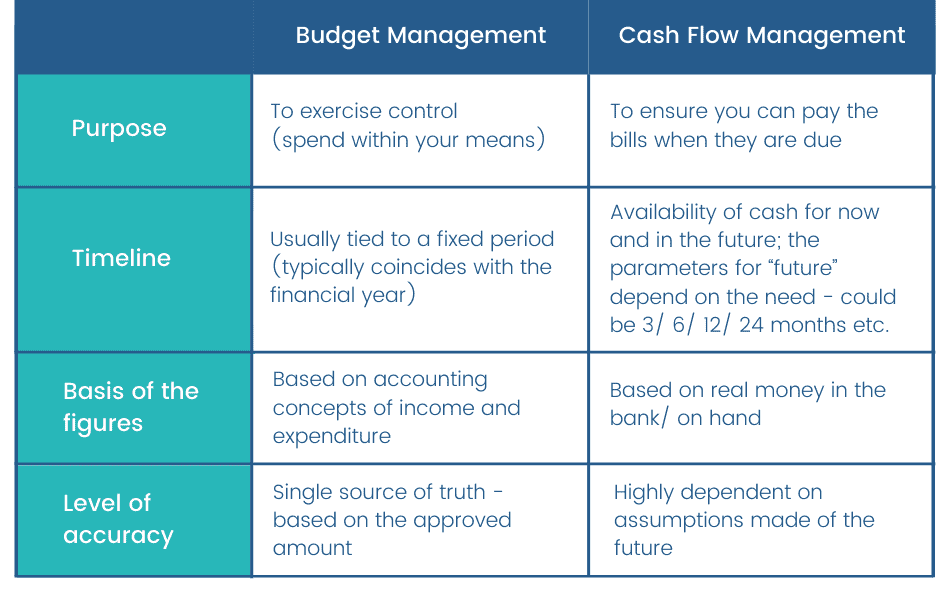

It refers to the process of managing a company's. Here, the sources of cash include receipts from. Cash flow management:

Stay liquid, think global, and better manage resources with this authoritative guide. A cash budget should be prepared for ascertaining the cash surplus or deficit for each period of planning through the inflows and outflows of cash. The importance of working capital management.

Developing a cash management strategy the global economy is being impacted by a number of events, curtailing the ability to conduct business as usual. The cash budget is a type of budget that estimates cash inflows and the use of cash during a specific period. Evidence that students prefer the teaching example to explanations of the effect of working capital on project cash flows given in the assigned text.

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)